Our view at Stack - Pipedrive is a robust CRM platform, offering automation, contact data collection, webhooks, AI-powered sales assistant, email communications, email marketing, and customisable sales pipeline workflows.

While your business demands most of your attention, it’s also worth watching your competitors. Understanding competitor pricing strategies, product offerings and consumer sentiment can help you position your company for success.

A competitive matrix visualizes your competitors’ strengths and weaknesses. It pinpoints your position in the market and highlights ways to improve.

In this article, you’ll learn about different types of competitive matrices, their benefits and how to create your first one. You’ll even find a free template at the end for immediate use.

What is a competitive matrix?

A competitive matrix is a tool for visualizing your competitive analysis. It helps you understand how your company compares with one or more competitors.

Competitive matrices are often charts, tables or spreadsheets. Sometimes, they can be graphics. Whatever form they take, they make it easy to compare companies across different criteria like:

-

Price

-

Products

-

Popularity

-

Market share

The visual nature of a competitive matrix makes it easy for small business owners, marketing teams and product managers to spot their company’s place in the market and identify ways to capitalize on their strengths.

Here’s how different departments can use a matrix:

-

Business owners can use a price matrix to adjust their business strategy

-

Marketers can use a competitive positioning matrix to sharpen their brand positioning and value proposition

-

Product development can prioritize specific features to fill gaps in the market

A competitive matrix can compare entire businesses, specific markets or product lines.

High-level matrices help make data-backed, big-picture decisions like how to position your brand. More granular competitive matrices can help you hone your message or identify gaps in the market to fill.

Recommended reading

How to sell a new product: 6 tips to drive new product sales

What are the different competitive matrix types?

A competitive matrix can take a range of formats and compare entire businesses, specific markets or product lines.

Below are some of the most common competitive matrix types.

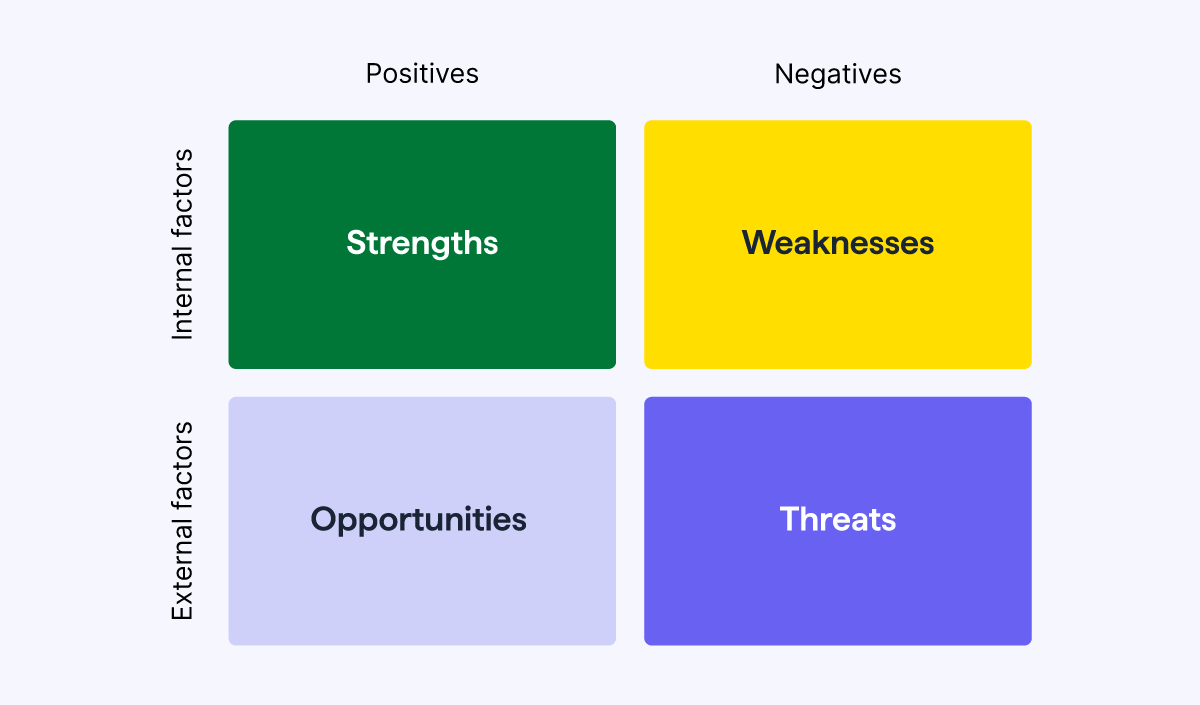

SWOT analysis

A SWOT analysis evaluates your company and competitors across four internal and external factors:

-

Strengths. What do they do well? Think about product features or brand recognition.

-

Weaknesses. Where do they fall short? Consider customer sentiment, poor infrastructure or an outdated offering.

-

Opportunities. What external factors can they leverage for business growth? Think about emerging technologies or new markets.

-

Threats. What external issues could impact business? Think about economic conditions or disruptive technologies.

Plot the results on this four-by-four grid, listing your findings under each heading:

Use a SWOT analysis to capitalize on your competitor’s weaknesses, nullify their strengths, pursue similar opportunities and overcome the same threats.

Note: Creating a SWOT analysis for each competitor is best practice. Start with your direct competitors before moving on to indirect and emerging competitors (more on those below). Remember to run a SWOT analysis, too.

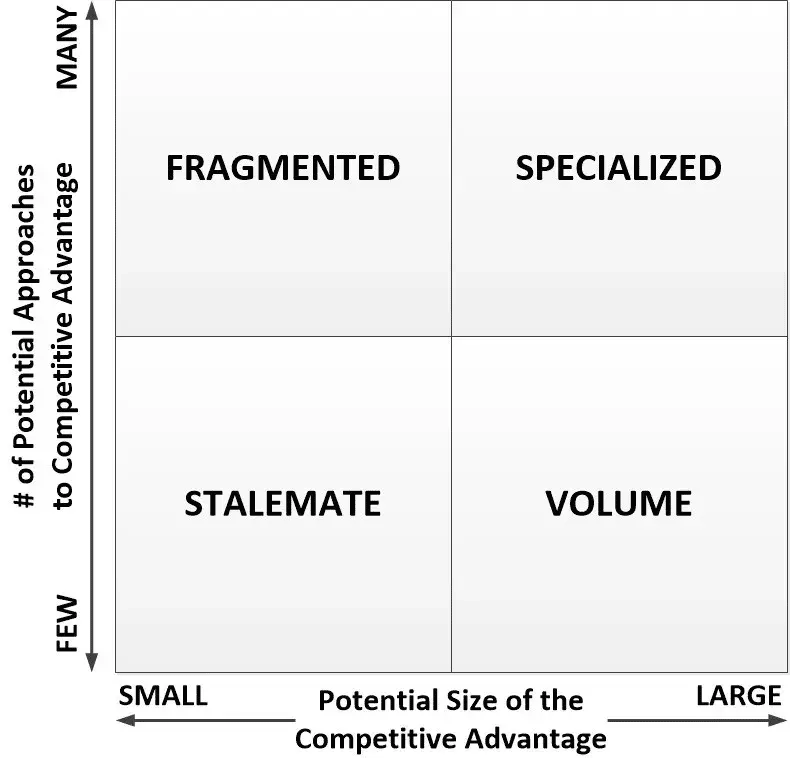

Competitive advantage matrix

The competitive advantage matrix from Boston Consulting Group visualizes the size and quality of each competitor’s market opportunities. It combines two theories: a company’s ability to gain economies of scale and how it differentiates itself from competitors.

Use your research to place each competitor into one of the four categories:

-

Specialized. These companies achieve significant advantages through economies of scale and differentiation. Companies in this quadrant, like Apple, can make huge profits.

-

Volume. Companies here have few opportunities to differentiate themselves, but the potential to gain an economy of scale is significant. The biggest companies tend to dominate these industries.

-

Stalemate. These companies have few opportunities (if any) to get an advantage, and those advantages have little potential. They’ll struggle to gain economies of scale and can’t differentiate their products. Lower costs and low prices win here.

-

Fragmented. Companies in this quadrant have plenty of opportunities to achieve an advantage through differentiation but need more time to scale. Innovation is essential if you want to dominate here.

List as many competitors as you like on a chart and include your brand.

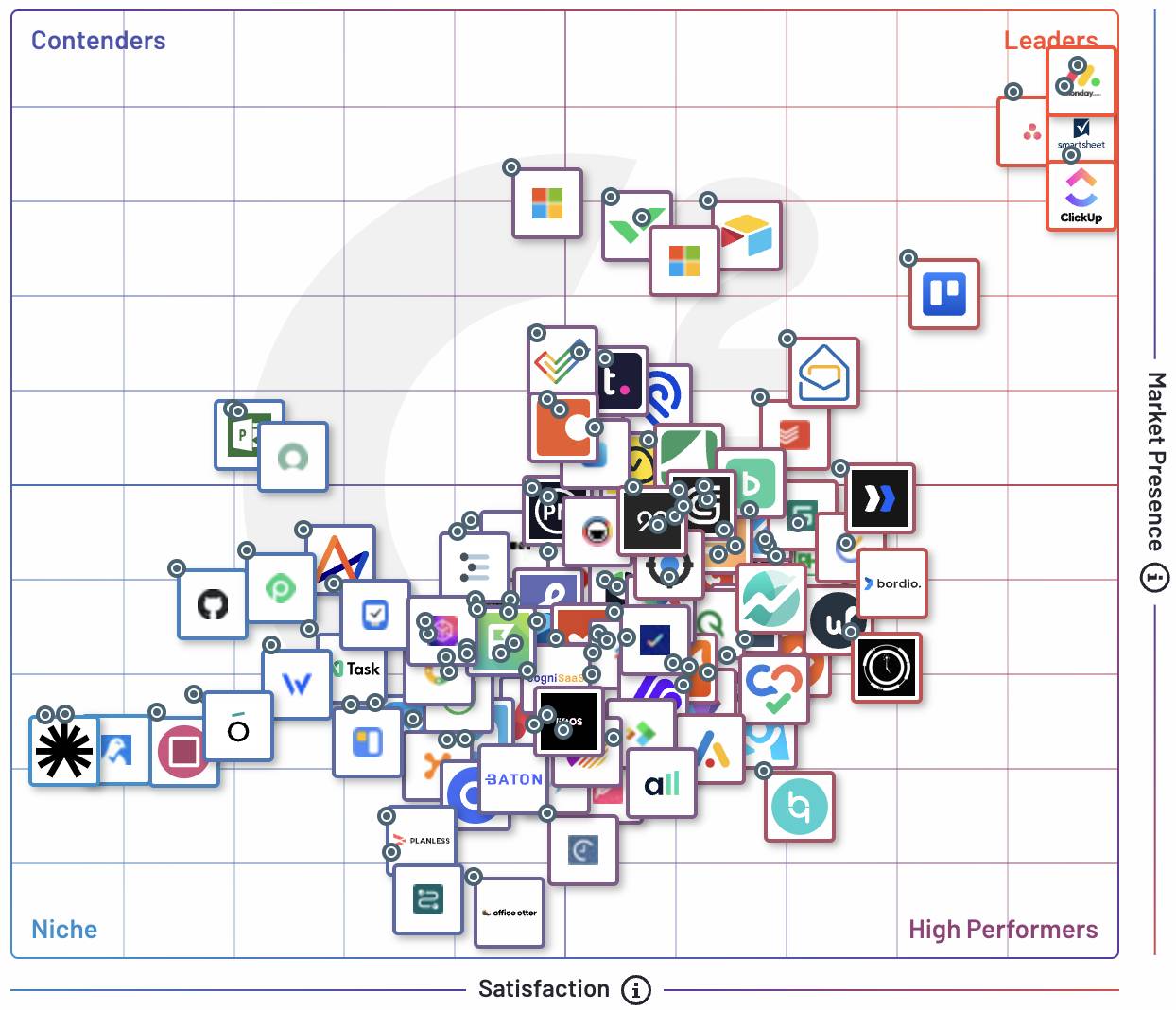

Competitive positioning grid

A competitive positioning grid (or competitive comparison matrix) maps businesses’ market position. It does this by benchmarking companies against factors that may influence customer choice.

Those factors can include:

Here’s a competitive matrix example from G2 comparing the size and customer satisfaction of competitors in the project management space:

The graph plots customer satisfaction on the horizontal x-axis and market share on the vertical y-axis. G2 can split the graph into four quadrants as a result:

-

Contenders with high market share but low satisfaction

-

Niche brands with low share and low satisfaction

-

High performers with high satisfaction but low market share

-

Leaders with high satisfaction and high market share

While G2 compares market share and customer satisfaction, you can use any factors you like. A popular option is to compare price and customer satisfaction to see if there’s an opportunity to raise your pricing in line with customer sentiment.

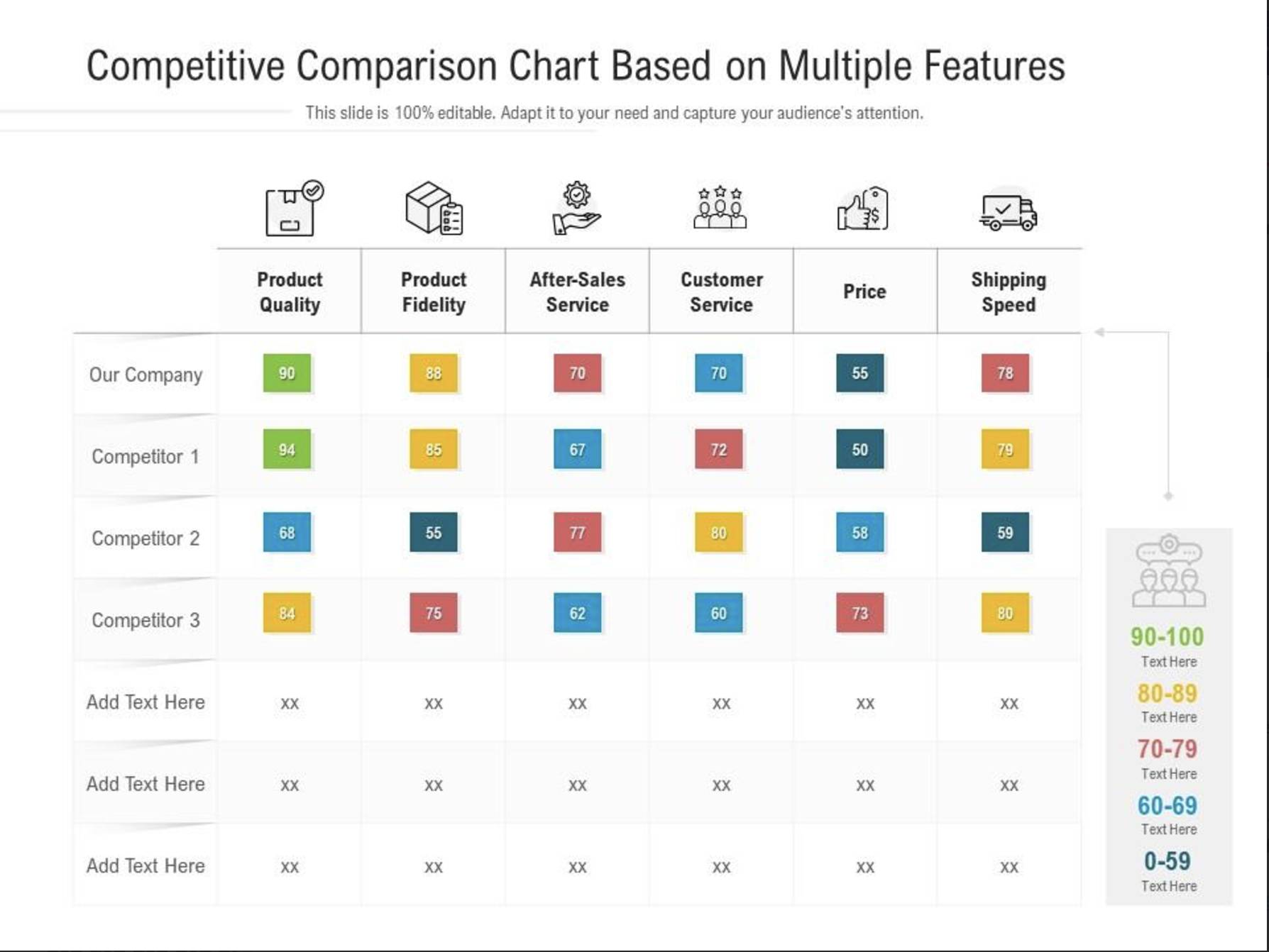

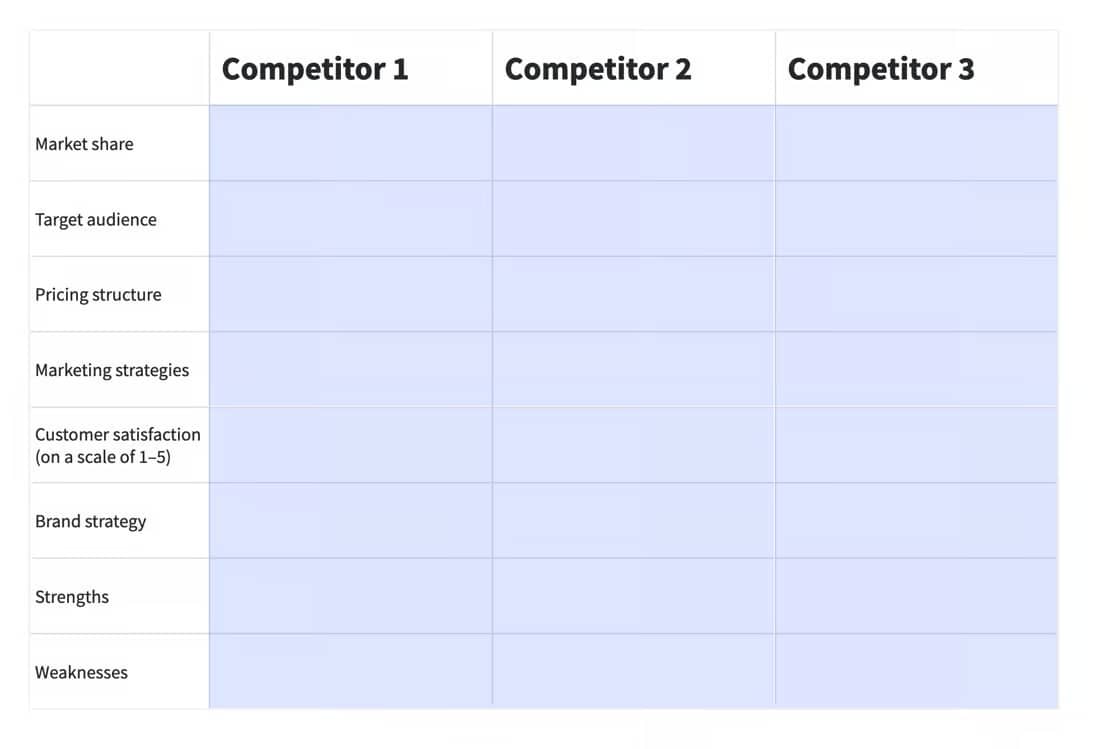

Competitive comparison chart

A competitive comparison chart is a table that compares a range of features for multiple competitors. It’s like a competitive positioning matrix that compares more than two factors. Use this chart for broad analysis or to compare marketing strategies.

For example, take a look at this competitive comparison chart template comparing products across competitors.

The side-by-side differentiation lets you spot each company’s strengths and weaknesses. Color-code the research, like in the chart above, to make analysis easier.

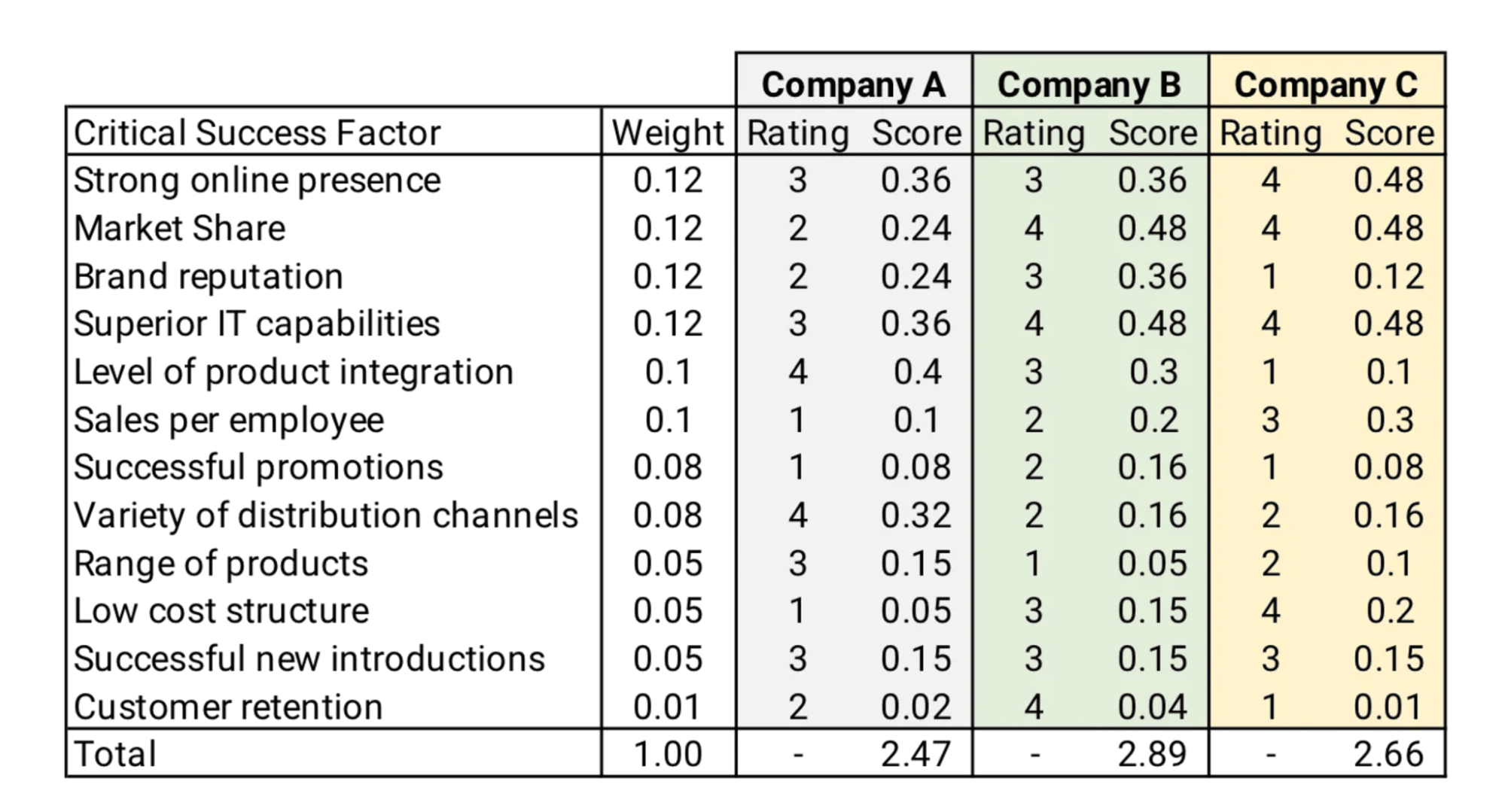

Competitive profile matrix

A competitive profile matrix is a comprehensive assessment of competitor performance across various critical success factors (CSFs), which vary from industry to industry.

For instance, CSFs for a software-as-a-service (SaaS) company might be:

-

User interface

-

Usability

-

Customer support

-

Price

This matrix offers more depth by weighting scoring depending on a factor’s importance – the more critical the factor, the heavier the weighting.

CSFs are rated on a scale from one to four, with four indicating a major strength, three indicating a minor strength, two indicating a minor weakness and one indicating a major weakness.

Weighting elements in this way lets you give a cumulative score so you can quickly see which competitor is strongest. It also helps you identify the extent to which customers are ahead of or behind your company on any given factor.

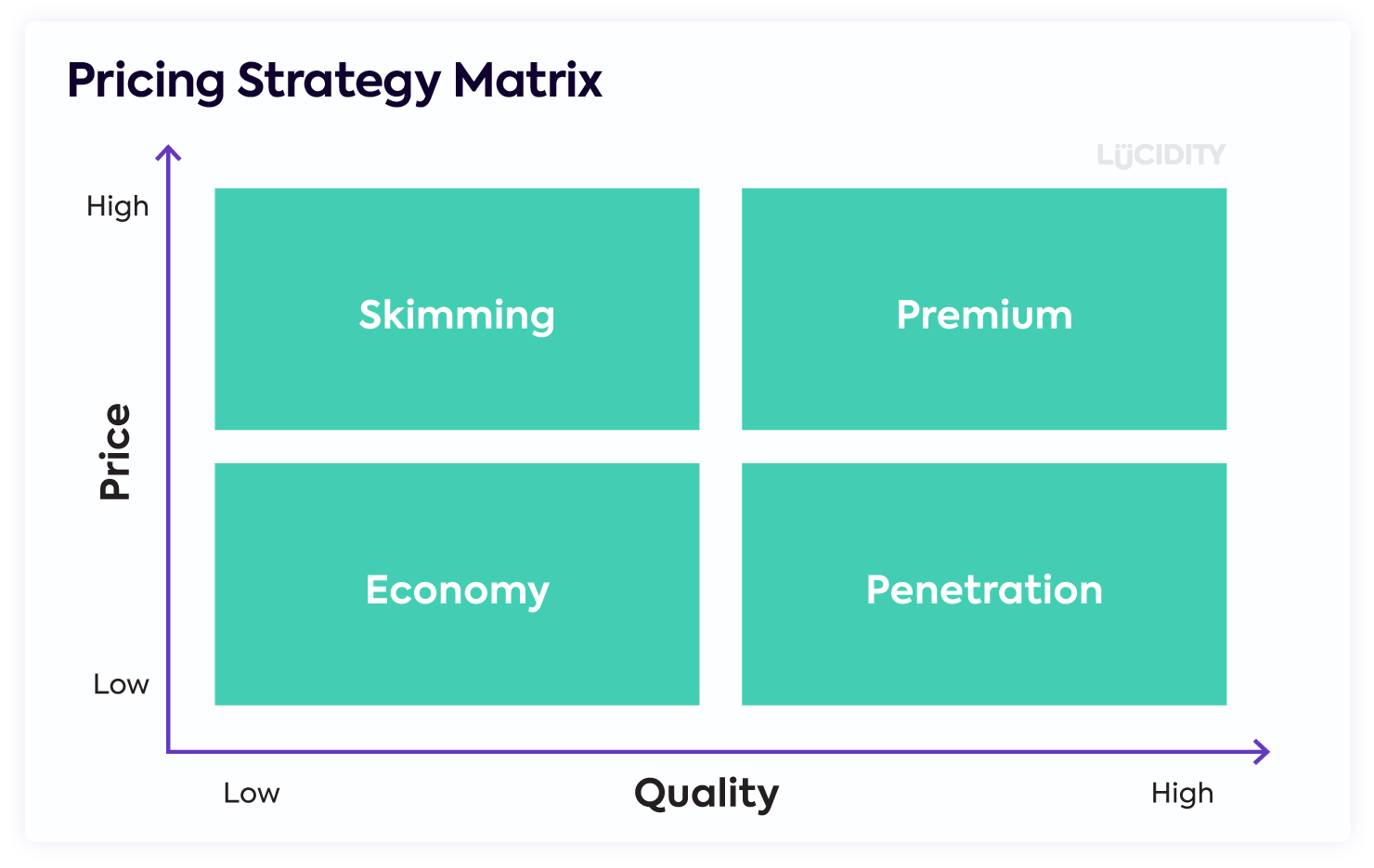

Price matrix

A price matrix compares company pricing strategies. It helps you understand how your pricing fits in with the market’s competitive landscape and discover whether there’s an opportunity to adjust pricing.

Plot each company under one of the four categories:

-

Skimming. High prices for low-quality goods

-

Economy. Low prices for low-quality goods

-

Penetration. Low prices for high-quality goods

-

Premium. High prices for high-quality goods

Recommended reading

4 steps to turn sales reporting data into actionable insights

What are the benefits of competitive matrices?

A competitive analysis matrix turns otherwise bland competitor analysis into a visual analysis tool that’s easy to understand and share.

Bringing insights to life in this way provides many benefits.

Understand the market

A competitive matrix gives small business owners an instant understanding of their industry’s competitive landscape. It shows how companies compare on criteria like price, market share and customer sentiment.

Pinpoint your position in the market and act. For example, if every competitor’s product has a particular feature, you can prioritize that feature on your product roadmap to catch up.

Analyzing competitors this way also helps you spot gaps in the market. Imagine you’re a sportswear brand looking for a new opportunity. If a competitor matrix shows rivals aren’t creating products for a sport like Padel that’s surging in popularity, you might decide that’s a niche you should fill.

Position your brand and sharpen your USP

A competitive matrix highlights your company’s strengths compared to other players. Use it to uncover competitive advantages that set your brand apart.

These insights can also sharpen your marketing messages. For example, clothing retailer Patagonia makes environmental responsibility a USP by highlighting its progress toward sustainability on its website.

Customers who care about the environment can feel good about their Patagonia purchase, and the company reinforces its mission statement through this messaging.

Identify weaknesses and threats

Use a competitive matrix to fix weaknesses and limit the impact of threats. Such insights can inform long-term thinking and product development.

Suppose a SWOT analysis shows every competitor in your industry feels threatened by generative AI tools. In that case, you can pivot to focus on something AI can’t offer, like exceptional customer service.

Improve sales rep knowledge

A competitive matrix is an excellent sales tool reps can use to expand their market knowledge, promote market-leading features and offer insight during sales conversations.

It helps reps get more familiar with the market. They can address objections by talking to prospects about how your company addresses a need or solves a problem better than competitors.

A competitor matrix also acts as an educational tool when onboarding new reps. It helps them learn:

-

Your company’s place in the industry

-

Your competitors’ strengths and weaknesses

-

Competitor pricing strategies

-

Market opportunities and threats

Reps can start conversations with customers faster since they’ll spend less time researching the industry.

Recommended reading

Developing a pricing strategy: methods and examples

How to create a competitive matrix

Competitive matrices may come in all shapes and sizes, but you must follow similar steps to create them. Here’s an overview of the process:

1. Define objectives

Start by determining the goals of your competitive analysis. Do you want to:

Clear objectives help you pick the most appropriate competitive matrix.

2. Choose a competitive matrix

Next, choose a competitive matrix to achieve your goal. For example, business owners looking to optimize their pricing should choose a price matrix. However, a competitive comparison chart is a better choice if you want to improve your product.

Once you’ve chosen your matrix, you can pick appropriate metrics and factors to compare, like:

-

Revenue

-

Company size

-

Market share

-

Pricing

-

Customer ratings

-

Product features

Choose factors relevant to your objective and business. If you pride yourself on customer service, you’ll want to add customer ratings as a factor. Budget-friendly brands will likely want to focus on price.

3. Identify competitors

Next, make a list of the competitors you’ll be researching. There are three types of competitors to include in a competitive matrix:

-

Direct competitors. These companies offer comparable products or services to similar demographics. You probably know who they are already, but a quick Google search for your product or service will uncover more details.

-

Indirect competitors. These organizations sell different products or offer an alternative business model but target the same audience. Prospects may mention indirect customers during sales conversations, so check your customer relationship management (CRM) system.

-

Emerging competitors. These new brands or startups don’t have the same market share or market cap as existing ones, but they target your customers.

Lyft is a direct competitor of Uber, for example. It offers the same product to the same audience. Buses, cars and subways are indirect competitors. They provide a different service to help consumers get around. Waymo and other autonomous or driverless cars are emerging competitors. They have the same target market but don’t yet have a strong market presence.

Most leaders find it easy to list direct and indirect competitors. If you need help, a quick Google search is your friend. Also, consult market research reports, ask your sales reps and speak to existing customers. The latter is beneficial when finding indirect and emerging competitors.

4. Collect competitor data

It’s time for the most time-consuming process: collecting the data. Work through your list of comparison factors and compile the relevant information about each competitor.

Here’s a table of competitor data you may want to collect, along with directions on how to find it.

|

Data |

Source |

|

Revenue |

Found in press releases, public records or business directories like Crunchbase. Unless it is part of a financial statement, it tends to be an estimate |

|

Number of employees |

Company LinkedIn profiles list employee numbers, as do most business directories |

|

Location |

Check a company’s website or Google its headquarters |

|

Target audience |

Companies may mention specific audiences in marketing materials or press releases. As an alternative, manually analyze social media and marketing content or use Semrush |

|

Products or services |

Check each company’s website for the most up-to-date product or service information |

|

Product features |

Look for competitor comparison charts or read product descriptions |

|

Pricing |

Look for pricing pages on your competitors’ sites |

|

Customer ratings |

Check review sites like Reviews.io, Trustpilot and G2 |

Accuracy is vital, so double-check your entries. It will ensure a small mistake doesn’t throw off your visualization.

5. Fill in your matrix

Add your competitor research to your chosen matrix. In some cases, like a competitive comparison chart, it will be as simple as filling in the template.

In other cases, you must analyze further before plotting competitors on your matrix. For example, a SWOT analysis requires you to assess the strengths and weaknesses of each competitor based on your research.

Most professionals create charts or graphs using Excel or Google Sheets. To make your matrix more appealing, you can also use a design tool like Canva.

Keep it simple, though. A straightforward design will make your matrix even more impactful since colleagues can spend more time implementing your insights and less time deciphering your diagram.

6. Analyze, share and apply the results

The real value of a competitive matrix lies in turning the insights into action. Use these tips to analyze your matrix while keeping your goal in mind:

-

Identify gaps and opportunities. Are there any customer needs the market currently under-serves? Can you fill them?

-

Evaluate competitor positioning. Where do competitors sit on the matrix? Are they clustered in the same place, sharing the same traits? Or are they spread out?

-

Spot threats. Are there competitors that excel in multiple areas? Does a competitor have a monopoly on a feature or USP?

-

Find weaknesses. In which areas does your business lag? How can you rectify them?

Share the results of your competitive matrix across your business. The matrix centralizes a lot of information that multiple departments will find helpful.

Here are examples of how different departments can apply insights from a competitive matrix:

-

Business owners can use it to adjust pricing in line with the market, perceived value or customer satisfaction

-

Product teams can use it to prioritize feature development or keep pace with competitors

-

Marketing teams can use it to tweak their messaging or highlight an unrivaled USP

-

Sales teams can use it to overcome objections and accelerate onboarding programs

Sharing your matrix also ensures every department uses the same research to develop cohesive strategies that achieve the same goals.

Note: Return to your competitive matrix once or twice a year. Updating it or running a fresh analysis will keep you abreast of market changes and help you uncover new opportunities.

Free competitive matrix template

A ready-made template is the fastest way to create your first competitive matrix.

Pipedrive’s competitor analysis template lets you differentiate three competitors using the criteria discussed above.

Download the free PDF template below to create your first competitive matrix today.

Download our competitor analysis template

Use this template to compare yourself to your competitors and see where you stand

Final thoughts

A competitive matrix provides a snapshot of competitor strengths and weaknesses. It helps small business owners understand their market position and spot opportunities to improve their business plans.

Return to your reports every six months or so to keep them relevant. Share them across your organization so everyone works from the same competitor intelligence.

If Pipedrive is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.