How do you think small businesses in your area are doing? New regional and provincial data from Xero Small Business Insights (XSBI) helps track differences in small business performance within Canada and within the US. This data provides a more granular look at each country by sharing a richer, more nuanced perspective when compared to national level statistics.

The new data covers:

- Canada: Alberta, British Columbia and Ontario

- United States: Northeast, Midwest, South and West (the major regions defined by the US Census Bureau)

To help set the scene for this new data, we’ve released two new research notes covering how sales and payment times have tracked in each region and province since 2017. This includes how they performed during the Covid-19 pandemic and how they’ve recovered since.

You can download the full research notes from the XSBI Commentary and Research page.

How can you use this data?

Regional data can be especially helpful for small businesses and advisors who want to benchmark performance against similar businesses in the region. You can take the insights and make adjustments or set achievable goals for your business or clients. Some considerations could include:

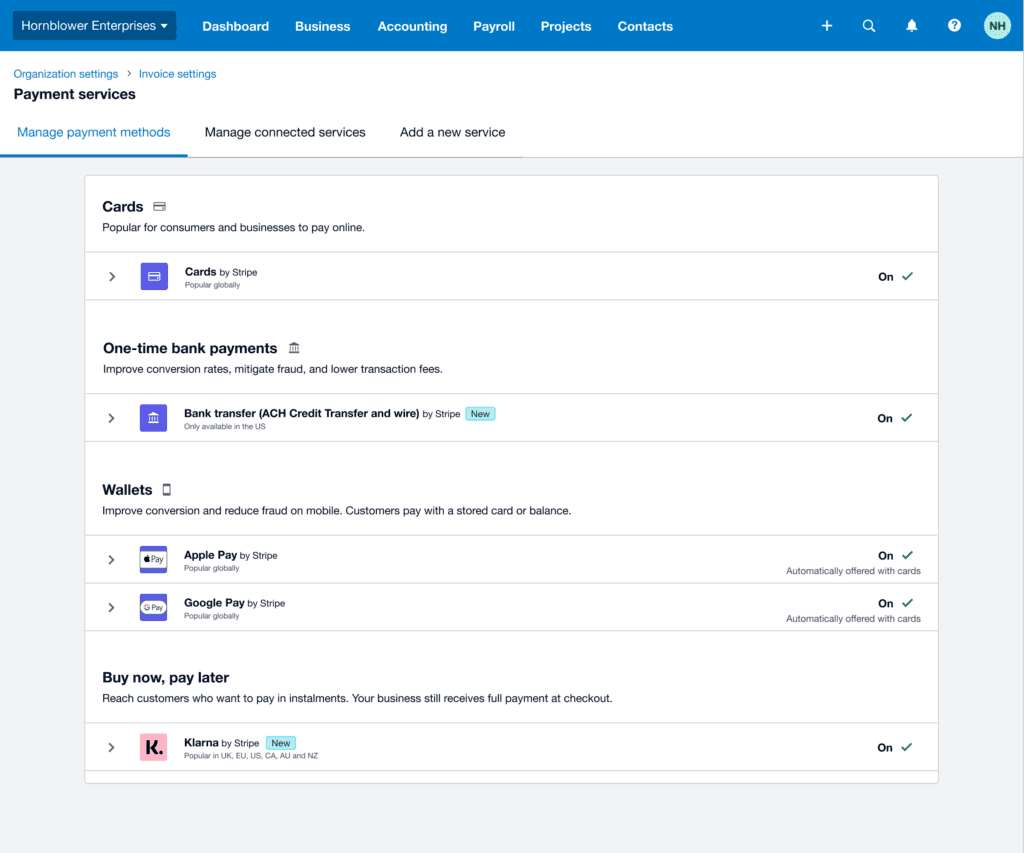

- How do your payment times compare to the average in your province? What payment services can you implement to improve them?

- How do sales in your local business compare to average sales in the broader region?

- What factors might be contributing to economic volatility in your area? How can you plan for these now and into the future?

What did we learn from these reports?

Canada:

- Alberta has experienced more volatility in sales performance compared to other provinces, probably due to a reliance on the energy sector and the flow-on impacts of global oil price fluctuations. Payment times rose during the pandemic – a trend not generally seen elsewhere in the XSBI data – but have since improved

- British Columbia was the province most impacted during the pandemic lockdown period, probably due to its exposure to international trade and tourism. British Columbia has had the smallest improvement in payment times over the period XSBI has been tracking them

- Ontario’s large, diversified economy protects it from the fluctuations seen in the other two provinces. The most recent months of data point to improving sales performance after a weak 2023. Ontario small businesses have had the most improvement in payment times over the period XSBI has been tracking them

United States:

- The Northeast has shown the biggest improvement in payment times since 2017 out of the four major regions. Payment times improved by around three days, after earlier having the longest wait time, indicating better cash flow outcomes for small businesses

- The Midwest was the least impacted by the pandemic of the major regions, possibly due to its strong agricultural industry. However, recent statistics show only three months of positive sales growth in the 15 months to March 2024

- The South now accounts for nearly a third of the US economy according to the Bank of America, with strong and diversified industries and sectors – great news for small businesses. It had the shallowest slowdown in sales of any of the major regions during 2023 and the early months of 2024

- The West had the strongest pre-pandemic average sales growth. However, despite a diverse economy, small businesses sales have struggled to recover since the pandemic, making the West one of the weakest sales performers.

The post What new XSBI data tells us about North American small businesses appeared first on Xero Blog.

]

]