Our view at Stack - Simplify web development with Webflow, reduce costs, and deliver professional results. No-code, responsive, and SEO-friendly. Explore your creative potential!

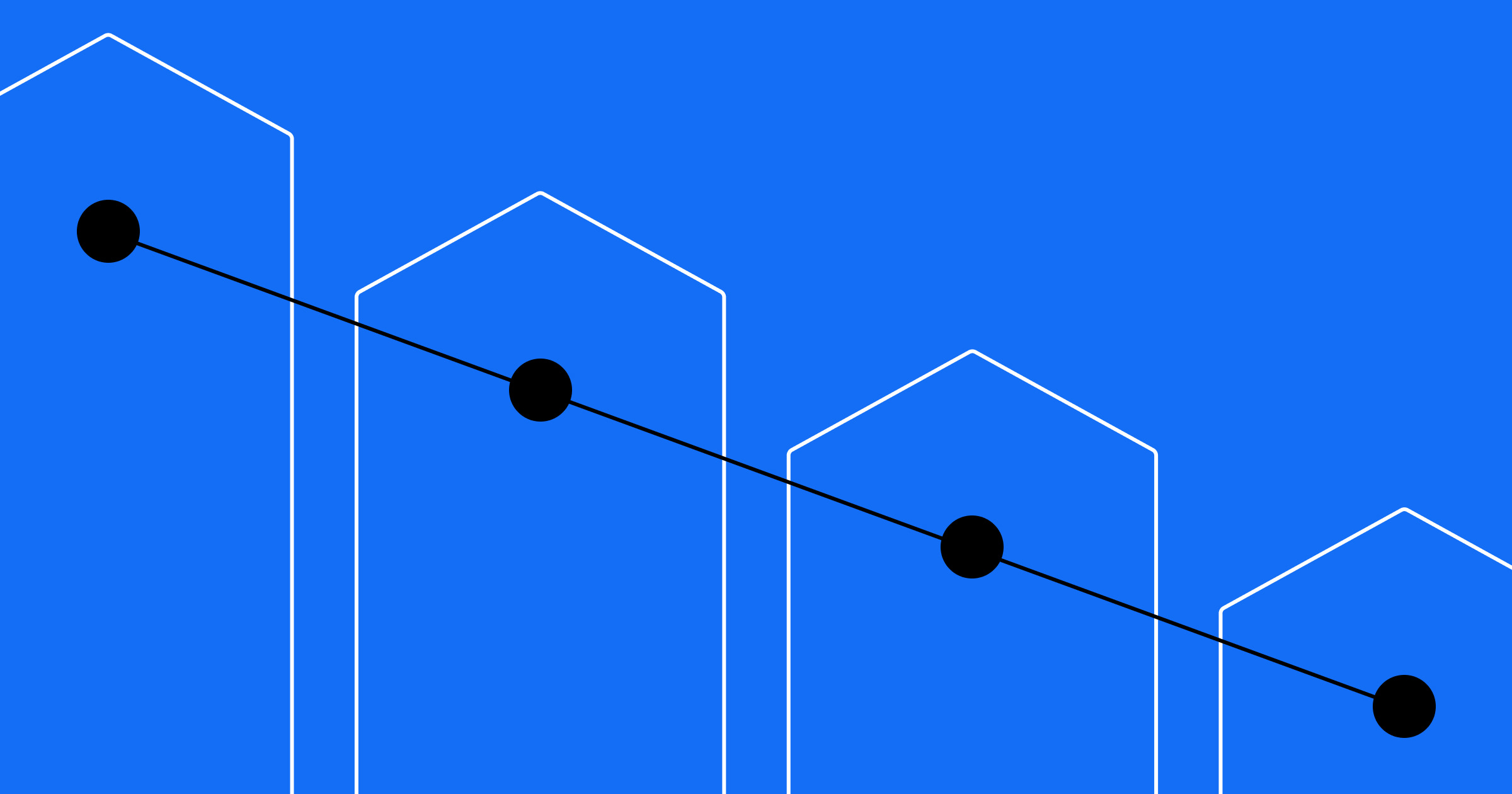

Leveraging metrics like TAM, SAM, and SOM is key to strategic market positioning and impact.

Whether launching a new product or scaling an existing venture, understanding your market’s size is essential. Beyond identifying potential customers, this involves analyzing demand trends and pinpointing growth areas, competitive advantages, and underserved niches within your industry. These insights are key to developing strategies that resonate with your audience and capitalize on untapped market potential.

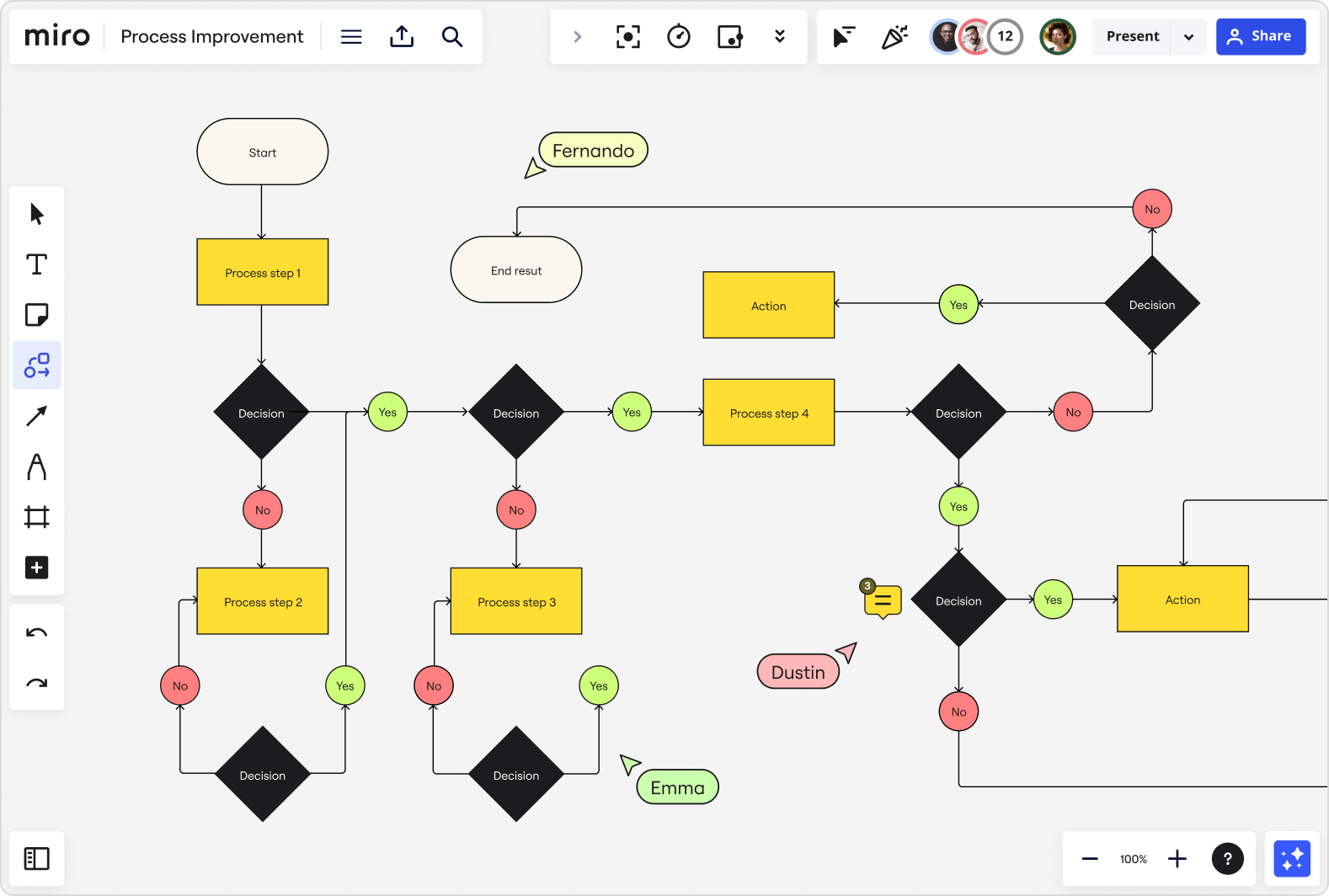

While metrics like total addressable market (TAM), serviceable available market (SAM), and serviceable obtainable market (SOM) help in this analysis, their true value lies in how they transform market data into actionable insights, guiding your business decisions and strategy.

How to calculate TAM, SAM, and SOM

In business, a market defines a group of potential customers who share common characteristics and needs, making them likely to purchase a product or service. But calculating a market’s size depends on how you define it, which is where TAM, SAM, and SOM become crucial. Each metric offers a different perspective on market definition, providing unique insights into your potential customer base and revenue opportunities.

Here’s how to calculate each metric and how they differ.

Total addressable market

Formula: TAM = average revenue per user (ARPU) x total potential customers in market

In business, TAM quantifies the total potential demand for a product in a specific market. Businesses typically calculate it using two methods:

- Top-down market sizing. This method starts with the broad market, using industry reports, government data, and other external sources to estimate the overall market size. From there, refine this estimate to focus on your target segment. A software company specializing in enterprise project management (EPM) tools might begin with the global demand for EPM software, which could be 1 billion dollars, and then narrow it down based on its market niche.

- Bottom-up market sizing: This approach begins at the niche level and expands outward. It starts with data about your specific target audience before estimating the broader market demand. If the software company’s tools are popular among graphic designers, web developers, and design agencies, it will use this data to extrapolate the overall market demand within the creative industry.

You arrive at a more comprehensive TAM estimate by combining top-down and bottom-up approaches. The software company, for instance, could use the top-down method to analyze data on various segments of the project management software market, such as corporate enterprise solutions and small business tools, before identifying its niche in specialized software for creative industries. And a bottom-up analysis of its current user base’s popularity can help estimate the broader market demand in this niche.

Integrating both these approaches, the software company might estimate its TAM at 150 million dollars within the 1 billion dollar global project management software market. This figure represents the company’s total potential revenue opportunity in its specialized segment, offering a clear target for business growth and strategy development.

Serviceable addressable market

Formula: SAM = target segment of TAM x ARPU

When comparing TAM versus SAM, the latter is a more focused estimation that accounts for the constraints limiting your business’s reach. It refines the broader concept of TAM by focusing on the market portion realistically accessible to your business, considering factors like geographical limitations and regulatory restrictions. SAM narrows down your potential audience, providing a more targeted estimate.

Consider the earlier project management software example, which faces regulatory restrictions limiting its operation to North America. While its TAM might be estimated at 150 million dollars, SAM represents the market portion it can actually serve. If 72% of its potential market is outside North America, the company’s SAM would be significantly smaller than its TAM, at around 42 million dollars.

Serviceable obtainable market

Formula: SOM = last year’s market share x this year’s SAM

SOM further refines SAM by estimating the market share your company can realistically capture. This calculation factors in your company’s operational efficiency, capabilities, and existing market share within the SAM. It offers a more pragmatic and feasible measure of your market share, acknowledging that completely capturing the SAM is unlikely.

For example, if the EPM software company secured 10% of the North American market last year, based on its SAM of 42 million dollars, its SOM would be 4.2 million dollars. This figure represents an attainable target, reflecting the company’s actual market potential, guided by its resources and strategic approaches.

What’s the difference between SAM and SOM?

SAM and SOM are similar metrics that differ in scope and practicality. SAM is a segment of the TAM that your business can serve within its constraints. SOM is a more focused measure, estimating the part of SAM your business will likely capture while considering competition and operational capabilities. While SAM outlines the serviceable market, SOM pinpoints what’s realistically achievable within that space.

Tips to calculate market size

Each market varies in size, but calculating it typically follows a consistent method. Here are some valuable tips to guide you through the process.

Adopt a realistic approach

While estimating market size, it’s crucial to keep your projections realistic. Avoid overly optimistic forecasts that could lead to inflated expectations. Unrealistically high expectations may result in allocating excessive resources like funds, time, and effort without understanding the actual market dynamics, leading to disappointment and financial strain.

To be realistic, recognize and consider your market’s constraints and challenges, such as market saturation, potential competition, and economic conditions. If you’re entering a highly competitive market like ecommerce, consider the dominance of established players and factor in a gradual market share gain over time. Adopting this realistic approach helps set achievable targets and prevents resource overcommitment, aligning your business strategies with actual market potential.

Understand when to use TAM, SAM, and SOM

Each market definition — TAM, SAM, and SOM — serves a specific purpose. TAM offers a broad market overview, SAM refines this view based on specific constraints, and SOM further narrows it to what you can realistically achieve. Knowing how and when to use each is crucial for different business strategy aspects:

- Use TAM for high-level strategic planning since it helps you understand the market’s full scope, making it ideal for long-term vision and growth potential strategies.

- Apply SAM for targeted marketing efforts. It’s beneficial for focusing on specific market niches and segments you can realistically serve, given your current business model and constraints.

- Apply SOM to guide resource allocation and set achievable targets. It helps pinpoint the market share you can feasibly capture, making it useful for short-term planning and specific goal setting.

If you’re running a tech start-up, you might analyze TAM to gauge the overall market potential for your software. This helps in envisioning the broader scope and opportunities for growth. As your business matures and you consider expanding operations, SAM becomes essential to identify the most viable markets, whether they’re specific regions or industries. Finally, SOM is key in helping you set realistic sales and marketing targets within your serviceable market, ensuring efficient resource use.

Use reliable sources

Your market size estimation’s accuracy connects closely to the quality of your data sources. Ensure precise, current information by relying on credible sources such as industry reports, government statistics, and established market research findings.

When estimating the market size for a new initiative on a healthcare platform, for instance, use data from authoritative medical journals, clinical studies, and regulatory information. Leveraging these reliable and respected sources ensures a trustworthy foundation for your market analysis, boosting the credibility and relevance of your findings.

From potential to reality with Webflow

Evaluating your market size through TAM, SAM, and SOM offers progressively focused insights, shaping your strategy from broad market potential to a realistically attainable market share. But understanding potential is only half the battle.

Webflow Enterprise helps you transform your vision into reality. When you’re ready to expand beyond your typical market, our localization features provide an end-to-end solution to tailor your content for a global audience.

Head to the Webflow blog to learn more about localization and internationalization, as well as testing strategies for optimizing marketing strategies to new segments.

If Webflow is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.

![Makerpad homepage. White background, black text headline: Build [blank] without writing code next to video labeled](https://assets-global.website-files.com/6009ec8cda7f305645c9d91b/63654a2b9c9ecd3b15ba3488_makerpad.jpg)