Our view at Stack - GoCardless is a payment services provider - highlights include low processing rates, no monthly fee for the basic account, month-to-month billing without early termination fees, and extensive support for international payments. It’s optimized for direct bank payments, offering security and flexibility

LONDON, 13 August 2024 — GoCardless, the bank payment company, has announced a partnership with Future Ticketing, an API-first ticketing solution for sports, visitor attractions, venues and event organisers, to make the purchase of tickets and memberships easier and more affordable for consumers in the UK and Ireland.

By integrating GoCardless directly into its platform, Future Ticketing can now offer customers — which include clubs in the English Football League, Scottish Premier League,Super League and Elite Ice Hockey League — the ability to collect payments via Direct Debit.

This means that season ticket holders, festival-goers and other event attendees will be able to split the cost of their ticket into smaller amounts to be paid over several months through Direct Debit.

Seb Hempstead, VP of Partnerships at GoCardless, said: “This partnership is a game-changer. Future Ticketing customers can now use GoCardless to give their fans the ability to break down larger purchases into smaller, more manageable repayments — so season tickets for their favourite team or tickets to that once-in-a-lifetime gig are all within reach. At the same time, clubs, venues and event organisers save money on card fees and gain peace of mind knowing that repayments will be automatically collected on the day they’re due. It’s a win-win for everyone.”

Ann Marie Guinan, Chief Marketing Officer at Future Ticketing, said: “Ensuring seamless payments and customer conversion is a top priority for us and our clients. By offering a wider range of payment options, we are meeting the growing demand for instalment payments from today’s customers.”

The announcement adds another leading name to GoCardless’ list of more than 350 partners. These partnerships allow businesses to seamlessly integrate GoCardless bank payments into the platforms they use everyday.

Notes to Editors

For more information, contact:

press@gocardless.com

Contact: Ann Marie Guinan,

Chief Marketing Officer, Future Ticketing

annmarie@futureticketing.com

About GoCardless

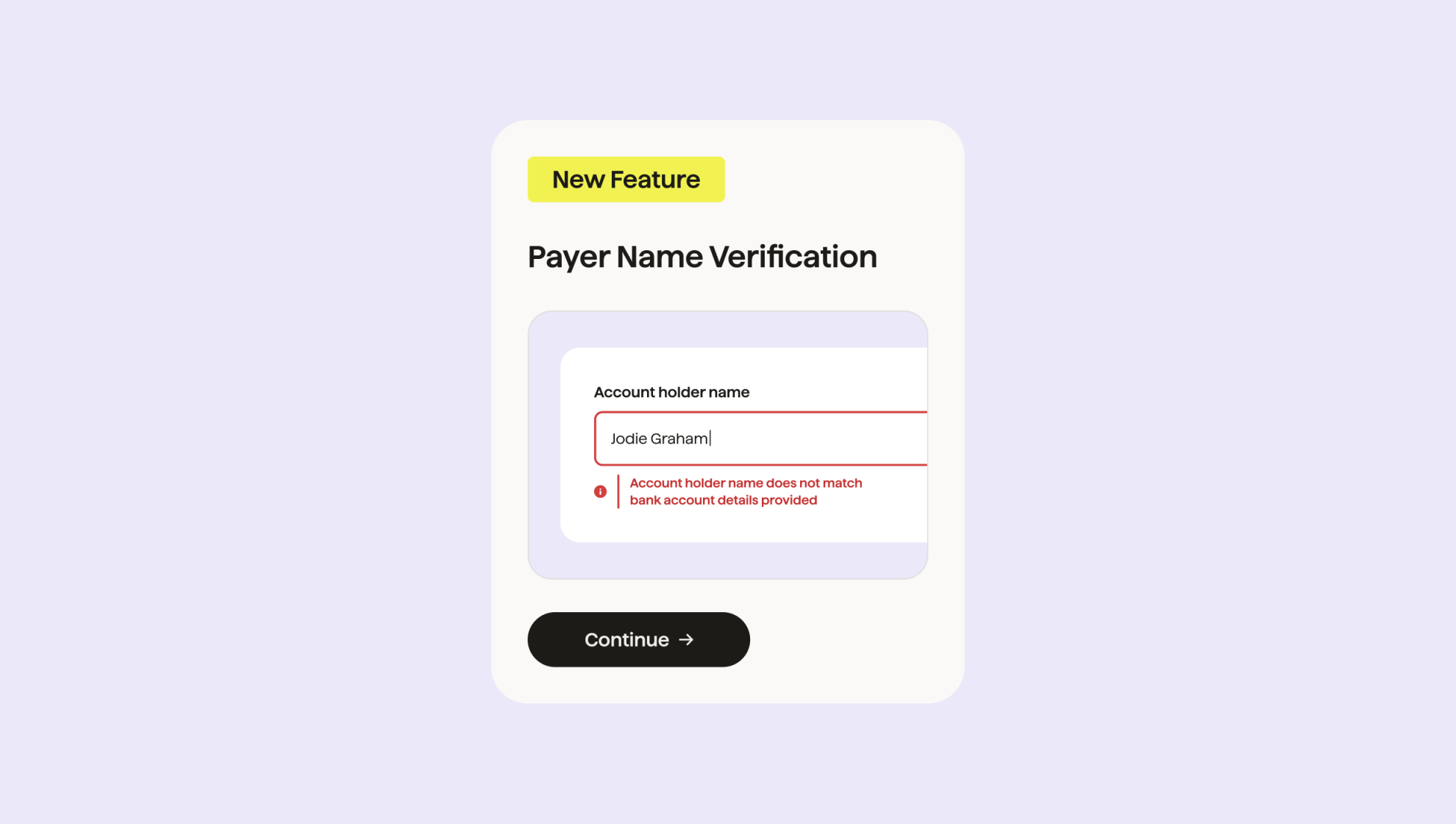

GoCardless is a global leader in direct bank payments. We help more than 85,000 businesses, from start-ups to household names, collect both recurring and one-off payments, without the chasing, stress or expensive fees. Each year GoCardless processes more than US$35 billion of payments across 30+ countries. Our acquisition of Nordigen means we’re also helping businesses make faster and more informed decisions through easy access to bank account data. We are headquartered in the UK, with additional offices in Australia, France, Latvia and the United States. For more information, please visit www.gocardless.com and follow us on Twitter @GoCardless.

© 2024 GoCardless Ltd. All Rights Reserved. GoCardless is a registered trademark of GoCardless Ltd in multiple countries. Third party trademarks mentioned above are owned by their respective companies. Unless explicitly identified as such, nothing in this press release should be construed to the contrary, or as an approval, endorsement or sponsorship by any third parties of GoCardless Ltd. or any aspect of this press release.

About Future Ticketing

Future Ticketing is at the forefront of high-performance API and software ticketing. Our mission is to accelerate digital transformation and empower venues and events to build their data eco-system through next-generation ticketing. Headquartered in Ireland with offices in Manchester and Glasgow, Future Ticketing’s continued focus on product development and innovation places it at the forefront of sports’ rapidly developing tech sector. For more information, please visit our website www.futureticketing.com.

If GoCardless is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.