Our view at Stack - Xero is a cloud-based accounting platform that offers numerous benefits. It simplifies financial management with automated bank feeds, allowing you to save time on data entry. Create, email, and print professional invoices effortlessly. Access your finances in real time via the cloud from any device. Retain records of income, expenses, assets, and liabilities securely online. Whether you’re a small business owner or an accountant, Xero streamlines your financial processes and provides a clear view of your financial health.

This month’s Xero product updates include exciting new features and enhancements to streamline your workflows and boost productivity.

From rolling out new tools for our accountants and bookkeepers, to improvements to the Xero Accounting app, and tools for managing inventory, Xero’s October updates offer valuable enhancements for both small businesses and advisors alike. Read on to discover how these updates can benefit you.

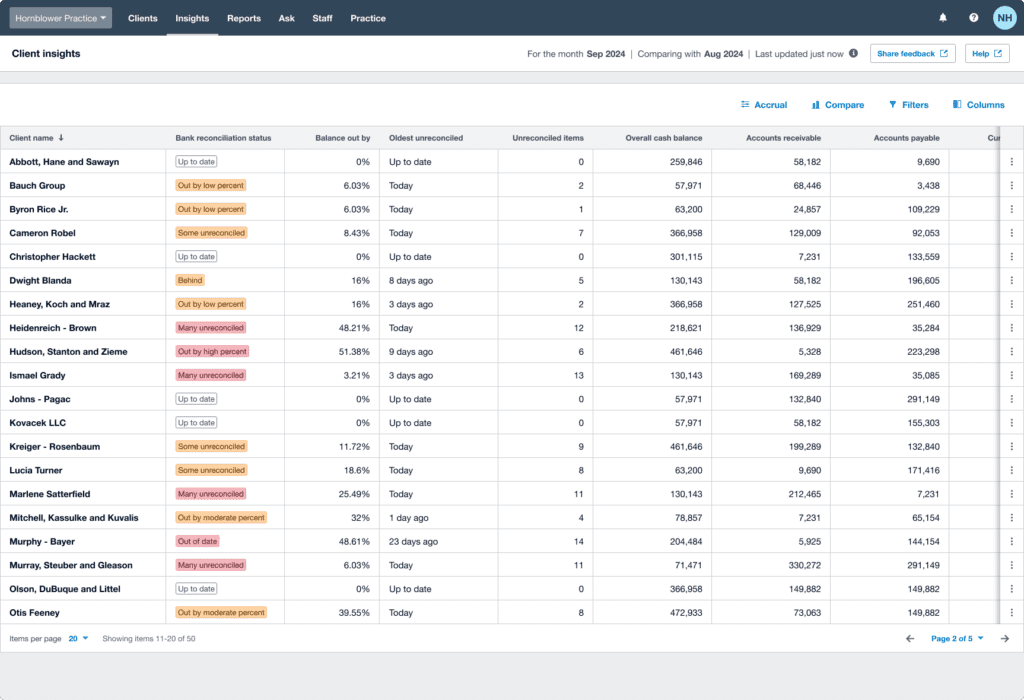

Global: Get a snapshot of your client’s financial health in Xero Practice Manager and Xero HQ

Client insights is now available for all Xero partners. The insights screen in Xero HQ (and coming soon in XPM) shows you the latest shows you the latest financial data across all your business edition clients, to help you identify which clients would benefit from your support or advice and a timely conversation. Read more in the blog post: A new Xero dashboard to elevate your advisory services.

Global: Manage finances from anywhere with Xero Accounting app enhancements [Product Idea ]

]

We’ve also made it easier to share invoices from the Xero Accounting app on iPhone, so you can manage them more efficiently on the go. You can now share invoices on any available app on your mobile device (e.g. Messages, WhatsApp and more) with a few simple taps.

Global: Managing your inventory is now more efficient [Product Idea ]

]

It’s now easier to navigate your products and services list and view key information at a glance with new inventory filtering options within Xero Inventory. Filter inventory items by type (tracked or untracked) and apply this filter to your export. Your export file will also show the quantity on hand. Plus, you can now customise your columns and save your preferred view as a default. These small (and highly requested) improvements will make it easier to track your inventory, to ensure you have the right stock on hand.

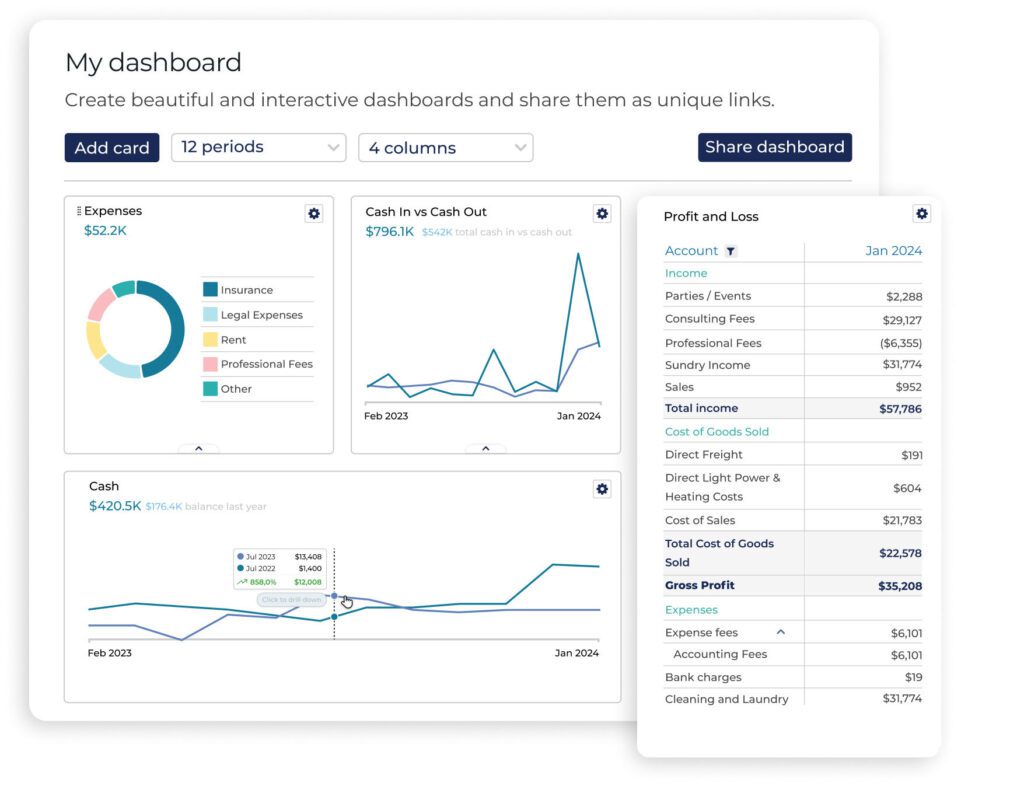

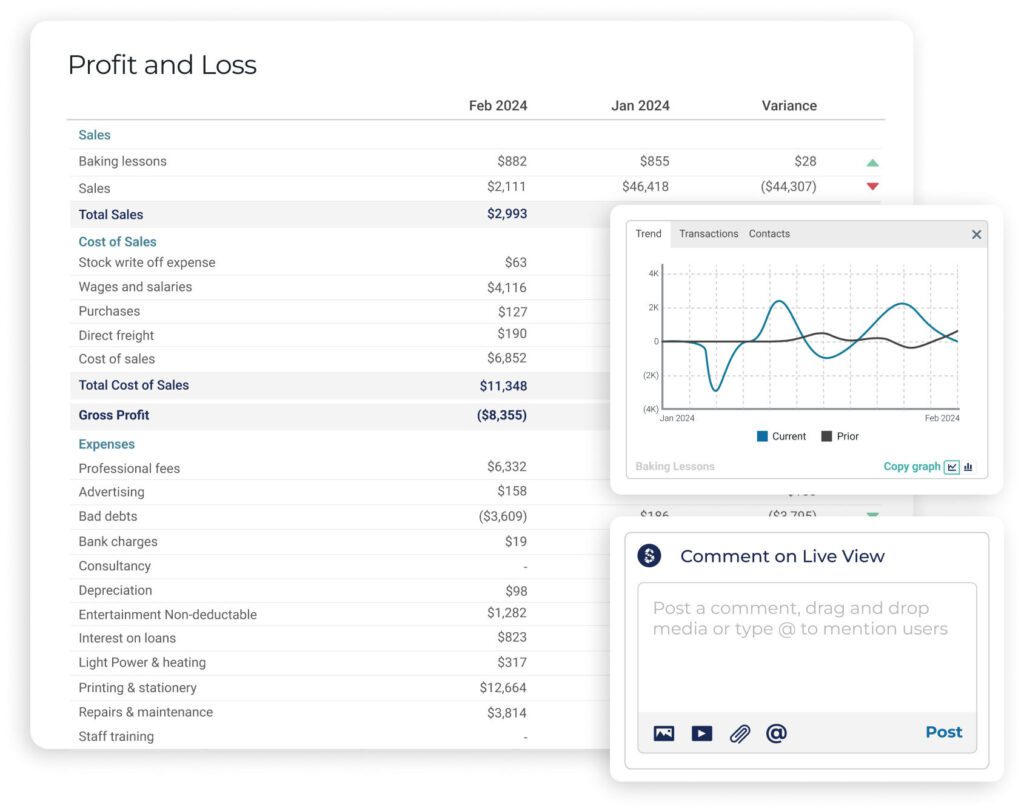

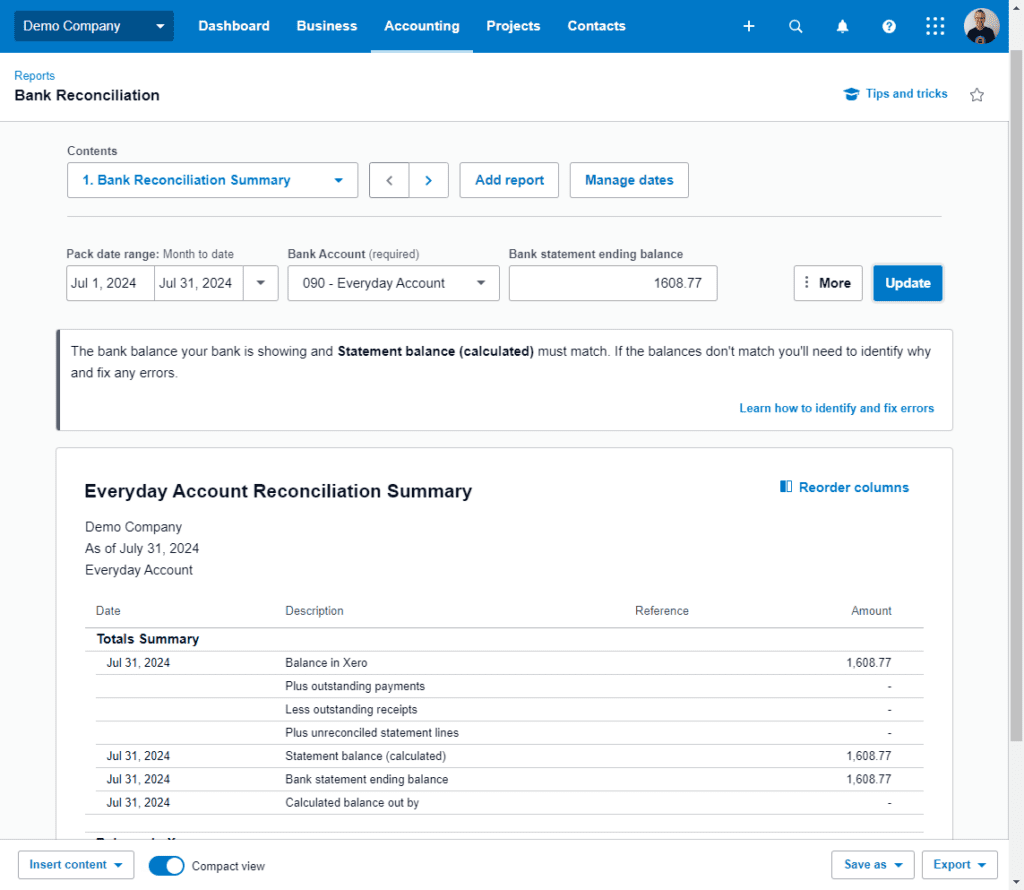

Global: Preview reports from the layout editor

Check out the new preview panel in the layout editor of all reports in Xero. This enhancement will help you to customise report layouts with minimal effort.

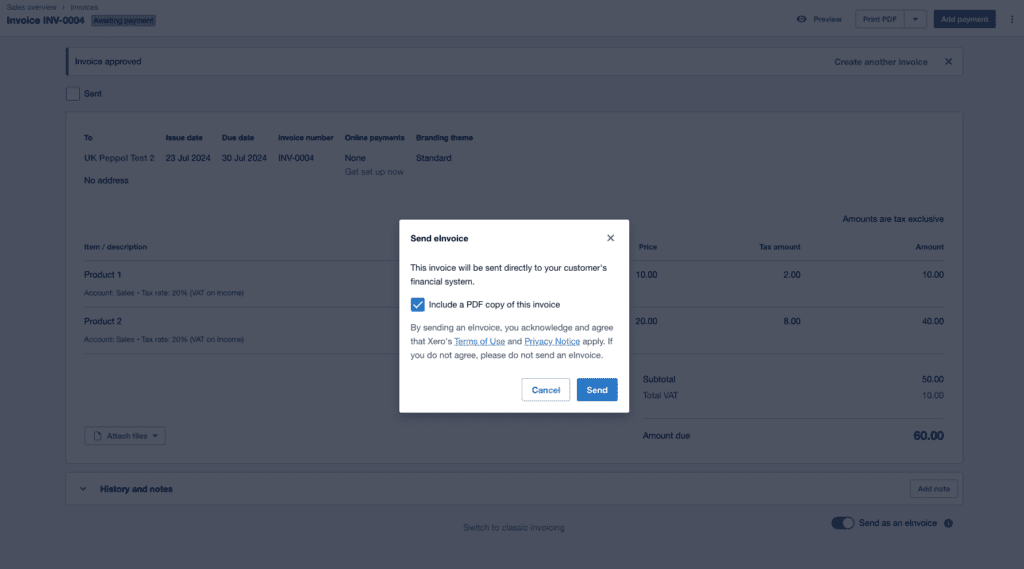

AU, UK, NZ: Accept payments without the hassle of creating an invoice

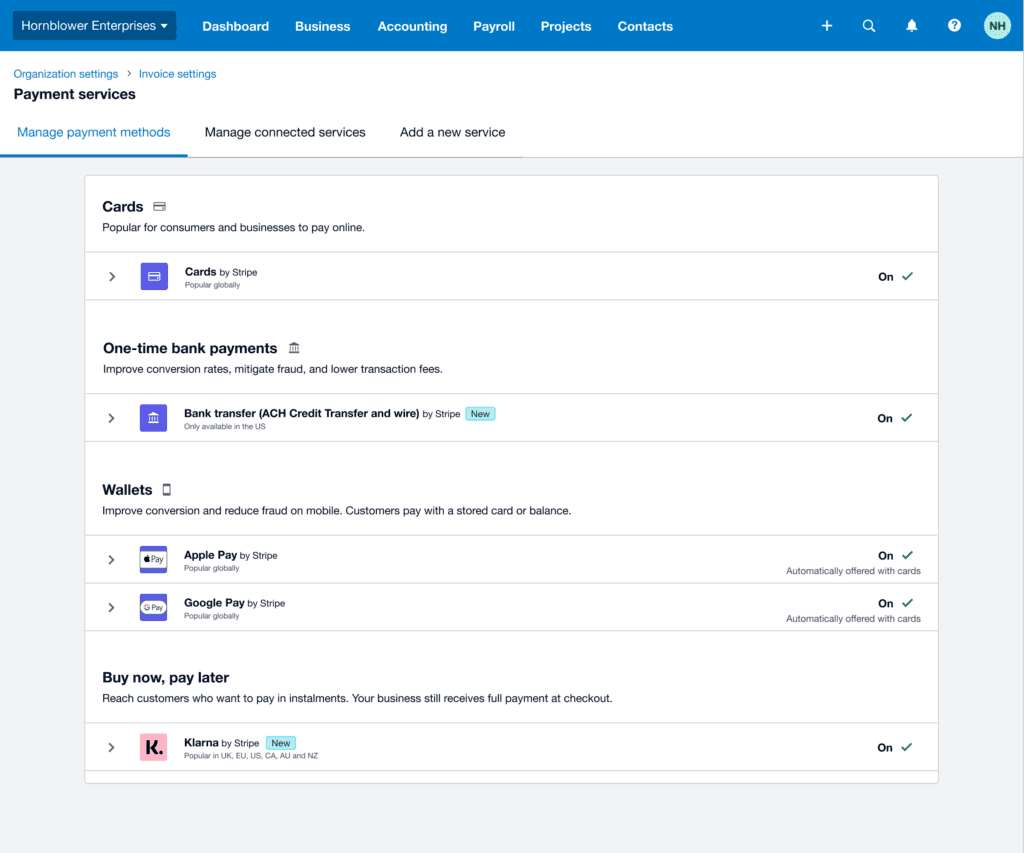

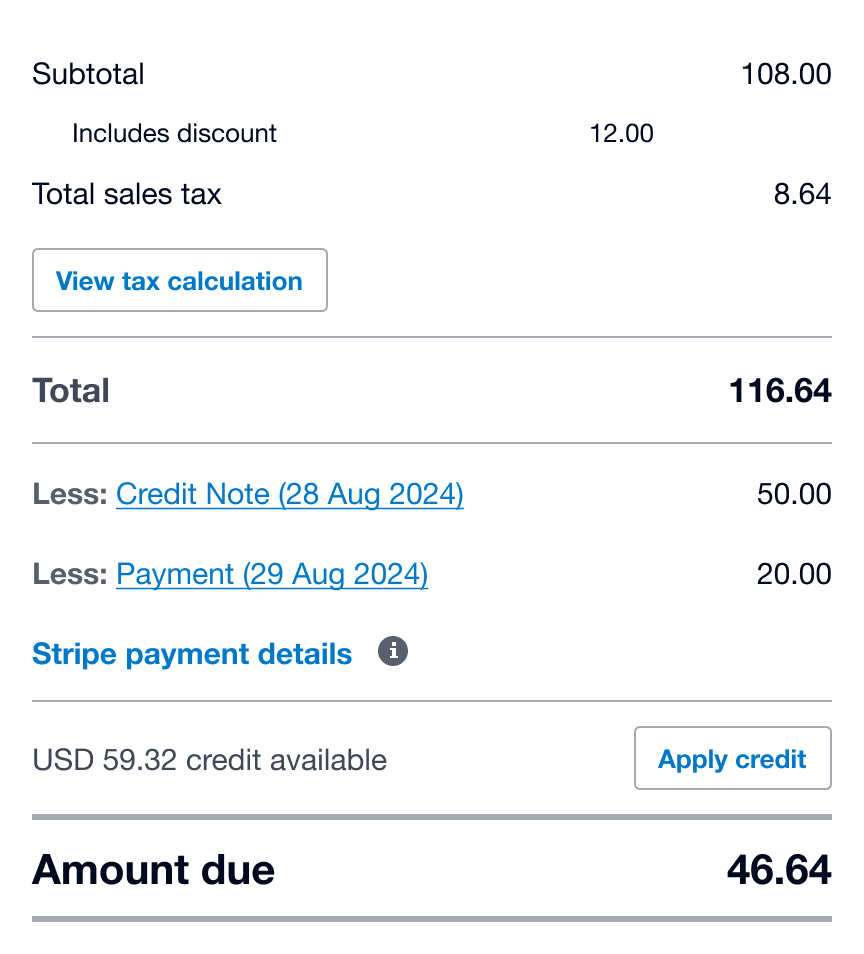

Xero customers can now sell any time, anywhere, by creating a payment checkout without the need to create an invoice. Simply generate a payment link to share with your customers, and keep track of when you’ve been paid. No set up is required, but you must be connected to an online payment provider such as Stripe, GoCardless, or Paypal.

These are just some of the updates that have rolled out in Xero this month. Check out the September edition here, and for a full list of what’s new this October, check out our Release Notes in Xero Central.

The post What’s new in Xero – October 2024 appeared first on Xero Blog.

If Xero is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.