Our view at Stack - Freshbooks simplifies accounting for solo business owners, freelancers, and small companies. Intuitive, easy-to-use, and affordable. Manage payments, expenses, invoices, and accept payments seamlessly.

As a business owner or independent contractor, you understand the importance of accommodating your clients’ preferred payment methods. Dealing with a diverse portfolio of clients means you encounter a range of payment preferences, from traditional checks to online transactions.

To simplify and streamline the payment process for you and your clients, FreshBooks has introduced Bank Transfers (aka Automated Clearing House or ACHΩ payments). By accepting Bank Transfers (ACH payments) with FreshBooks, your clients can send payments in seconds, and you can say goodbye to manual payment tracking and time-consuming trips to the bank.

Table of Contents

What Is a Bank Transfer (ACH Payment)?

Bank Transfers, or ACH payments (which stands for Automated Clearing House), allow your clients to transfer money online from their bank to yours. ACH in particular connects financial institutions across the U.S. for seamless transfers.

Are Bank Transfers (ACH Payments) Secure for My Business and My Clients?

Yes! The ACH network, which facilitates Bank Transfers through FreshBooks, follows strict security protocols to ensure the integrity and confidentiality of the transferred funds and all sensitive information.

These transfers use encryption, which protects the information sent between banks and keeps it private and safe. Additionally, ACH transactions require strong authentication to ensure only authorized individuals can initiate or approve payments.

The ACH network has built-in security measures, like firewalls, to prevent unauthorized access. Moreover, there are regulations in place to ensure that financial institutions take the necessary steps to protect customer data.

By using ACH transfers, small business owners can have peace of mind knowing that their payment transactions are secure and their sensitive information is well-protected.

Why Should I Enable Bank Transfers (ACH Payments)?

Here are some great reasons:

- Only a 1% flat fee, lower than a credit card payment

- Get paid 2x faster than by check

- More flexibility and convenience for clients

- No setup fees, monthly fees, or minimum charges

- A good, reliable option for recurring payments

How Long Do Bank Transfers Take?

Good question! Bank transfers are often completed in 1 business day. But they can take up to 5 days, depending on which payment gateway you use and how long it takes the financial institution to process the transaction from your bank account.

How Do I Enable Bank Transfers (or ACH Payments)?

To enable Bank Transfers:

- Log into your FreshBooks account and click the gear icon in the top left corner.

- Click on Online Payments Settings. Here’s what it looks like in-app:

- Click Get Started with Online Payments and then click Continue

- Verify your email, business information, and add a bank account

- Now, you’ll have the option to accept Bank Transfers on an invoice

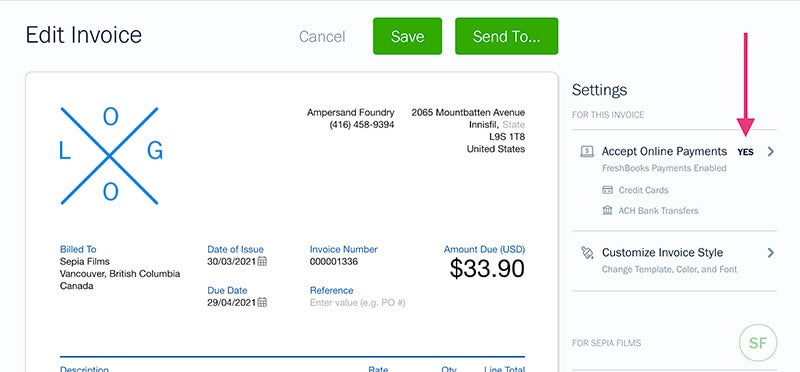

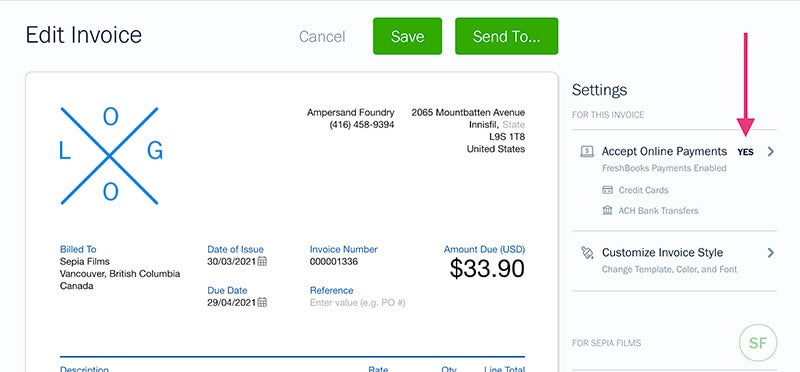

You can also enable ACH payments directly on an invoice:

- Click on the right of the invoice.

- Select the checkbox beside ACH.

- Click Done. That’s it!

Here’s what it looks like in-app:

Note: to be able to accept Bank Transfers (ACH), you first need to set up Online Payments. You can .

How Do ACH Transactions Work?

ACH payments are similar to bank transfers or wire transfers (the sending of money from one bank account to another). So let’s say a client wants to use ACH payments on an invoice. When you send the invoice out to be paid, your client can provide their bank account information to you (their account and routing number) and sign an authorization for ACH transactions.

Then, when it’s time to pay, your bank will send their bank a request to transfer the money they owe from the provided account. And the two banks will then communicate to ensure that there are sufficient funds to process the ACH transaction into your bank account (similar to a direct deposit).

All of this is done through the Automated Clearing House network, which handles the transactions for a variety of banks and financial institutions.

Need Help With Bank Transfers (ACH Payments)?

If you have any questions about getting started with Bank Transfers or ACH payments (like how to set up ACH payments, what are the ACH transaction fees, or how exactly do ACH payments work) feel free to .

Plus, learn more about accepting online payments with , , and .

[embedded content]

This post was updated in September 2023.

If Freshbooks is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.