Our view at Stack - Freshbooks simplifies accounting for solo business owners, freelancers, and small companies. Intuitive, easy-to-use, and affordable. Manage payments, expenses, invoices, and accept payments seamlessly.

Starting your own accounting advisory firm offers many benefits, such as the freedom to choose your clients, specialize in an industry or service you’re passionate about, or build a professional environment that allows you to thrive.

And if you plan to include advisory work as part of your accounting services, you should be confident that the demand is there to attract clients. In a 66% of respondents said “their clients are strongly in favor of receiving more business advice.” Your skills and expertise are in demand to gain prospective clients!

Table of Contents

Is Running an Accounting Firm the Best Option for You?

Running your own accounting firm can be incredibly rewarding, but it’s not the right path for everyone. Before diving in, it’s crucial to evaluate whether this career move aligns with your personal and professional goals. Here are some key considerations to help you decide.

Do You Prefer Being a Business Owner/Boss or an Employee?

Running an accounting firm requires a unique blend of technical expertise and business acumen. As a business owner, you’ll have the freedom to make decisions, set your own schedule, and reap the financial rewards of your hard work. However, this also means you’ll be responsible for managing the business side of things, including marketing, finance, and human resources. If you enjoy being in control and are willing to take on the challenges of entrepreneurship, running an accounting firm might be the best option for you.

Do You Have the Required Experience, Motivation, and Support?

Starting an accounting firm requires a significant amount of experience, motivation, and support. You’ll need to have a strong foundation in accounting principles, as well as experience working with clients and managing a team. You’ll also need to be motivated to succeed, as running a business can be challenging and unpredictable. Finally, you’ll need a support system in place, including mentors, peers, and family members who can provide guidance and encouragement along the way.

Will the Business Be Adequately Capitalized?

Starting an accounting firm requires a significant investment of time, money, and resources. You’ll need to have a solid business plan in place, including a budget, financial projections, and a plan for attracting clients. You’ll also need to have access to capital, whether through loans, investors, or personal savings. It’s essential to ensure that your business is adequately capitalized to avoid financial struggles and ensure long-term success.

How to Start an Advisory Accounting Firm

Starting your own accounting business can be daunting, as it involves significant work and preparation. That’s why we’ve created a step-by-step guide to getting your accounting practice off the ground.

Perform Market Research and Analysis

As you begin to envision the scope of your business, it’s important to verify that the market aligns with the direction you’re headed. Get a thorough understanding of the current landscape you want to enter and look for gaps you might fill. Accounting firms play a crucial role in maintaining accuracy and compliance in financial reporting, making it essential to understand their impact on the market and the specialized services they offer.

Some things to consider:

- Industry: What’s the size and historic growth rate?

- Target market: Who will you serve? What niche can you find in a larger target market?

- Pricing structure: What does the market tolerate? If you’re starting out, can you command what your competitors charge—or do you need more experience? Are you offering a service that can charge more/less than your competitors?

- Quality of work: How does the quality of your service relate to what’s available in the marketplace? Can you do better? What can you do differently?

- Customer service: What kind of customer service do clients in the market expect? What can you learn from your competitors about how to communicate with their customers?

- Marketing: How do your competitors find new clients? How do they stay top-of-mind with the clients they have? What marketing techniques work well for this industry?

Ensure You Have the Right and Certifications and Experience

It’s important to make sure your accounting qualifications and experience have prepared you for the type of work you want to do and the expectations of your prospective clients. Some clients may insist on hiring a CPA firm or a certified public accountant to satisfy their legal requirements. Smaller businesses may be less concerned about certifications. Do your homework to provide your client with the right service offerings, and give them what they want.

Also, consider the jurisdiction and associated tax laws that are applicable to your clients’ books. You’ll need to be well-versed in their regulatory and tax obligations.

Select Your Accounting Niche

Now’s the time to formally select the niche you’d like your business to operate in. Although your business may grow and change over time, it’s wise to begin by focusing on one or two specialties. Your market analysis and interests will inform your decision. Managing your own practice allows you the flexibility and control to choose niches that align with your personal career goals and work-life balance.

There are 5 major categories to consider::

- tax

- accounting

- assurance services

- bookkeeping

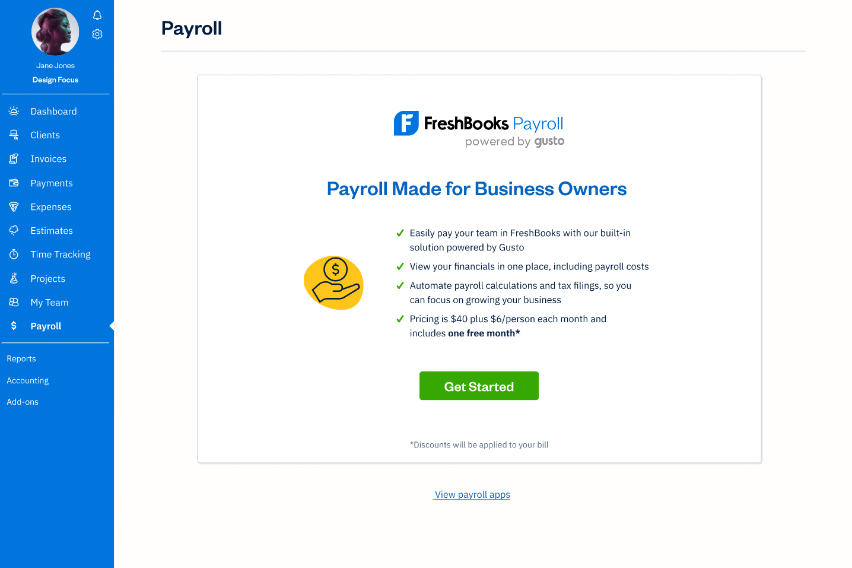

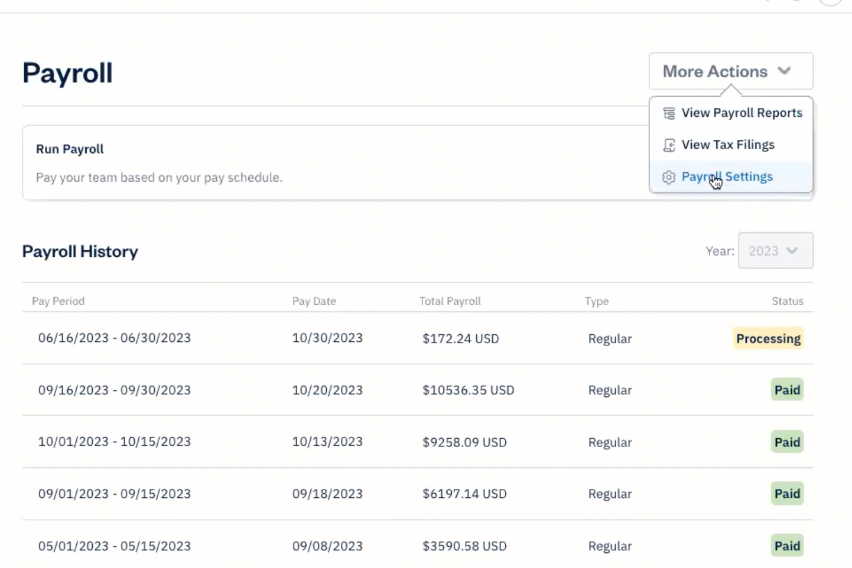

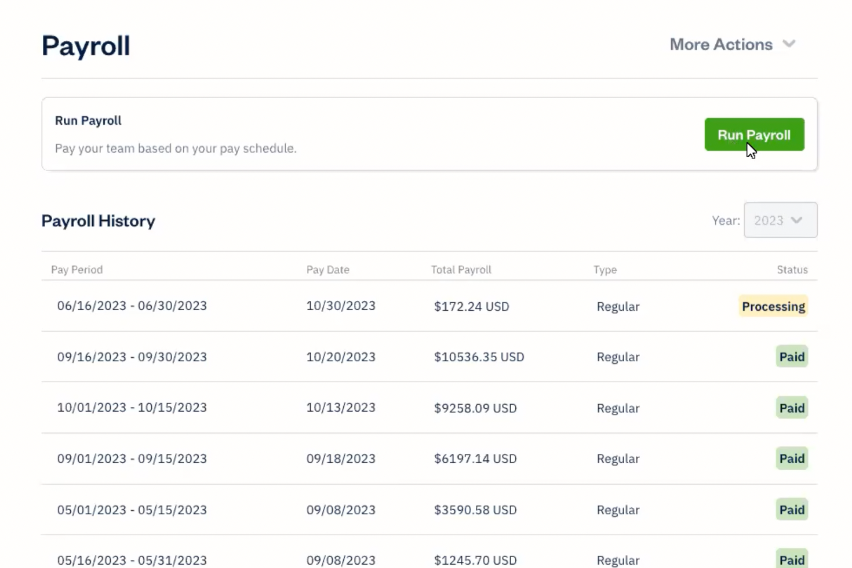

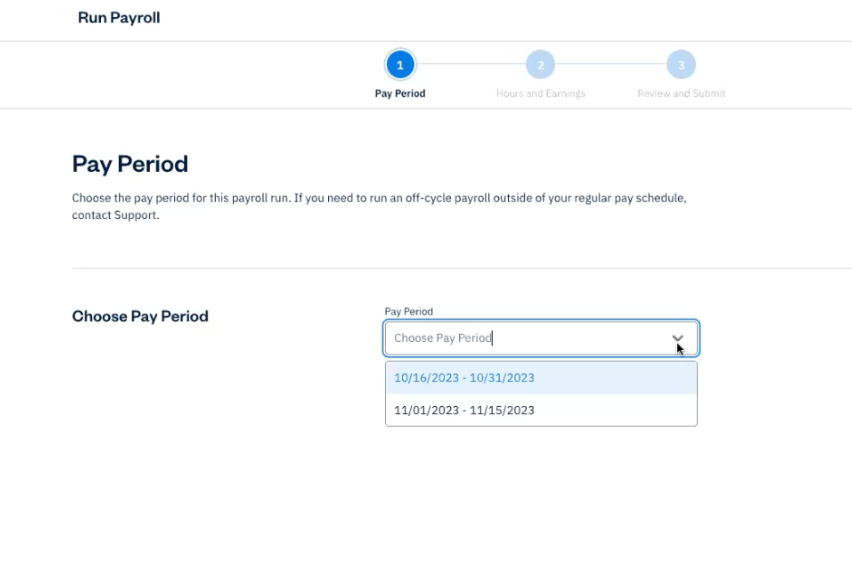

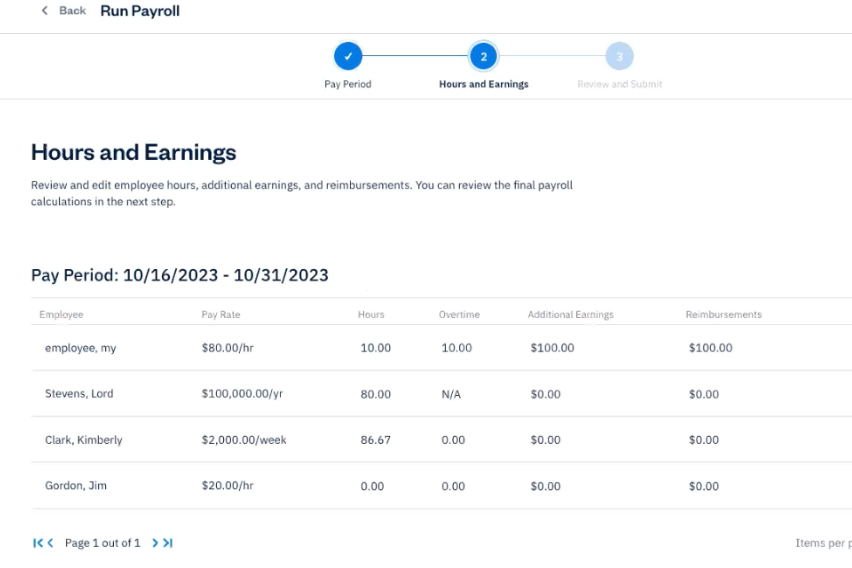

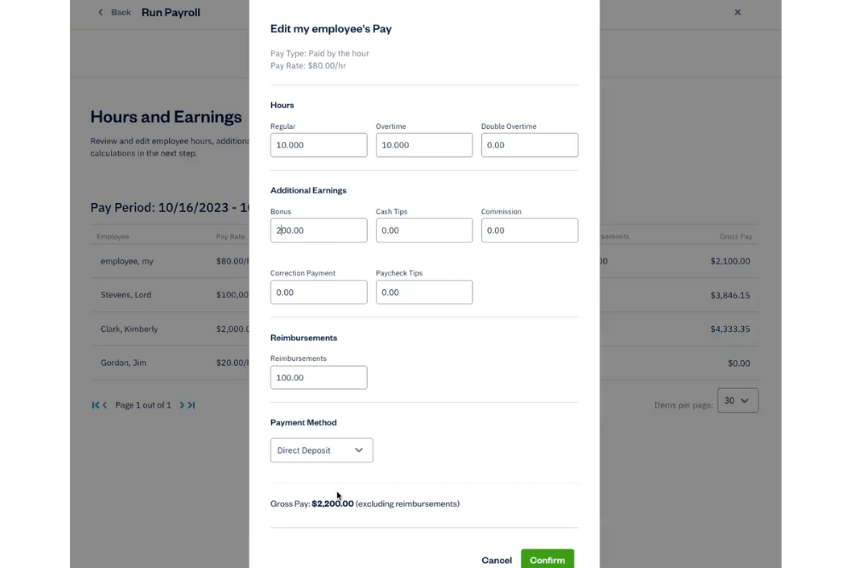

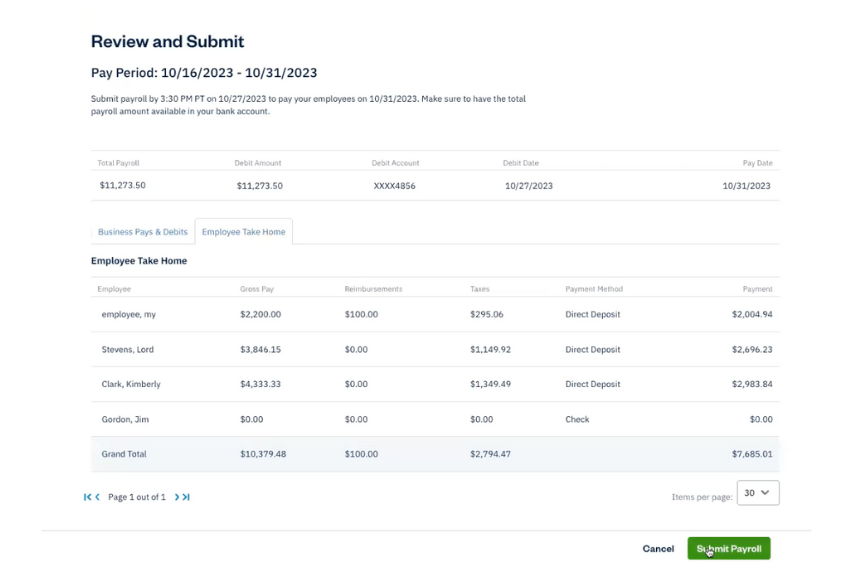

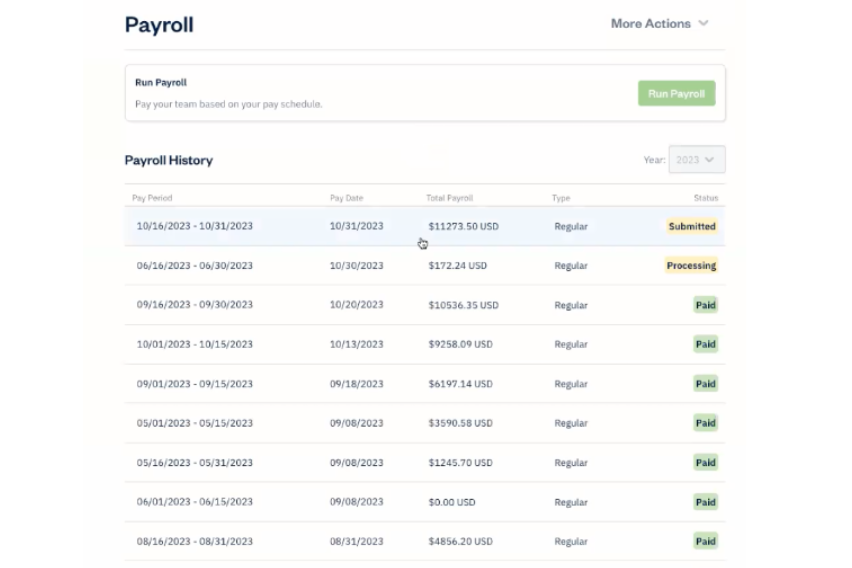

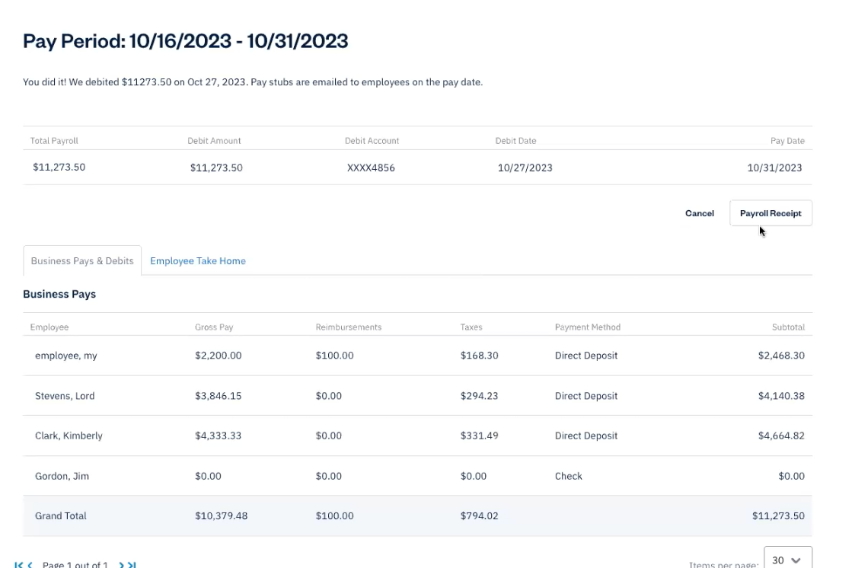

- payroll

You may also choose to focus on particular industries or types of businesses you want to serve, e.g. creatives, real estate, or IT businesses. It’s helpful if you have specific experience, interests, and connections in your chosen niches.

Select a Business Type and Register

Adhering to tax and legal obligations is a part of owning a business. The first step in navigating these responsibilities is to select the right business structure. This may include forming a limited liability company (LLC) or a separate legal entity to protect your personal assets.

- Sole proprietorship: A single person owns and manages the business, with personal liability.

- Partnership: Two or more individuals share the business’s ownership, profits, and liabilities.

- LLC (Limited Liability Company): Offers limited liability protection like a corporation but operates with partnership flexibility.

- S corporations (S corps): A corporation with tax advantages, allowing profits/losses to pass through to shareholders.

- C corporations (C corps): A standard corporation with limited liability but taxed separately from its owners.

It’s crucial to consult a legal expert when deciding the right structure for your accounting firm. They can guide you in choosing the best framework for your business, ensuring it aligns with your goals and complies with local regulations. Additionally, they can advise you on how to register in your jurisdiction, help you avoid potential legal pitfalls, and set a strong foundation for future success.

Get the Required Business Licenses and Permits

Starting an accounting firm requires to operate legally, including an Employer Identification Number (EIN). Each state in the US has its own requirements, but here are a few general licenses most businesses require, including:

- : Obtain an EIN from the IRS if hiring employees or operating as a partnership or corporation.

- : Get a business TIN from the IRS to use to file taxes, report income, and complete other financial transactions as a business.

- : Depending on your location, you may need a general business license or permit from your city, county, or state to operate legally. Check with local city and county offices.

- Professional liability insurance: While not always required, having errors and omissions insurance (professional liability) is highly recommended to protect the firm from client lawsuits related to negligence or mistakes.

- Occupational license: Some states and localities require accountants to obtain a specific occupational or professional license to operate in the accounting field.

- Industry-specific regulations: Depending on the services provided (e.g., tax preparation, auditing), certain specialty certifications or permits, such as the IRS PTIN (Preparer Tax Identification Number) for tax preparation, may be required.

It’s also a good idea to consult with local authorities or legal professionals to ensure full compliance.

Open a Business Bank Account for Your Accounting Firm

Before you begin operating your own accounting advisory firm, one of the most critical steps is to clearly separate personal and business finances. This is particularly important for LLCs and corporations because these business structures are designed to shield owners from personal liability.

By keeping finances separate, you preserve these entities’ legal protection ensuring that your personal assets—like your home or savings—are not at risk if your business faces a lawsuit or financial difficulty. This distinction between personal and business finances is fundamental to the “corporate veil” that protects business owners from creditors and lawsuits directed at the business.

Once you’ve registered your company and obtained an EIN, the next essential step is to . This simplifies your accounting, but it’s also just more professional and lends credibility to your firm.

Failure to separate finances could lead to “piercing the corporate veil,” where courts may hold you personally responsible for business debts, negating the benefits of forming an LLC or corporation in the first place.

Develop a Marketing Strategy

Developing a solid marketing strategy is key to . The first step is to define your target market—whether you’re focusing on small businesses, individuals, or specialized industries like real estate or healthcare. Understanding your ideal client’s needs will allow you to effectively tailor your services and messaging.

Next, create a strong brand presence by designing a professional logo, website, and social media profiles. Ensure that your online presence showcases your expertise, services, and testimonials, which builds credibility and trust with potential clients.

is another crucial component of your marketing strategy. Establish relationships with local business owners, financial advisors, and legal professionals who may refer clients to you. Consider joining industry associations or attending local business events to get your name out there. Offering free resources like blog posts, webinars, or consultations can demonstrate your knowledge and provide value to potential clients.

Don’t forget to optimize your firm’s website for local search engine optimization (SEO), so that individuals and businesses in your area can easily find you when searching for accounting services. By combining online marketing with networking and relationship-building, you’ll create a well-rounded strategy that consistently brings in new clients.

Mistakes to Avoid When Starting an Accounting Firm

Starting an accounting firm is exciting but it is possible to get off on the wrong foot if you’re not mindful from the outset. Managing your own accounting practice comes with its own set of challenges and advantages, such as increased control over income and flexibility in scheduling. Here are some common mistakes to avoid:

- Not creating a business plan: A solid business plan helps define your target market, pricing strategy, operational goals, and growth path. Without one, you risk directionless growth and missed opportunities.

- Failing to separate personal and business finances: As discussed, it’s crucial to separate personal and business finances, especially if you’ve registered as an LLC or corporation. Mixing the two can lead to liability issues, tax complications, and confusion in financial management.

- : Trying to attract clients by underpricing your services can devalue your expertise and hurt profitability. It’s essential to charge competitive rates that reflect your skill level and the value you provide.

- Neglecting marketing and networking: Many accountants focus solely on their technical skills rather than marketing. It’s important to invest time in networking, creating an online presence, and developing relationships with referral sources. Relying solely on word-of-mouth without an active marketing strategy can limit your firm’s growth potential.

- Not being selective with clients: Taking on every client, even those who don’t fit your services or budget, can create headaches and impact your firm’s profitability. , ensuring they align with your expertise and goals.

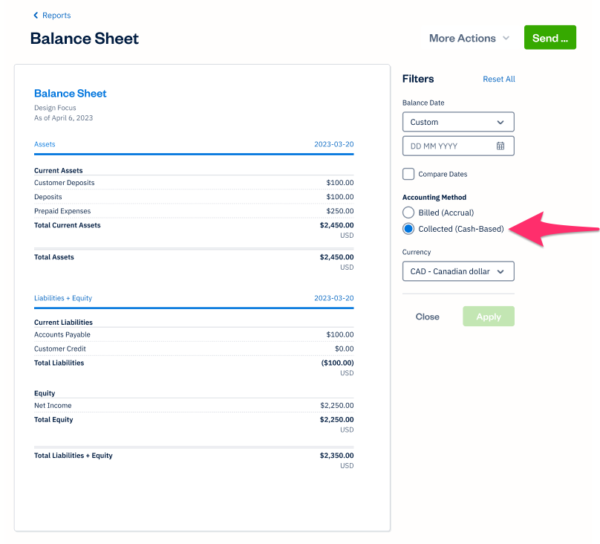

- Ignoring technology and automation: Failing to adopt can slow down your operations and reduce efficiency. Leveraging cloud accounting, client portals, and other technologies helps you stay competitive and deliver faster, more accurate services.

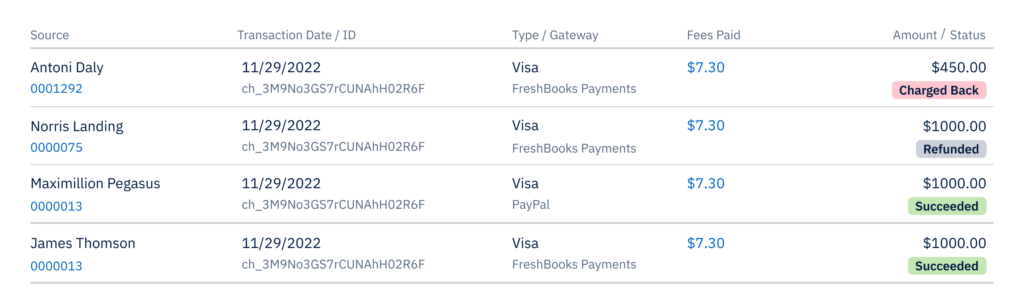

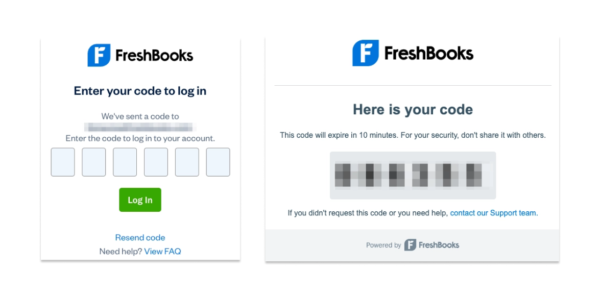

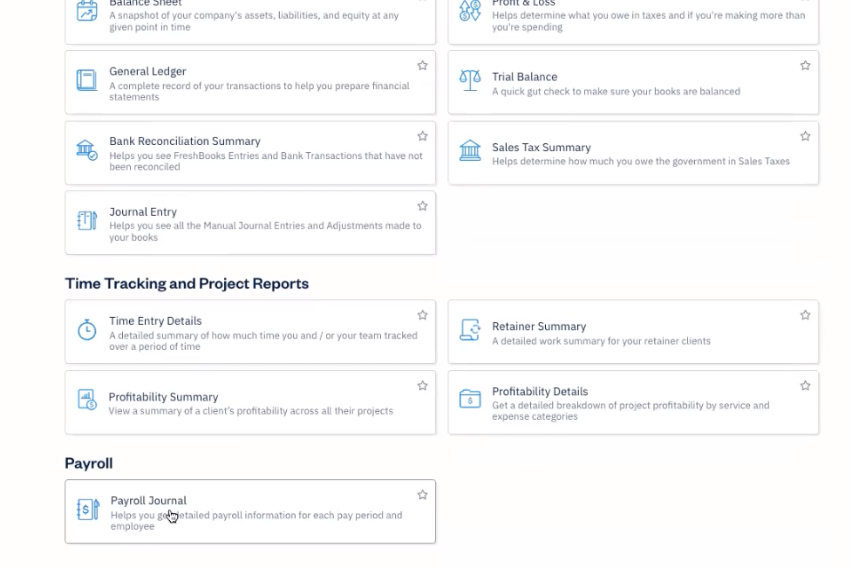

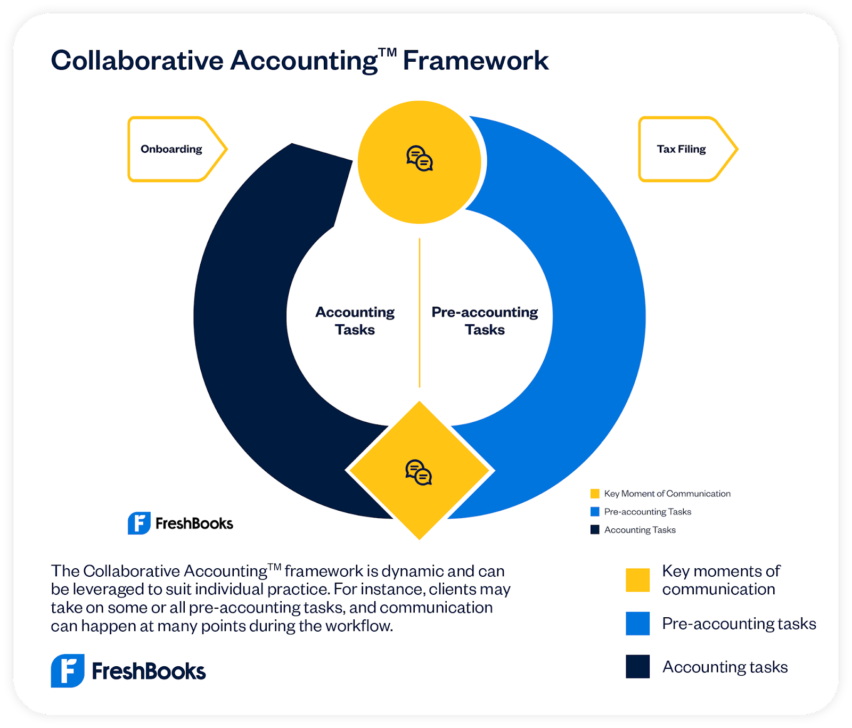

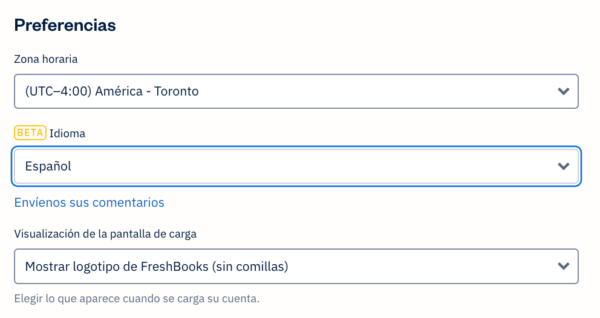

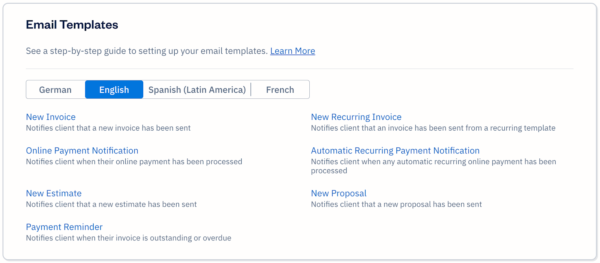

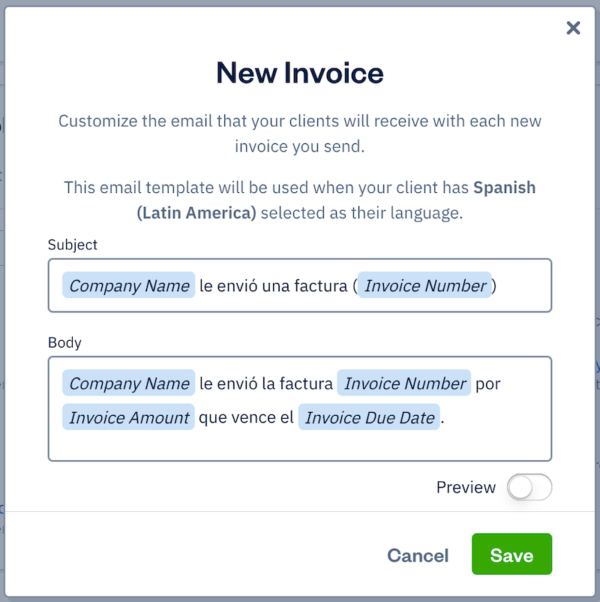

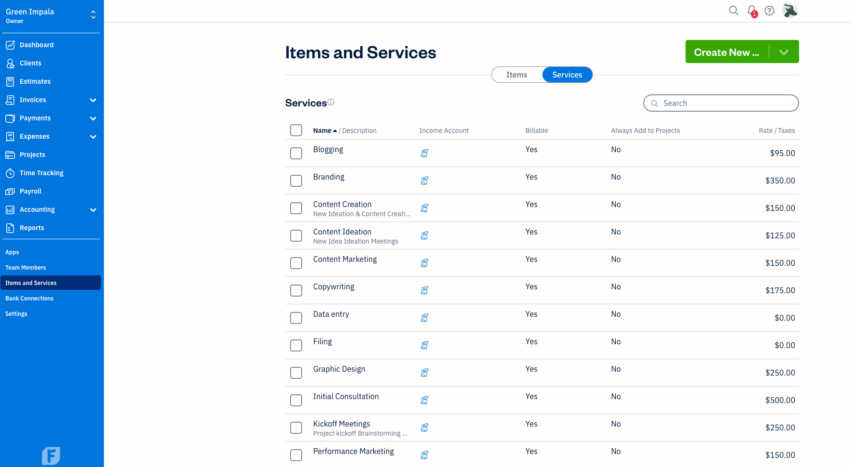

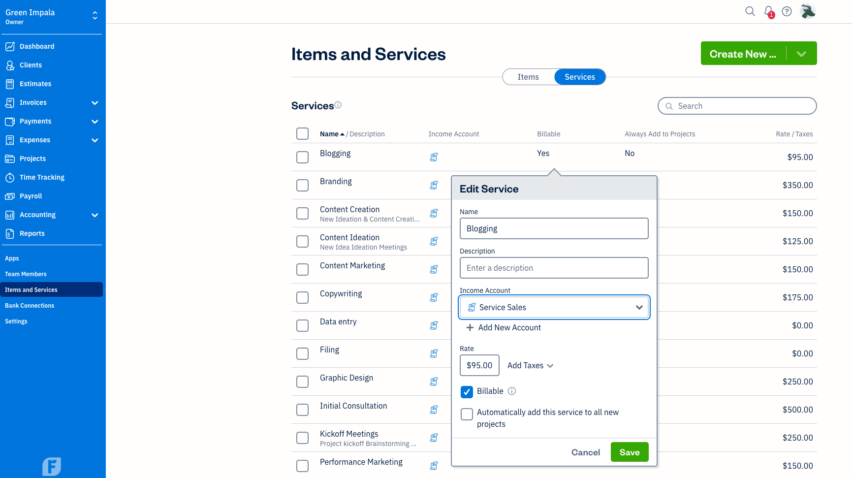

FreshBooks can set your accounting firm up for success, making operations smooth and efficient. This all-in-one software connects you with your clients in a single digital platform, helping you manage their finances, organize tax documents, ensure compliance, and provide timely, informed financial advice. It includes everything from proposals, invoicing, and payments to time tracking, payroll, accounting reports, and more.

Its intuitive interface and ability to automate tasks like invoicing, expense tracking, and payment processing make it a popular choice for many accounting professionals. You can also join the , which provides access to education, and certification along with accountant-centric support from real humans.

How Much Does It Cost to Start an Accounting Firm?

The cost can vary significantly depending on your location, business structure, the services you offer, and your initial client base. Some typical expenses might include:

1. Business registration and licensing fees

- Business structure registration: $100–$800 (depending on state and whether you’re forming an LLC, corporation, or partnership).

- CPA license fees: $50–$500, depending on your state.

- Other licences/permits: Varies by city/county; could be around $50–$200.

2. Office space and utilities

- Home office: Minimal costs (if working remotely).

- Leased office space: $500–$2,000/month, depending on location and size.

- Utilities: $100–$300/month for electricity, internet, etc.

3. Technology and software

- Computer and peripherals: $1,000–$3,000 (for a reliable setup, including a desktop/laptop, monitor, and printer).

- Accounting software: $15–$70/month per user (options like FreshBooks).

- Data backup and security: $10–$50/month.

4. Insurance

- Professional liability insurance: $500–$2,000/year, depending on the coverage needed.

- General business insurance: $300–$600/year.

5. Marketing and branding

- Website design and development: $500–$3,000 (initial setup) or $50–$100/month for hosting and maintenance.

- Business cards, brochures, and branding: $200–$1,000 for printed materials and logo design.

- Online marketing (SEO, ads): $200–$500/month (depending on scale).

6. Professional memberships and training

- AICPA or state CPA society memberships: $150–$500/year.

- Continuing education and training: $200–$1,000/year to meet licensing requirements and stay updated on industry trends.

7. Miscellaneous expenses

- Office supplies: $50–$150/month.

- Legal and accounting fees: $500–$2,000 for setting up the business, filing taxes, or legal consultations.

8. Initial working capital

- You should plan to have enough working capital to cover the first 3-6 months of operating expenses. This could range from $5,000 to $25,000, depending on your location, overhead, and initial client load.

Estimated Total Costs

- Low-end estimate: $5,000–$10,000 (home office, minimal marketing, few employees).

- Mid-range estimate: $10,000–$20,000 (leased office, moderate marketing, more services).

- High-end estimate: $20,000–$50,000+ (prime office space, full tech setup, advanced marketing).

These costs can vary depending on how aggressively you want to market yourself, the services you plan to offer (e.g., bookkeeping vs. tax planning), and the size of your initial team. Starting with a home office and relying on cloud-based accounting software can significantly reduce your costs.

You’re Not Alone as You Start Your Accounting Firm

Going out on your own can feel unnerving, but you don’t have to go it alone. offers a whole community of accounting professionals who are already deep into operating their own accounting and advisory practice. You can also get guidance from experts to help you grow your own firm.

With the right preparation and the right tools, you can bring a successful, sustainable business to life.

If Freshbooks is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.