Our view at Stack - Pipedrive is a robust CRM platform, offering automation, contact data collection, webhooks, AI-powered sales assistant, email communications, email marketing, and customisable sales pipeline workflows.

Operating income is one of the most important metrics for understanding a company’s profitability and core financial health without any impact from external factors.

Whether you’re a business owner, manager or investor, knowing how to calculate and analyze operating income is essential for making informed decisions and driving growth.

In this article, you’ll learn what operating income is and why it matters. You’ll also find actionable tips to improve operating income and strengthen your business’s financial foundation.

What is operating income?

Operating income definition: Operating income is a financial metric that shows a business’s profit from its core operations without considering taxes, interest income, sale of assets or anything else that isn’t directly related to operations.

In simple terms, operating income tells you the amount of money your business earns from its primary activities.

To understand what precisely operating income is, here’s how it compares to other similar profit metrics:

|

Metric |

Definition |

|

Gross profit / gross income |

Profit after subtracting cost of goods sold (COGS) from net sales |

|

Operating income |

Profit from core business operations after deducting operating expenses |

|

Earnings before interest and taxes (EBIT) |

Profit before interest and taxes, including any non-operating income such as from investments |

|

Earnings before interest, taxes, depreciation and amortization (EBITDA) |

EBIT plus non-cash expenses like depreciation and amortization, offering a clearer view of operating cash flow |

|

Net profit / net income |

Total profit after deducting all expenses (including operational costs, interest and taxes) |

Imagine a small retail store whose main source of income is selling clothes. The store must also cover rent, salaries, administrative expenses and utilities to keep the business running. Operating income tells you how much profit remains after accounting for these operating costs without factoring in taxes or interest on loans.

Operating income is often a key financial metric in a company’s income statement, alongside other terms from the above table.

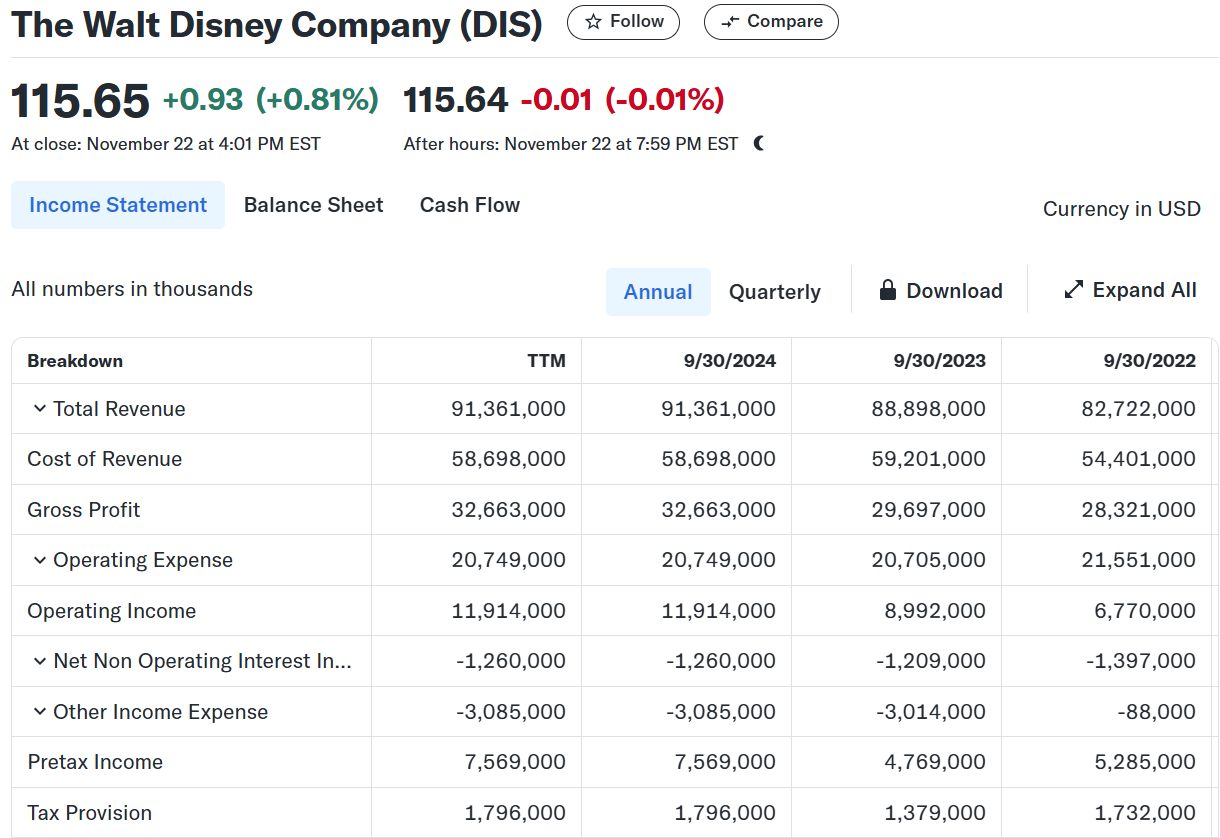

For example, here’s a glimpse of Disney’s income statement for the fiscal year ending 9/30/2024 on the Yahoo Finance website:

As you can see on the financial statement, the net profit ($32,633 million) is much higher than the operating income ($11,914 million). Further down, the statement shows EBIT is $9,639 million and EBITDA is $14,629 million.

Note: Other standard terms for operating income include operating profit and operating earnings. The terms are often interchangeable in financial modeling, and all refer to the same measure of core operational profitability.

What operating income means for your business

Operating income is a vital metric for business owners, managers and stakeholders to assess the efficiency of their company’s core business activities.

A growing operating income signals your business is ready to expand into new areas or hire additional staff. A consistently low operating income might mean you’re struggling to manage costs or generate enough revenue from your core activities.

Going back to the retail store example, you might have stable sales but a declining operating income, indicating it’s time to review your processes.

Other costs, such as rent or payroll, might have increased. Your gross profit may look healthy, but your operating income will tell a different story if operating expenses are too high.

Investors are also interested in operating income to evaluate how efficiently you manage operations and control costs. A solid operating income indicates a well-run business with sustainable processes, making it an attractive investment.

While gross profit shows how well you sell products and net profit reflects your overall financial standing, operating income zooms in on your operation’s efficiency. It bridges the gap between sales performance and overall profitability, giving you actionable insights to make smarter business decisions.

Recommended reading

What’s the difference between gross sales vs. net sales?

How to calculate operating income

The operating income calculation is straightforward once you know what to include and exclude. Simply take your total revenue and subtract selling, general and administrative expenses (SG&A) directly tied to operating activities.

Operating income = sales revenue − (COGS + operating expenses)

Alternatively, if you already know your gross profit, you can use this as your operating income formula:

Operating income = gross profit − operating expenses

Let’s break it down with an example. Suppose you run a local furniture store that generates $200,000 in sales. You spend $80,000 on raw materials and production costs for the furniture. You also have additional costs such as salaries, rent, utilities and marketing, which total $50,000.

Using the above formula, revenue ($200,000) minus your COGS and operating expenses ($80,000 + $50,000) gives you an operating income of $70,000.

Remember not to include non-operating expenses like taxes, interest expenses or one-time costs (e.g., equipment purchases). Those business expenses are part of net profit calculations, not operating profit.

At the same time, you must include all relevant operating expenses, such as utilities and employee benefits, to ensure your figures genuinely reflect the cost of running your core business operations.

What is net operating income?

Net operating income (NOI) is a financial metric commonly used in real estate and investment analysis to measure a property’s profitability. The meaning of net operating income is the income generated from a property’s operations, excluding financing costs or taxes.

How to calculate net operating income: Net operating income = gross revenue − operating expenses

Gross revenue includes all rental income and other property-related revenue. Operating expenses cover costs like maintenance, property management fees and utilities but exclude interest payments and taxes.

For example, if a property generates $100,000 in gross revenue and incurs $40,000 in operating expenses, the NOI would be $60,000.

The complete guide to real estate sales

When it comes to Real Estate Sales, process is king. Optimize your process with our free ebook guide.

Best practices for calculating operating income

Here are some best practices to ensure your calculations are both accurate and useful.

Use reliable financial tracking tools

While you can technically use pen and paper or homemade spreadsheets to track your income and expenses, investing in good financial software makes it much easier to categorize all your records correctly.

Categorize direct costs (like raw materials) and indirect costs (like office supplies) accurately when calculating operating income.

The right software helps you distinguish between operating and non-operating costs. It will include utilities, salaries and rent while excluding taxes, interest and one-time expenses. Automating data collection and categorization reduces the risk of human error and saves time.

Look for accounting and finance software that can integrate with your existing tools – such as customer relationship management (CRM) or point of sale (POS) systems – to keep all your information in one place and up to date.

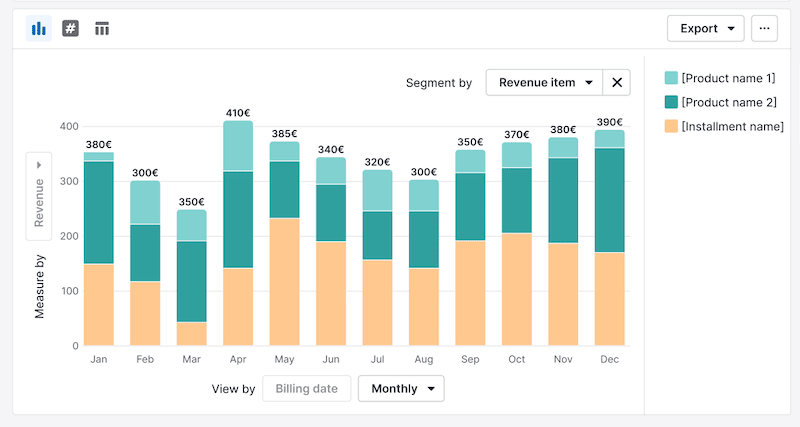

For example, Pipedrive’s insights and reports feature can show you how much revenue different products generate, helping you make data-driven forecasts and decisions to improve operating income.

Review operating income regularly

Operating income acts as a health check for your business operations, but that’s only useful if you regularly track it. Consistently monitoring your operating income lets you spot trends and address potential issues early.

Whether you do it monthly, quarterly or yearly, make time for regular financial reviews with your team to discuss operating income trends and their implications.

Benchmark against other companies in your industry

Comparing your operating income to industry benchmarks provides valuable context for evaluating your performance. Benchmarks help you assess whether your profit margins are competitive and identify areas where you may be overspending or falling short.

For example, if your operating income margin is lower than your competitors’, it might be because your operating expenses are too high or you’re not charging enough for your products.

Sites like Yahoo Finance, the official SEC website and Bloomberg collect financial data for publicly traded businesses, which you can use to see operating incomes for companies similar to yours. Alternatively, use consulting services to find relevant benchmarks for your sector.

Recommended reading

Cash flow statements: how to track and manage your business finances

5 ways to improve operating income

Once you’ve calculated your operating income, the next logical step is to improve it. Find smarter, more efficient ways to run your business that can boost profitability without compromising on quality or service.

The following methods will help you build a strong foundation for your operations and find new growth opportunities.

1. Increase your revenue streams

Start by looking at your income. Are there ways you can boost revenue without significantly increasing your costs?

One way to raise revenue is through new products or services. Talk to your customers and see if you can solve any unmet needs, pain points or challenges. Pilot your new offer with a small group of customers and collect feedback. Make any necessary changes, then roll it out to a broader audience.

You can often generate more revenue with your existing solutions if you closely examine your sales strategies.

For example, you could review your cross-sell and upsell process. Encouraging customers to purchase more or upgrade their choices can significantly increase your average order value (AOV). Train your sales team on effectively engaging buyers, or use technology to suggest the most relevant offers during checkout.

Similarly, optimizing your pricing strategy helps maximize revenue without creating completely new solutions. Find out what competitors charge for similar offerings and test new price points with limited-time deals.

2. Optimize operating expenses

At the other end of the spectrum, reducing costs (without compromising quality) is another reliable way to improve operating income.

Start by reviewing your current expenses and identifying areas where you can make changes. If you’ve been working with the same vendors for a while, see if there’s room to secure better pricing or more favorable terms. Could you negotiate bulk discounts or longer payment windows to reduce immediate cash outflow?

Next, take a closer look at your day-to-day work. Could you simplify or automate some processes? For instance, switching from manual inventory management to a digital system can save time and reduce errors. Similarly, small changes like energy-saving initiatives or optimizing resource usage can lead to long-term cost savings.

Audit your current spending and look for unnecessary expenses you can safely cut. What services, recurring payments or resources don’t deliver enough value? Redirecting those funds to more impactful areas can improve efficiency while controlling costs.

3. Streamline operations

Identifying and eliminating bottlenecks in your workflows leads to more efficient operations management, improving your bottom line and operating income.

Training your employees is one way to streamline operations. Focus on equipping them with the necessary skills to perform their tasks more effectively.

For example, providing advanced training to your customer service team could improve response times and overall customer satisfaction, leading to fewer issues and lower operational costs.

You can also simplify processes by mapping out workflows and identifying redundancies.

For example, if approvals for specific tasks go through too many layers, consider consolidating steps to save time and resources. Even small changes – like switching to a more user-friendly project management tool – can make a big difference.

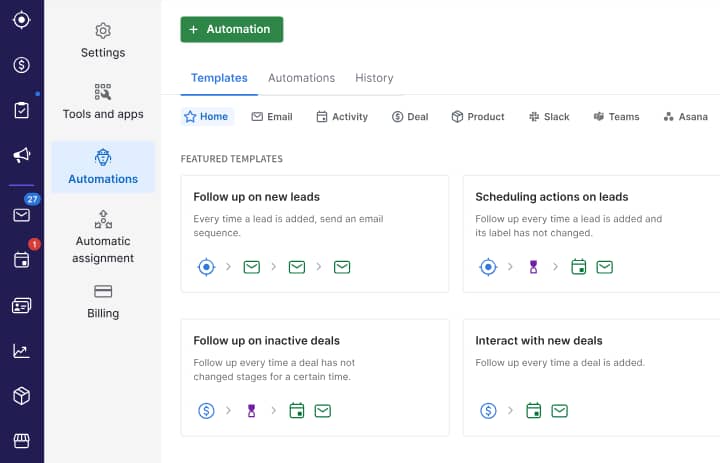

Finally, investing in the right technology can help you automate repetitive tasks and provide valuable insights. CRM software like Pipedrive, for instance, simplifies customer management while freeing up your team to focus on higher-value work and efficiency.

4. Plan for seasonal trends

If your business experiences seasonal fluctuations, thinking ahead can help you stabilize operating income throughout the year.

Start with your staffing levels. Use historical sales data to predict busy and slow periods so you can scale your workforce accordingly.

For example, hiring temporary staff during peak seasons and reducing hours during quieter months keeps labor costs in check while maintaining flexibility.

You can also use targeted promotions to drive sales during off-peak times. Seasonal discounts or themed campaigns can help maintain customer interest even during slower periods.

For example, the knowledge-base company Document360 ran this promotion for Black Friday in an X post:

Discounts can be helpful if you have excess stock and need to clear inventory while generating additional revenue.

5. Focus on customer retention

Generally, keeping your existing customers is more cost-effective than acquiring new ones. A strong customer retention strategy can improve operating income by increasing repeat purchases.

Loyalty programs are one of the more popular ways to retain customers.

For example, you could reward repeat buyers with points they can redeem for discounts or exclusive perks, encouraging them to return and making them feel valued.

You can also re-engage customers who haven’t purchased in a while. Use email campaigns or special promotions to remind them about your business. Sending a personalized discount code to a lapsed customer can be a particularly effective way to bring them back.

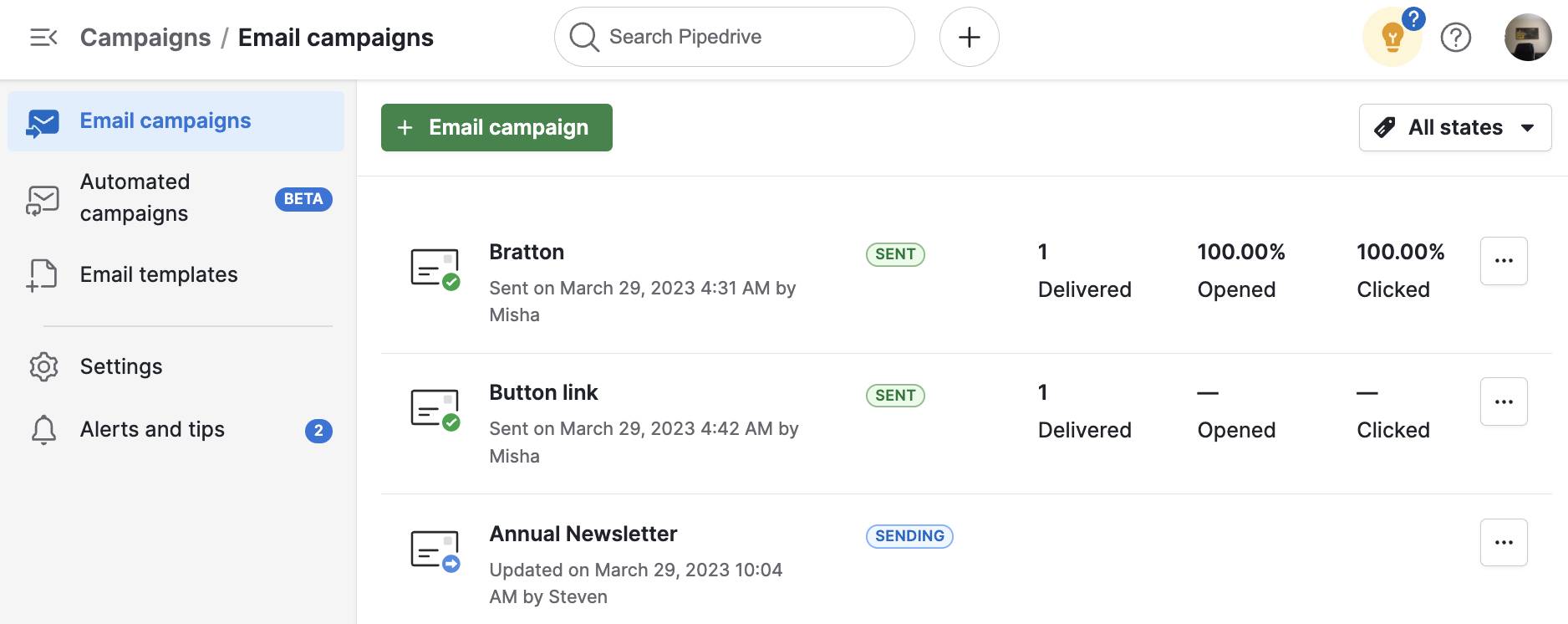

With Pipedrive’s Campaigns tool, you can use an intuitive drag-and-drop email builder to create targeted campaigns for different customer segments based on your CRM data.

Ultimately, the best way to retain customers is to deliver an exceptional service. Train your team to go above and beyond for customers and encourage them to collect feedback on their experiences. Acting quickly on customer complaints and suggestions can turn potential negatives into positives, building trust and long-term relationships.

Final thoughts

Regularly tracking operating income provides valuable insights into your company’s earnings and overall financial health, enabling you to evaluate your performance and make smarter decisions.

Put the above tips into action by regularly calculating your operating income, comparing it to industry benchmarks and tracking trends over time. You can then use this data to identify areas for improvement, from new solutions to process optimizations.

By consistently focusing on monitoring and enhancing your operating income, you’ll be better positioned to strengthen your business operations, achieve sustainable growth and stay competitive in your market.

If Pipedrive is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.