Our view at Stack - Pipedrive is a robust CRM platform, offering automation, contact data collection, webhooks, AI-powered sales assistant, email communications, email marketing, and customisable sales pipeline workflows.

Smooth expense reporting helps you manage budgets effectively and keep the trust of staff who spend on the company’s behalf.

In this guide, you’ll learn what business expense reports include and how to build an efficient recording and reimbursement process from the ground up.

You’ll also find two free expense report templates to get started and learn how dedicated accounting software aids efficiency.

What is an expense report?

An expense report is a document that employees use to record and receive reimbursement for company-related expenses, such as business travel, meals and equipment.

Expense reports are usually submitted to a business owner, manager or finance team for approval before the reimbursed amount is deposited into the employee’s bank account.

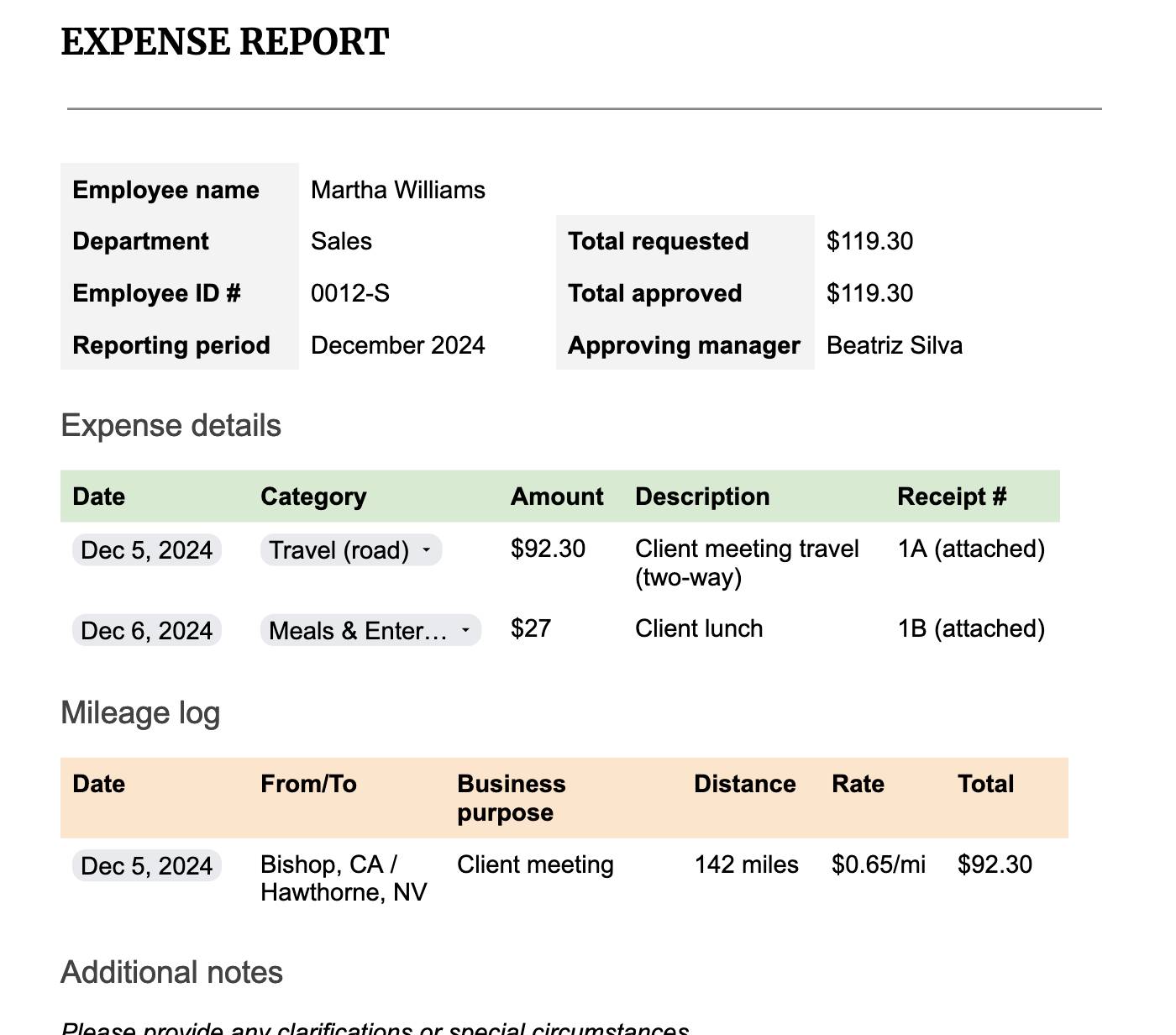

For example, imagine one of your sales reps drives out of state for a business trip. They pay for gas and lunch on their credit card, knowing they can claim reimbursement.

The following week, they submit an expense report detailing what they spent, when and why, with a receipt for evidence.

It looks like this:

As their manager (or “approver”), you see that the spending adheres to the company’s expense policy. You sign the report and add the total costs to their monthly paycheck.

A clear, repeatable process like this lets staff confidently complete tasks that require ad-hoc payment (e.g., getting to meetings and entertaining clients) while organizing company financial records.

Note: Expense reporting can also mean detailing all company outgoings in an expenditure report template, which is helpful for budgeting and forecasting. However, tracking employee expenses for reimbursement is the more common definition and this guide’s focus.

What’s included in an expense report?

In their simplest form, expense reports have the following details:

-

Employee name

-

Date of transaction

-

Category (e.g., type of expense)

-

Total amount (or subtotal)

-

Brief description

-

Evidence (e.g., a sales receipt or invoice)

This information ensures the approving person or team knows who spent what and why. They can check the claim aligns with company policy and proceed accordingly (i.e., approve, deny or request more information).

Sometimes, extra details make expense reports easier to process. For example, including associated project codes or client names helps finance teams allocate costs to the right budgets, minimizing follow-up questions.

Recommended reading

The Ideal On-The-Road Routine For Traveling Sales Jobs

Why expense reporting matters for small businesses

A smooth, standardized expense reporting process will help you track employee spending and strengthen staff relationships.

After building yours, you can expect the following outcomes:

-

Accurate financial records. Formally tracking expenses gives businesses accurate, up-to-date financial records. These reliable records simplify audits and tax returns, freeing time for other tasks and preventing penalties.

-

Timely reimbursements. Employees who cover business expenses out of their own pockets expect quick reimbursement. A streamlined reporting process prevents delays, boosts morale and protects trust between employees and management.

-

Simpler budgeting and forecasting. When you know where company money goes, you can spot trends and tweak budgets accordingly. For example, if travel expenses rise, you could explore cheaper alternatives (e.g., virtual meetings) or tighten guidelines.

Clear policies and streamlined workflows help you create a system that makes life easier for employees and managers.

How to build a basic expense reporting process

Creating and refining your expense reporting process has no downside, especially since it’s such a straightforward activity.

Follow the steps below to set up a system that organizes finances, simplifies reimbursements and unlocks clear visibility into company spending.

Step 1. Define expense categories and policies

Start by setting clear guidelines for what qualifies as a reimbursable business expense. It’ll help employees understand which costs they can claim and prevent unnecessary expenditures.

While every business is different, it’s wise to cover basics like travel, meals, office supplies and client entertainment. These costs could arise at any time, even if they’re irregular. Being prepared will ensure smooth processing.

Depending on how your company operates, you might also include the following in your expenses report template:

-

Subscription fees (e.g., to relevant publications)

-

Event tickets (e.g., industry conferences)

-

Training courses (e.g., skills workshops)

-

Employee perks (e.g., gym memberships)

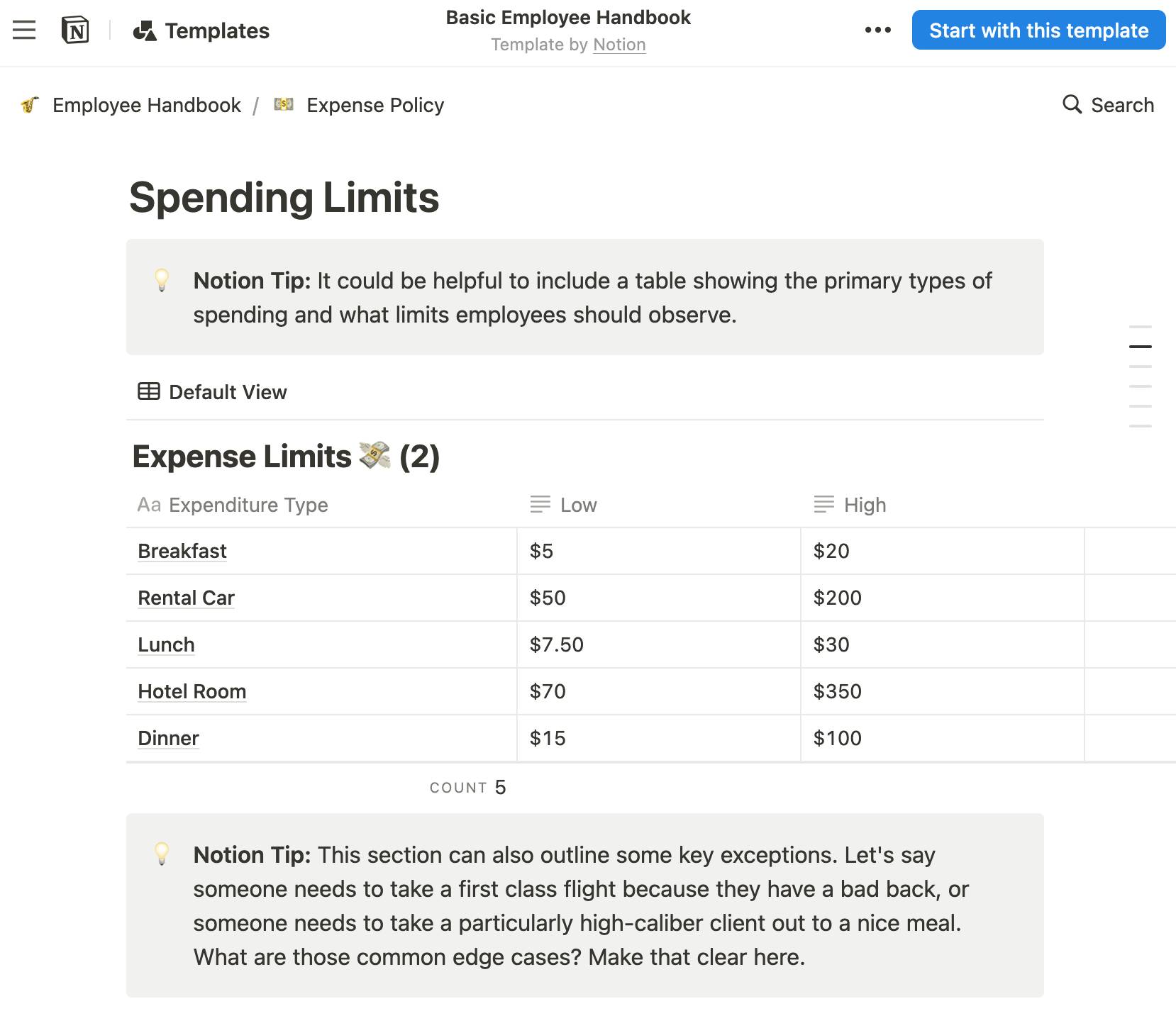

Keep the details in a shared space that’s easy for all employees to access, like a company wiki page or policy handbook. For example, Notion’s employee handbook template has an expenses section for listing categories and limits:

Providing specific examples in your policy can also minimize confusion and speed up the approval process.

For instance, if you include travel, you might state that airfares to client meetings are reimbursable, but taxi fares to the office aren’t.

If you manage employee perks through expenses, remind staff of their allowances and offer ideas (e.g., yoga classes for a wellness budget).

Step 2: Request standardized evidence for each expense

Require employees to submit receipts or invoices for every expense. It will benefit you and your finance team in a couple of ways.

Firstly, receipts allow for quick verification of transaction details, including dates, costs and locations, speeding up processing and reimbursement.

For example, if an employee claims for a client lunch, their receipt will show what they ordered. The finance team can check that the spending aligns with company policy, like covering client meals but not alcoholic drinks.

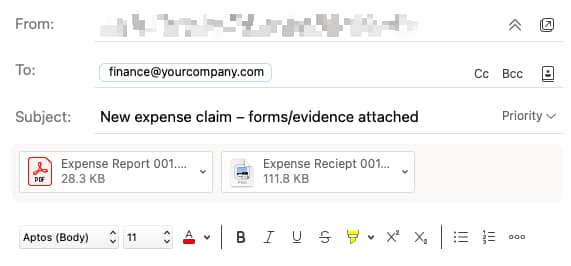

If you request expense claims via email, you can ask staff to attach receipts as images or PDFs along with their reimbursement forms, like in the example below.

Storing purchase records in one place also means that if an issue arises (e.g., a canceled or delayed flight), you or a line manager can address it directly with the vendor. It keeps employees focused on their work instead of managing follow-ups.

Step 3: Implement a simple review and approval workflow

Establish a clear workflow for reviewing and approving expenses. Employees are less likely to drop work to seek information or let expense claims pile up if they know exactly how to do an expense report.

If you manage a small team, you might have employees submit expense reports directly to you.

For larger teams or to streamline the process, consider these options:

-

Let line managers approve expenses in their departments (e.g., the sales manager would approve claims from the sales team)

-

Create an approval hierarchy based on expense amounts (e.g., claims over $1,000 go to you, individual department heads manage everything else)

-

Employ a finance team, office manager or accountant to handle all expense reports

Once roles are clear, decide how employees will submit reports. It could be via email, printed forms, shared cloud storage or an accounting tool’s reporting feature.

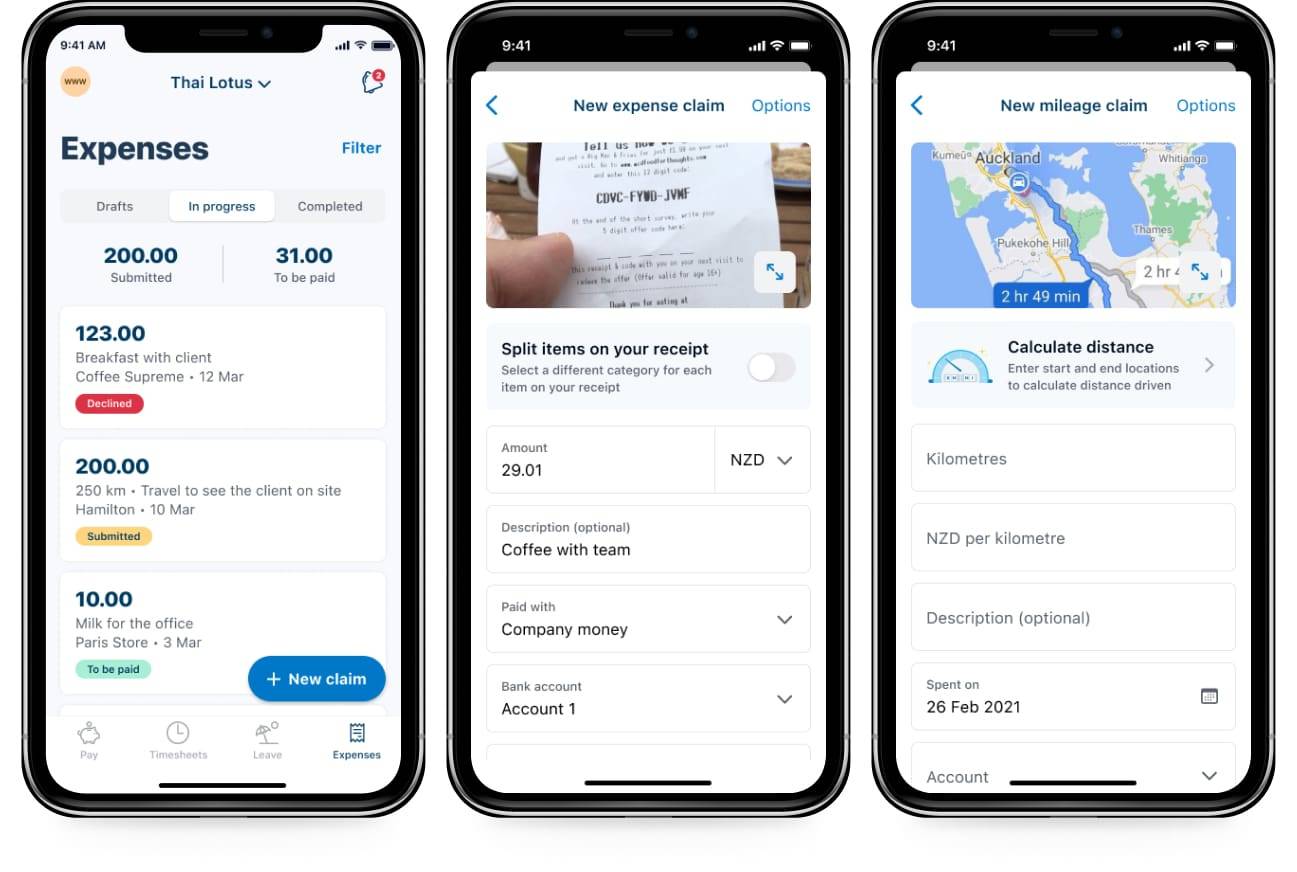

For example, Xero’s mobile app allows employees to enter details, photograph receipts and track their claims.

Use what fits best with your setup. For instance, if you already have accounting software with expense reporting, use it to save time. You could also use your customer relationship management (CRM) system to share and store reports if it suits your workflow.

Finally, set a time limit for reporting submissions. One calendar month (or 30 days) should be enough to stop claim backlogs affecting your financial data or cash flow.

Step 4: Use an expense report template for consistency

Standardized expense report templates keep claims consistent. They ensure that employees only give the necessary information and that approvers can process claims quickly and accurately.

Accounting software often includes a built-in expense report form, so check if your provider offers one.

Otherwise, you can create one in a document or spreadsheet, find an expense report template in Excel for free or download one from the next section of this guide.

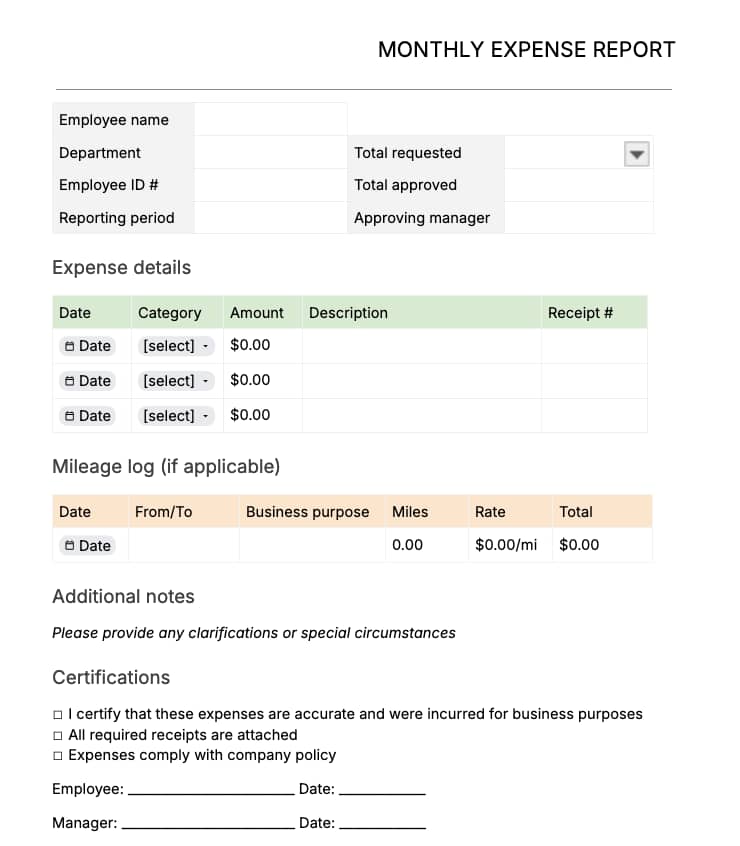

Our template looks like this:

However you create it, your template should include essential fields (e.g., name, date, description and cost) along with sections for notes and evidence.

A notes section allows employees to add context, reducing follow-up questions. For instance, an account manager might explain why a client meeting required a higher-than-usual meal expense, eliminating back-and-forth.

Store your template in a shared space, such as your CRM or project management tool, to make it easy for everyone to access.

Recommended reading

Inside sales vs. outside sales representatives

Download free expense report templates

Below are two simple expense reporting templates for use in Google Docs or Microsoft Word.

They work for ad-hoc claims or as monthly expense report templates (e.g., for employees to bundle multiple claims into a single report each month).

Basic expense report template. A straightforward option with fields for date, category, amount and descriptions – and space for mileage information:

Download Pipedrive’s Basic expense report template

Our more straightforward option, with fields for date, category, amount and descriptions.

Detailed expense report template. Offers additional fields for project or client references, helping you allocate expenses more specifically:

Download Pipedrive’s Detailed expense report template

Our detailed expense report template offers additional fields including projects and client references

Both of our downloads are text-based documents rather than spreadsheets (like the simple expense report templates in Excel’s library), so they’re easy to customize based on your small business’s needs. There are no formulas to break; you can move or re-label any elements as you see fit.

Add or remove data fields, categories and any other information as necessary, then select “File > Save as” to create a new copy.

Note: Our Word templates are simple and streamlined, making them ideal for printing or submitting via email. However, if you’re looking for a free Excel expense report template, check out the Microsoft 365 library.

The case for automating expense reports

Managing expense reports manually will become more time-consuming for you and your employees as your business grows.

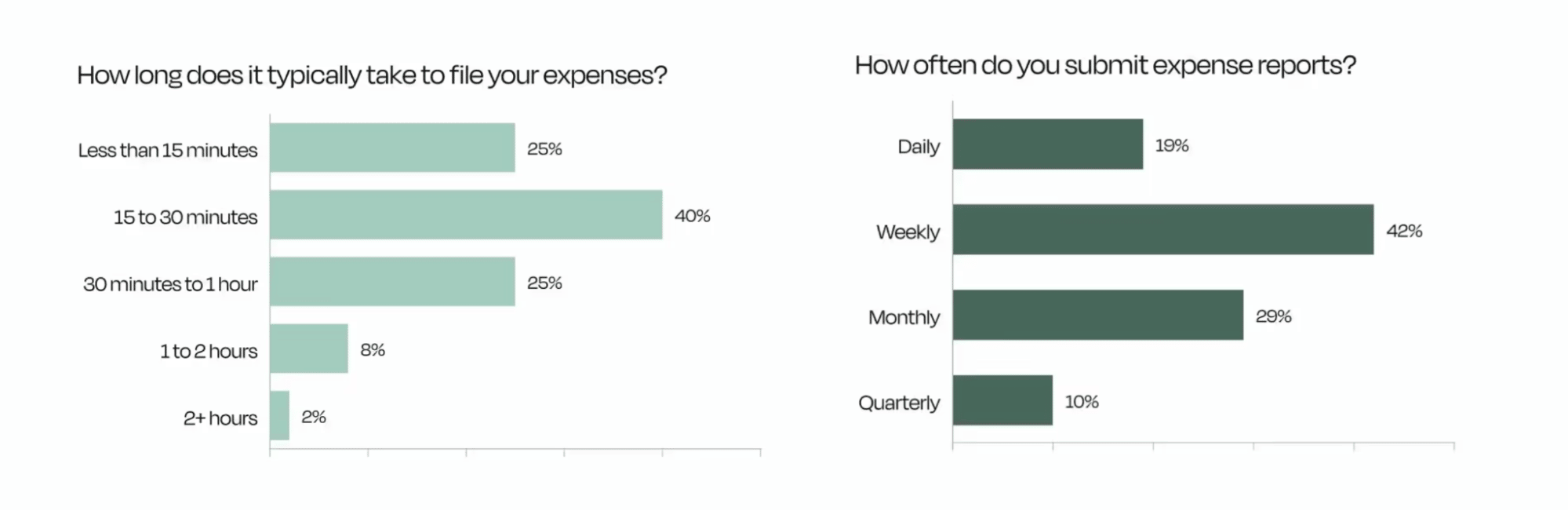

A Rho survey found that around 60% of employees at mid-sized businesses file expense reports daily or weekly, and 75% spend more than 15 minutes filling out each report – an average of at least an hour per month.

Automating part of the expense management process will reduce the whole team’s administrative workload, freeing time for more pressing tasks.

Team members who submit claims through accounting software will still need to enter some information. Still, automation can handle tasks like categorizing expenses, calculating tax deductions, tracking approvals and generating reports.

That ultimately leads to:

-

Faster reimbursements. Eliminate back-and-forth emails so employees get paid quickly and have a better experience.

-

Effortless record-keeping. Store digital copies of all reports and receipts to easily retrieve past expenses and keep a clear audit trail.

-

Improved data privacy. Rely on data encryption and secure access controls to protect sensitive employee and financial data.

-

Integration with sales apps. Connect your accounting and CRM software to link expense data to accounts or deals automatically.

Given these benefits, it’s no wonder expense management was the third-biggest automation priority among finance professionals surveyed by MineralTree, ahead of forecasting and payroll.

Choosing an expense reporting automation tool

Once you decide that automating expense reports is right for your business, you must choose a tool.

Plenty are available, from basic apps for small teams to advanced platforms better suited to larger organizations. Some offer broad accounting functionality while others solely handle expenses, so consider what you need yours to do.

For example, you might already have general bookkeeping covered but would benefit from dedicated expense reporting software.

Either way, prioritize the following qualities when researching:

-

Ease of use. Ensure the tool is intuitive for employees and approvers. It should require minimal training and have plenty of support materials.

-

Scalability. Choose software that will accommodate new users or more advanced workflows as your company grows.

-

Security. Prioritize solutions with strong encryption and access controls to protect sensitive data.

-

Integrations. Look for connectivity with your existing tools, like your CRM, to create seamless workflows.

Many solutions offer free trials so you and your team can test their user-friendliness before committing. Even then, most cloud-based tools have flexible subscription options, so you can switch easily.

Popular expense management tools that fit all the criteria above include Rexpense, Xero and QuickBooks – all of which also integrate with Pipedrive. Check out review sites like G2.com and Capterra for impartial reviews of these tools and others from small businesses.

Recommended reading

The best accounting and invoicing software in 2025

Expense report FAQs

Final thoughts

A clear, efficient expense reporting process is essential for any business – and running one needn’t be time-consuming.

By using templates or automated expense reports, small business owners and leaders can take the hassle out of managing claims and focus on what matters most: optimizing growth.

Download your guide to managing teams and scaling sales

The blueprint you need to find a team of superstars and build a strong foundation for lasting sales success

If Pipedrive is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.