The problem: You want to serve your clients well and offer them higher-value accounting , but you and your team don’t have time or capacity.

But what if you could take back some of that time spent on all the data entry and pre-accounting work you do? Or the back-and-forth with clients to get the information you need?

We have a solution. It’s called Collaborative Accounting, a new way to work with your clients that elevates your client experience and gives you the space to deliver advisory solutions at scale.

Table of Contents

[embedded content]

What Is Collaborative Accounting™?

Collaborative Accounting is a technology-enabled accounting model anchored in a shared workflow between accounting professionals and their clients. It focuses business owners on completing front-end tasks in an easy-to-use software platform and frees up accountants to apply their expertise to more in-depth advisory work that has increased value for clients.

For too long, accountants and their clients have been operating out of alignment. Workflows and technology designed for accountants leave clients out of the loop about their own financial well-being.

The result? No one is winning. As business owners feel more and more lost, financial admin falls on accounting professionals’ shoulders. Accountants have less capacity to give the expert guidance that their business-owner clients need.

In contrast, Collaborative Accounting is anchored around a shared accounting workflow. Accountants and clients work together in one client-friendly platform, FreshBooks, with each taking on key elements of financial operations, so both are empowered, and no one is in the dark.

Who Is Collaborative Accounting™ For?

How do you know if Collaborative Accounting is right for you and your clients? It’s less about where you are now and more about where you want to go.

Collaborative Accountants™ are:

- Innovative, forward-thinking, and prepared to try new methodologies

- Client-focused, and want to deepen client relationships and attract higher-value clients

- Ready to say goodbye to the busywork of chasing data and start delivering more valuable advisory services

Collaborative business owners are:

- Looking for support and guidance from an accounting professional

- Open to being involved in and educated about their business’s finances so they have the insights they need to grow

But Collaborative Accounting isn’t for everyone. If your growth strategy is high-volume, done-for-you compliance work, for example, then it may not be for you. Or if your clients demand a completely hands-off approach to their end-to-end accounting.

Collaborative Accounting™ Model in Action

So, how does it work?

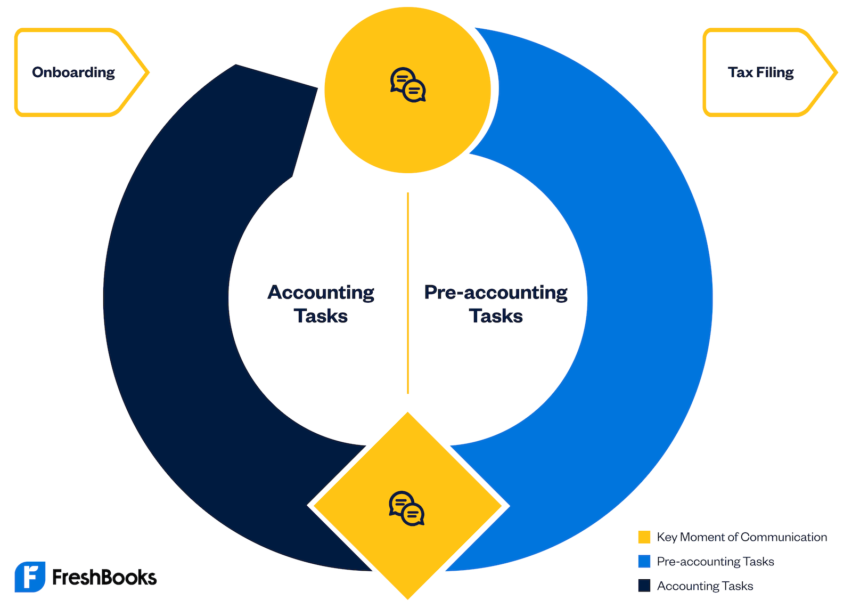

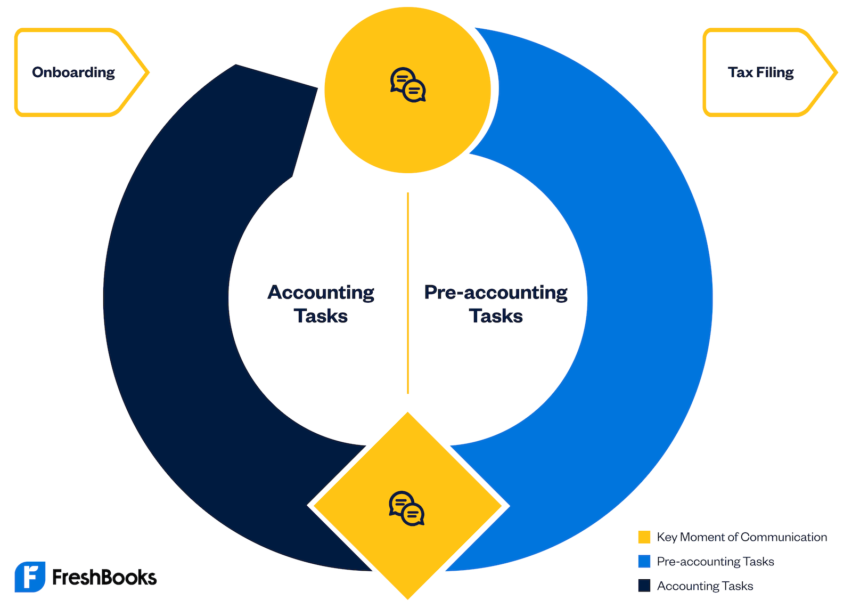

The framework shown here gives you a high-level look at how Collaborative Accounting can be applied to real-life accounting processes.

For the complete framework and hands-on training to implement the Collaborative Accounting framework in your own firm using FreshBooks, sign up for the .

Start With the Right Technology

You might wonder, do you have to use FreshBooks to implement Collaborative Accounting into your firm? The short answer is: Not necessarily. But, this model was designed around a workflow where your clients are active participants in their day-to-day finances, and you work together in a single accounting system. FreshBooks is the ideal software choice for the Collaborative Accounting model because it’s designed for seamless, shared workflows between accountants and business owners. It’s yet still robust enough for you to and provide real accounting, tax, and reporting insights.

“Collaborative Accounting not only gives the clients transparency into our tasks but it gives us transparency into the client’s workflow and how they’re going to earn money. And so, that can now help us to advise them on how to get paid,” says Kristen Keats, CPA, of Breakaway Bookkeeping & Advising.

Collaborative Accounting gives us transparency into the client’s workflow and how they’re going to earn money, [which can] help us to advise them on how to get paid.

Step 1: Client Onboarding

The Collaborative Accounting process begins with client onboarding. Right from the start, you set up clients for success with an introduction to Collaborative Accounting and how it can benefit them, along with resources and training. These are provided for you inside the .

Step 2: Clients Complete the Pre-Accounting Tasks

The key to a collaborative workflow? You both get hands-on. That means your tasks—at least in part. Meaning things like invoicing, project management, billing, and managing expenses.

That might sound scary, especially if you’ve been stuck untangling a mess of DIY bookkeeping in the past. (Been there, done that!) But small businesses can manage these pre-accounting processes—as long as they have the right tools. That means:

- Software that’s easy to use, has (only) the features they need, and has responsive, always-on support

- Comprehensive onboarding and resources to guide them through

- Communication touchpoints to make sure they’re on track

Having your client share the workflow can save you time, but that’s not all it’s about.

Michael Ly, CEO of , says, “I don’t think it’s really focused on how we can get the client to do more work. That’s not really what it is. It’s really, how can we get both sides in the relationship to do the things that are most valuable in the relationship that we’re building with our clients.”

Step 3: Accounting Professionals Do the Accounting Tasks

Novel idea, right? In the real world, though, you probably end up doing things that are admin-heavy, which has a huge opportunity cost.

When you work together with your clients in a platform that gives you accurate and timely financial information, this starts to turn around. You avoid getting lost in their day-to-day admin. Now, you can step in when it’s time for those more complex accounting tasks: Reconciling accounts, closing the books, and advisory services like tax strategies and financial analysis.

This is where your expertise can shine. “It’s not just us delivering the report,” says , CPA, CVA, “It’s us actually having a conversation and understanding these are the things we need to change, these are the decisions that we think, you, the business owner, need to make in order to move your business to whatever that end state is.”

Add Communication Touchpoints

There is no collaboration without communication. At different phases of the accounting cycle, there are key moments for important conversations to keep work on track, maintain , and look at reporting and insights.

Within the Collaborative Accounting framework are two regular conversation points: The handover from pre-accounting to accounting tasks and the interpretation of financial information with forward-looking insights after a period close.

But advisory isn’t one-size-fits-all. Listen to your clients so you can determine what they’ll value most based on their company and its needs.

3 Benefits of Collaborative Accounting™ for Your Practice

Let’s look at the impact this new way of working can have—for you and your clients.

Our skillset really gets to shine on top of a tool like FreshBooks.

1. Enhanced Client Experience

When you develop a real partnership with your clients and give them the tools for more agency over their business, it builds trust and helps you longer-term.

A shared workflow in a single system is also more efficient and removes from your client interactions the friction of following up on missing info and managing day-to-day bookkeeping.

Kristen Keats agrees, “Having that transparency and visibility is huge, and that real-time access that a program and product like FreshBooks gives us. Because if [clients] get stuck at any point in the process, we’re able to jump in, in real-time, and help them get through the tasks that they need to be doing.”

2. More Valuable Services

Are you struggling to find a way to offer clients ? Collaborative Accounting makes it attainable. It empowers you to focus on advisory or work that has real value for your clients and can bring in more revenue for your practice.

“Our skillset really gets to shine on top of a tool like FreshBooks because [the] insights are pulled out for us; we can work with them, we can go talk to our clients about what we’re seeing [and] how we can make decisions that could impact their business,” says accountant Kenji Kuramoto of .

3. A Sustainable Way to Scale

The old way of working—accountants and clients siloed in their separate workflows—just isn’t sustainable. Especially with current accounting recruitment challenges, most firms don’t have the capacity to scale by simply adding more compliance services.

With the technology-enabled Collaborative Accounting methodology, you can expand advisory services without adding more team members.

Nicole Davis, CPA, of , says: “Collaborative Accounting will empower me to scale my firm because I don’t have to worry about going back and cleaning up books. The client and I can work together from the start. It allows me to do more of the advisory-type services versus the compliance or the data entry.”

Get Started with Collaborative Accounting™

FreshBooks has designed the so you can begin adopting and integrating this new way of working into your practice.

The certification includes hands-on training with real-life examples and a comprehensive client onboarding pack to get your clients up to speed, too.

As a certified Collaborative Accountant™, you’ll get all the benefits of being a FreshBooks certified partner, including resources, exclusive discounts for your clients, dedicated accountant-specific support, and membership in a community of like-minded professionals, plus 3 CPE credit.

Today, we have what we need—the technology and tools—to drastically increase efficiency and provide more value at scale, but we need to change how we work to make it happen.

So, are you ready to join the Collaborative Accounting revolution?