Our view at Stack - Shopify has just about everything you need if you're looking to sell online. It excels with unlimited products, user-friendly setup, and 24/7 support. It offers 6,000+ app integrations, abandoned cart recovery, and shipping discounts up to 88%. Plus, it allows selling both online and in-person, scaling as your business grows.

When you’re running a small business, every sale feels like a win. But, how do you determine how much you actually made off that sale? There’s a surprisingly simple formula for figuring it out called customer acquisition cost, or CAC.

Learn what customer acquisition cost is, why it’s important, and how to calculate it. Find out how to use this calculation to determine your overall profitability and get some advice for reducing your CAC if it’s not where you want it to be.

What is customer acquisition cost?

Customer acquisition cost (CAC) is the total cost of acquiring a single customer. It factors in all spending on sales, marketing, or any other activities associated with converting a lead into a paying customer.

CAC tells you how efficient your conversion efforts are and helps you identify opportunities to make them more efficient. In the process of calculating it, you’ll be able to identify roadblocks and inefficiencies in your sales funnel.

How to calculate customer acquisition cost

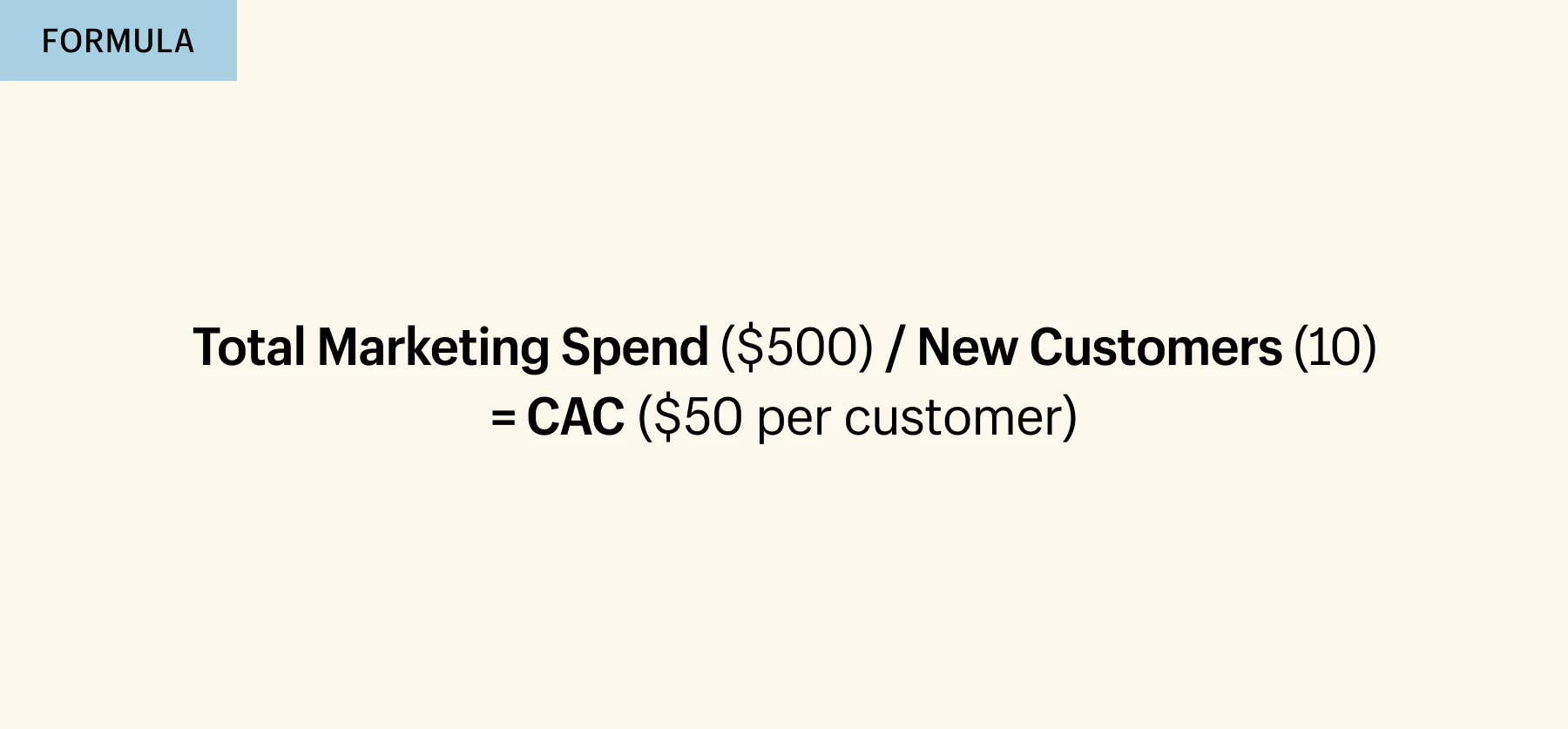

To calculate CAC, add up all the costs associated with acquiring new customers in a specific period, then divide the total by the number of new customers who made purchases during that period.

It’s important to note the number of new customers acquired refers only to first-time customers and does not include returning or retained customers. This distinction ensures the CAC calculation accurately reflects the cost of attracting new business, rather than conflating it with the costs associated with existing customer retention.

Costs to include in total marketing spend

When calculating your total marketing spend, it’s essential to account for all relevant expenses to get an accurate picture of your CAC. Here are some key costs to include:

- Marketing software and tools. Subscriptions to customer relationship management (CRM) systems, analytics platforms, email marketing services, and other essential tools.

- Marketing staff salaries. Compensation for your marketing team, including salaries, benefits, and any freelance or contract work.

- Advertising fees. Costs associated with online and offline advertising, including pay-per-click (PPC) campaigns, social media ads, and traditional media buys.

- Discounts and promotional offers. The value of discount codes, coupons, and special offers used to attract new customers.

- Content creation. Expenses related to creating marketing content, such as blog posts, videos, infographics, and other materials.

- Sales costs. Any additional costs tied to the sales process that support marketing efforts.

Tom Jauncey, co-head of Nautilus Marketing, meticulously tracks the breakdown of his CAC. He allocates 40% of the budget to ad spending, 30% to salaries, 15% to software, 10% to content creation, and 5% to sales costs. This detailed tracking ensures that each aspect of the marketing budget is optimized for maximum efficiency and effectiveness.

Metrics to use with CAC

Although customer acquisition cost (CAC) is a useful metric on its own, factoring it in with other key metrics can provide even deeper insights into business health. Here’s how to use CAC in combination with additional metrics:

Customer lifetime value

The customer lifetime value (CLV) to CAC ratio is a crucial metric that helps you understand the long-term profitability of your customer acquisition efforts. CLV represents the total revenue you can expect from a customer over the entire duration of their relationship with your business. By comparing CLV with CAC, you can determine if the cost of acquiring a customer is justified by the revenue they generate.

To calculate CLV, multiply your average revenue per customer by your average customer lifespan (the length of their relationship with your business). Once you have that, you can divide it by your CAC to get your CLV to CAC ratio. Here’s the formula:

If your ratio falls between 3:1 to 5:1, your acquisition strategy is working efficiently. A ratio above this range indicates that while your spending is under control, you might not be investing enough in growth opportunities. Conversely, a ratio below the optimal range suggests a need to revisit your strategies to either increase CLV or decrease CAC. Maintaining an optimal CLV to CAC ratio ensures that your marketing investments yield profitable returns and guide your business toward sustainable growth.

Gross margin

CLV tells you how much you can expect to earn from your average customer; however, it doesn’t tell you how much you’re profiting from each customer. To determine that, multiply CLV by your gross margin, which is the percentage of revenue left after accounting for the cost of goods sold (COGS).

For example, if your gross margin is 40% and your CLV is $300, multiplying the two gives you a profit of $120 from each customer. If this profit is less than your CAC, it indicates you’re spending more on acquiring customers than the profit you generate from them over time. You may need to reevaluate your acquisition strategy in this case.

Return on ad spend

Return on ad spend (ROAS) measures the revenue generated for every dollar spent on advertising. It’s a crucial metric that helps you understand the effectiveness of your marketing efforts and whether your spending is delivering a good return.

To calculate ROAS, divide the revenue attributable to advertising efforts by the total spend on ads. Here’s the formula:

ROAS = revenue attributable to advertising / total advertising spend x 100

By comparing ROAS with CAC, you can determine whether your marketing efforts are cost-effective. If your CAC is high and your ROAS is low, it means you are spending a lot to acquire customers without getting a proportional return, signaling a need to optimize your strategies.

For example, let’s say your company spent $10,000 on advertising last month and generated $50,000 in revenue directly from those ads. Your ROAS would be calculated as follows:

ROAS = (50,000 / 10,000) x 100 = 500%

This means that for every dollar spent on advertising, your company earned $5 in revenue. A high ROAS like this indicates that your advertising campaigns are highly effective and generating significant revenue relative to the amount spent

Sales efficiency

Sales efficiency measures how effectively your sales team converts leads into paying customers. It’s an important metric that helps you gauge the productivity of your sales efforts. To calculate sales efficiency, divide the revenue generated by the sales team by the total sales and marketing expenses.

High sales efficiency indicates that your marketing processes are yielding a good return. For instance, if your CAC is $150 per customer and your sales efficiency ratio is 2:1, it means each customer generates $300 in revenue, making the investment worthwhile. If sales efficiency is low, it suggests that your CAC might be too high relative to the revenue generated, indicating a need to optimize your sales approach.

3 tips for reducing CAC

- Improve your site’s SEO

- Identify your most effective marketing channels

- Focus on high-value customer segments

If you find your customer acquisition costs are higher than you’d like, take these steps to lower them:

1. Improve your site’s SEO

When Renaissance Digital Marketing embarked on a mission to improve its CAC, the founders focused on search engine optimization (SEO) through content optimization, technical SEO enhancements, and backlink building. “As a result, we saw a significant increase in organic traffic by 45% within six months,” says managing director Doug Darroch. “This directly contributed to a 30% reduction in CAC, as organic leads tend to be more cost-effective compared to paid acquisition channels.”

2. Identify your most effective marketing channels

Digital marketing agency Nautilus Marketing undertook a comprehensive review and optimization of its digital marketing strategy. The team analyzed the performance of various marketing channels to identify the most cost-effective options. By reallocating their budget toward high-performing digital ads, they maximized their reach and engagement.

Simultaneously, they cut back on spending in less effective channels, redirecting resources away from strategies that did not yield satisfactory returns. “By implementing these changes, we successfully reduced 15% of CAC within around six months,” says Tom Jauncey, Nautilus marketing co-head. With the help of marketing analytics tools like Google Analytics, you can measure the effectiveness of your campaigns.

3. Focus on high-value customer segments

Nautilus Marketing also reduced its CAC payback period (meaning the time it takes to recoup the cost of acquiring a customer) by focusing its acquisition efforts on customers who are likely to spend more or be more loyal. “By focusing on higher-value customer segments, we have successfully reduced our CAC payback period from six months to four and a half months,” says Tom.

To try this strategy, use a segmentation tool to profile customers and uncover the gold mine that is your customer base. Once you’ve pinpointed these high-value groups, tailor your marketing strategies to speak directly to their needs, preferences, and behaviors.

Customer acquisition cost FAQ

What exactly is customer acquisition cost (CAC)?

Customer acquisition cost (CAC) is the total cost of acquiring a new customer. This includes all expenditures related to sales, marketing, and any other activities that contributed to converting a lead into a paying customer.

How do you calculate customer acquisition cost?

To calculate CAC, first sum up all the costs associated with marketing and sales over a specific period. Divide this total by the number of new customers who made purchases for the first time during that same period. The resulting figure will be the average amount you spent to acquire a new customer.

What costs should be included when calculating total marketing spend for CAC?

Include expenses such as marketing software and tools, marketing staff salaries, advertising fees, the value of discounts and promotional offers, content creation expenses, and any additional sales costs that supported marketing efforts during the time period you’re measuring.

If Shopify is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.