Our view at Stack - Shopify has just about everything you need if you're looking to sell online. It excels with unlimited products, user-friendly setup, and 24/7 support. It offers 6,000+ app integrations, abandoned cart recovery, and shipping discounts up to 88%. Plus, it allows selling both online and in-person, scaling as your business grows.

Anyone with a personal checking account understands the challenge of keeping track of the money available to pay the bills. The point of watching a checkbook is to ensure the money coming in exceeds the money going out. The movement of money in and out of a checking account represents cash flow.

Businesses are like households in that respect. They must keep a close eye on their checkbook to maintain a positive cash flow, or to anticipate a possible negative cash balance by sourcing (or raising) money from other sources. Ahead, learn more about the different types of cash flow.

What is cash flow?

Cash flow is a record of both money received (cash inflow) and money paid (cash outflow) during a given time period. Effective cash flow management ensures there’s more inflow than outflow.

Accounts receivable, or money owed to a business, and accounts payable, money owed by a business, are ignored in cash flow. They are recorded in another financial statement, the balance sheet, of a business’s total assets and liabilities. Only once receivable amounts are collected, and payable amounts are paid, does a business record them as net cash flow.

Cash flow vs. profit

A business’s profit and cash flow can be quite different, because of the differing methods of accounting. Income statements (also called profit-and-loss statements) use accrual accounting, which means sales, expenses, and profit are recorded as they’re incurred in a given period, regardless of when money is received or paid.

So, for example, a company that sells $10 million in goods during a given period records the full amount on the income statement, even if all $10 million hasn’t yet been collected from customers.

Similarly, if expenses are $8 million, they’re fully recorded because they were incurred during that period, even if payment of some of the expenses was deferred. Cash accounting, in contrast, records only the portion of sales that were collected in the period, and the portion of expenses that were actually paid.

The importance of cash flow

Cash flow is important to businesses because it essentially keeps the doors open and the lights on. Businesses have to maintain a positive cash flow or be able to anticipate a possible negative cash flow by sourcing (or raising) money from other sources.

Maintaining positive cash flow ensures you can pay bills, including salaries, rent, and suppliers. Without sufficient cash flow, you may struggle to meet financial obligations, leading to potential insolvency.

Adequate cash flow also allows a business to invest in new opportunities—expanding to new markets, developing new products, or acquiring other businesses. It provides the financial flexibility needed to pursue growth strategies.

Healthy cash flow also helps businesses weather unexpected storms, like economic downturns or supply chain disruptions. It also makes businesses more appealing to investors and lenders when they need outside funding.

Types of cash flow

There are three main types of cash flow widely recognized in business accounting, as well as additional types adopted by some industries and locations. US companies typically list them in quarterly financial reports in a statement of cash flows. The cash flows are:

Cash flow from operations

Operating cash flow tracks the flow of money that stems from the production and sale of a company’s goods and services. It includes cash received from the company’s business operations minus cash expenses, which includes the cost of goods sold and held, plus general and administrative expenses.

Cash from operations is the most important because it shows whether a company is viable and bringing in enough money on a regular basis to pay its bills without needing outside financing.

Cash flow from investing

This tracks money spent or received to buy and sell business assets, such as property and equipment. It also includes money spent to buy stocks, bonds, or other securities, and any dividends or interest payments received from these investments.

While cash from investing may show a negative balance, it’s not necessarily a red flag if the cash is invested in income-producing assets like inventory or in activities such as research and development that can bring about future sales and profit.

Cash flow from financing

Cash flow from financing accounts for money the business receives from outside sources to fund its operations, including proceeds from loans or bond sales, the sale of an equity stake to an investor, or a public offering of shares. It also accounts for money spent to repay loan or bond principal (the interest paid on loans and bonds comes out of cash from operations), repurchase shares or equity stakes, and pay any dividends.

Cash from financing shows how much a business is relying on outside sources of money, rather than internally generated cash from operations.

Unlevered free cash flow

Unlevered free cash flow is the money a company has left after it has made investments in its assets but before it’s paid interest for debt.

It doesn’t take into account the cost of any debt that may be used in operating a business. Debt is typically in the form of bonds or bank loans. So unlevered free cash flow is the amount of cash available for the business to use before subtracting interest expense on debt. Analysts and investment managers often use this.

Discounted cash flow

Discounted cash flow is a method of estimating the value of something based on how much money it’s expected to generate in the future.

The main purpose of discounted cash flow is to determine a theoretical value or price for an asset, such as an appropriate stock price for a company. Comparing the discounted cash flows a business generates against the stock price can help an investor assess whether the company is undervalued or overvalued.

Incremental cash flow

Incremental cash flow is a way for businesses to measure the profitability of individual projects or investments, helping them decide what to pursue. Determining incremental cash flow allows businesses to compare expected cash flow across projects. This helps businesses identify which projects are likely to be profitable, and where to invest money.

How to calculate cash flow

You can calculate cash flow in a few different ways, depending on what type of cash flow you’re focusing on. Three often-cited types are listed below, with the cash flow formulas for calculating each.

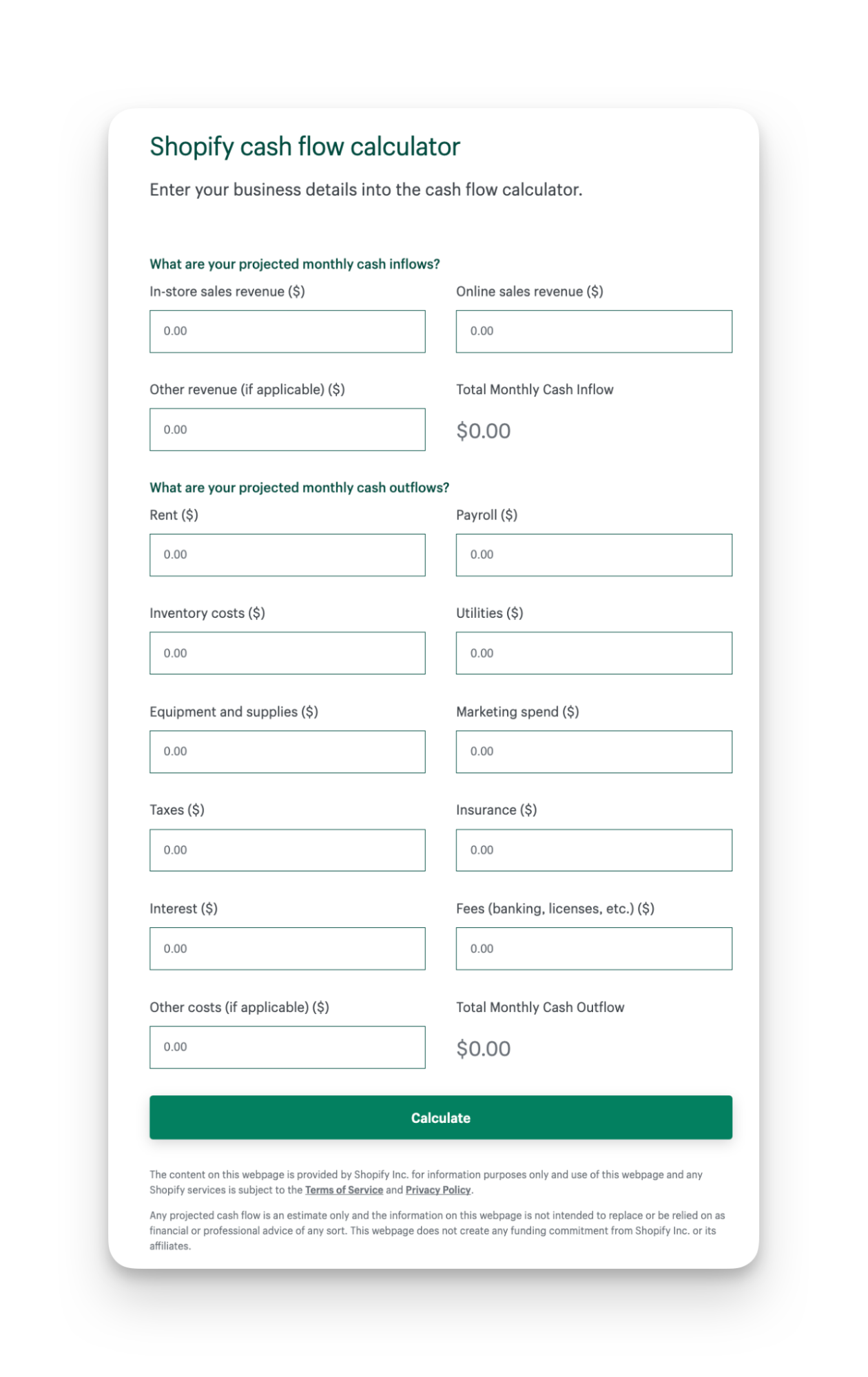

You don’t have to be a mathematician—you can also use online tools and calculators to help, like the Shopify cash flow calculator. Just plug in your numbers to get the results.

Operating cash flow

Companies can vary in their formulas, depending on the amount of details they provide. Many big companies provide a line item that accounts for their operating cash flow. But in the absence of a cash flow statement, you could use this basic formula to figure it out:

Net income + non-cash expenses – change in working capital – taxes = operating cash flow

Non-cash expenses from the income statement are added to cash flow. These expenses include depreciation of asset values and stock-based compensation to employees. Net change in working capital is subtracted—working capital is current assets minus current liabilities. Taxes are subtracted because they must be paid in cash.

Free cash flow

Free cash flow is simply how much cash you have to operate with, minus spending to maintain or upgrade the business’s assets, such as factories and offices. Such spending is called capital expenditure, or capex, and the free cash flow formula is:

Cash flow from operations – CAPEX = free cash flow

Free cash flow, which is calculated by financial analysts and corporate managers, is a key measure of the strength of a business, because it shows how much money the business has at its disposal to use for expansion, acquisitions, pay dividends or buy back stock, or repay debt. It gauges how well a company can rely on its own resources without needing outside financing.

Cash flow forecast

Just as a business creates a budget and a seasonal forecast for sales growth and profitability, it might consider a forecast for cash flow. A simple formula could be:

Beginning cash balance + projected inflows – projected outflows = cash flow forecast

Projections may need to incorporate any expected price and cost changes during the forecast period—for example, if the business foresees a 10% increase in its product costs and overhead, and plans to raise its prices by 12%. Cash flow forecasts may need continual monitoring and adjusting, based on how money actually flows into and out of the business.

Cash flow example

Here’s a hypothetical example of cash flow, based on accrual accounting versus cash accounting:

An entrepreneur with a business making sports apparel has seen the business grow to about $10 million in monthly sales. Expenses of $8 million yield a profit of $2 million.

But half of the sales, or $5 million, are on 30-day payment terms from customers, leaving $5 million in cash sales.

Meanwhile, the entrepreneur pays $4 million of the monthly expenses in cash, and the remaining $4 million will be paid on 30-day credit terms.

So while the business’s profit was $2 million, cash flow was half that amount:

$5 million cash sales – $4 million cash expenses = $1 million

Accrual accounting is guided by something called the matching principle: sales for a specific period are matched with expenses associated with the production of the sales. So in the example above, the $10 million in sales and $8 million in expenses are matched in the same period, rather than just the cash portion of each in cash accounting.

Cash flow is critical for any business

You might not have pictured yourself fiddling in spreadsheets when you started your business, but some of these not-so-glamorous processes are actually critical to success. Without a handle on your future cash flow, you could run out of money to keep the doors open. Luckily, there are calculators, templates, and formulas to help you get on top of your business’s cash flow and improve profitability.

Cash flow FAQ

What is cash flow in simple terms?

In simple terms, cash flow is the movement of money into and out of a business or an individual’s finances. It tracks the change in actual cash or cash equivalents over a specific period of time.

What is a cash flow statement?

A cash flow statement is a financial document that provides detailed information about a company’s cash inflows (receipts) and outflows (payments) over a specific period. It helps to assess the company’s liquidity, solvency, and overall financial performance.

What does cash flow explain?

Cash flow explains how well a company manages its cash position, indicating the ability to generate cash to fund operations, pay debts, and invest in growth. It provides insight into the company’s operational efficiency and financial health.

Does cash flow mean profit?

No, cash flow does not mean profit. Profit is the difference between revenues and expenses, while cash flow refers to the actual movement of cash in and out of the business. A company can be profitable but still have cash flow problems if it doesn’t manage it well.

What is a healthy cash flow?

A healthy cash flow is positive, one where a company consistently generates more cash than it spends. This positive cash flow ensures that the business can cover its operating expenses, invest in opportunities, pay off debts, and provide returns to shareholders.

What is a good cash flow ratio?

A good cash flow ratio is generally above 1. A ratio greater than 1 indicates that the company can cover its short-term liabilities with its cash generated from operations. This ratio is calculated by dividing operating cash flow by current liabilities.

If Shopify is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.