As an accounting professional, you know your clients best. You understand their business model and structure, the tax and labor laws they need to comply with, and their unique financial challenges.

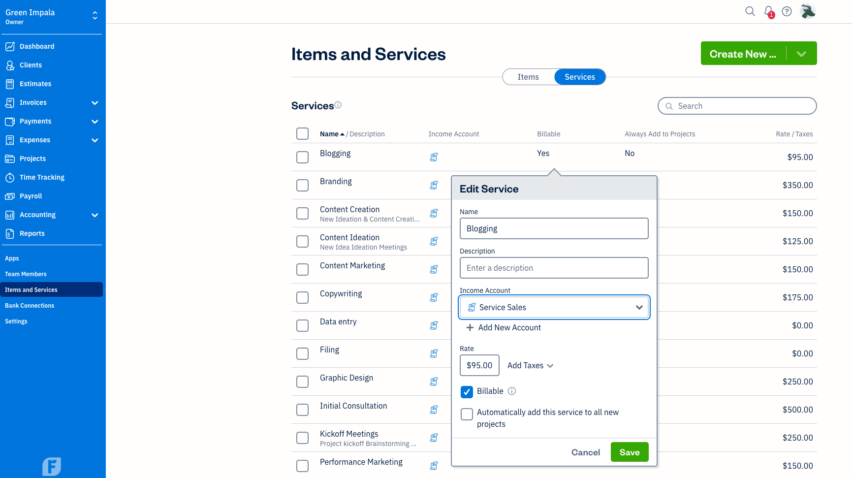

With your guidance and user-friendly general-ledger software like FreshBooks, they can (and should!) manage pre-accounting tasks like:

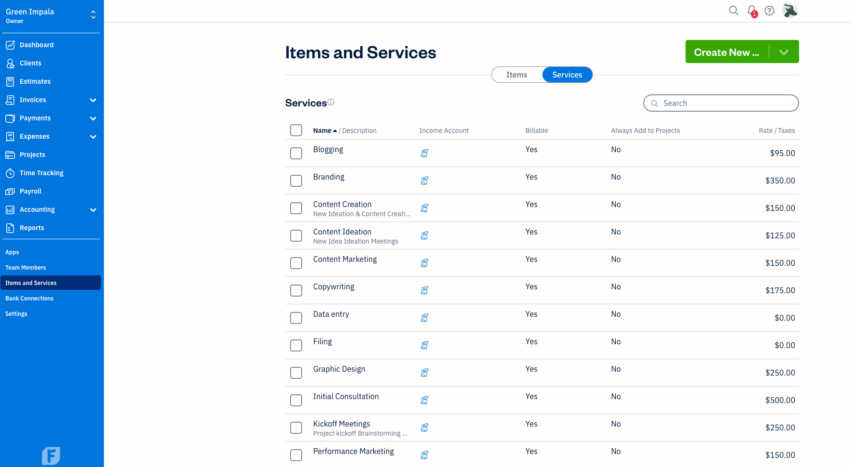

- preparing estimates

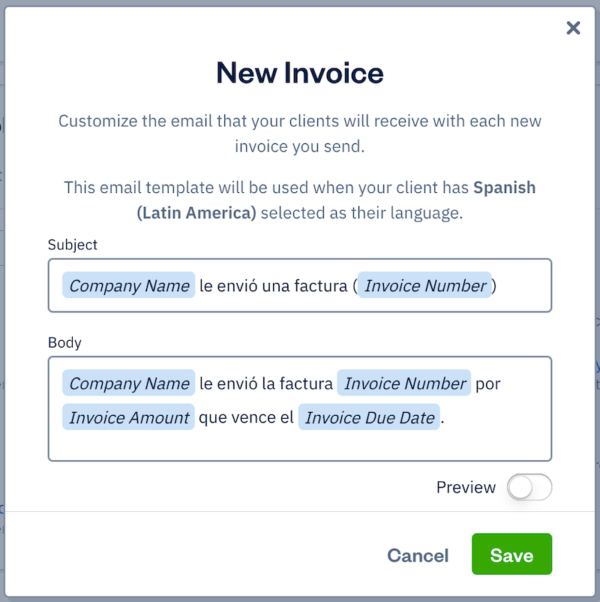

- sending invoices

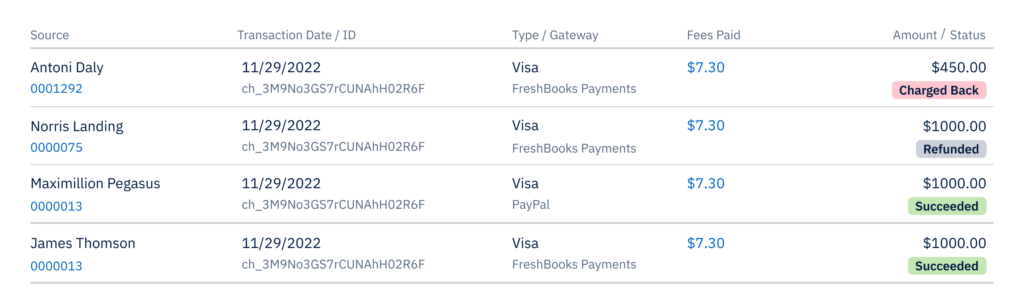

- setting up online payments

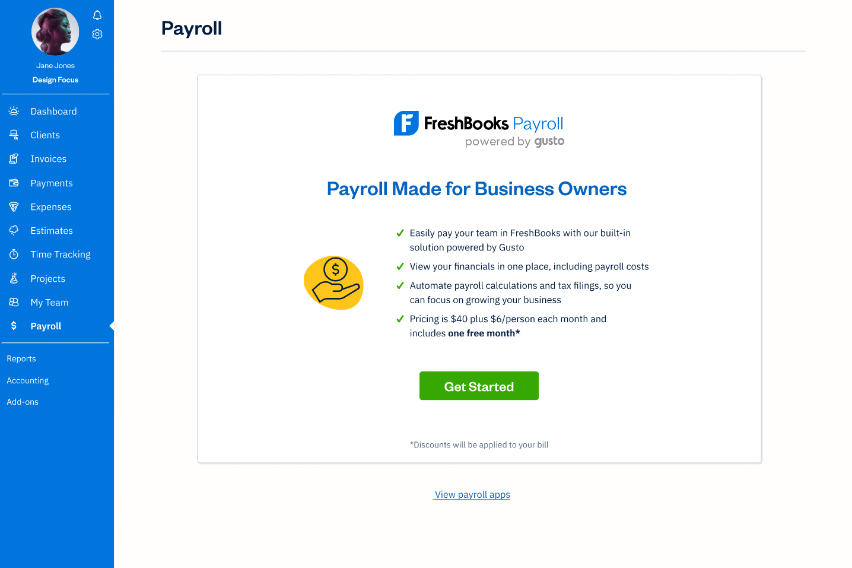

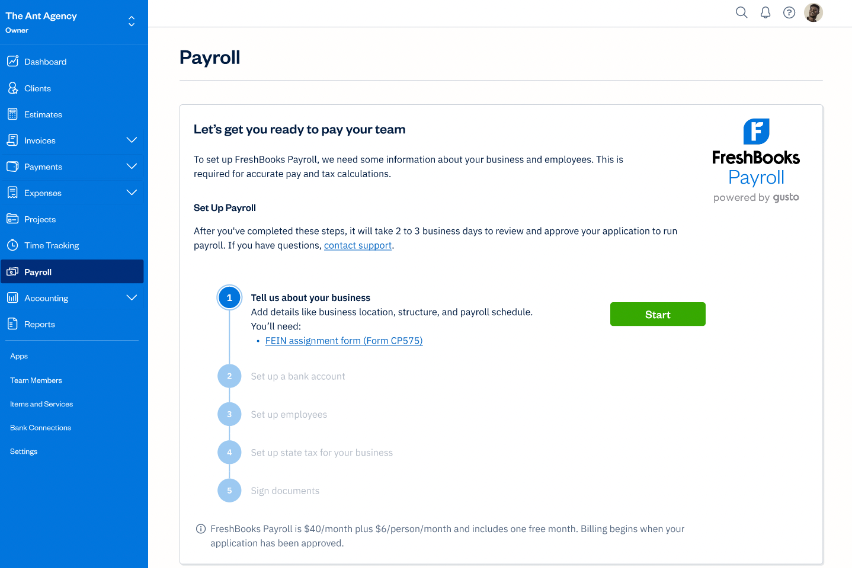

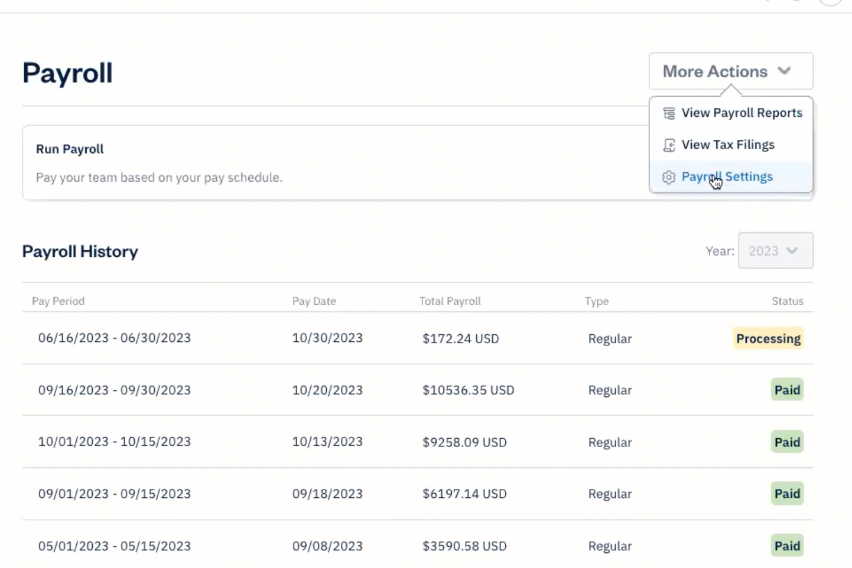

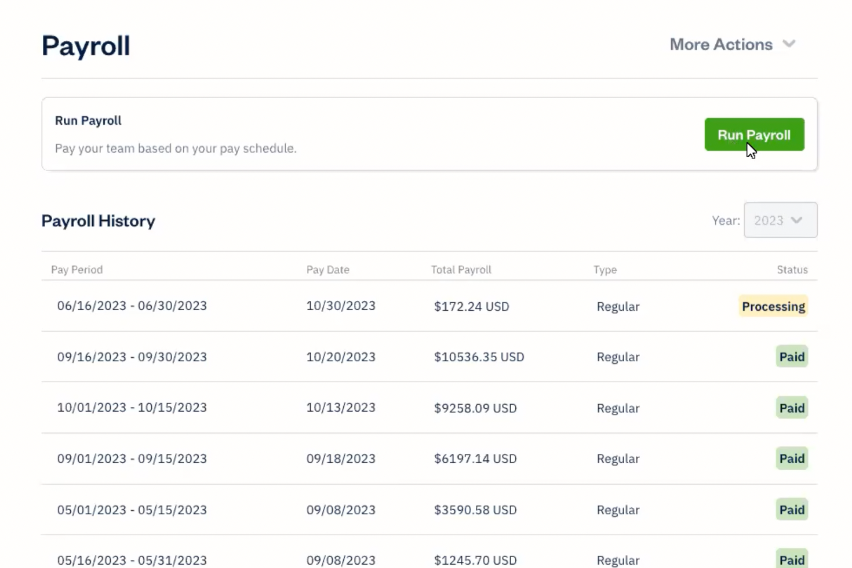

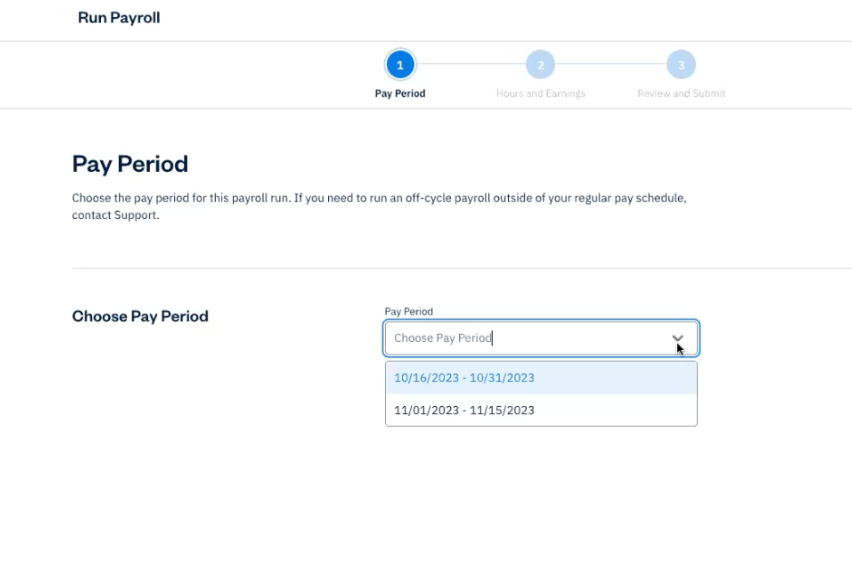

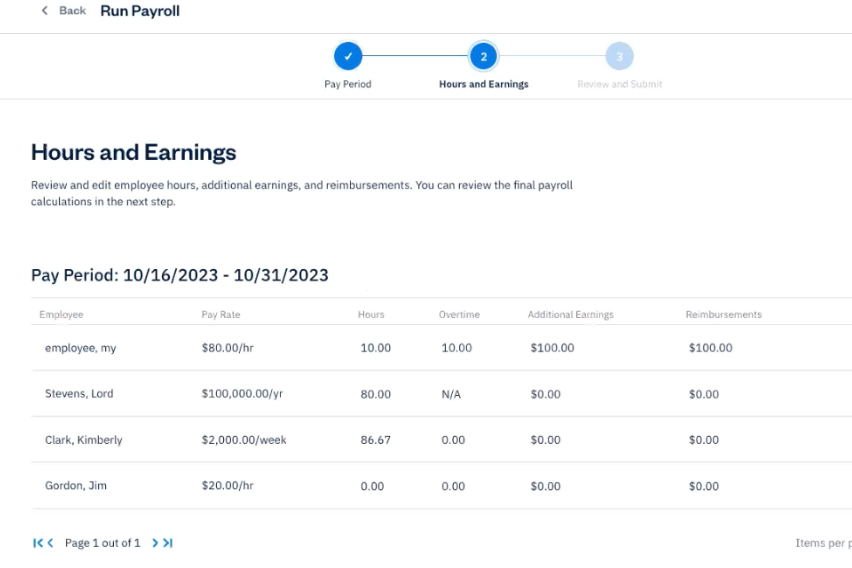

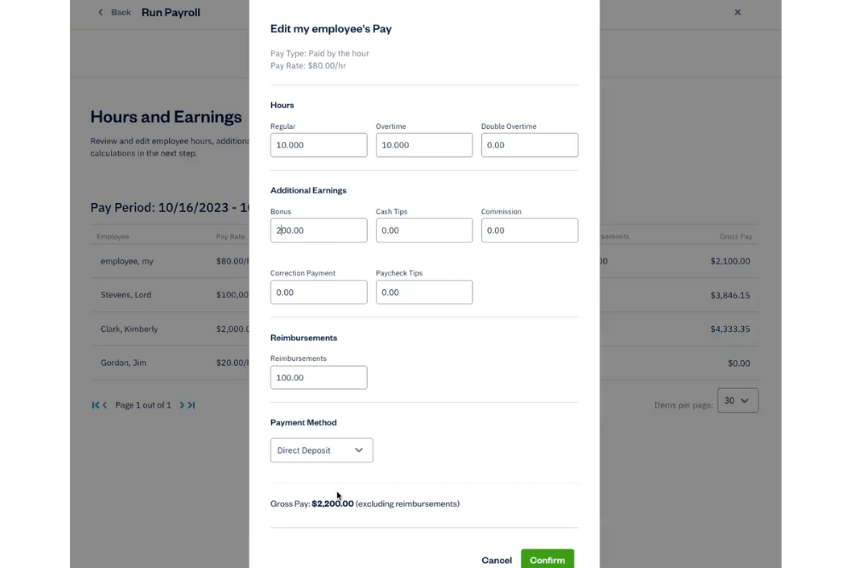

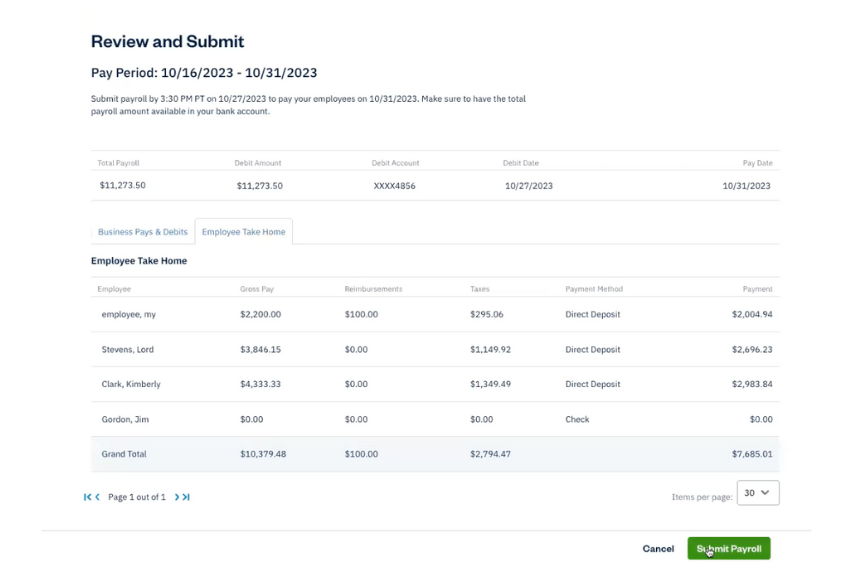

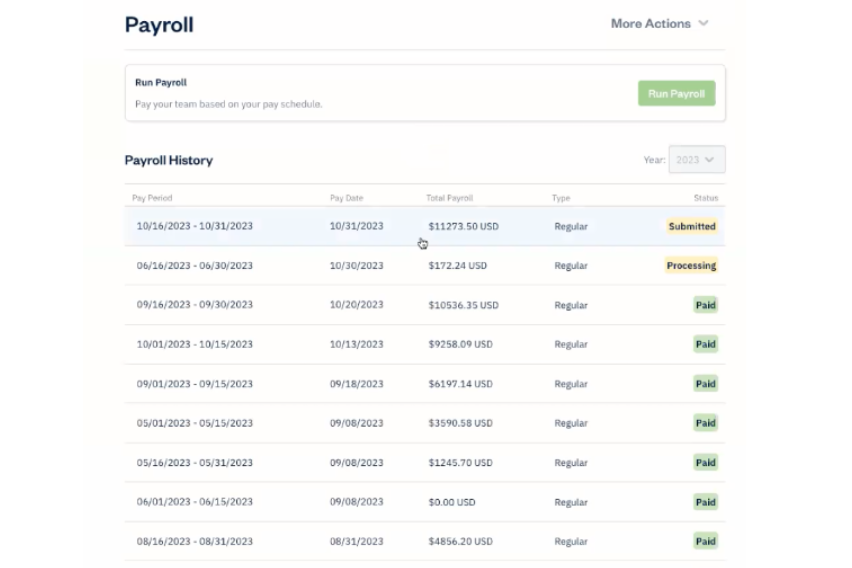

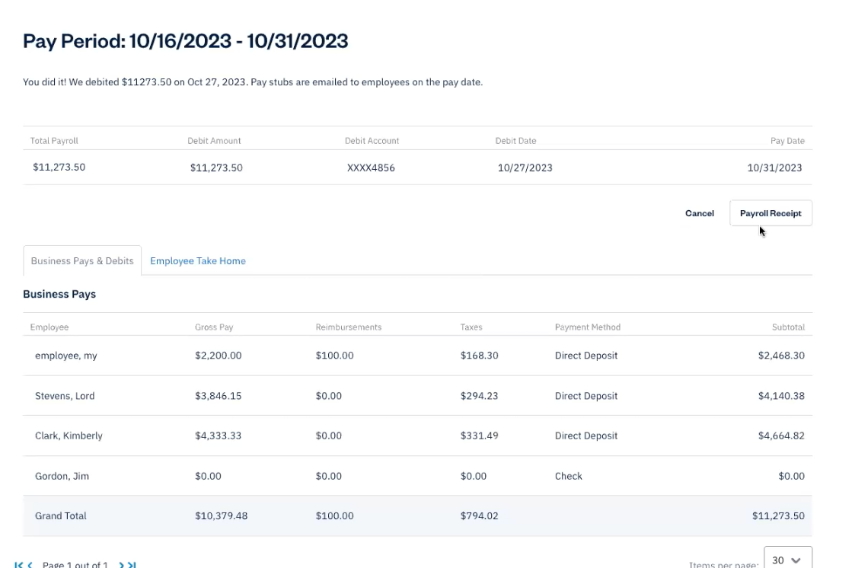

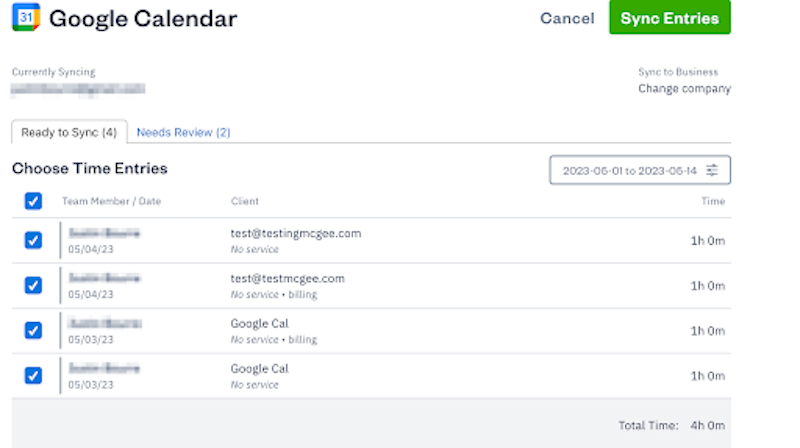

- employee time tracking for payroll

That’s the process, which allows you to provide value to your clients through advisory services. Especially since you know things about their business that they may not be aware of just yet. But with your guidance, they’ll get there.

That’s why you have to get your clients on board. Here are some considerations and steps to take that will bring everyone together.

Table of Contents

Explain The Benefits of Collaborative Accounting

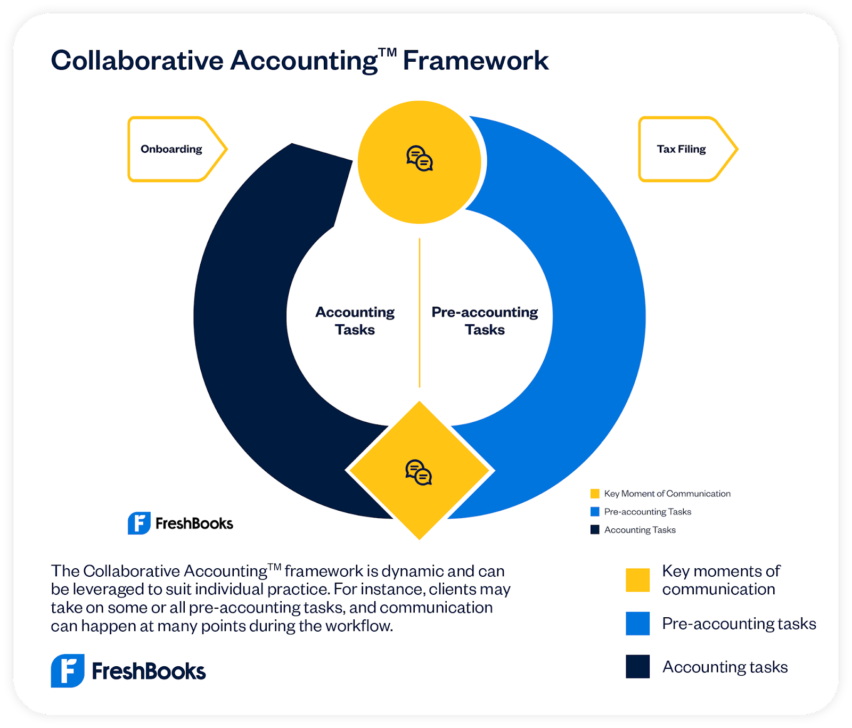

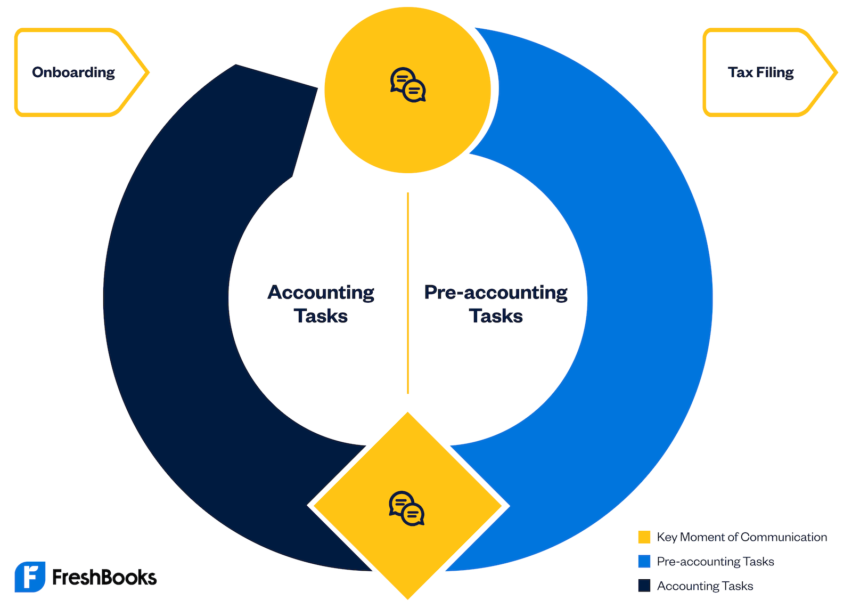

Collaborative Accounting is anchored around a shared accounting workflow between accountants and clients. You both work together, with full transparency, in a single

client-friendly platform. Each of you takes on key elements of the business’s financial operations, so your client is empowered, and no one is left uninformed.

When following the Collaborative Accounting framework, your clients can expect:

Smart financial advice when they need it

While the client handles pre-accounting tasks like creating estimates and proposals, sending invoices, and tracking time and expenses, you pick up where they leave off with accounting tasks that require your expertise.

Peace of mind knowing they’re on top of their finances

Your clients will now have more agency over their own business and a deeper understanding of their financials—freeing up your time to do more astute analysis that can help them make those big-picture business decisions.

A stronger partnership with you, their accounting professional

You can meet regularly to discuss the financial insights you’re observing so that your client can optimize their business and prepare for sustainable growth.

Clean, organized, and compliant books

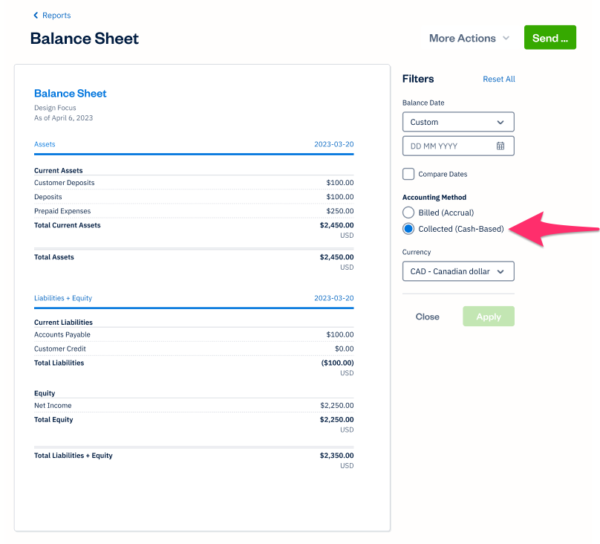

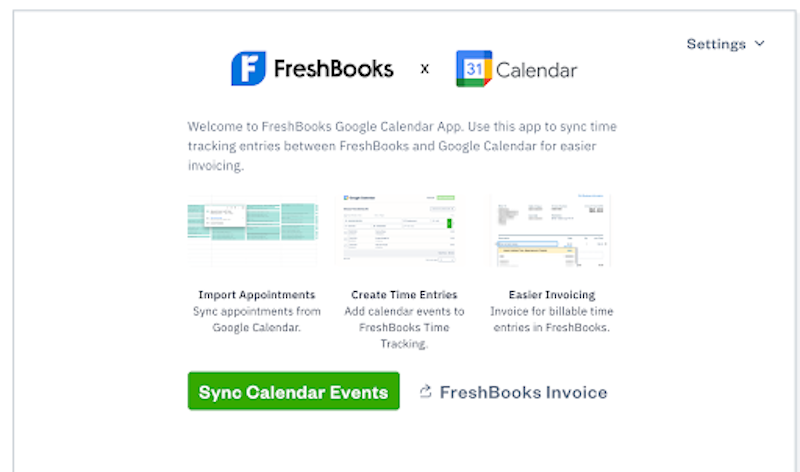

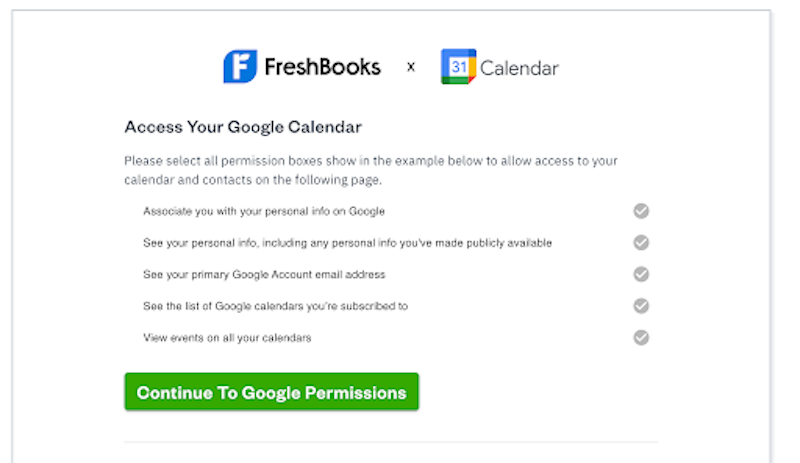

When either you or your client wants to share information or ask questions, you can communicate in one simple, and easy place—right in the FreshBooks platform.

Empower Your Clients to Do More

For some clients, taking more responsibility for their finances may seem intimidating. After all, they have a relationship with you because they recognize they could use professional assistance.

They may need to be reminded that, as business owners, they know their products, services, expenses, and workflows better than anyone. They can make real-time decisions about what should go on an invoice (or into a proposal), to which project an expense should be assigned to, and or how much time they or their team members spend on a particular project.

When they take responsibility for these tasks, they’ll have a better handle on the efficiency of their workflows and the real-time financial realities of their business. Delegating them to an accounting professional means they won’t be aware of the details that could help them make smarter short- and long-term business decisions.

In short, managing their own pre-accounting tasks will keep them informed and allow them to make more confident decisions.

Show Your Clients How Your Insights Will Help Them Grow

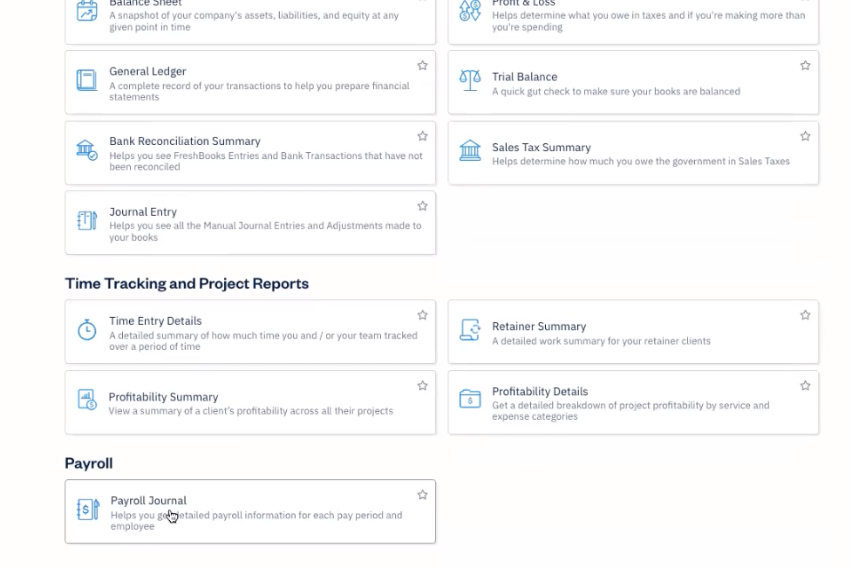

When clients keep up with their pre-accounting tasks, their accounting reports will offer you insights that can help them understand things like:

- which projects/services are most profitable through comparisons

- how to price a project or service properly

- how to assign the right people to projects

- which project pipeline can better handle cash flow in the future

- which services cost the most and are lowering margins

- how the project is tracking against the original estimate

These are the insights that can help an astute business owner find efficiencies, develop growth strategies, improve cash flow, and much more. And it’s all part of Collaborative Accounting.

Resources to Help You Get Your Clients Behind Collaborative Accounting

You’re not alone in introducing Collaborative Accounting to your clients and getting them on board with this new way of working. Here’s how we can help:

- : Get certified in under 4 hours to master product features and practice advisory conversations, enabling you to work more effectively with your clients.

- 1:1 meeting with a partner consultant: When you complete your certification, you have access to a partner consultant who can answer your questions and walk you through how to introduce Collaborative Accounting to clients.

- An Owner’s Guide to FreshBooks Collaborative Accounting: You lay the groundwork in your client meeting and this user-friendly guidebook will detail everything they need to know about Collaborative Accounting.

Embracing Collaborative Accounting can change how you and your clients work together. You’ll build a partnership based on transparency and mutual support.

And ultimately, Collaborative Accounting not only strengthens your client relationships but also positions you as a valued mentor and advisor capable of guiding them toward long-term success.