Our view at Stack - Shopify has just about everything you need if you're looking to sell online. It excels with unlimited products, user-friendly setup, and 24/7 support. It offers 6,000+ app integrations, abandoned cart recovery, and shipping discounts up to 88%. Plus, it allows selling both online and in-person, scaling as your business grows.

Operating a retail store requires a lot of money. Whether you’re paying the deposit for a new location or investing inventory that you plan to sell in-store, you don’t have to use your own money to finance the business. A retail loan gives you a chunk of money upfront that you can repay later down the line.

Searching for financing options can feel overwhelming, particularly if you’ve never borrowed money before. This guide shares the different types of retail loans you could consider, plus the top retail lenders you can use to secure financing for your business.

What is a retail loan?

Retail loans refer to any type of business financing provided by banks, credit unions, or online lenders. Retailers can use them to run and grow their stores, whether that’s by purchasing inventory in bulk, paying the deposit for a new store lease, launching a marketing campaign, or paying staff salaries.

Types of retail loans

Personal loans

A personal loan is funding that’s made available to you personally, rather than the business. The interest attached to your personal loan is typically based on your credit score—the higher this is, the more banks will be willing to lend at a lower rate.

The downside of using a personal loan for your retail store is that you’re personally liable for any repayments. If you’re unable to repay it, personal assets such as your home or car could be at risk of repossession.

Business term loans

A business term loan is a lump sum of money that’s paid to your business from a financial institution. The lender will add their own interest rate. There are two types to choose from:

- Secured loans, which require collateral (such as inventory or real estate) that the lender can seize if you fail to make the monthly repayments.

- Unsecured loan, which doesn’t have any specific collateral requirements. The lender can choose what to seize if you don’t repay the loan.

If you meet the eligibility criteria for a retail business loan (such as a good business credit score and a history of repaying loans), you’ll have a set repayment schedule of fixed monthly payments. Your payments will include the initial amount you’re borrowing plus interest.

Credit card loan

Credit cards are a type of credit you can use to grow a retail business. These can either be personal credit cards in your name that you are personally liable for or business credit cards that are dependent on the business’s credit history.

Credit cards are a good short-term retail loan option. Most lenders don’t charge interest if you pay off the full amount at the end of the grace period. If you need $500 to buy inventory that you’ll sell within the next month, for example, you could use a business credit card to improve cash flow.

The downside of business credit cards is that interest can quickly rise if you don’t pay off the full amount. And if the card is in your name, you’re personally liable for all repayments.

Merchant cash advance

If you need working capital to pay for expenses before you generate sales, a merchant cash advance is worth considering. It’s a type of retail loan that can get paid out quickly to use for retail expenses like salaries, inventory, or rent. You repay the merchant cash advance by automatically deducting a percentage of your sales to give back to the lender.

Line of credit

A line of credit is a flexible type of retail loan where you can borrow funds as and when they’re needed. There’s typically a ceiling on a line of credit. If your line of credit goes up to $5,000, for example, you could withdraw $1,000 per month for five months.

The most attractive part of a line of credit is the fact you’ll only pay interest on what you borrow (instead of the whole credit amount). If you know your retail store will need to borrow a certain amount over the year, you can spread it out and only pay interest when you need to use the money. Most lenders also offer flexible repayment options on a line of credit.

SBA loan programs

The US Small Business Administration (SBA) is a government agency that lends money to startup companies, including retailers. Popular options include:

- SBA 7(A) loan. This loan has a maximum amount of $5 million. Interest rates range between 7.5% and 10%, and you’ll need a credit score of at least 680.

- CSC/504 loan. This loan is specifically for businesses that want to buy real estate. It’s a good option for retailers. You can borrow up to 50% of the money it’d cost you to buy a retail location.

- Disaster loans. If you run into unexpected challenges and need money fast, this is a good one to consider. This type of SBA retail loan can protect you from natural disasters that have officially been declared by the US president, such as earthquakes or tornados that have damaged your retail store and are not covered by insurance.

Equipment financing

Most retailers need equipment to operate their stores or manufacture products. If that’s the case, and you don’t have a lump sum to buy the equipment outright, consider equipment financing.

You won’t own the equipment if you choose this type of retail loan. You’ll simply rent the tools, machinery, or vehicle from the lender and pay a fixed rate over a set period of time to use it. Once the agreement ends, most lenders offer the option of a balloon payment if you want to take ownership of the equipment.

Inventory financing

Inventory financing allows you to get a retail loan by using inventory as collateral. Lenders typically offer up to 80% of your inventory’s value in this type of loan, and if you can’t commit to the repayments, the lender can seize your inventory to claim the money back.

Inventory loans tend to be riskier because valuations can fluctuate. If the market changes and inventory becomes less in demand, you’re at risk of paying back more money than you’ll make from selling stock.

Advantages of a retail loan

Many retail store owners turn towards loans as a way to grow their business because it offers the following advantages:

- Improve cash flow. When you secure a loan, you’ll have a lump sum upfront that can cover expenses such as rent, utilities, and inventory. This is useful if you’re going through a slow season and can’t generate enough turnover to cover your short-term expenses.

- Build business credit. Should you ever need to secure a bigger loan further down the line, a smaller retail loan proves you pay back your loans on time. This is evidence you can use to negotiate more favorable terms with future retail lenders.

- Keep equity of your retail business. Unlike equity financing, retail loans mean you don’t have to give away equity in your business. You keep total control over your company.

What is a retail lender?

A retail lender is any financial institution that lends money to retail businesses. Unlike traditional lenders that borrow money from people or online stores, a retail lender has strict criteria, requiring only registered businesses with a physical location to secure the loan.

Retail lenders to consider in 2024

Shopify

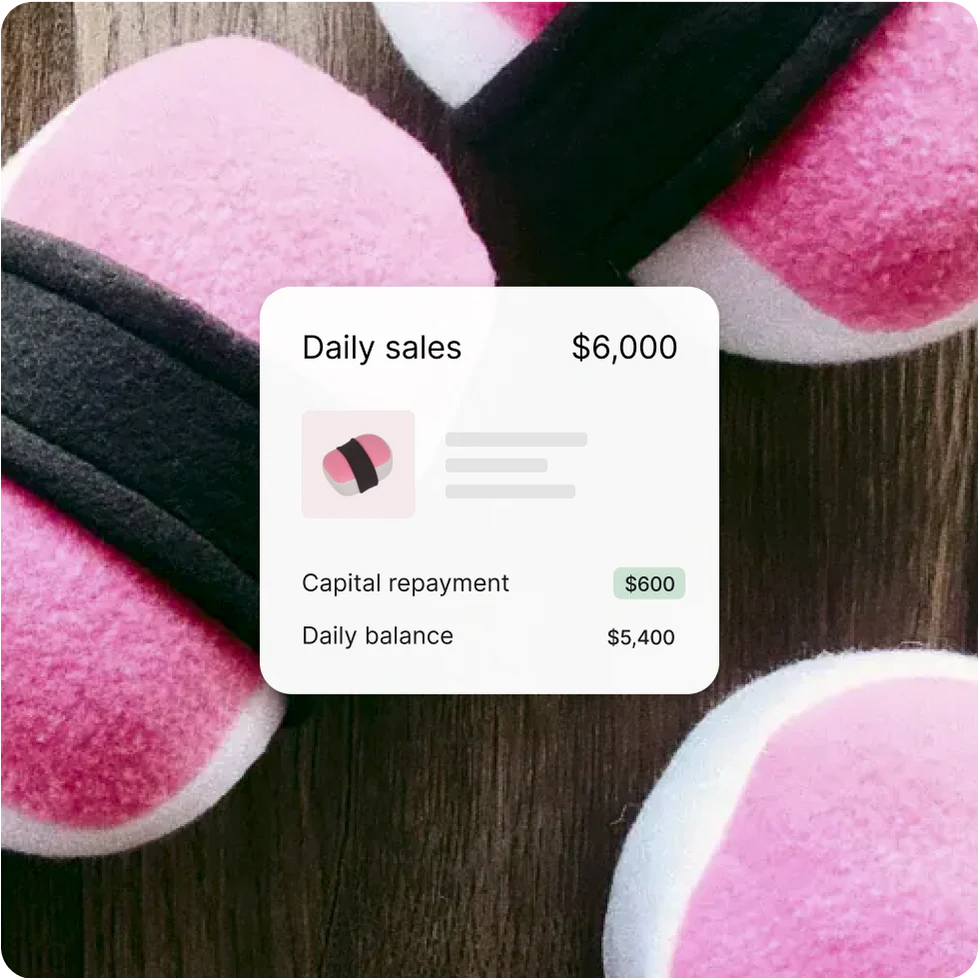

Shopify has provided over $5.1 billion of funding to merchants through Shopify Capital. It offers retail funding available to eligible merchants selling on the platform. Through Shopify Capital, eligible businesses can borrow up to $2 million and automatically repay the retail loan as a percentage of their daily sales.*

Receiving financing through Shopify Capital means you retain complete control of business without giving away equity. The loan application process is simple, and if you’re approved (in as little as two business days), funds will be deposited directly into your account, ready for you to start spending.

American Express

American Express offers retail loans to business owners. You can open a personal or business credit card with American Express and earn points on your purchases. So long as you pay off the balance in full at the end of each month, there’s no interest to pay.

If you need to borrow more money over a longer term, American Express also has a business line of credit. You’ll need a FICO credit score of at least 660, average monthly revenue of over $3,000, and the business needs to be at least one year old.

Chase

Chase is one of the more traditional banks that offer retail business loans. Depending on your business credit score, how much you wish to borrow, and what you plan to use the funding for, options include:

Bank of America

Bank of America only offers loans to businesses, but you can choose from any type of retail loan you could think of. That includes:

- Business credit cards

- Lines of credit

- Term loans

- Vehicle loans and auto loans

- Commercial real estate loans

- Equipment loans

- SBA loans

According to Bank of America, You’ll need to have been in business for at least two years and have $100,000+ in annual revenue to apply for most of these retail loans. Most options also have a minimum FICO credit score requirement of 700.

Understanding retail loans for your business

If there’s one thing you should never rush into, it’s agreeing to a business loan. Make sure that you can pay back any money you’re borrowing—including interest. Just one missed payment can damage your credit score and make you less likely to secure funding in the future.

Take your time to compare your options and choose the type of retail loan that best suits your business. If that’s an online lender with a loan that you can repay as a percentage of your daily sales, consider Shopify Capital.

Retail loan FAQ

What is the meaning of retail lender?

“Retail lender” refers to financial institutions that are willing to lend money to retailers. Examples of retail lenders include banks, credit unions, and many online lenders like Shopify Capital.

What is the difference between retail loan and business loan?

A retail loan is a specific type of business loan that’s only available to retail store owners. You can use these loans to pay for rent, in-person marketing, and inventory that you’ll stock in a brick and mortar store.

What is retail borrowing?

Retail borrowing happens when a customer lends money from a retail store. If someone wants to buy an expensive sofa, for example, they could borrow from the retailer and pay for the item in installments, plus interest.

Is a retail loan secured?

Lenders offer retail loans that can be secured or unsecured. A secured loan uses your property or assets as collateral. Some lenders allow you to borrow more money if the retail loan is secured because the lender can seize whatever you’ve used as collateral if you can’t make timely repayments.

* Shopify Capital loans must be paid in full within 18 months, and two minimum payments apply within the first two 6 month periods.

This article is focused on industry standards and descriptions are not specific to Shopify’s financial suite of products. To understand the features of Shopify’s lending products, please visit shopify.com/lending.

Available in select countries. Offers to apply do not guarantee financing. All financing through Shopify Lending, including Shopify Capital, is issued by WebBank in the United States.

If Shopify is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.