This guest blog was written by the team behind transport management app MyTrucking.

The powerhouse of regional Australia sits in part with its farming, mining and construction industries. The thousands of communities and family-owned small businesses in these sectors around the country help keep the wheels of Australia turning.

One such family-owned business has been on the tools since 2009. Through strategic growth and a focus on technology, innovation and efficiency, TGR Transport has expanded to become a primary contractor to major grain traders in Australia.

Building a foundation of success

TGR Transport is a nationwide freight company established by managing director Tom Allen. The family-owned and operated business specialises in bulk grain transport alongside agricultural machinery transport.

“I had a real passion for trucking, and I started to notice a demand for paddock trucks during grain harvest. I saw an opportunity to better utilise my father’s farm truck, and it grew from there,” says Tom.

The business now includes a fleet of trucks with a range of trailers to move bulk grain, hay, straw and oversized machinery, as well as supplying pilot vehicles and container sales.

TGR Transport has grown rapidly since its establishment, and one of the critical cornerstones has been building a solid and reliable team that helps it thrive in an ever-changing transport industry.

“We’ve grown from an owner-operated business to a team with a broad range of skills. Our team members all have different backgrounds, from transport, farming, vehicle maintenance and engineering, to name just a few. We benefit from these skills daily as they allow us to adapt quickly to constant operational and industry changes,” says TGR transport operations manager Amy Throckmorton.

Passion, experience, and expertise drives the team to deliver top-notch customer service and satisfaction. TGR’s employees do this by getting the job done efficiently and economically, and their high-quality service remains a vital part of TGR’s ongoing success and growth.

Driving innovation forward with tech

TGR’s success is also driven by their willingness to embrace new technologies and innovations to propel them forward.

“We aim to become more efficient using high productivity vehicles (HPVs), such as A-Doubles, not just with grain, hay, and general freight. We’re one of the first companies in the area to start using these, and it means we can transport more grain per load for our customers,” says Tom.

It’s just a small taste of the many parts of the business that are geared towards innovation and efficiency.

Their foundation of a solid, knowledgeable and diverse team, coupled with a knack for innovation, quickly put them at the top of the list for grain traders around the country. They help tackle the task of moving the nearly 40 million tonnes of grains, oilseeds and pulses that are transported around Australia annually.

“Being a primary contractor for major grain traders has been a huge win for us. It’s wins like that that keep us moving forward,” adds Tom.

On-road technology changes rapidly, as does the technology behind the scenes. TGR Transport has remained dedicated to its mission to keep up with the latest advances in this space to help give it an edge.

“It keeps us efficient, which ultimately benefits our customers, so it’s a no-brainer,” says Amy.

Removing inefficiency with the help of apps

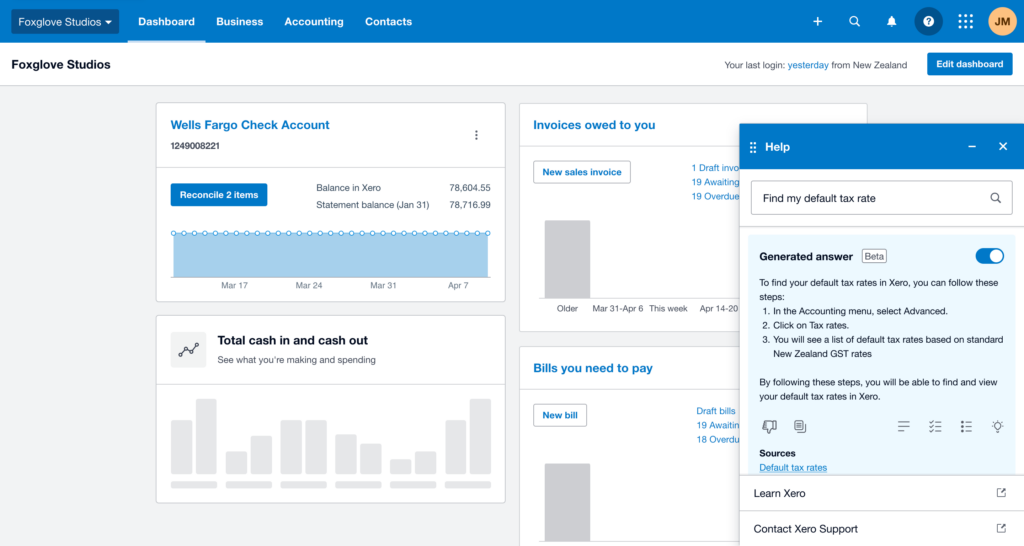

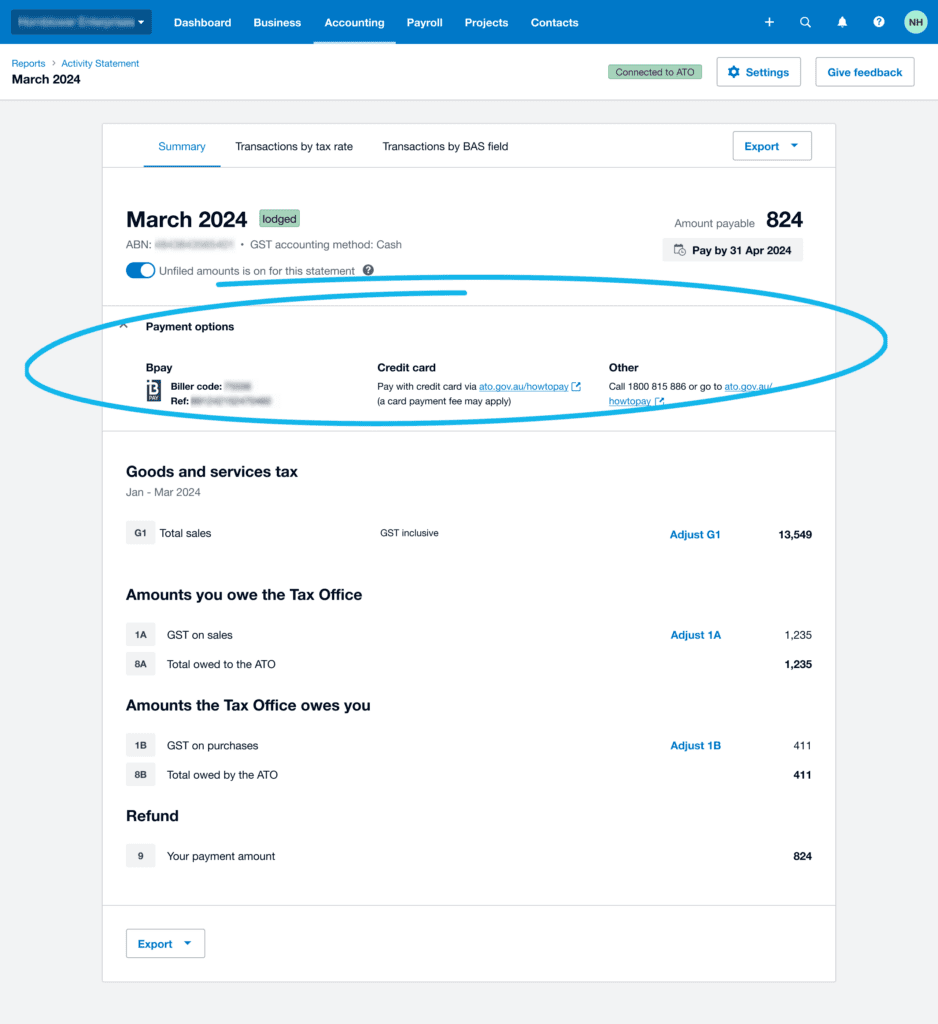

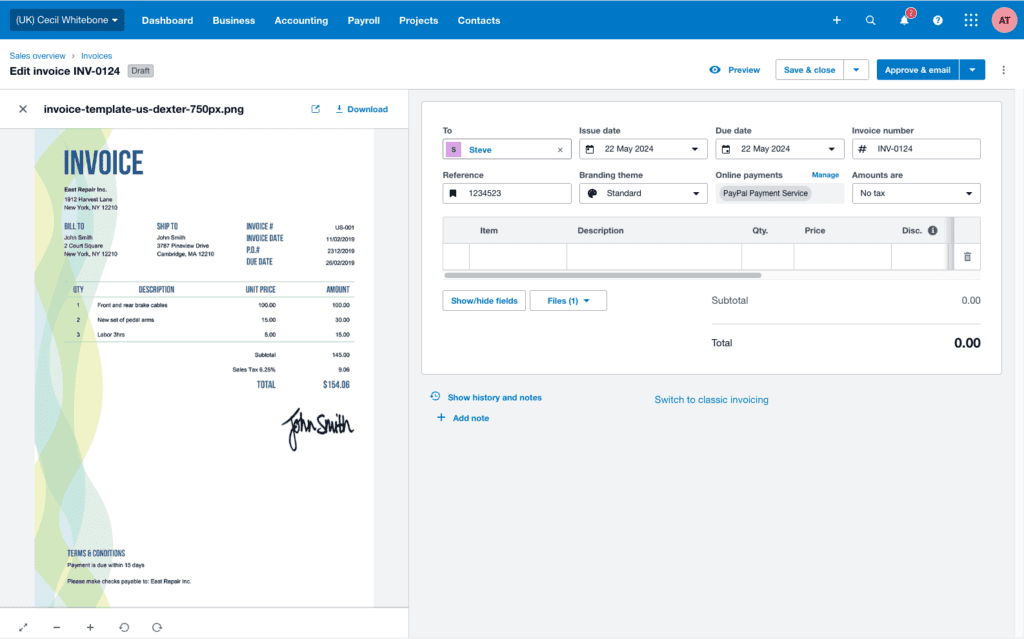

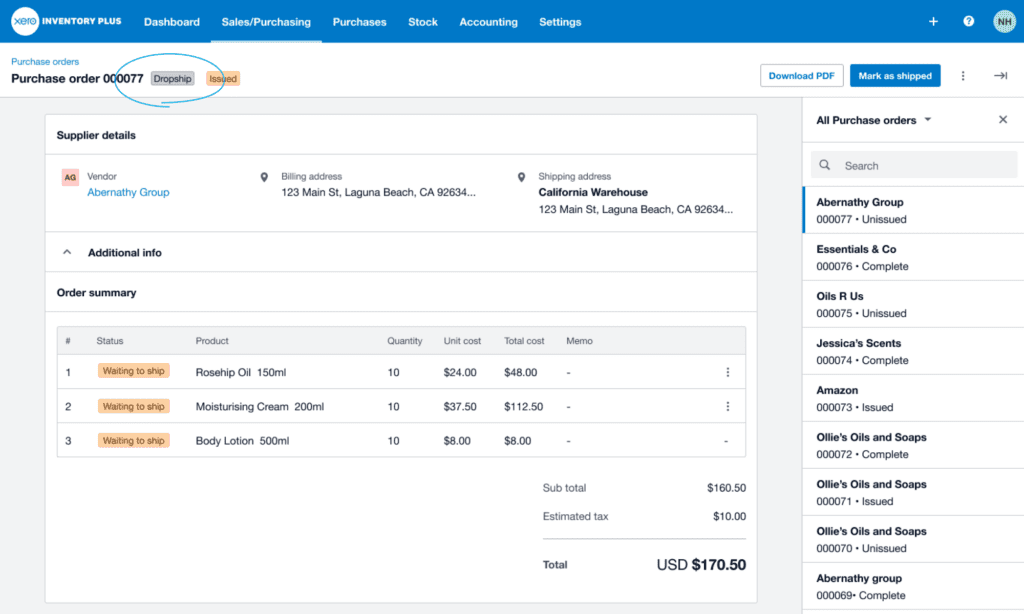

Until 2016, TGR Transport had an entirely manual process for their workflow and paperwork. Drivers completed run sheets and kept hard copies of paperwork that were gathered at the end of the week and collated into a spreadsheet. Manual invoices were created and sent from Xero.

“Obviously, with a manual process, human error was a factor. There was also the challenge of dealing with subcontractors and chasing paperwork. It was inefficient and sucking up time,” says Amy.

On the recommendation of their accounting team, they discovered MyTrucking, a transport management app designed to assist transport operators with job management workflow.

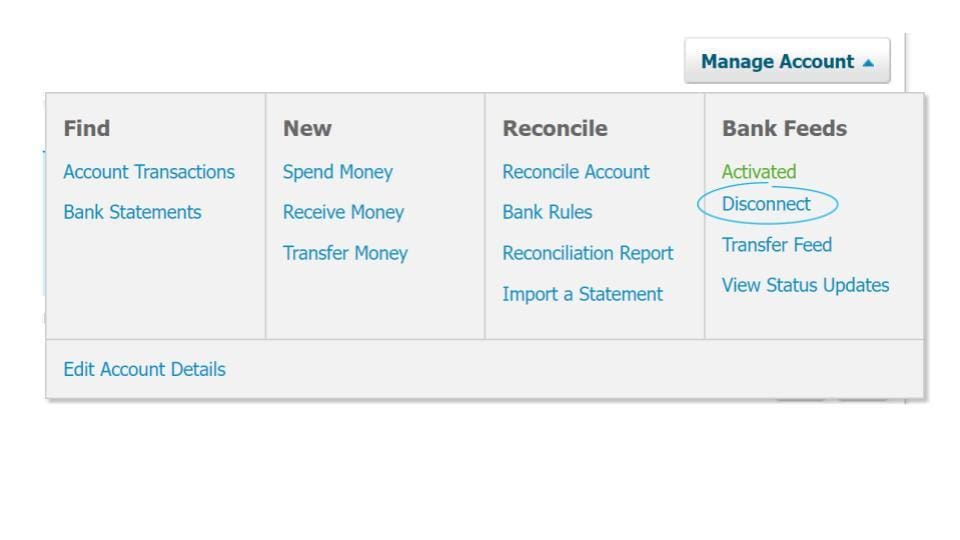

Since implementing MyTrucking, TGR Transport gets near real-time information directly from drivers while they’re on the road. Photos of paperwork are attached to each job to ensure the accuracy of information entered by team members.

It’s created a highly streamlined process where nearly everything is as simple as pushing a button.

Tom says, “Using MyTrucking and Xero together has made our lives so much simpler. MyTrucking enables us to track everything we do simply and accurately through real-time information.”

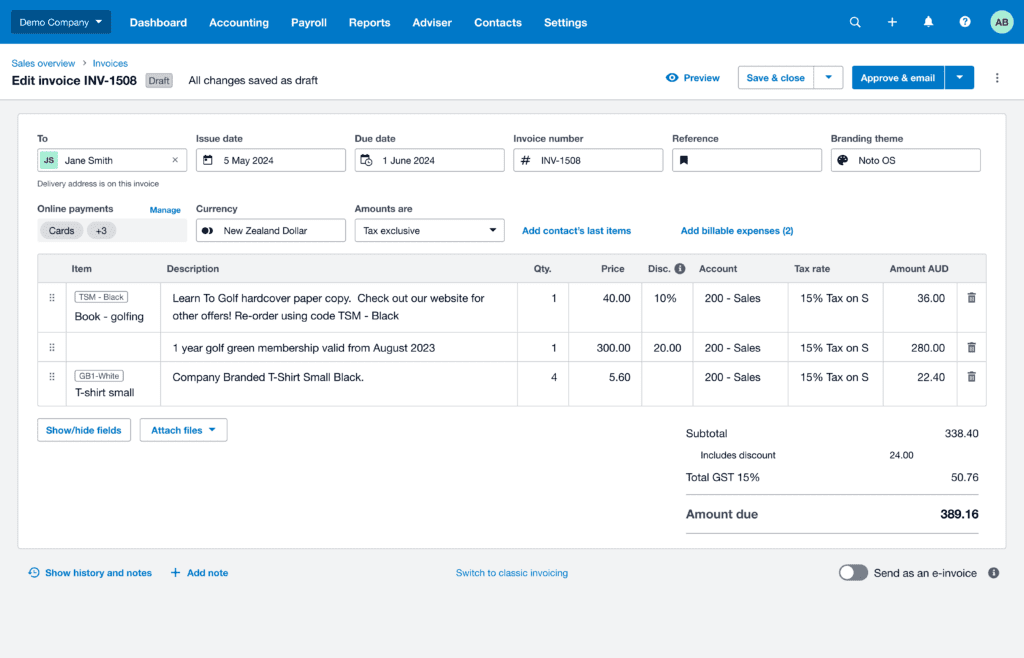

The ability to populate an invoice directly to Xero in just a few clicks is invaluable to TGR Transport.

“It has completely streamlined our invoicing and reporting processes, ultimately leaving us more time to focus on other areas of the business and continue to grow and thrive.”

Check out MyTrucking on the Xero App Store.

The post App partner stories: Keeping the wheels of Australia turning appeared first on Xero Blog.

]

]