Running payroll for your business is hard enough. Switching back and forth between multiple systems makes it that much more difficult.

Having disconnected systems is time-consuming, whether you’re trying to pay (or file) payroll taxes (and stay up to date on compliance), pay your employees, view payroll expenses, or simply get a complete picture of your business finances.

Wouldn’t it be nice to have a single platform for all your billing, accounting, and payroll needs?

Enter FreshBooks Payroll, the answer to your payroll headaches.

Table of Contents

What Is FreshBooks Payroll?

FreshBooks Payroll is powered by Gusto, an industry-leading HR and payroll technology provider. It’s a full-service payroll solution for U.S. business owners: A one-stop shop for billing, accounting, and payroll needs. Every payroll transaction is automatically recorded in FreshBooks, ensuring you see the whole picture of your business, all in one easily accessible platform.

What does that all mean? Well, when you process payroll with us, automatic payroll tax filings, W-2s, unlimited payroll runs, and direct deposit all come standard. And with all your payroll information documented in one place, you can keep more accurate books and see the full scope of your business’s health.

Why Gusto?

Gusto is one of the most popular payroll solutions for small businesses in the U.S. It goes beyond being just a payroll provider: It’s an all-inclusive platform that covers hiring, onboarding, benefits, and compliance support.

In a nutshell, it’s exceptional software.

Since 2017, FreshBooks and Gusto have been working together to empower businesses with the technology to make payroll and accounting easier and more efficient. And now you need only one tool—FreshBooks—to keep your books in order and take advantage of Gusto’s payroll features.

Gusto has served more than 200,000 businesses like yours. So you can trust that you will have access to a comprehensive solution for your payroll needs.

Who Is FreshBooks Payroll For?

FreshBooks Payroll is available for U.S. business owners looking to tackle their payroll headaches. Because payroll can be just that—a major headache—especially when split up across multiple platforms.

Now, more than ever, business owners are looking for a simple, embedded payroll solution—which is where we come in, because FreshBooks Payroll is for business owners who:

- Are looking for the convenience that most payroll providers don’t offer

- Want an easier way to pay employees the right way

- Are concerned about payroll compliance

- Want world-class support with no hidden fees

It’s for business owners just like you.

And luckily, FreshBooks isn’t just a pretty face. We deliver on all 4 reasons business owners are looking for payroll. Check. Check. And check.

How Can I Use FreshBooks Payroll?

Excellent question. Glad you asked.

U.S. business owners can sign up for FreshBooks Payroll directly through their FreshBooks account. (You’ll also find pricing there.)

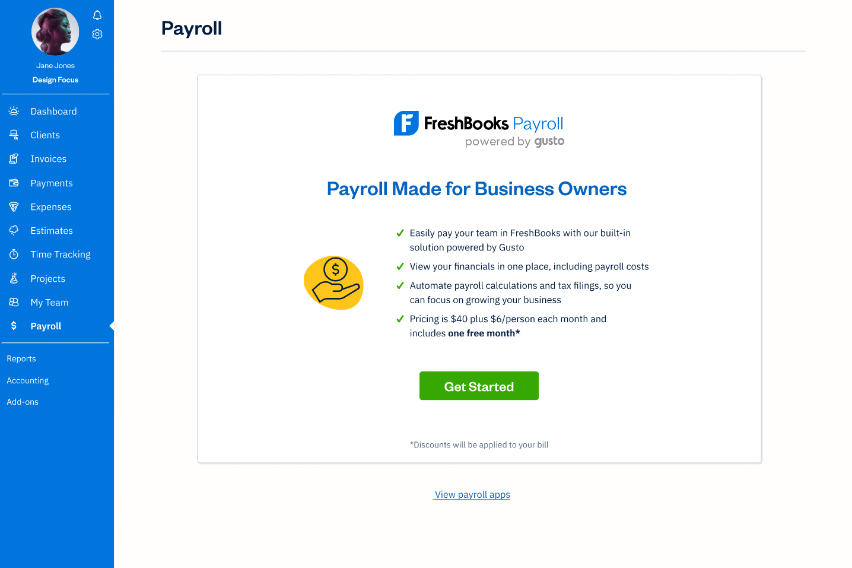

Step 1: Log Into Your FreshBooks Account

- Select Payroll in the left sidebar.

- Select the green Get Started button to begin.

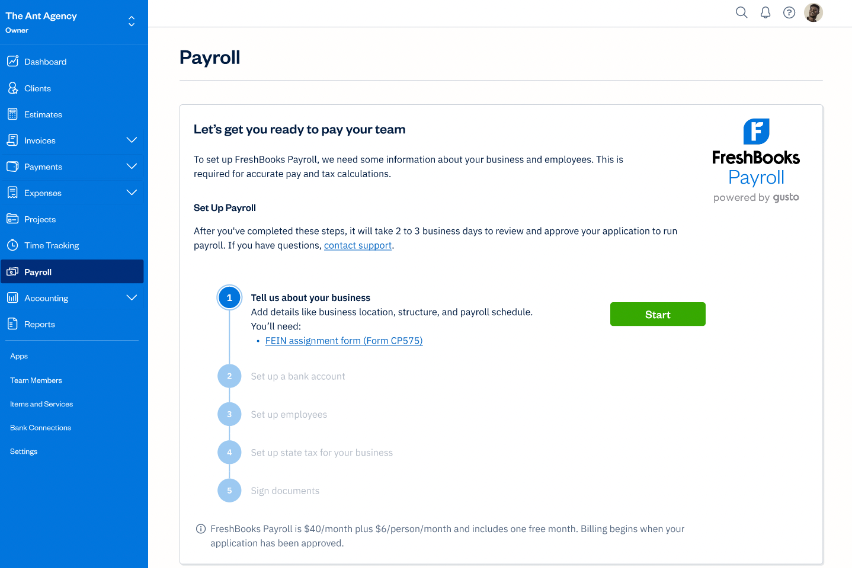

Step 2: Get Payroll-Ready

You will need to fill in the required company and employee information. This allows FreshBooks Payroll to calculate pay and tax requirements accurately.

- Add details about your business—i.e., business structure, location, and payroll schedule. You will need to complete a FEIN Assignment Form (Form CP575).

- Set up a bank account.

- Add your employees.

- Set up state tax for your business.

- Sign and select Start.

Please note that it will take 2–3 business days to review and approve your application after it’s submitted.

Step 3: Run Payroll

Once your application has been approved, log back into your FreshBooks account and follow these steps:

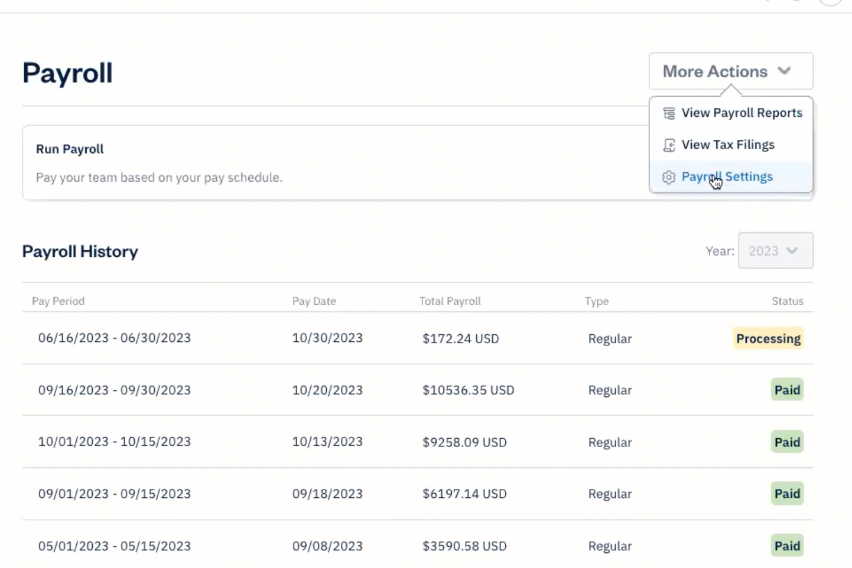

- Select Payroll in the left sidebar to access FreshBooks Payroll.

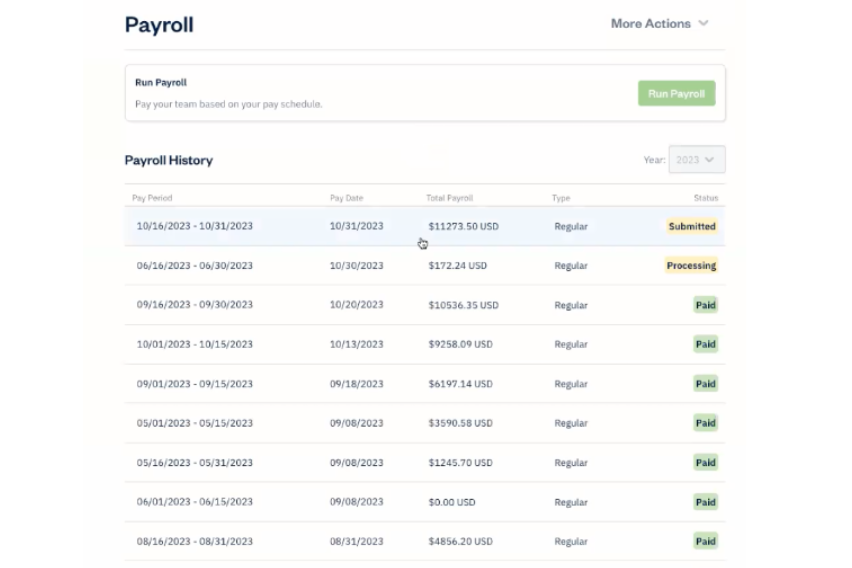

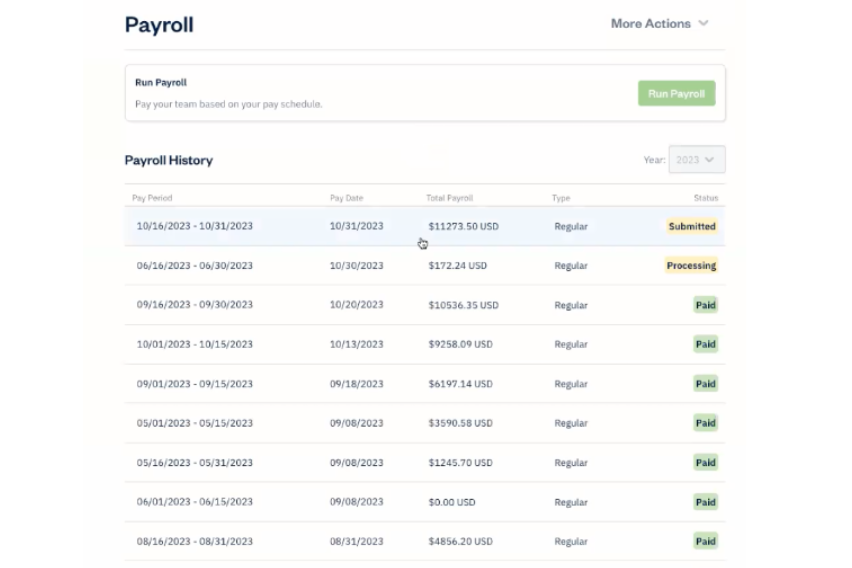

This page will give you a complete picture of your payroll history that has been run through FreshBooks.

2. Select the More Actions dropdown in the right-hand corner.

This dropdown will allow you to choose from three options to view:

- Payroll Reports — this will allow you to see your Payroll Journal report (more on that later)

- Tax Filings — will allows you to see your payroll tax filings and documents

- Payroll Settings — to edit company information.

Choose one of the selections from the dropdown to see your payroll tax filings and documents, payroll reports, all payroll history run in FreshBooks, and Payroll Settings to edit company information.

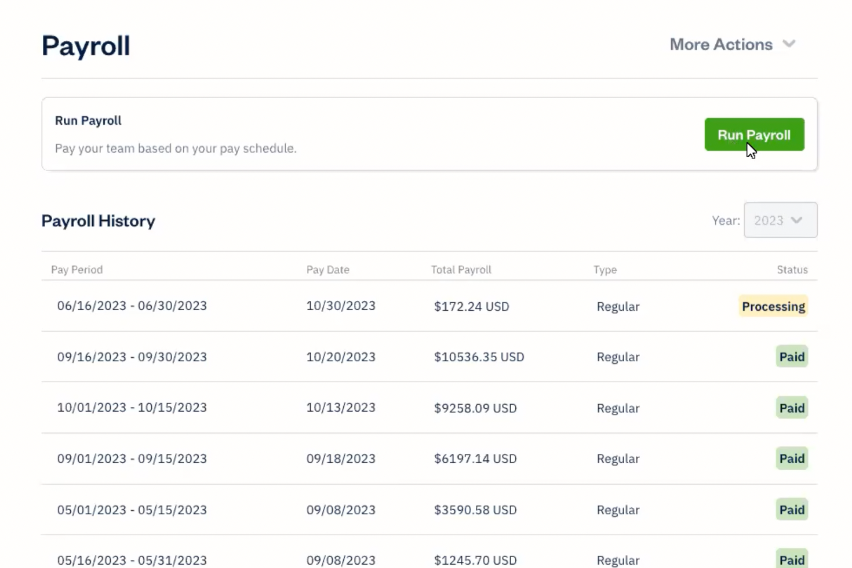

3. Select the green Run Payroll button to begin.

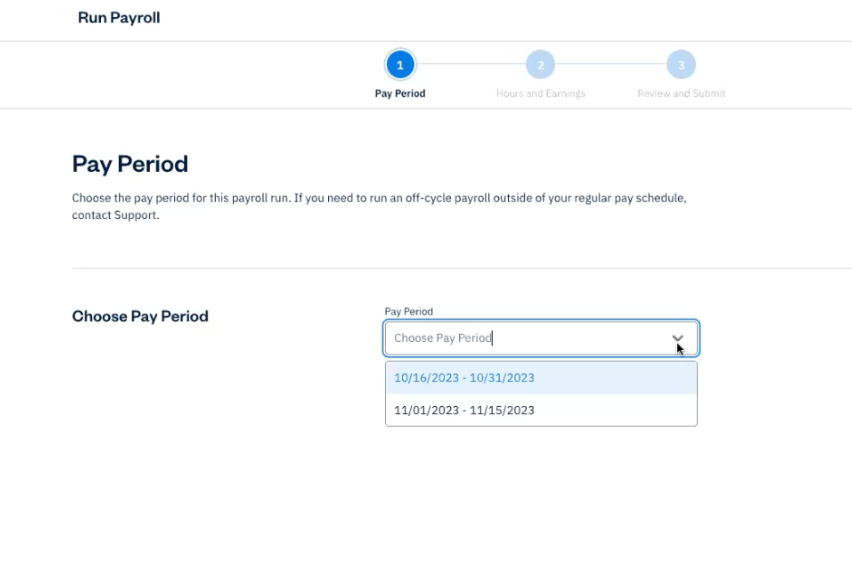

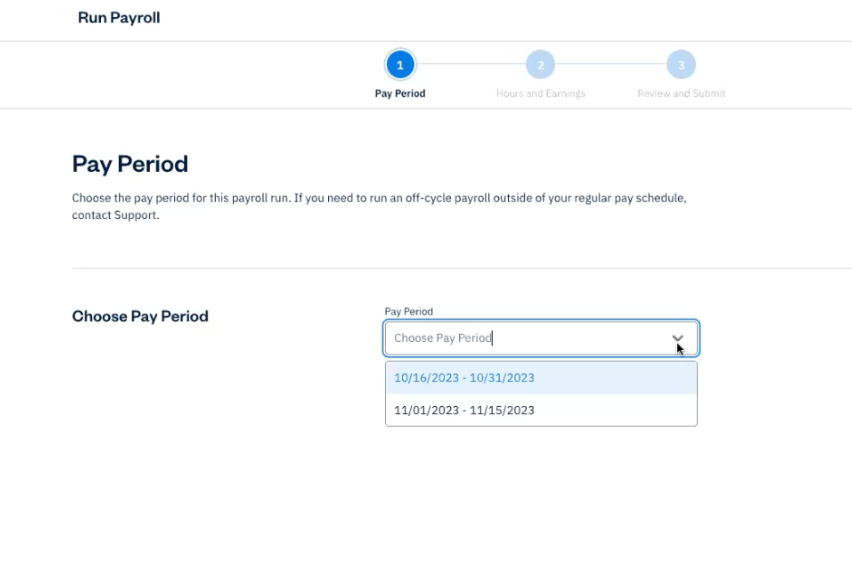

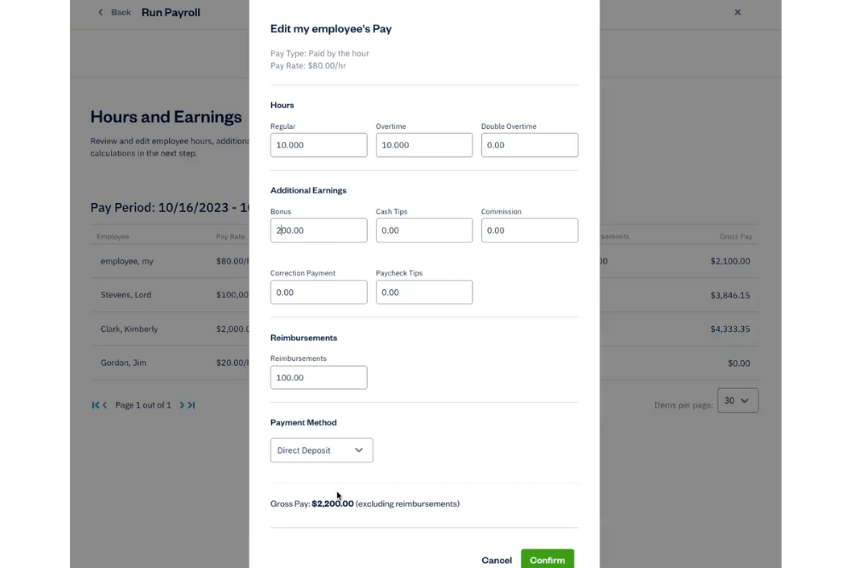

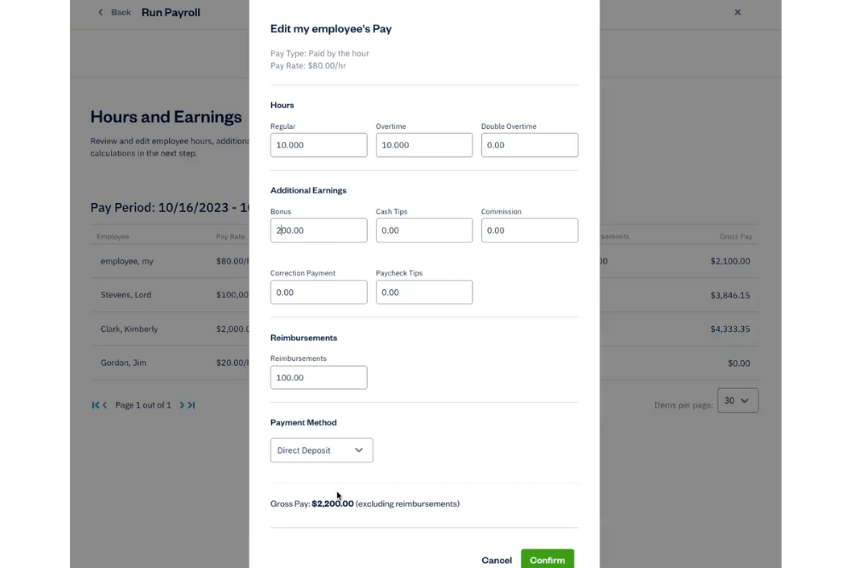

4. Select a pay period based on the first pay date and pay schedule you set for your company to see your employees’ pay rate, hours, additional pay, reimbursements, and gross pay.

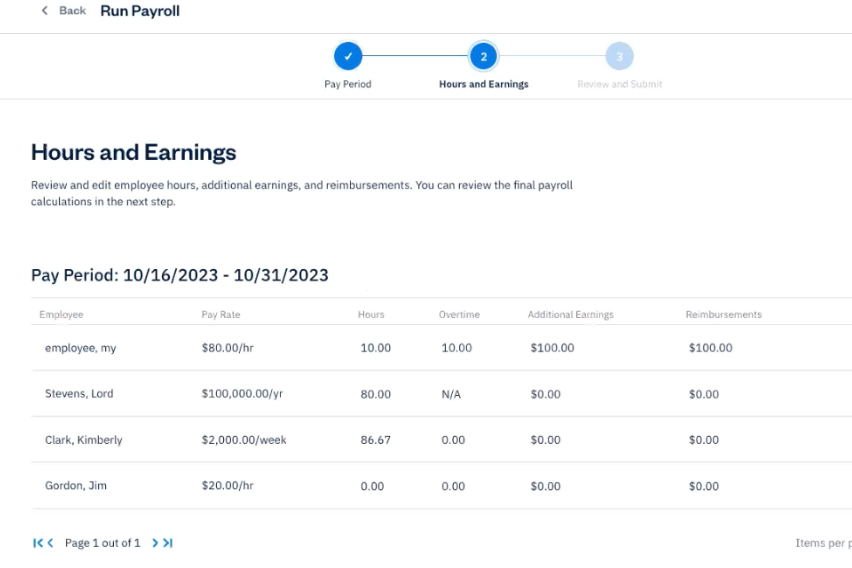

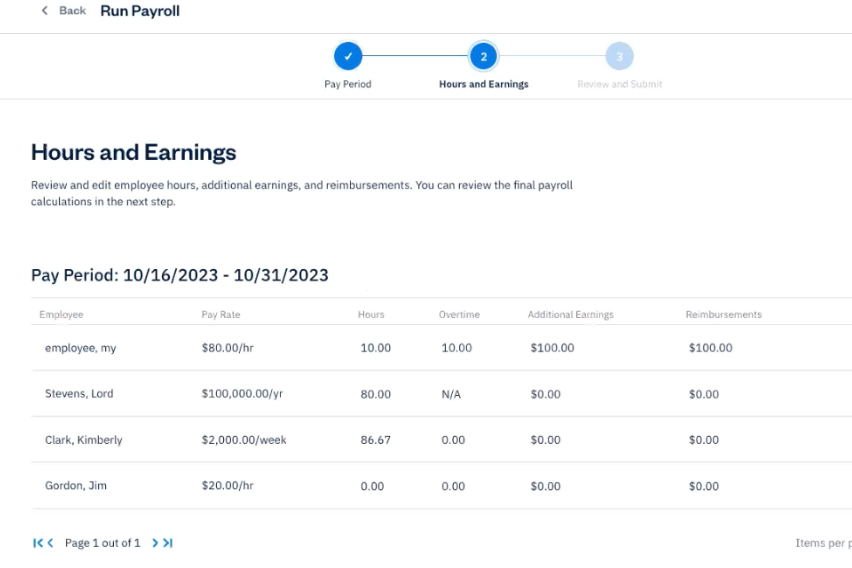

This will take you to the Hours and Earnings page, where you can see a list of your employees, pay rate, hours worked, overtime hours worked, additional earnings, reimbursements, and gross pay.

5. You can edit the information by selecting the employee.

NOTE: Changes will automatically update, and certain employees won’t be editable (i.e if an employee’s pay type is marked as Salary / No Overtime).

6. Once done, select the green Confirm button.

7. When done with the Hours and Earnings page, select the green Save and Continue button in the bottom right corner.

Please note that it will take 1–2 minutes to calculate total payments, payroll taxes, deductions, and reimbursements.

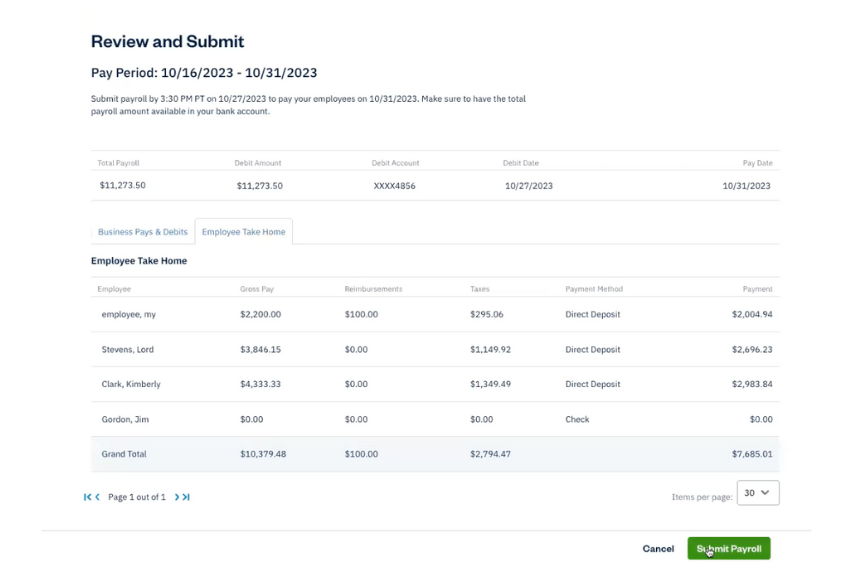

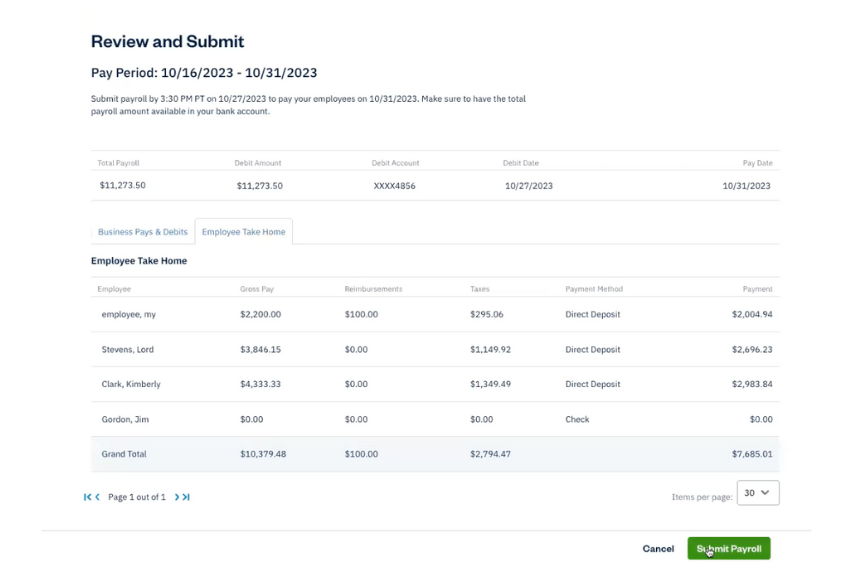

8. Review the calculated data.

9. To preview an employee’s draft pay stub, click on the employee name

10. Once done, select the green Submit Payroll button in the bottom right corner.

NOTE: Users must submit payroll 4 days before the payout date

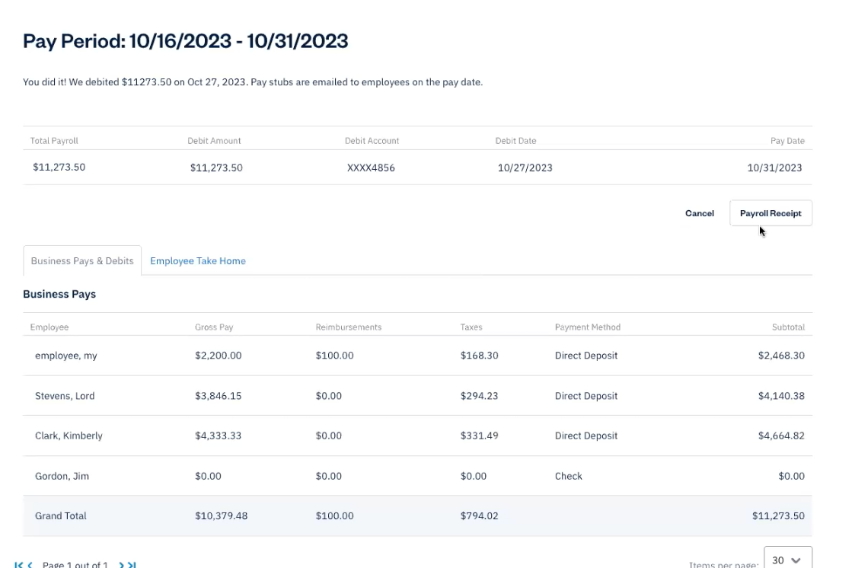

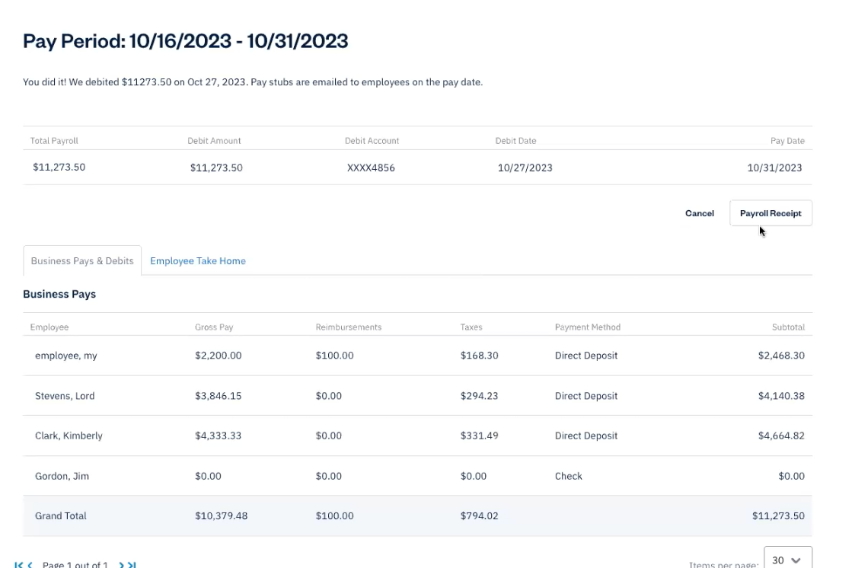

11. To see your submitted payroll, return to your Payroll tab in the dashboard.

12. Select your submitted entry to see the item page for access to employee pay stubs.

13. Select Payroll Receipt for a breakdown of total debits, U.S. taxes, and employee breakdown.

NOTE: You can cancel an entry still in the Submitted status.

Once the payroll entry hits the pay date, it will automatically change to Paid status. The pay stubs will be sent to the employees via password-protected email.

And just like that, you’ve paid your team.

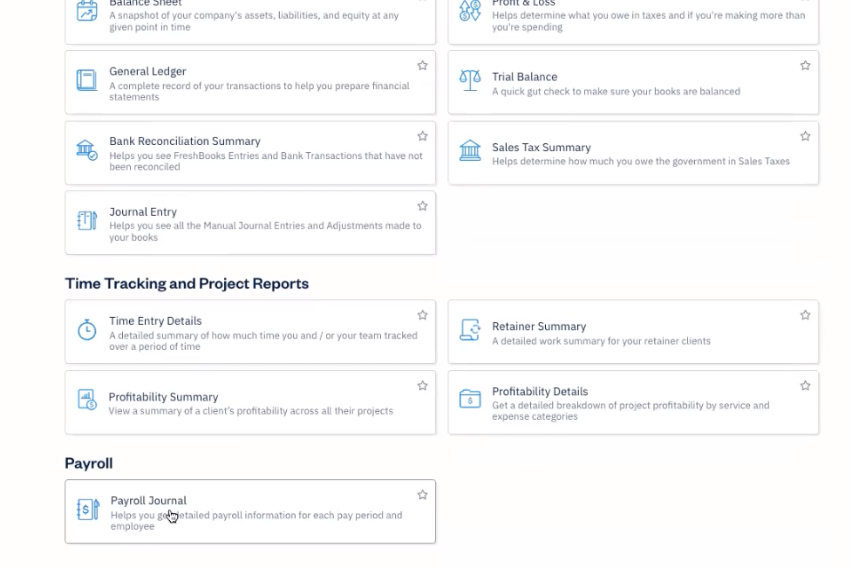

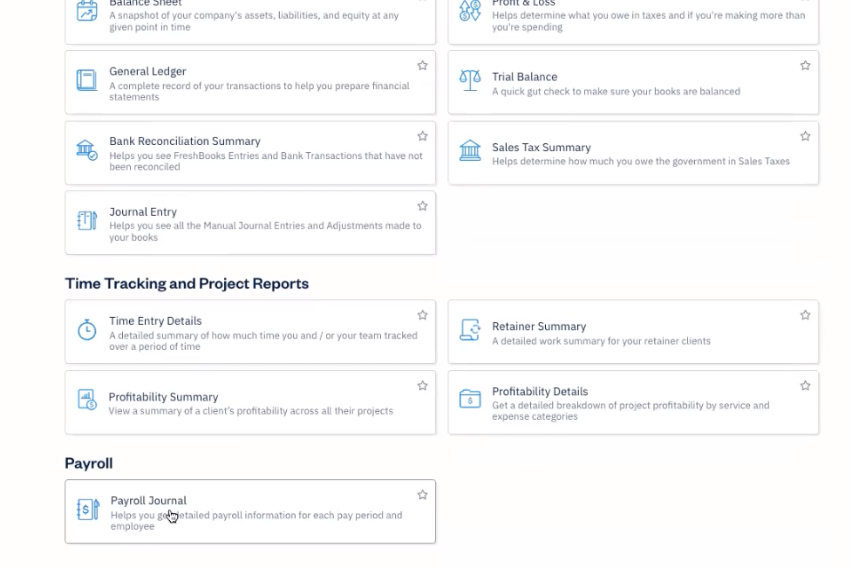

Step 4: View Payroll Expenses and Access Reports

The FreshBooks Payroll Journal report gives a detailed breakdown of employee payrolls per pay period.

1. Log into your Freshbooks Account.

2. Select Reports in the left sidebar.

3. Scroll down to Payroll and select Payroll Journal.

4. Select your date range and click the green Download CSV button.

This report will include all the payrolls with a pay date that falls within the range you selected, which includes any off-cycle payrolls like bonus pay or tax reconciliations done directly in Gusto.

There you have it. Now, you’re ready to pay and file payroll taxes directly in FreshBooks.

Get Started With FreshBooks Payroll

If you have any questions about how to use FreshBooks Payroll, don’t hesitate to .

If you have questions about adding FreshBooks Payroll to your account, please .