Our view at Stack - Pipedrive is a robust CRM platform, offering automation, contact data collection, webhooks, AI-powered sales assistant, email communications, email marketing, and customisable sales pipeline workflows.

How much does it really cost you to win a new customer? If you’re like most small business owners, you might not know the exact figure – but you should.

Customer acquisition cost is an important metric that helps you understand how much money you actually make each time you close a deal. Without it, you can’t truly know if your marketing is profitable or your prices are right.

In this post, you’ll learn what customer acquisition cost is, why it matters and how to calculate it. We’ll also break down the different costs that go into this metric and offer tips on bringing yours down to maximize your bottom line.

What is customer acquisition cost?

Customer acquisition cost (CAC) is what it costs your business to attain a new customer. You calculate it by adding up all your sales and marketing expenses, then dividing the total by the number of customers you acquired during a specific period of time.

CAC matters because it tells you whether your marketing and sales expenses are turning into a profit. The answer is highly relative.

For a small coffee shop, spending $50 to acquire a customer who only buys a $5 latte once means losing money. However, for a SaaS company selling $300 yearly subscriptions, that same $50 CAC could be excellent value.

By tracking your CAC, you can focus on marketing tactics that help you grow your customer base at a cost that makes sense for your industry, business size and pricing.

What is the average customer acquisition cost?

The average customer acquisition cost varies across industries. Knowing these averages helps you understand a good CAC for your company.

Every business spends money to win new customers, but how much you can afford depends on what you’re selling, who you’re selling to and the market you operate in.

Here are the average CAC benchmarks by industry for B2B startups.

|

Industry (B2B) |

Average CAC (organic and paid) |

|

Automotive |

$692 |

|

Business consulting |

$656 |

|

Construction |

$349 |

|

Cybersecurity |

$439 |

|

E-commerce |

$84 |

|

Entertainment |

$329 |

|

Financial services |

$923 |

|

Insurance |

$595 |

|

IT and managed services |

$583 |

|

Legal services |

$915 |

|

Real estate |

$923 |

|

SaaS |

$273 |

|

Transportation and logistics |

$584 |

B2B companies typically face higher CACs because their sales cycles are longer and more complex. As an enterprise SaaS, you might pay for multiple calls, meetings, product demos and long negotiations.

All these costs add up, but they’re often worth it because B2B customers usually stick around for years and make higher-value purchases.

In contrast, here are the average CAC benchmarks by industry for B2C startups.

|

Industry (B2C) |

Average CAC (organic and paid) |

|

Automotive |

$234 |

|

Construction |

$294 |

|

Cybersecurity |

$73 |

|

E-commerce |

$68 |

|

Entertainment |

$106 |

|

Financial services |

$173 |

|

Insurance |

$94 |

|

IT and managed services |

$98 |

|

Legal services |

$457 |

|

Real estate |

$165 |

|

SaaS |

$166 |

|

Transportation and logistics |

$147 |

Customer acquisition costs are significantly lower for B2C companies.

Businesses selling directly to individual customers have tighter profit margins. B2C buyers typically make small, quick purchases and often switch easily to other brands.

In this case, spending too much to acquire each customer is risky, which is why B2C companies tend to focus on low-cost marketing to attract many buyers.

CAC vs. CPA: What’s the difference?

CAC and CPA are often used interchangeably, but there’s a difference between the two business metrics.

Customer acquisition cost (CAC) measures the total cost of gaining one paying customer.

For example, your marketing agency might spend $12,000 monthly on ads, content marketing, sales team salaries and automation tools. If you land 15 clients that month, your CAC would be $800 per customer.

Your CAC shows you whether your sales and marketing efforts are profitable, especially when compared to how much each customer typically spends with you over time.

Cost per action (CPA) is a campaign metric that specifically tracks how much you spend to get a single conversion – whether that’s a sale, signup or consultation.

For instance, your agency might invest $4,000 in LinkedIn ads. If those ads get you 20 discovery calls, your CPA for that campaign would be $200 per call.

Your CPA helps you evaluate which marketing channels provide the most value so you can adjust your ad spend accordingly.

Recommended reading

A beginner’s guide to common marketing abbreviations

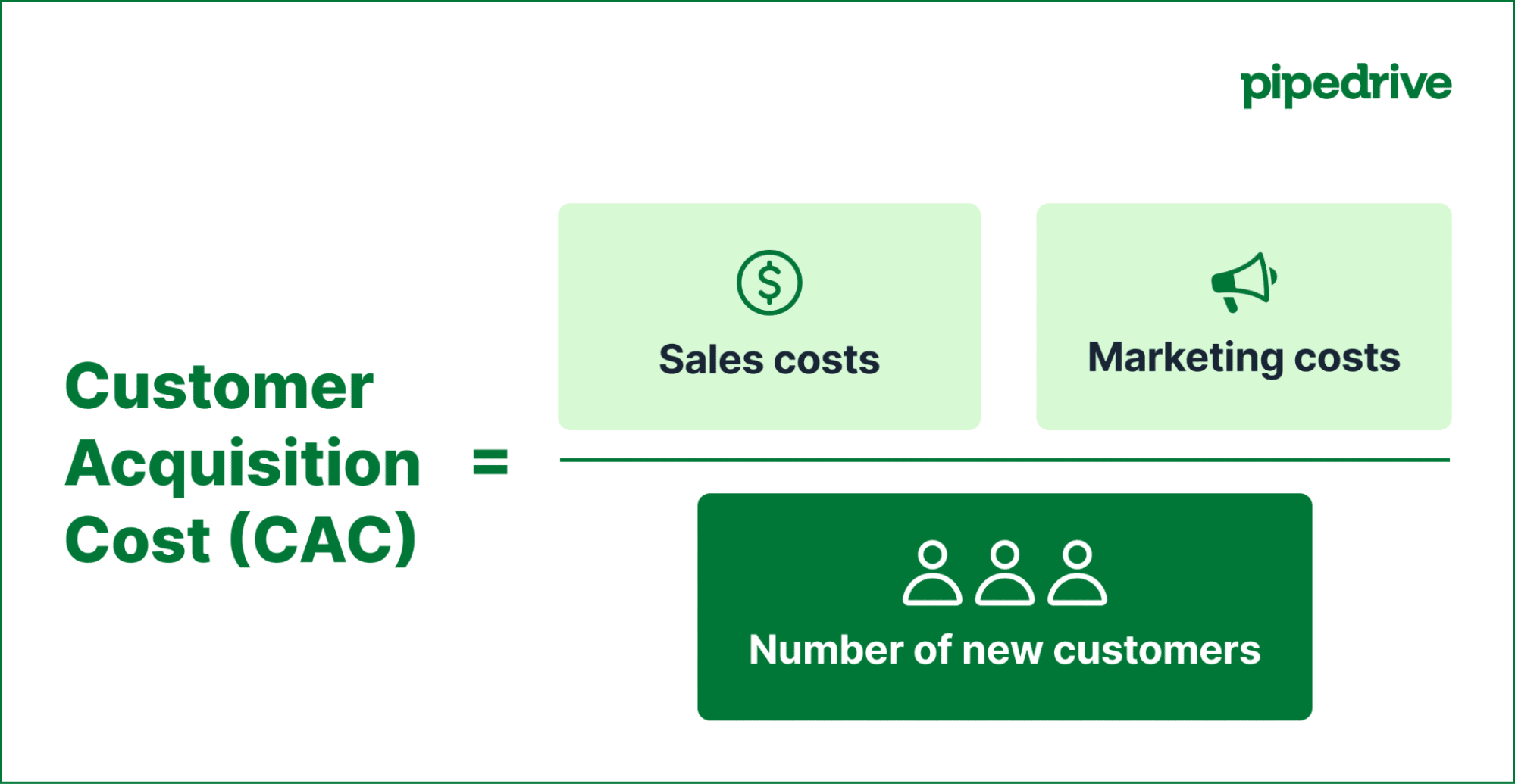

How to calculate your CAC

Calculating your customer acquisition cost (CAC) helps you understand exactly how much you’re investing to bring in each new customer.

This important metric guides your marketing budget and pricing strategy so your company can stay profitable and achieve sustainable growth over time.

Here’s the CAC formula:

CAC = Marketing costs + Sales costs / Number of new customers

For example, if you spent $500 on marketing and $1,000 on sales last month, and got 20 new customers, your CAC would be:

$500 + $1,000 / 20 = $75 (CAC)

CAC is typically calculated monthly, but the costs can also be determined quarterly or even annually.

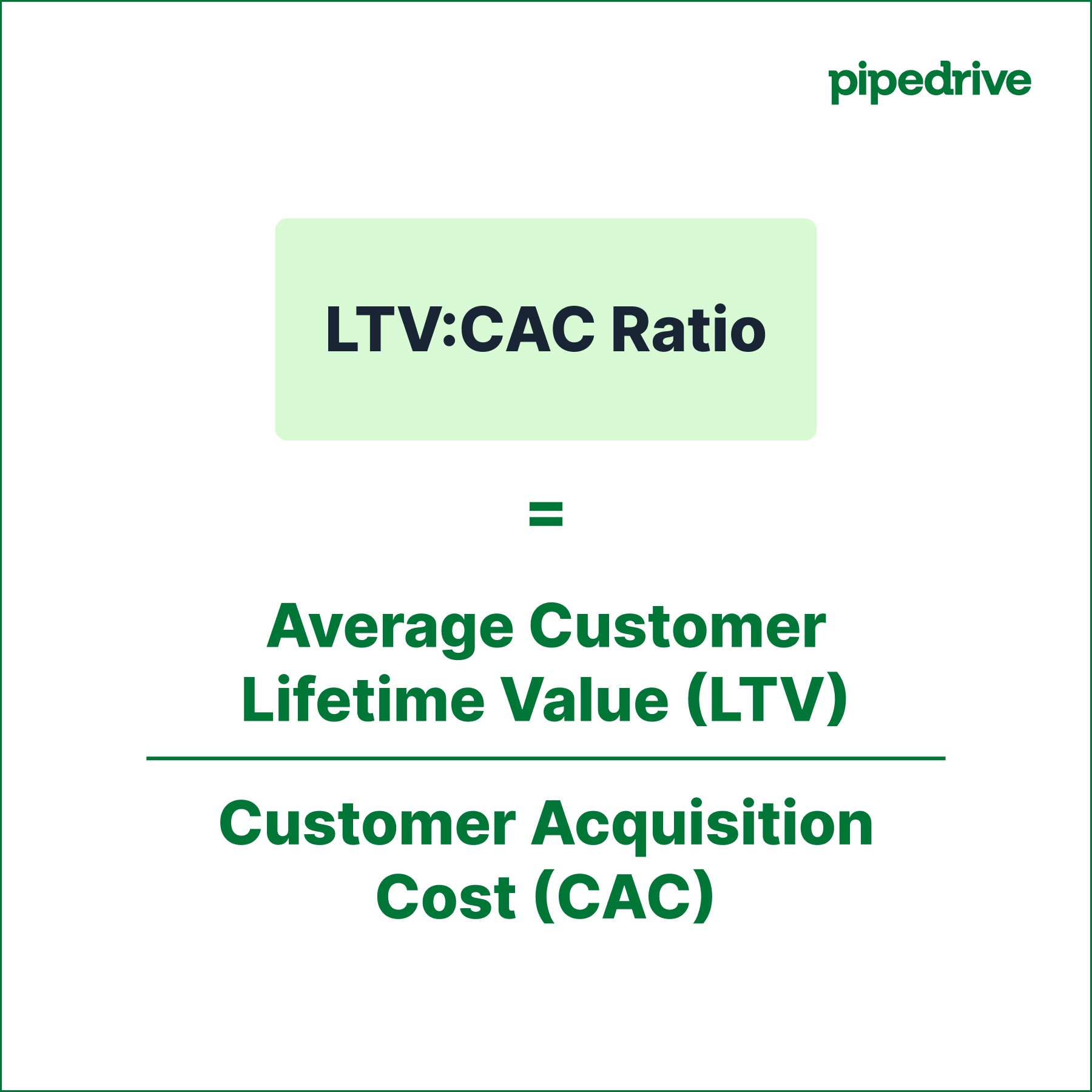

Calculating the LTV: CAC ratio

Your acquisition costs only tell half the story. To accurately analyze your sales and marketing spend, you need to compare it against your average Customer Lifetime Value (CLV or LTV).

LTV shows how much revenue each customer generates over their relationship with your business. The LTV to CAC ratio helps determine whether your customer acquisition strategy is profitable and sustainable.

Here’s how to calculate it.

LTV: CAC Ratio = Average Customer Lifetime Value (LTV) / Customer Acquisition Cost (CAC)

For example, if your SaaS customers have an average LTV of $1,800 and your CAC is $450, your LTV: CAC ratio would be:

$1,800 / 450 = 4:1

Several factors affect whether this ratio is good or bad.

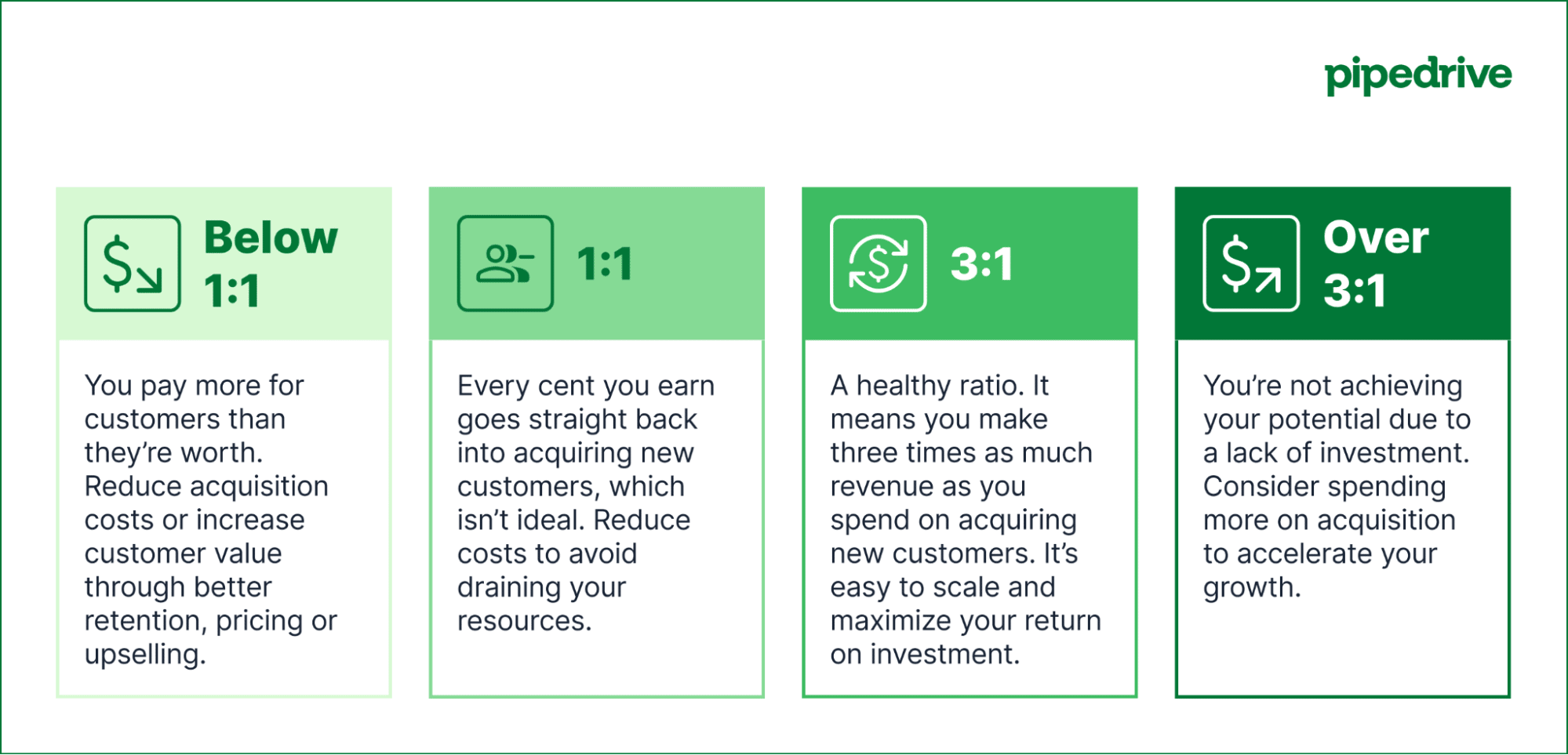

Here are different LTV: CAC ratios and what they mean for your business.

-

Below 1:1: You pay more for customers than they’re worth. Your company continually loses money and gets into financial difficulties. You must reduce acquisition costs or increase customer value through better retention, pricing or upselling.

-

1:1: Every cent you earn goes straight back into acquiring new customers, meaning this ratio isn’t ideal. Quickly improve customer retention and reduce costs to avoid draining your resources.

-

3:1: This is a perfectly healthy ratio. It means you make three times as much revenue as you spend on getting new customers. It’s easy to scale and maximize your return on investment.

-

Over 3:1: This may seem like a great ratio, but you’re not achieving your potential. A lack of investment means your business could grow faster. Consider spending more on acquisition to accelerate your growth.

What goes into customer acquisition costs?

Calculating the cost of acquisition might sound straightforward – simply add your marketing and sales expenses.

However, sales and marketing are two different departments, each with its own costs. When you break down all your expenses, you’ll find many hidden costs in the customer acquisition process.

Here are some types of expenses that could impact your customer acquisition cost.

Advertising costs

Advertising is one of the most direct costs in acquiring customers. From digital ads to paid SEO to print, broadcast and local promotions, your ad spend can quickly add up if you pay for visibility across multiple channels.

Here are some advertising costs to account for in your CAC:

-

Google ads (e.g., search ads, display ads, video ads)

-

Social media ads (e.g., Facebook, Instagram, LinkedIn ads)

-

Print ads (e.g., flyers, brochures, posters)

-

Broadcast ads (e.g., TV commercials, radio ads)

Production costs

Content helps you attract customers and nurture leads to conversion. However, creating engaging content for marketing campaigns comes at a price.

Production costs include all expenses related to developing creative assets such as blog posts, videos, webinars, infographics, support pages, tutorials and sales demos.

You can divide them into the following categories to make the calculation easier:

-

Creative costs. Any expenses related to research and planning, hiring specialized talent like writers, designers and videographers, licensing fees for stock photos, videos and other paid assets and any editing or post-production costs.

-

Equipment costs. You may choose to outsource content production. However, if you create content in-house, factor in costs for renting or purchasing cameras, lights, microphones, props, sets, studios and even editing software.

-

Event-related costs. If your business plans to host online or in-person events, you should add costs related to webinar hosting platforms, speaker fees, venue rentals and event promotion to your CAC.

People costs

The people in your company responsible for getting customers on board (i.e., sales and marketing employees) don’t work for free. Factoring in costs like their salaries and commissions gives you a realistic picture of your acquisition cost.

Other than compensation, you should consider human capital costs related to:

-

Salaries. Most companies include salaries for the period (e.g., monthly salaries and any commission paid out because of an acquisition).

-

Employee training. Costs associated with training sales and marketing staff on specific software or skills that directly contribute to customer acquisition (e.g., a new email marketing tool to run a campaign that drives sign-ups).

-

Travel and meetings. Expenses for flights, hotels and meals for conferences, industry events or in-person meetings with potential clients.

Note: When calculating your CAC, focus solely on expenses incurred while your sales and marketing teams are actively working to acquire customers. For example, if a sales representative spends 70% of their time pursuing leads, allocate 70% of their salary to your CAC calculation. Likewise, include only training costs that directly support customer acquisition and conversion efforts, such as CRM training, while excluding general workplace training (e.g., HR software training for logging leave).

Partnership costs

Working with influencers or other brands can boost your reach, but it comes at a cost. Partnership costs are marketing costs you need to include in your CAC.

Here are some specific examples of partnership costs:

-

Influencer marketing fees (e.g., Instagram, YouTube, TikTok collaborations)

-

Affiliate commissions (e.g., payouts for referred sales or leads)

-

Event sponsorships (e.g., activations, logos, banners, giveaways)

-

Brand collaborations (e.g., co-marketing, joint product launches)

-

Speaking engagements at industry events

Technical costs

The tools you use to support your acquisition efforts contribute to your overall CAC.

Technical costs often include recurring expenses for software subscriptions, website upkeep, product updates and more.

Here are some technical costs your business may incur:

-

Software costs. Subscriptions or licenses for customer relationship management (CRM) platforms, automation tools, analytics software and other tech your sales and marketing teams use.

-

Website hosting and maintenance. Costs for having a fast, secure and user-friendly website and landing pages that are optimized for conversions.

-

Product inventory and updates. Costs for maintaining inventory, storage and packaging, as well as regularly updating product features or fixing issues to align your product or service with customer needs.

Understanding the different costs involved in the acquisition process can help you refine your sales and marketing strategy, cut unnecessary expenses and create a customer acquisition model that supports your business’s growth and innovation.

Recommended reading

Sales commission: attract star sellers with an effective sales compensation plan

Customer acquisition cost example

Let’s examine an example of calculating the customer acquisition cost for a B2B software business. The company has a two-person sales and marketing team, invests in online advertising and content creation and uses several tools to support its acquisition efforts.

Over a three-month period, they calculate all related expenses to determine their CAC.

Advertising costs

The company runs a few targeted ads on Facebook and Google to build awareness and generate leads.

Total advertising costs: $1,400

Production costs

They primarily outsource creative work to produce two blog posts and one monthly newsletter (with visuals).

Total production costs: $650

People costs

The small sales and marketing team includes one salesperson and one marketer, both working part-time. They calculate people costs over the quarter, pro-rated for how much time they dedicate to customer acquisition.

-

Salaries for part-time sales and marketing roles: $5,000

-

Sales commissions on new clients: $250

Total people costs: $5,250

Technical Costs

The sales and marketing team uses software for specific customer acquisition tasks.

-

Quarterly license of an affordable CRM platform: $100

-

Subscription to a simple email automation tool: $75

-

Basic website hosting fees: $100

Total technical costs: $275

Final CAC calculation

Adding up total marketing and sales costs over the three months:

Total costs = $1,400 + $650 + $5,250 + $275 = $7,575

If the business acquired 25 new customers over the quarter, their CAC would be:

CAC = $7,575 / 25 = 303

Customer Acquisition Cost (CAC) = $303

Recommended reading

How to calculate your return on sales ratio: formula, definition and more

How to reduce your customer acquisition cost

For small businesses, acquiring new customers is just as important as keeping costs low.

Fortunately, lowering your acquisition costs doesn’t always mean cutting corners. There are ways to reduce your CAC without sacrificing the quality of your leads or slowing down your growth, such as using the right tools and making some strategic adjustments.

Here are some tips to lower CAC.

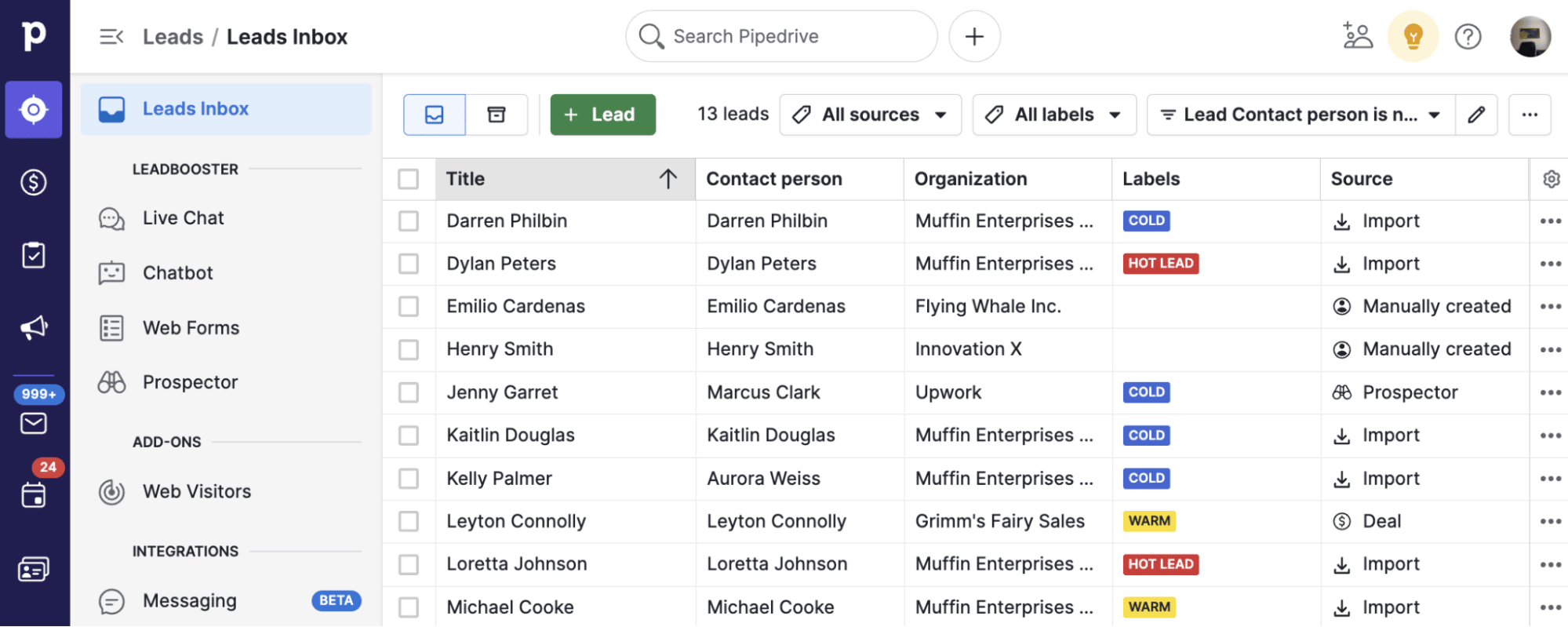

Use a CRM to focus your sales and marketing efforts

Businesses often waste money chasing the wrong leads. Using a CRM like Pipedrive, you can map the sales pipeline visually in your dashboard and receive all customer information at a glance.

This data helps you identify leads genuinely interested in your solutions. Targeting prospects who are already closer to making a purchase can increase conversions and reduce the time and money spent on nurturing less qualified leads – bringing acquisition costs down.

Using a CRM also makes it easier to segment your leads, such as by demographics, browsing history or past interactions.

Segmentation helps you speak directly to each customer by tailoring your messages and strategies to resonate with their specific needs.

For example, consultancy firm Simon-Kucher reduced its banking client’s acquisition costs by 50% by focusing on specific customer segments and developing targeted promotional strategies to attract those customers across relevant channels.

The better you know your customers, the better the offers you can make them. The more personalized your offers are, the faster they’ll convert into leads and paying customers.

Invest in customer satisfaction and retention

Prioritizing your existing customers can increase their LTV. It can also get you new customers for free. Happy customers typically spend more and stick around longer. They’re also likely to refer your business to others, drastically reducing your acquisition costs.

Here are some ways to reduce churn and improve your retention rate:

-

Deliver more value. Offering extra resources or incentives to customers can increase the perceived value of your product or service. For example, your SaaS company could offer live training sessions to new clients to help them make the most of your product and maximize the value of their subscription.

-

Collect (and act on) customer feedback. Regularly conduct surveys and encourage customers to share their thoughts at multiple touchpoints (where customers interact with your brand) to make them feel heard. More importantly, act on that feedback to show you care(fixing issues or working on feature requests).

-

Provide exceptional customer service. Quality service creates a positive customer experience and keeps customers returning for more. Go above and beyond in your interactions to turn regular customers into loyal fans and even brand advocates.

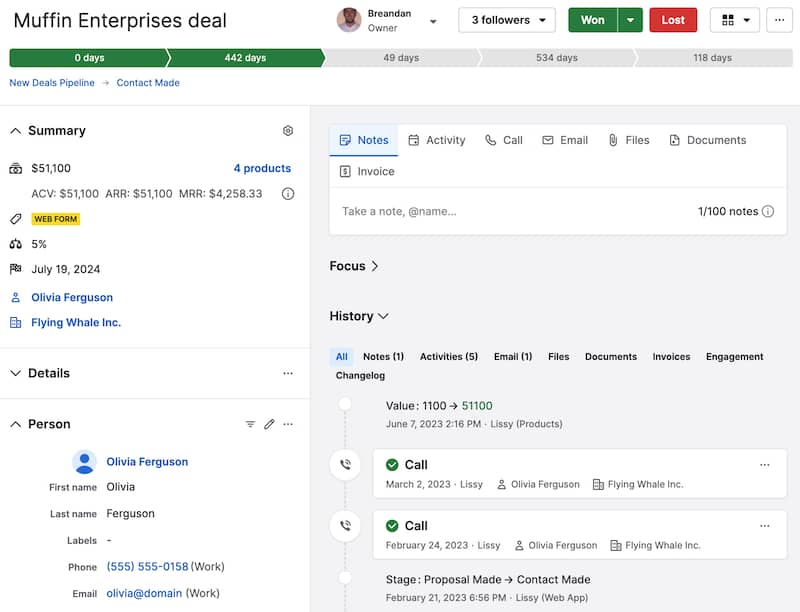

Pipedrive’s CRM can track purchase history, sales conversations, channels and more. You can use this sales data to add value to your products and services, personalize your messaging and improve the overall customer experience.

Analyze your conversion rate to improve it

A good conversion rate is vital to reducing your CAC. Using Google Analytics or another tracking tool, you can see which touchpoints drive the highest conversions and which points in the customer journey need optimizing.

For example, analyzing traffic, bounce rate and form submissions might show potential customers often visit your landing page but leave without downloading your white paper. A heatmap tool like Hotjar or Crazy Egg might reveal a problem with the contact form.

Optimize the touchpoint to increase your lead conversion rate and reduce acquisition costs.

For instance, you could tweak the copy to better communicate the value of your resource, reduce the number of form fields visitors need to fill out or adjust the design of the call to action.

Adding features like live chat or chatbots to your landing pages can further improve your sales process. By answering customer questions while they’re still on the page, you can potentially increase the likelihood that they’ll stay on your website for longer and convert.

Pipedrive’s LeadBooster add-on, which includes tools like live chat and forms, can help you improve your conversion rates. SurfaWhile, for example, generated up to three times more leads while cutting marketing costs by 80% using Pipedrive’s CRM and LeadBooster tools.

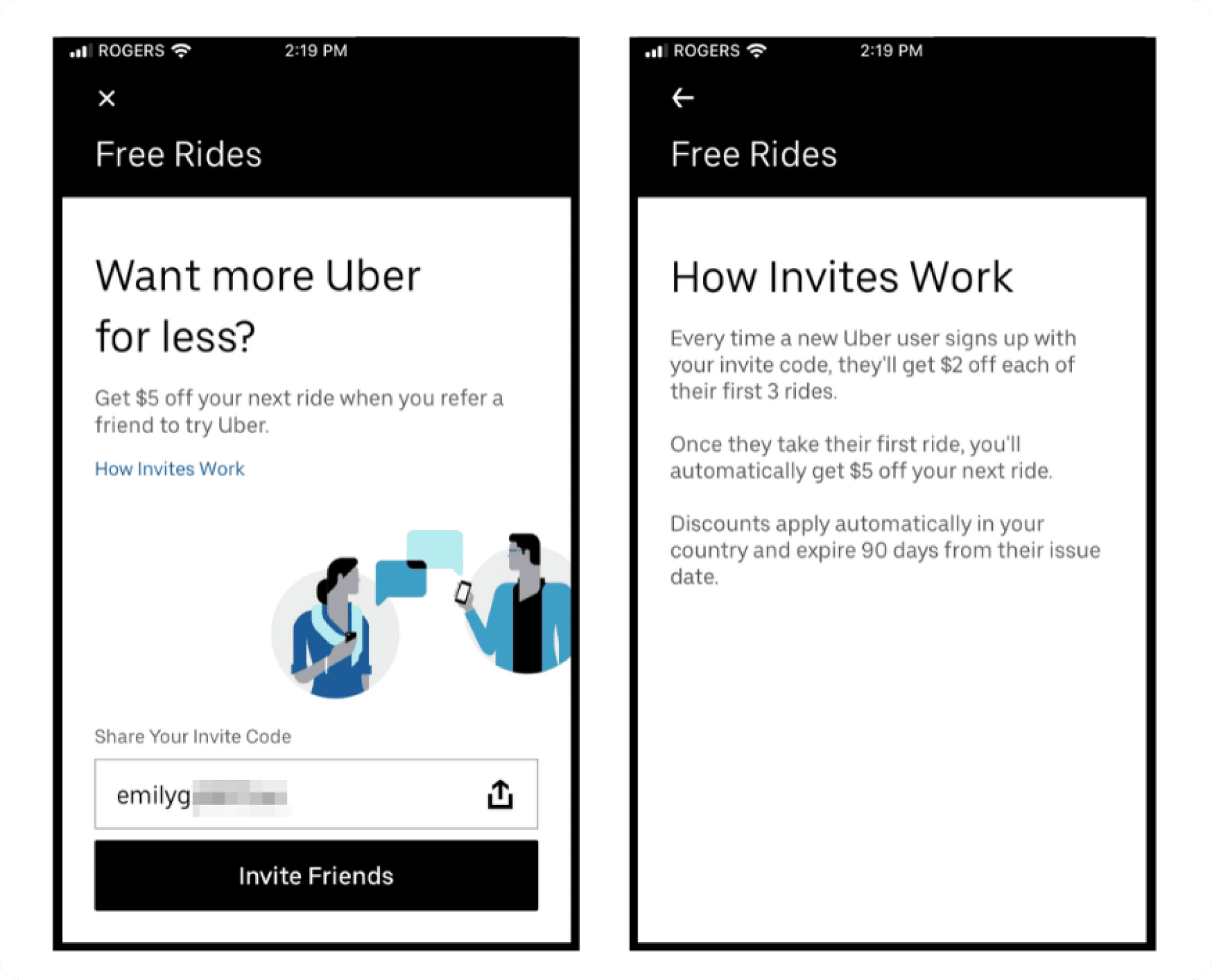

Encourage customer referrals

Sales referrals are one of the most cost-effective ways to acquire new customers. When existing customers recommend your business to their network, it creates trust and interest before you even make contact – leading to higher conversion rates with minimal spending.

To encourage referrals, you can set up a referral program that rewards customers for each new client they bring in through discounts or credits. Uber, for example, offers discounted rides to the referrer and the referred person.

Final thoughts

Knowing your customer acquisition cost helps you spend wisely on sales and marketing and gives your company a better chance of growing sustainably.

The ideal CAC for your business depends on your specific product, target audience, industry, company size, business model and dozens of other factors. Comparing your CAC to LTV gives you a better idea of whether you’re overspending on acquisition.

Pipedrive can help you keep your acquisition costs in check with real-time sales KPIs and metrics at your fingertips. You can also easily track customer data to improve retention and identify high-value leads, focusing your budget where it truly matters.

Sign up for a free 14-day trial and take it for a test drive.

If Pipedrive is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.