Our view at Stack - Shopify has just about everything you need if you're looking to sell online. It excels with unlimited products, user-friendly setup, and 24/7 support. It offers 6,000+ app integrations, abandoned cart recovery, and shipping discounts up to 88%. Plus, it allows selling both online and in-person, scaling as your business grows.

Imagine if when a customer gets to the checkout page of your ecommerce site, they had to email you their credit card number so you could process the transaction. That wouldn’t be very convenient for either of you.

But thanks to payment APIs, checkout experiences are much safer and more efficient. A payment API is a more secure, practical interface that allows businesses to accept payments online.

This article explains the different payment APIs available, the factors to consider when choosing the right one, and the top providers in the market.

What is an API?

API, short for Application Programming Interface, is a piece of computer code that helps two software programs exchange information.

Most commonly, APIs allow one program to work on another. For example, when you see a map of a company’s headquarters on their website, they might be using a Google Maps API to embed that map without you having to exit the site to visit Google Maps.

Here’s another way to think of an API:

When you order at a restaurant, the kitchen staff is one software program, and you as the customer are the other software program. You don’t directly tell the kitchen staff what you want to eat, and they don’t follow up if you have questions about your order.

The waitstaff acts as the API to get the kitchen your food order and to deliver your food when it’s ready.

What is a payment API?

A payment API is a connection to a payment gateway and/or processor that lets apps and online stores accept and process payments. It helps you manage business transactions, accept various forms of payment, and automate the billing process, such as through subscription APIs.

A payment API’s core function is to process payments efficiently and securely. Rather than having to visit a separate website to complete the checkout, a payment API can enable customers to safely transmit payment information and lets stores process those payments all within one interface.

A payment API that connects to a payment processor makes it easy for stores to accept multiple payment methods like credit cards, ACH transfers, and digital wallets. They are essential for ecommerce stores and other types of businesses that rely entirely on online payments.

How do payment APIs work?

Payment APIs provide a built-in interface on your website to capture customer payment information and transmit it for authorization and settlement, ensuring smooth and secure transaction processing.

The specifics can differ a bit based on whether the payment API is for a payment gateway, a payment processor, or an integrated solution, but the process generally looks like this:

- Initial payment request: When customers make a purchase on a website or app, they enter their payment information (like credit card details) into a secure form provided by the payment API.

- Secure data transmission: The payment API encrypts and securely transmits the customer’s payment information to the payment gateway or payment processor.

- Payment authorization: The payment gateway sends the payment details to the payment processor, who then checks with the issuing bank or card network (like Visa or MasterCard) whether there are sufficient funds and no security flags so the payment can be authorized.

- Transaction response: The payment processor receives a response from the bank or card network whether the transaction was approved or declined and generally passes that information on to the payment gateway.

- Communicate outcome: The payment API receives the response from the payment gateway and relays it to the website or app that notifies the customer whether the payment was successful.

- Funds settlement: Upon approval, the bank reserves the money in the customer’s account and then transfers it to the merchant’s account. This process can take a few business days.

Types of payment APIs

Payment APIs come in different shapes and sizes. The following are some common types:

- Transaction APIs

- Subscription APIs

- Tokenization APIs

- Payout APIs

- Preauthorization APIs

Transaction APIs

As the name implies, transaction APIs are used to complete payment transactions. They help customers make several payment-related requests, including:

- Initiating payments

- Refund requests

- Canceling payments

Transaction APIs are common for ecommerce payment processing.

Subscription APIs

Subscription APIs help businesses automatically bill customers at regular intervals.

The subscription API could initially capture the billing details and approve the subscription. It could then communicate with other types of operational APIs to handle future orders, such as to make sure your inventory reflects the next shipment for that subscription

For companies with recurring payments, subscription APIs are indispensable.

Tokenization APIs

Tokenization is the masking of data to create a disguised version called a token.

Tokenization APIs disguise sensitive payment data, like credit card numbers, when transmitted to and from payment gateways and processors. A tokenization API can also be included in a transaction API.

Payout APIs

Payout APIs send disbursements to multiple payees at once to efficiently manage bulk payments, like to freelancers, suppliers, or payroll.

Payout APIs handle the complexities of transferring money to different accounts, in multiple currencies, and in multiple regions while complying with financial regulations and security standards.

Preauthorization APIs

Preauthorization APIs temporarily hold funds on a customer’s card or account to verify a customer’s ability to pay before releasing products or rendering services.

This is useful in scenarios where the final purchase amount might vary or if you need to verify the payment method is valid before doing work.

How to choose a payment API

Your payment API affects customer experience, cybersecurity, and overall operational efficiency.

Consider these factors when choosing your payment API.

- Security: APIs are often a common target of cyberattacks. Ensure the payment API complies with the highest security standards, including the PCI DSS (Payment Card Industry Data Security Standard). The API should include encryption, tokenization, and fraud detection to allow for secure payment processing.

- Payment methods: Look for an API that supports a wide range of online payment methods. If your customers can’t pay with their preferred credit card or digital wallet, for instance, they might abandon their carts, thereby costing you revenue.

- Ongoing technical support: A payment API should provide ongoing technical support, including dedicated support staff to help with troubleshooting and API updates.

- Fees and pricing: Understand the fee structure, including transaction fees, monthly subscription fees, and any hidden costs. While you might not want to make your decision on pricing alone, considering the importance of handling payments, you don’t want to overpay either.

- Integration and compatibility: Consider how well the API integrates with your current ecommerce platform and other systems like inventory management and accounting software. APIs should be convenient for both customers and store owners.

- Reliable uptime: Payment APIs should have minimal downtime and outages. Otherwise, you could miss out on sales.

- User experience: Think about how the API will impact your customers. Features like one-click payments, quick checkout processes, and reliability contribute to customer satisfaction.

Top payment API providers

- Stripe

- PayPal

- Square

- Authorize.net

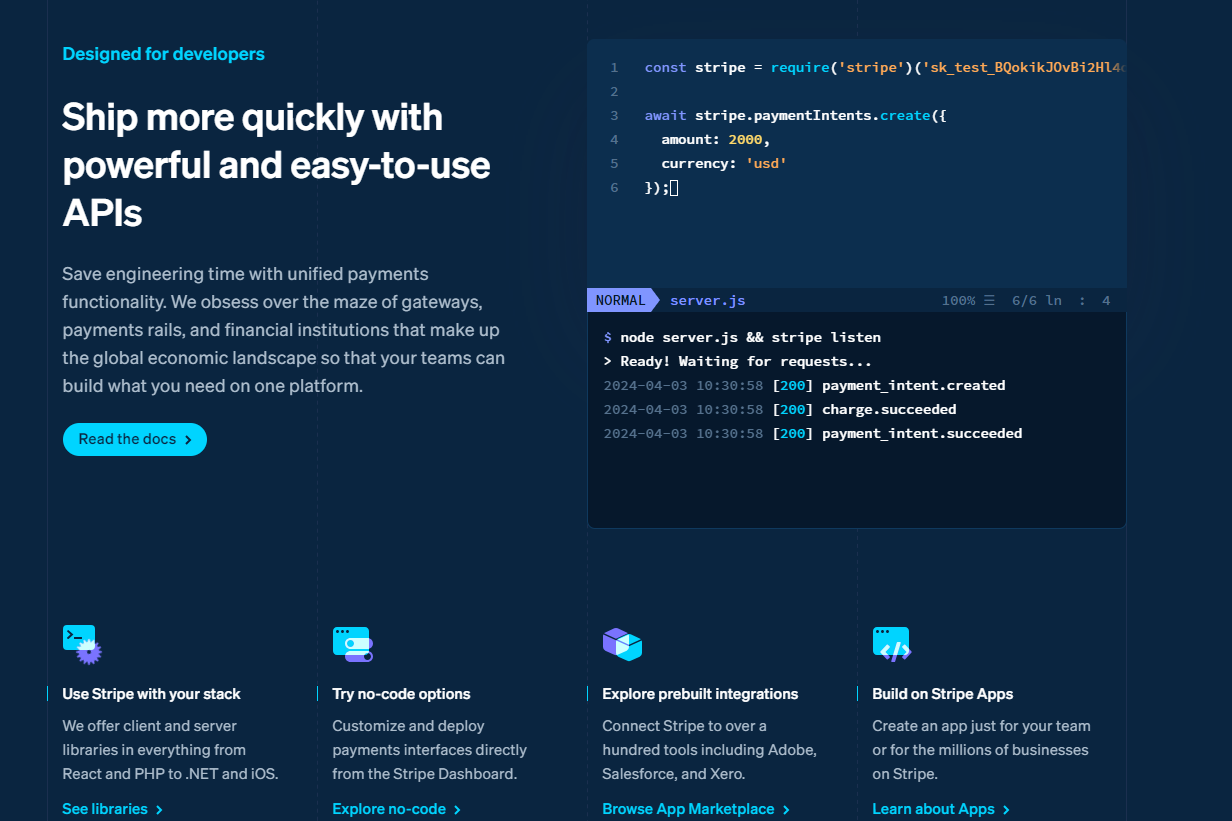

1. Stripe

Stripe is another full-service payments provider. While often known for working with ecommerce companies and integrating with hundreds of applications and software, Stripe also offers in-person payment terminals that can be integrated with online sales.

Top features:

Stripe accepts a vast array of electronic payment methods, such as major credit cards, Apple Pay, Amazon Pay, and multiple buy now, pay later options.

Plus, it was designed with developers in mind. To get the most out of Stripe’s APIs, businesses will need access to a team of developers. However, Stripe also offers no-code options for teams without coding experience and advanced security features, including the use of machine learning to spot fraud.

Pros:

- Strong international availability

- Lots of options for customization

- 24/7 support by phone, email, or live chat

Cons:

- Chargeback fees

- International fees

- Payouts can take longer than some competitors

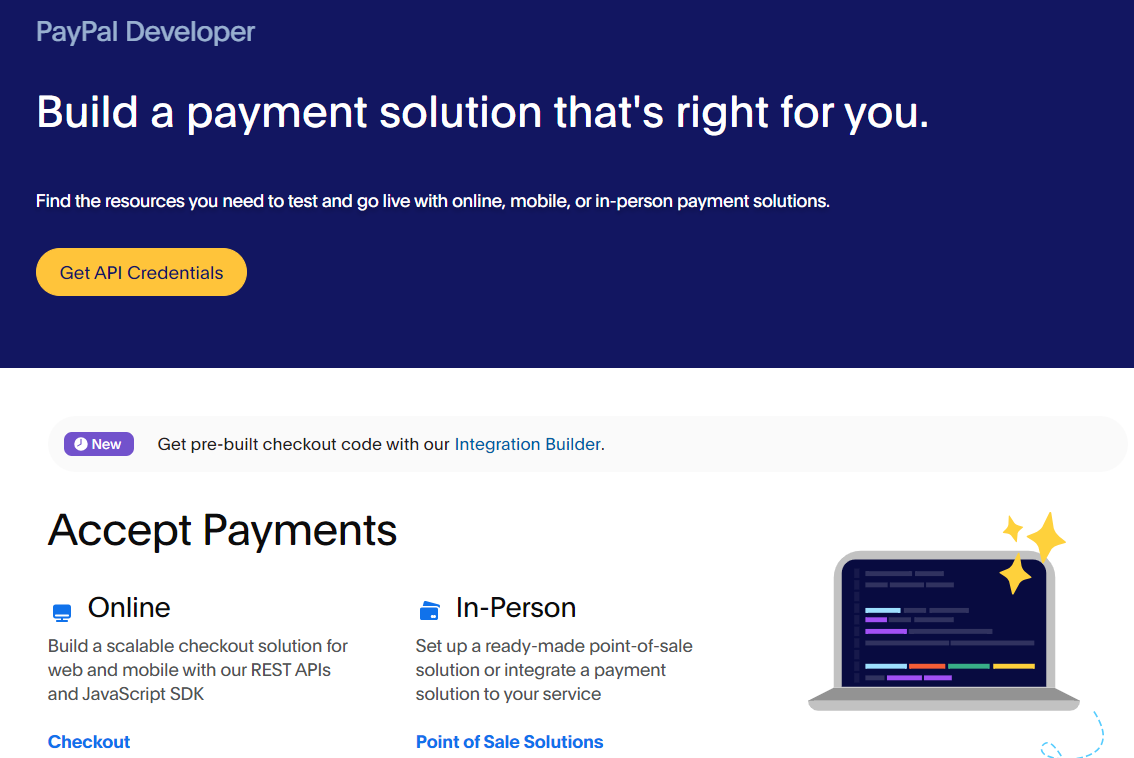

2. PayPal

PayPal is a household name in online payments. But it’s not just a payment method, it’s also a processor. Through PayPal’s APIs, you can accept payments on your site through PayPal.

It integrates with many popular ecommerce platforms, such as Shopify, and other software like accounting platforms.

Top features:

PayPal supports over 120 currencies and allows merchants to accept PayPal payments alongside credit card payments.

When PayPal is used as a payment gateway but transactions are processed outside PayPal, the payments company offers a number of other features, like accepting more payment types and offering enhanced security features.

Pros:

- Strong international availability

- Accepts crypto

- Offers option for seller chargeback protection

Cons:

- Standard transaction fees are higher than some competitors

- Payouts can take longer than some competitors

- May charge customer dispute fees

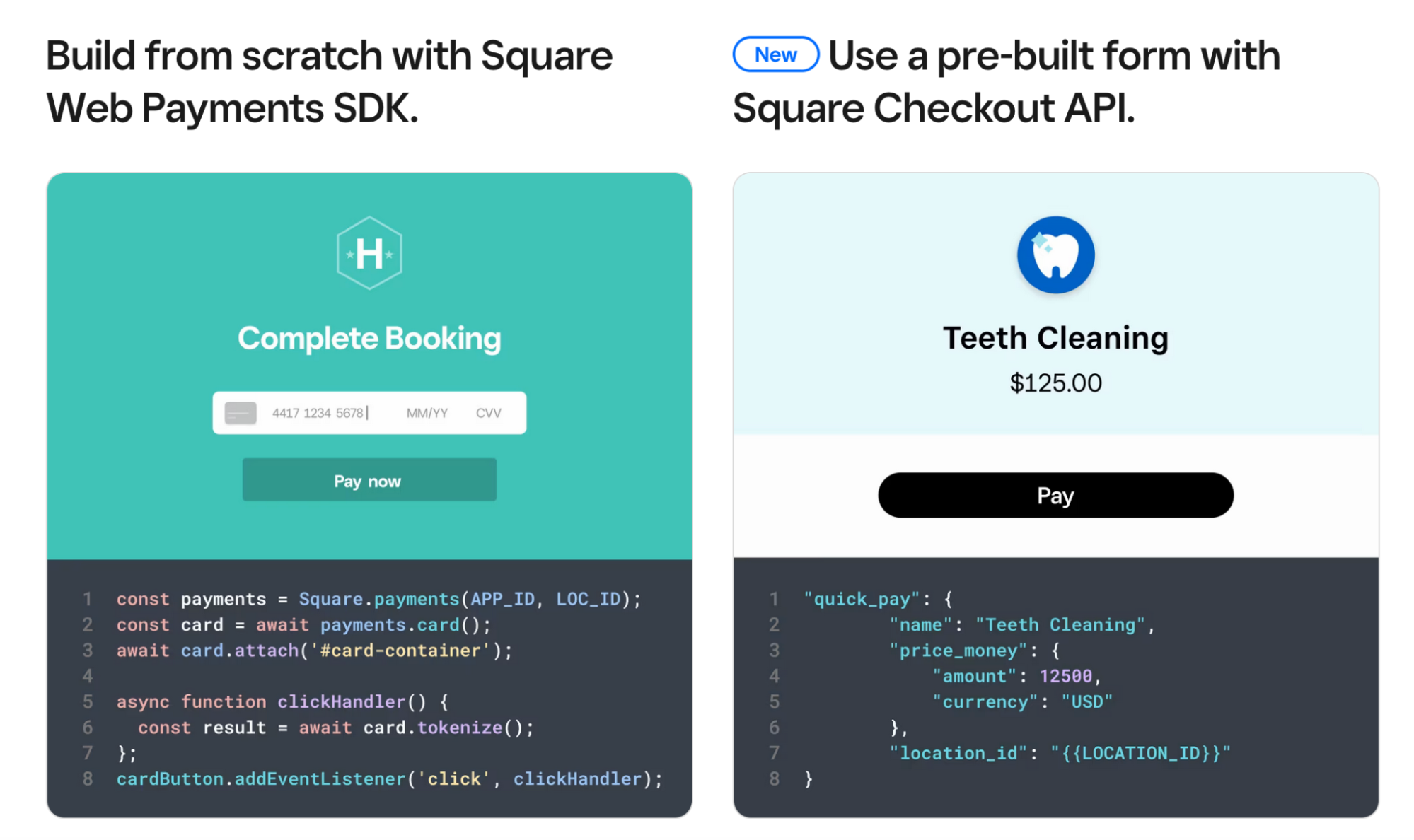

3. Square

Square is a payments service that acts as both a payment gateway and processor. The company also provides hardware, including card readers, which can be helpful for online stores that run pop-up locations.

Top features:

Square offers both pre-built and custom payment APIs. Its APIs integrate with several ecommerce platforms, inventory management systems, and accounting software.

The company also uses machine learning to help spot fraud and provides software tools for integrating online and offline sales.

Pros:

- No chargeback fees

- No direct international fees

- Fast payouts

Cons:

- Limited international use. Currently only supports sellers in the US, Canada, Australia, Japan, the UK, Ireland, France, and Spain

- Limited alternative payment methods accepted through direct integration

4. Authorize.net

Authorize.net, now owned by Visa, is one of the oldest payment gateways in the ecommerce world. However, the company does not act as a traditional payment processor itself, but it works with others.

Top features:

Some of Authorize.net’s top features include easy support for recurring billing and storage of customer data to facilitate repeat purchases. The company also has a number of advanced fraud protection measures.

Pros:

- Long track record

- Great for recurring billing

- Flexibility to choose your own payment processor, which could be helpful to some businesses

Cons:

- May need your own merchant account through another service, depending on the plan

- Limited international availability for sellers. Currently only available for merchants in the US, Canada, UK, Europe, and Australia.

- Pricing may not benefit all businesses, depending on the payment processor

Choose the right payment API for your business

APIs simplify payment acceptance and processing for ecommerce companies, ensuring smooth, secure transactions. Some payment APIs are pre-built, but others need to be customized to fit your site, so you need to pick the right one.

Payment providers to which these APIs connect vary a lot based on things like payment methods accepted, fees, and payout processing speed. Get the right payment API for your ecommerce store that integrates easily, prioritizes security, and fits your budget.

Payment API FAQ

What are the benefits of a payment API?

Payment APIs create a minimal-friction checkout experience that integrates directly into websites and apps. They allow businesses to accept a wide range of payment methods securely and at scale.

Are payment APIs free?

Payment APIs are often free in terms of there not being an extra charge for the computer code needed to connect to a payment gateway and/or payment processor. However, payment gateways and payment processors do charge fees, such as a percentage-based transaction fee along with a flat per-transaction fee.

What is the best payment gateway API?

Payment gateway APIs have distinct features and benefits. There is no universal best one. When analyzing your choices, consider your business size and transaction volume, technical expertise, accepted payment methods, and security features.

Is PayPal an API?

PayPal is a payments company that offers a payment processing API to integrate the PayPal checkout experience into other websites and apps.

How do I make a payment API?

Building a payment API from scratch is a complex coding process that typically requires expertise in payment processing, security, etc. However, many payment companies offer pre-built APIs and software developer kits (SDKs) that can be used to create custom APIs.

If Shopify is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.