Imagine this: You’re selling yard maintenance services, and someone wants to book you for lawn aeration. And they want it done super quickly. So you email them an invoice, and…you wait. And wait.

When you follow up, you realize they wanted to pay online but couldn’t, and then they forgot to send a check. In the meantime, they thought you’d ghosted them and moved on to a competitor.

Opportunity lost.

What if, instead, you sent them an invoice with a payment link, they paid the invoice immediately, and you received the money in your bank account and aerated their lawn a few days later? How much easier is that? (For both of you!)

With FreshBooks Payments powered by Stripe, your clients can pay instantly on the invoice or checkout link, using their preferred payment method, so you can get paid quickly and get the job done.

What Is FreshBooks Payments?

FreshBooks has partnered with Stripe, a trusted and secure payment processor, to offer more payment options. The two have been partners since 2016, and this expansion leverages the newest payment technology and builds upon a shared vision of FreshBooks as an all-in-one accounting solution for owners and accountants.

FreshBooks Payments allows customers to pay online directly on the invoice using various payment methods, including major credit cards, debit cards, and Apple Pay. It also processes payments through bank transfer (ACH).

What Are the Benefits of Using FreshBooks Payments?

FreshBooks Payments has many benefits—for both you and your clients.

- Your customers can use multiple payment options. Instead of writing a check or taking cash out of the bank, they can simply click a link in the invoice or you send them, enter their payment info, and voila! Payment is en route to your account.

- Your clients can pay on the go with mobile wallets (Apple Pay and Google Pay) and credit and debit cards.

- Charge clients instantly over the phone, in person, or on the go with a that safely stores client credit card information and processes payments on the spot.

- Collecting payments online makes bookkeeping easier since your payments are automatically marked as paid and will be reflected in your reports. You’ll reduce admin tasks and simplify your manual work. Because everything happens digitally, there’s an automatic record of every transaction, refund, and sale, which makes staying on top of business finances easy.

- Payments are secure. FreshBooks Payments uses real-time card validation, fraud detection, and encryption to process and store payment details safely. While checks can get lost in the mail, FreshBooks Payments is reliable and secure.

- Get fraudulent activity alerts. You’re alerted when a dispute occurs so chargebacks can be resolved quickly, and any suspicious fraudulent activity will be brought to your attention.

How Does FreshBooks Payments Work?

FreshBooks Payments allows your client to pay invoices using their credit card, debit card, or mobile wallet (like Apple Pay and Google Pay). The payment is processed for a small fee and deposited into your bank account. The entire process should take a few business days, and all transaction fees are automatically tracked in your FreshBooks account as an expense.

How Secure Is FreshBooks Payments?

FreshBooks employs industry-best online payment security practices through PCI (Payment Card Industry) compliance. PCI is the security standard for organizations that handle credit card transactions. Credit card companies mandate PCI compliance, and the Payment Card Industry Security Standards Council administers it.

How Easy Is It to Turn on FreshBooks Payments?

You can set up FreshBooks Payments yourself in just a few minutes, right inside your FreshBooks account.

To set up FreshBooks Payments in your account:

- Click on Settings on the left blue navigation and select Online Payments.

- Follow the simple steps on the screen.

- You’ll have to link to your bank account to receive payouts.

*Note: The first payment can take up to 7 business days to process; after that, you can expect payments to take 2 to 5 business days, depending on the type of payment.

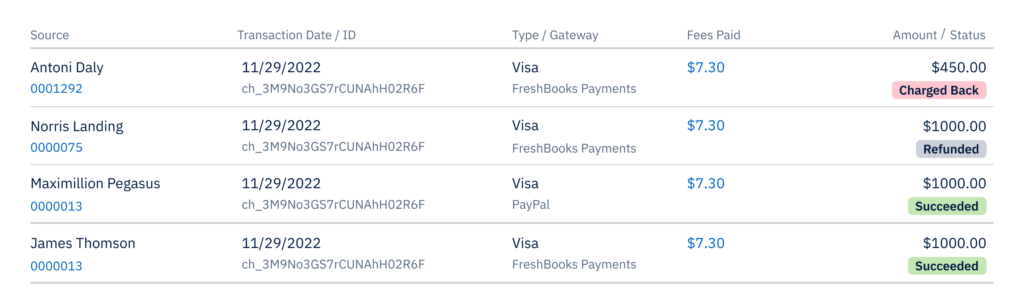

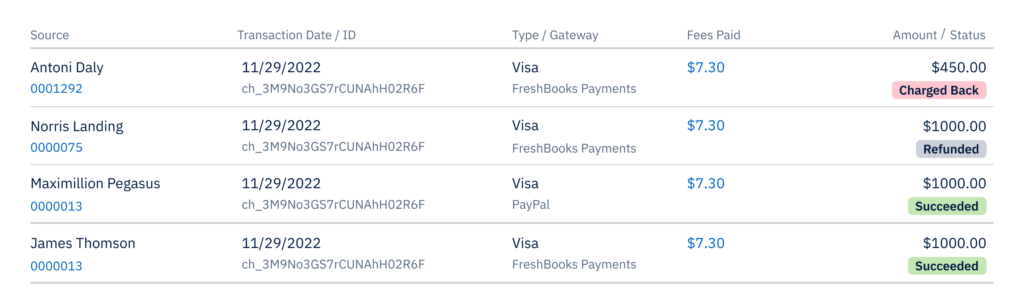

This is what your dashboard might look like:

How Much Does FreshBooks Payments Cost?

Pricing is simple and transparent:

- Visa/Mastercard/Discover/Apple Pay: 2.9% of the payment amount + $0.30 per transaction

- Amex: 3.5% + $0.30

- Bank transfers (ACH): 1% bank transfer fees (only available in the U.S.)

There are no setup fees, monthly fees, minimum charges, or costs associated with validations or client refunds. Plus, clients can save their credit card information for recurring payments, and even if a card expires, our card updater will automatically update the information so that owners and clients don’t need to worry about payments not going through.

Do I Have to Use FreshBooks Payments?

No, you don’t! If you have payment methods that work well for you, you can keep using them.

However, if waiting for checks to clear is challenging your cash flow, or you’d like to add an online payment method option for your clients, you may want to consider adding FreshBooks Payments. Payments happen faster because the payment option is available directly on the invoice, and your records are automatically updated.

We Are Excited to Show You What the Future Has in Store for FreshBooks Payments

As FreshBooks Payments grows, we will continue to listen to your feedback, innovate, and launch more features that will help you get paid faster so you can maximize your cash flow and grow your business.

If you need help, FreshBooks is here. If you have questions about this feature, please . We’re here to help!