Our view at Stack - Pipedrive is a robust CRM platform, offering automation, contact data collection, webhooks, AI-powered sales assistant, email communications, email marketing, and customisable sales pipeline workflows.

Tracking total contract value (TCV) lets you know how much revenue every contract brings over time. It helps you forecast profits and make smarter decisions about where to invest your resources.

In this article, you’ll learn what TCV is, why it matters and how to use it to improve customer relationships while driving revenue growth.

What is TCV?

Total contract value definition:

TCV is the expected total revenue from a customer contract, including fees, subscription costs and one-time charges.

It benefits software as a service (SaaS) companies and other businesses with multi-year deals because it provides a complete picture of future earnings.

Recommended reading

A complete guide to SaaS account management

How to calculate total contract value

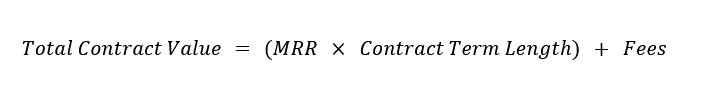

To calculate TCV, add all expected revenues from a customer contract over its entire term. Start with monthly recurring revenue (MRR), multiply it by the length of the contract and add any fees.

The TCV calculation formula is:

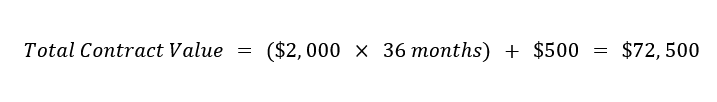

Say a contract includes a $2,000 monthly subscription fee for three years and an upfront $500 setup fee. Putting these figures into the TCV formula, we calculate a TCV of $72,500:

5 reasons to track total contract value

Here are five reasons to track the total value of a contract:

1. Forecast revenue

TCV estimates total contract income, helping you manage cash flow and allocate resources. Knowing how much revenue your contracts generate allows you to plan for future growth.

Imagine a SaaS company secured a two-year contract for $5,000 a month. They calculate the TCV to be $120,000 over two years, which helps the company plan its cash flow and revenue streams.

2. Identify lucrative contracts

TCV pinpoints the most valuable contracts, meaning you can adjust sales strategies to target them. For example, if a customer segment takes longer-term contracts and has higher TCV, you can focus more on those relationships.

Say a cloud storage company analyzes its contracts and discovers educational institutions extend multi-year deals, averaging a $300,000 TCV, much higher than their other segments. Based on that figure, they develop tailored marketing campaigns for this vertical.

3. Inform budgeting and investments

TCV guides budgeting toward growth and innovation. If you predict annual revenue and find room in the budget for more expenses, you can invest in new tools or account manager training.

For example, a company predicts an annual revenue of $2 million, allowing for a $200,000 budget surplus. With this extra margin, they invest in state-of-the-art software and training programs for their account managers, boosting future efforts.

4. Manage financial risk

Use TCV to evaluate risks from cancellations and minimize revenue loss. Say your company has a few high-TCV contracts in a sector that often experiences cancellations. Diversify your client base with several smaller contracts to cushion possible revenue dips.

Prepare contingency plans for high-TCV contracts so your business remains stable even if a major client cuts their order.

5. Optimize sales training

Analyzing TCV data helps you find indicators that signal high-TCV clients. Once you know these indicators, you can use them to develop effective training programs for your sales team.

Imagine a cybersecurity company that wants to increase its high-TCV client base. It finds that high-value clients come from industries with substantial regulatory compliance, like healthcare, because they need customized solutions.

Using this insight, the company creates a training program to help its sales team understand regulatory requirements and tailor sales pitches to healthcare companies.

Download Your Guide to Sales Performance Measurement

The must-read guide for any sales manager trying to track, forecast and minimize risk. Learn how to scale sales with data-backed decisions.

TCV vs. annual contract value (ACV)

While TCV is the whole lifetime value of a contract, ACV is its value over a single year. They both measure potential earnings, but they focus on different timeframes.

Comparing these two metrics gives you two essential perspectives for financial planning. Here’s the difference:

|

Total contract value |

Annual contract value |

|

Components: All fees within the agreement, including recurring subscription fees, one-time charges and extra costs |

Components: Average yearly contract revenue from subscription fees, not including any one-time charges |

|

Time range: The entire contract |

Time range: One year |

|

Purpose: Get a complete view of potential revenue from a single contract |

Purpose: Understand annual revenue from specific agreements |

|

Usage: Assess one-time or fixed contract terms for profitability and forecasting |

Usage: Evaluate and compare customer contracts over multiple years |

TCV measures the total revenue from a customer contract over its entire duration, while ACV is the average amount earned each year from the same contract.

Calculate ACV by subtracting fees from your TCV and dividing the TCV by the number of years in the contract. To continue the example above, say your TCV is $72,500, including three years of subscription costs and a $500 onboarding fee:

ACV = ($72,500 − $500) / 3 = $24,000

TCV vs. customer lifetime value (CLV)

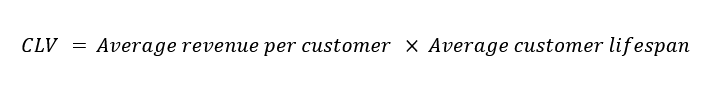

Customer lifetime value estimates the total revenue from a customer over the relationship’s lifespan. Unlike TCV and ACV, which focus on individual contracts, CLV uses average contract size and typical customer behavior for its projections.

While CLV is a broad estimate, TCV is based on specific contracts and predicts revenue if customers don’t cancel early.

CLV guides long-term strategies for customer retention and acquisition, while TCV assesses the revenue potential of specific contracts in the short- to medium-term.

The formula for LTV is:

5 strategies to boost TCV

With a strategic approach, you can influence and maximize your TCV. Enhance the overall value of your contracts, whether by targeting different clients, upselling or introducing better pricing strategies. Here’s what you can do to boost TCV and drive higher profits:

1. Incentivize longer contracts

Encouraging long-term contracts boosts TCV by ensuring predictable revenue flow. Longer commitments are a foundation for customer loyalty, providing upselling and cross-selling opportunities.

Extended contracts are especially beneficial if you have high acquisition costs since they spread expenses over a longer customer lifecycle.

For example, a project management software company could offer a 15% discount on subscriptions for clients who sign a three-year contract. These clients also gain access to premium features like advanced analytics and priority support, which aren’t available with shorter contracts.

The company guarantees a discounted rate throughout the contract, providing clients with price stability. This strategy attracts businesses seeking long-term solutions, boosting the project management company’s TCV.

Here are some strategies that convince customers to commit to extended contracts:

-

Offer discounts on long-term agreements. Provide savings for customers to make multi-year contracts more attractive

-

Bundle more features or services. Add value to long-term contracts by including exclusive features or services unavailable in short-term plans

-

Guarantee price locks. Offer financial security by ensuring customers that rates won’t increase during the contract

-

Enhance customer support levels. Offer priority customer support or dedicated account management to long-term clients

-

Implement flexible payment options. Allow customers to spread payments over the contract period and ease financial commitments

Note: A personalized onboarding experience can encourage customers to take on longer-term contracts. Cultivate stronger relationships and drive value for your clients by training them and helping them set up accounts.

2. Target larger companies

When you target larger companies, you tap into clients with bigger budgets and extensive needs. If you sell to startups and small businesses, consider moving up to medium-sized or enterprise accounts. While that can introduce longer sales cycles and more complicated decision-making processes, it’s also more lucrative.

For example, a cybersecurity firm might offer security solutions that protect large companies’ network infrastructure. To sell this package, they collect compelling case studies and assign a specialized sales team to focus on pursuing enterprise clients. It takes longer to convince each prospect to sign up, but the boost in TCV makes it worth the effort.

To target larger companies:

|

Strategy |

Action items |

|

Create enterprise-level packages |

Develop packages that combine products or services, providing a one-stop solution for their needs |

|

Leverage connections and networks |

Use industry relationships to get introductions and referrals to decision-makers in larger companies |

|

Invest in a dedicated sales team |

Train a specialized team to handle enterprise sales, ensuring they understand organizational behavior and purchasing processes |

3. Optimize your pricing plan

Optimizing your pricing plan aligns offers with what customers need and value. It encourages them to make informed decisions faster, spend more and choose higher-priced options.

To refine your pricing strategy:

-

Introduce tiered pricing. Different pricing levels based on features prompt companies to upgrade for better benefits. For instance, a streaming service might offer extra screens in higher-tier plans, encouraging customers to upgrade for convenience.

-

Create bundles. Make plans more appealing by packaging products or services together. For example, if you offer similar services like internet, phone and TV, bundle them into a package that costs less than purchasing separately.

-

Offer add-ons or premium features. Let users customize plans with extra features for a fee. If you sell a fitness app with workout plans and progress tracking, add optional extras like personalized meal plans or one-on-one coaching.

4. Invest in customer relationship management (CRM) technology

CRM software like Pipedrive streamlines customer interactions, maximizing the value of each relationship. Its features boost TCV by improving sales processes, enhancing communication and providing valuable insights into customer behavior.

Here’s how Pipedrive’s features can improve total contract value:

-

Pipeline management. Pipedrive’s intuitive pipeline view helps you visualize the sales process, meaning you can track opportunities at each stage and prioritize activities likely to close higher-value deals.

-

Contact and communication tracking. Pipedrive tracks all client interactions, ensuring sales teams know customer needs and preferences. Personalize communication and increase customer satisfaction.

-

Automation and workflow management. Pipedrive’s automation tools automate repetitive tasks so teams can focus on building relationships. This efficiency leads to quicker sales cycles and more effective upselling efforts.

-

Analytics and reporting. Pipedrive offers robust analytics and reporting capabilities, giving you insight into sales performance and customer behavior. Understanding which strategies work best allows you to refine your sales approach and maximize TCV.

-

Integration capabilities. Pipedrive integrates with many tools and platforms, including email marketing and customer support systems. Get a seamless flow of information and ensure all customer touchpoints work together to enhance the client experience.

With each feature at your fingertips, tracking and improving total contract value is easy.

5. Track other crucial sales metrics

TCV is a powerful indicator, but it isn’t the only significant source of information. Since TCV focuses on long-term value, tracking only this one metric can lead to problems like short-term performance blind spots, especially if your clients are prone to canceling contracts before the term is up.

Other important metrics include annual recurring revenue (ARR), customer acquisition cost (CAC), churn rate and revenue run rate. Here’s what these metrics track and how you can use them to your advantage:

|

Metric |

How to use it |

|

Annual recurring revenue: The annual income from recurring revenue sources. It reflects predictable cash flow. |

Use ARR to identify upselling and renewal opportunities. Target profitable customer segments for higher-value contracts. |

|

Customer acquisition cost: The expense it takes to gain a new customer. |

Use CAC to track and improve acquisition costs while generating customer loyalty over time and increasing TCV. |

|

Churn rate: The percentage of customers lost over a period. |

Reduce your churn rate to create longer customer relationships and enhanced TCV. Use data analytics to identify at-risk segments and address their pain points. |

|

Revenue run rate: An estimate of your annual revenue based on current earnings. |

Use revenue run rate to gauge future revenue potential alongside TCV and ARR, assuming sales remain consistent. |

Tracking these other SaaS metrics with TCV gives you a more well-rounded view of your financial health.

Total contract value FAQs

Final thoughts

Understanding total contract value is essential to optimizing revenue strategies and long-term SaaS business growth. Focusing on TCV provides insights into financial performance, refines pricing models and enhances sales tactics.

Consider Pipedrive to track and boost your TCV. This powerful CRM tool streamlines contract management, helping you maximize your revenue potential. Explore Pipedrive’s free trial and see how it can guide your business to success.

If Pipedrive is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.