Behind every FreshBooks update is a real conversation with a business owner who said, “I wish this worked differently.”

We don’t build new features just for fun. We build them because we hear what customers like you want and need to grow your business. (Although we definitely have fun building them too!)

So, thanks to your feedback, let’s explore some of our latest updates from the first half of 2025, to help you spend less time managing your books and more time growing your business.

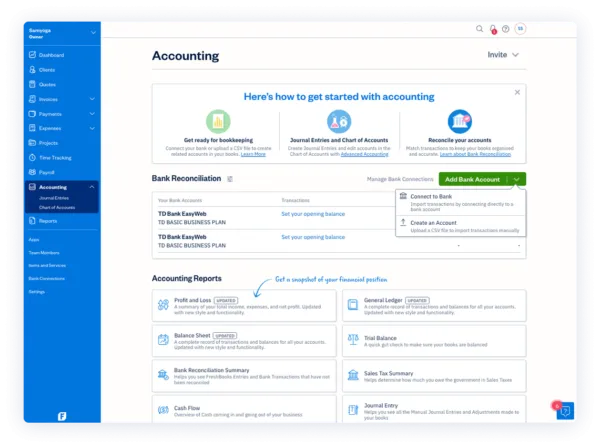

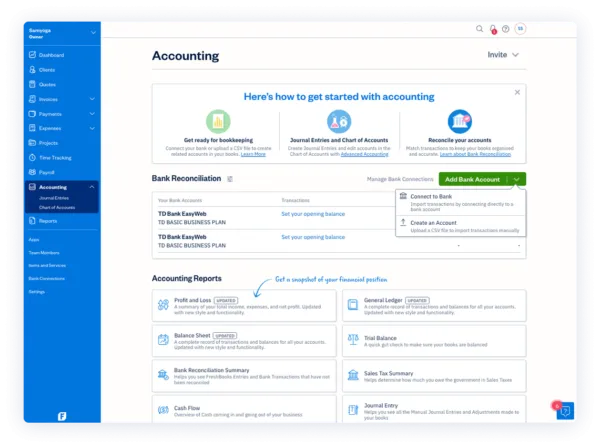

Keep your books reconciled without a direct bank connection

We all love automation, but sometimes there are things you just want to tackle manually. The latest update means you can manually create a bank account in FreshBooks to perform banking-related tasks, like , without having to set up a direct bank connection.

Previously, owners required a direct bank connection, but now you can create an account manually, set a starting balance, and upload and match your transactions via CSV. This is the perfect option if you prefer to review transactions yourself, if aren’t supported in your region, or if you simply don’t want to link your bank account.

Just head to the and select Add Bank Account to start reconciling.

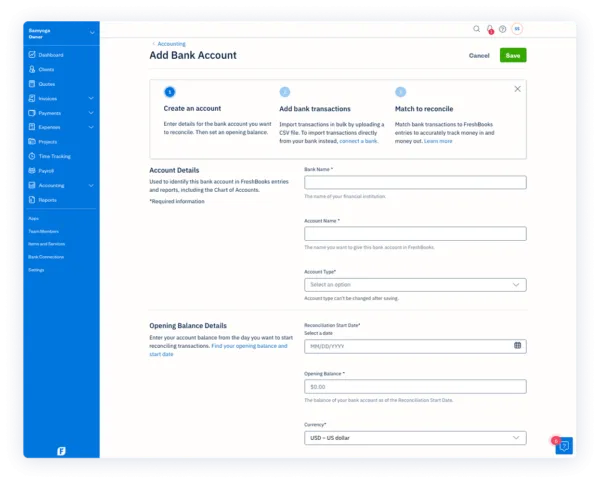

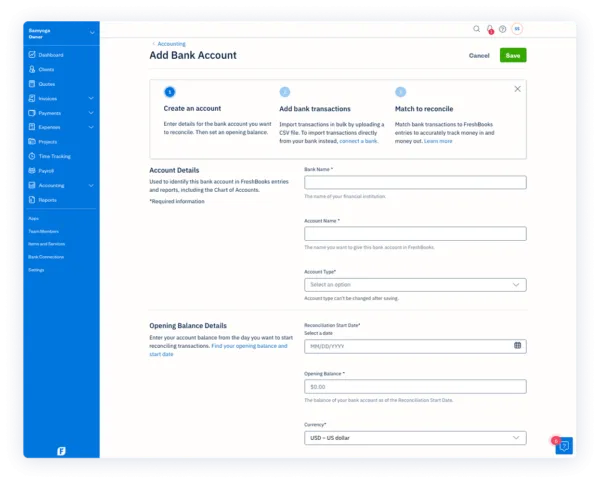

See all your historical banking data in FreshBooks

Speaking of reconciliation, direct bank connections have previously limited owners to importing the past 90 days of transactions into FreshBooks. Now, you can set your bank reconciliation start date to any date you want—even before the earliest date of your auto-imported bank transactions—and manually import historical data via CSV.

With this change, you can reconcile your books as far back as you’d like. So, whether you’re filing your taxes or just reviewing your transaction history, you can keep all your banking data up-to-date in FreshBooks.

of your FreshBooks account.

Enjoy (more) seamless bank connections with Yodlee

Users with bank connections on Yodlee can now enjoy guided onboarding to discover how bank connections work, plus responsive in-app notifications and real-time updates during imports.

If anything comes up along the way, are here to lend a helping hand. You can view real-time connection statuses, get insights into potential connection issues, and easily access support. With this new and improved experience, keeping your books up to date has never been more seamless.

Set your books on autopilot and in FreshBooks.

Close out your books with Financial Lock

There’s no better feeling than putting your closed books in the rearview mirror when you’ve dotted your i’s and crossed your last t’s.

Once you’ve wrapped everything up for a fiscal period, you can turn on Financial Lock to prevent unintentional changes to any entries during the previous accounting period. It gives you total peace of mind to work on your books and grow your business, without worrying about accidentally creating a bookkeeping mess.

But we all know things can change, so if you ever need to make an edit, just head into → Advanced Preferences → Accounting and hit unlock.

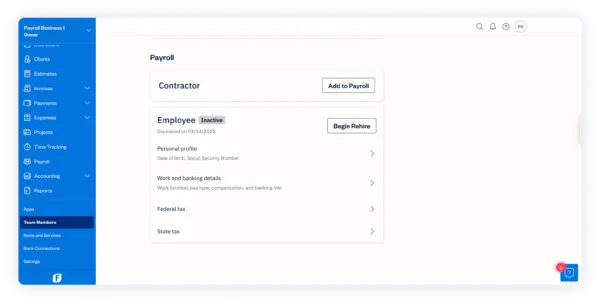

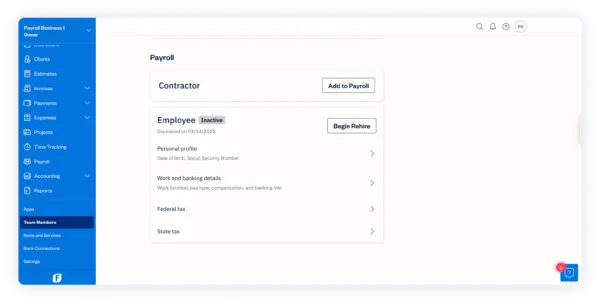

Streamline employee offboarding and rehiring

Employees will come and go as your business grows. And managing employee changes can come with a ton of HR and manual paperwork—but not anymore!

For customers on , the latest update gives you the ability to all within your account. You’ve always been able to invite new team members to your team, but now you can easily offboard departing employees and rehire any returning team members in just a few clicks. So you can spend less time dealing with HR and more time collaborating with your team.

Ready to explore these new features for yourself? or

︎

︎