Our view at Stack - Shopify has just about everything you need if you're looking to sell online. It excels with unlimited products, user-friendly setup, and 24/7 support. It offers 6,000+ app integrations, abandoned cart recovery, and shipping discounts up to 88%. Plus, it allows selling both online and in-person, scaling as your business grows.

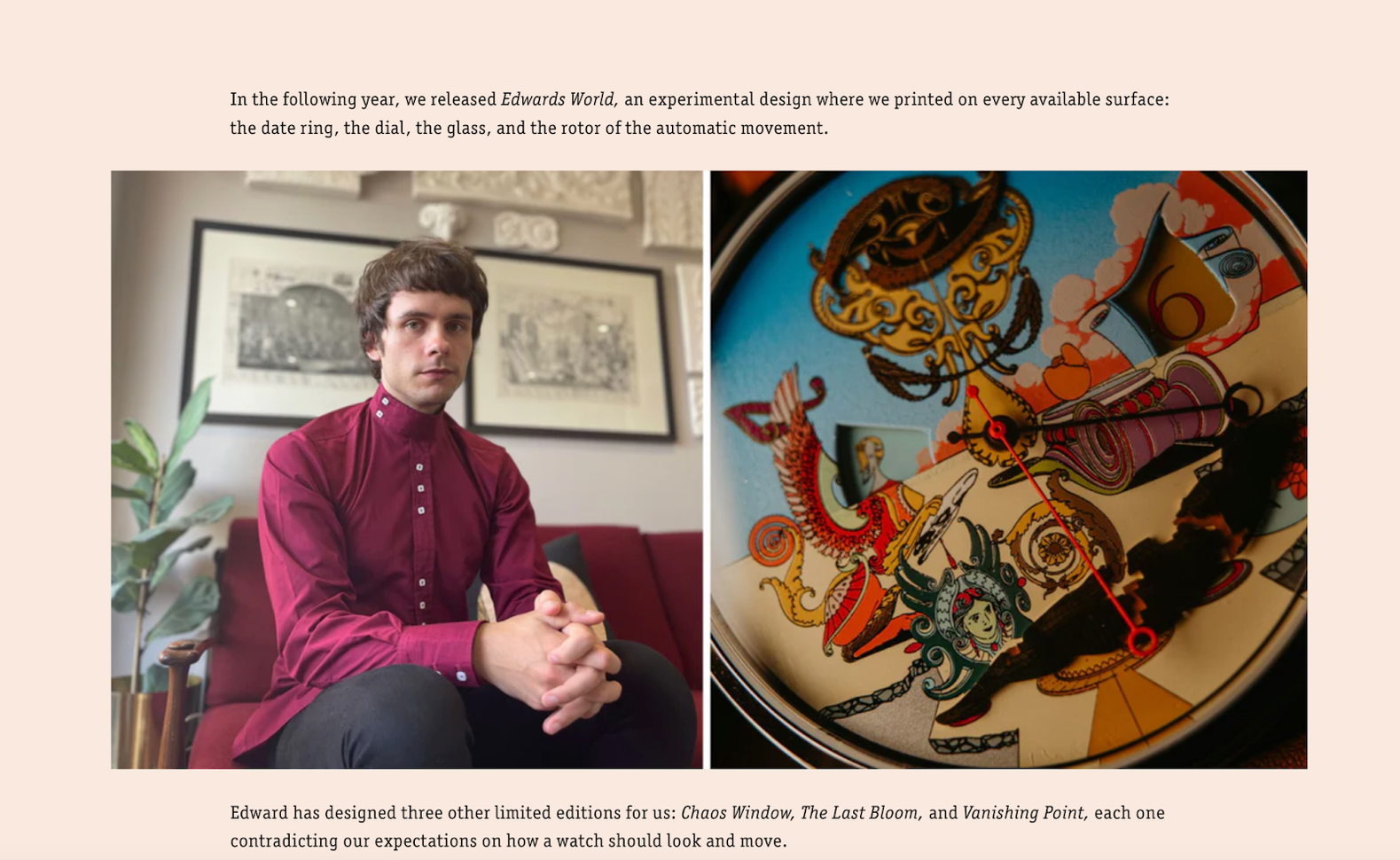

In 2014, sisters Taylor and Ali Frankel, along with their chemical engineer mother, Jenny, launched NUDESTIX from their home in Toronto, Canada. Their mission was clear: create easy-to-use multitasking makeup products for every woman. They knew their audience: the woman who preferred an extra 10 minutes of sleep over elaborate beauty routines.

Their flagship products, makeup sticks that provide a fresh-faced appearance, were designed without the need for brushes or complex techniques. This streamlined approach to applying makeup is a direct response to the beauty trends of the early 2010s, which often emphasized full-coverage, time-consuming routines.

A decade later, NUDESTIX is no longer a startup challenging beauty industry norms and is now a global brand available in more than 35 countries. The company has secured partnerships with retailers like Sephora and Boots UK and collaborated with celebrities such as Sofia Richie, all while maintaining relevance in an increasingly competitive market.

How does a brand like NUDESTIX succeed in a space dominated by social media fads and rapid product launches while remaining true to its core mission? Ahead, Taylor shares the exact mix of social media and community strategies that have unlocked NUDESTIX’s success.

Creating community first OR Treating customers like the influencers

“We truly believe that our community are our influencers,” says Taylor. “They are the ones that are buying our NUDESTIX products, that follow the brand, that have invested in our story.” Community building looks like real, authentic conversations on social media posts, in the DMs, or at in-person events or pop-ups. For Taylor, true community means people interact and engage with one another on top of engaging with the brand.

The brand recently launched Nude Love Club, an affiliate program that goes beyond traditional commission structures. It’s designed to foster a deeper connection with its community.

Nude Love Club, accessible through the NUDESTIX website, offers:

- Affiliate commissions for content creators (regardless of follower count)

- Access to exclusive community events across global markets

- Quarterly mentorship programs with industry experts

- Educational panels on topics ranging from product development to content monetization

This approach allows NUDESTIX to turn customers into brand advocates. While most consumers are used to seeing their favorite beauty influencer post about brands they’re using, Nude Love Club offers its community an opportunity to hear from the small creators, founders, chemists, and makeup artists that work with the brand. Taylor suggests entrepreneurs seek out opportunities to engage with their audience to inspire a cycle of organic content creation and word-of-mouth marketing.

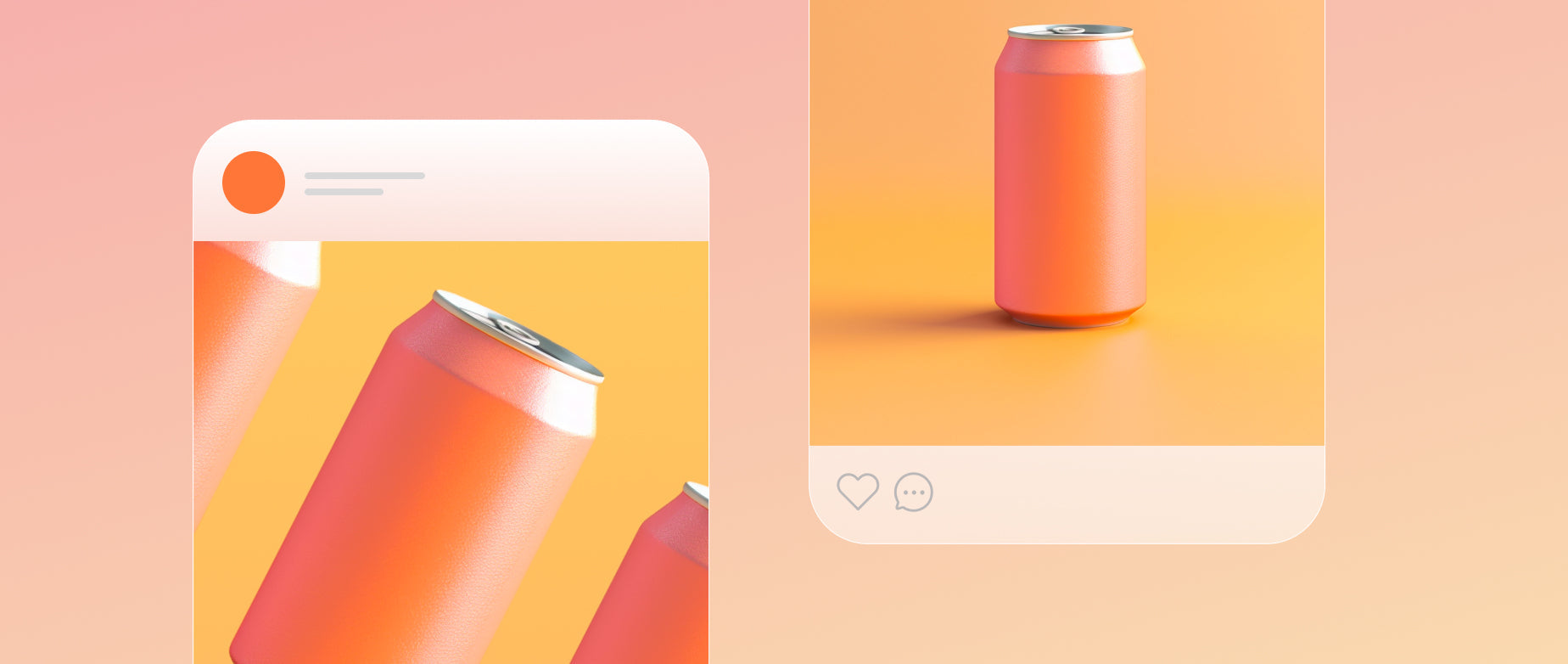

Transforming viral moments into 360-degree campaigns OR Acting fast when virality strikes

To capitalize on trending moments, especially on platforms like TikTok and Instagram, NUDESTIX holds weekly “trend talks” at its Toronto headquarters, where team members discuss viral content and celebrity mentions. The team uses opportunities like these to anchor their multichannel marketing plans to.

“When Sofia Richie mentioned NUDESTIX last year, we all dropped everything we were doing,” Taylor reveals. “We had a PR strategy around it, we had a social strategy around it, we had a retail strategy around it. We made it a moment.”

This agile approach allows NUDESTIX to quickly act on unexpected publicity, turning fleeting social media mentions into full-fledged marketing campaigns that span multiple channels.

Choosing partnerships wisely

“We never go into any partnership unless it is already an authentic partnership. The consumer today is so smart that they will pick out a pay-to-play,” Taylor says.

Key partnership criteria for Taylor includes the following three elements: partners have organically used and talked about the brand on social media before, the brand feels like a natural extension of existing relationships, and all parties are in it for the long haul.

This strategy has led to successful collaborations with influencers like the aforementioned Sophia Ritchie, Stephanie “Glamzilla” Valentine, and makeup artist Kevin Kodra, as well as partnerships with multinational retailers like Sephora. Taylor suggests going beyond evaluating the audience a partnership will give you access to and holistically evaluating if the collaboration is a natural fit.

Ignoring the competition

Taylor warns against chasing competitors: “It can destroy your brand,” she says. To stay ahead, and even set trends, don’t get distracted by the competition. Instead, focus on product innovation and visual evolution.

“We have always been at the forefront of this less-is-more philosophy with these really beautiful, high-quality products,” Taylor says. NUDESTIX continually iterates on formulations and products that align with its core mission of easy, multitasking makeup. Don’t get caught up recreating the latest trends that seemingly come out of nowhere. It may seem an easy lift because it is brand adjacent, but chasing fads is a losing proposition. Instead, lean into other ways of elevating your marketing.

NUDESTIX changes up its imagery point of view on the social feeds, its website and its email marketing to keep the brand feeling fresh and inventive. Find ways to shoot photography and social media content that isn’t traditional to your industry to push yourself creatively.

Putting yourself out there for in-person opportunities

NUDESTIX would not have the level of success it has without the amazing in-person events and networking opportunities Taylor hosts and takes part in. When she can hear from the people at the forefront of beauty, she can better evaluate how NUDESTIX can grow and continue generating more buzz.

Attending trade shows like Cosmoprof, Beautycon, and Essence Fest has led to crucial retail partnerships and new customer acquisition, and given Taylor foresight into upcoming innovations.

At networking events hosted by publications like Women’s Wear Daily Taylor has been able to connect with investors or other brand founders who have been instrumental to the brand’s strategy.

From its beginnings in Toronto to its current global presence, the brand has not only survived but thrived in the highly competitive beauty market. “Resiliency in business is so important,” Taylor concludes. “If you can get through the extremely difficult times and you can find solutions in extremely difficult times, I think you are more likely to create a sustainable business.”

The NUDESTIX journey demonstrates that maintaining relevance doesn’t mean constantly reinventing yourself—it means thoughtfully adapting while staying true to your core values and community.

Check out the full Shopify Masters episode to hear more strategies and creative exercises that have contributed to NUDESTIX continued success.

If Shopify is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.