As we kick off 2025, we’re sharing a host of exciting updates designed to improve your Typeform experience. From simplifying your research to more in-depth analysis of your open ended responses, these updates aim to help you create smarter, more engaging forms with less hassle. Let’s dive into what’s new.

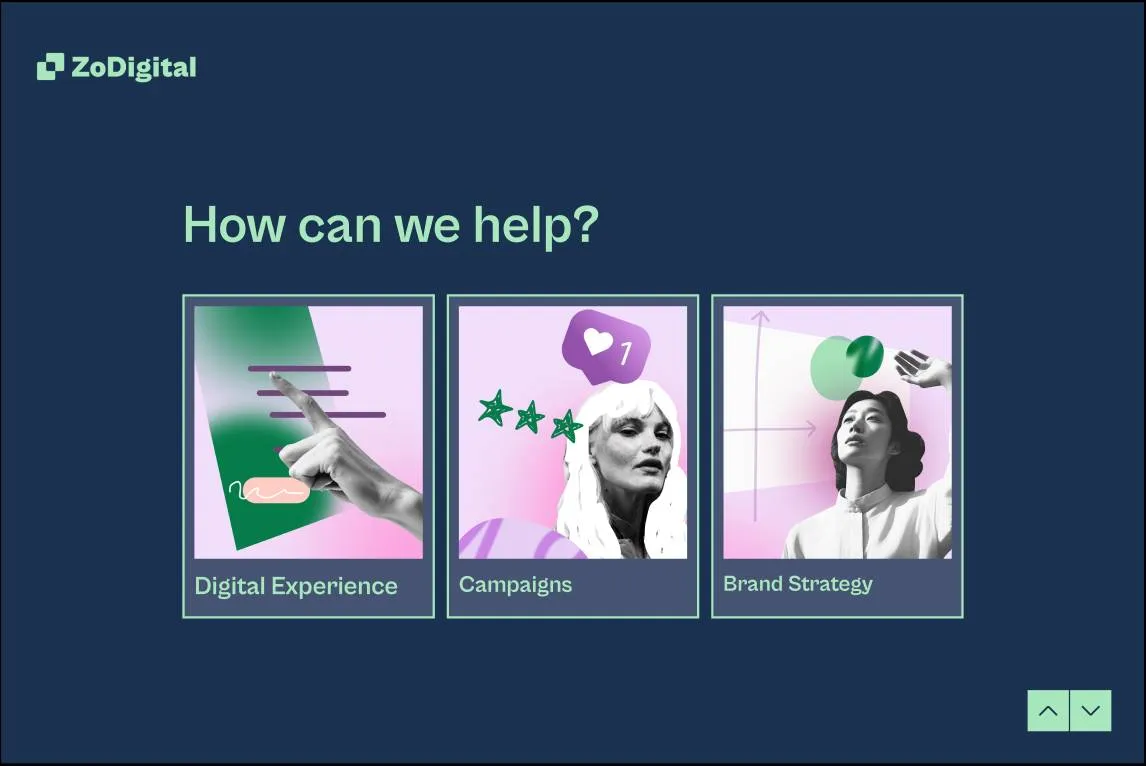

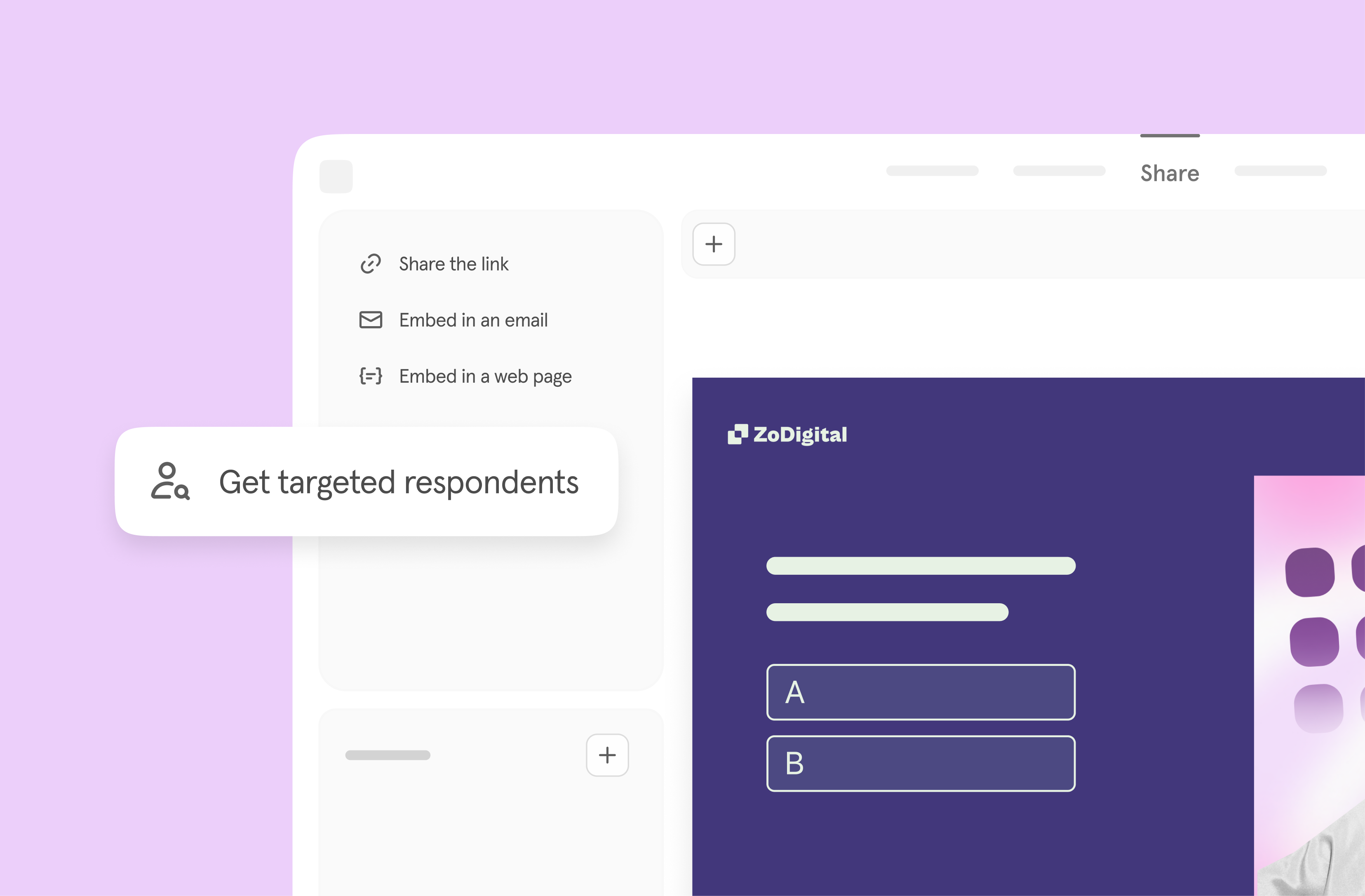

Find high-quality participants for your research

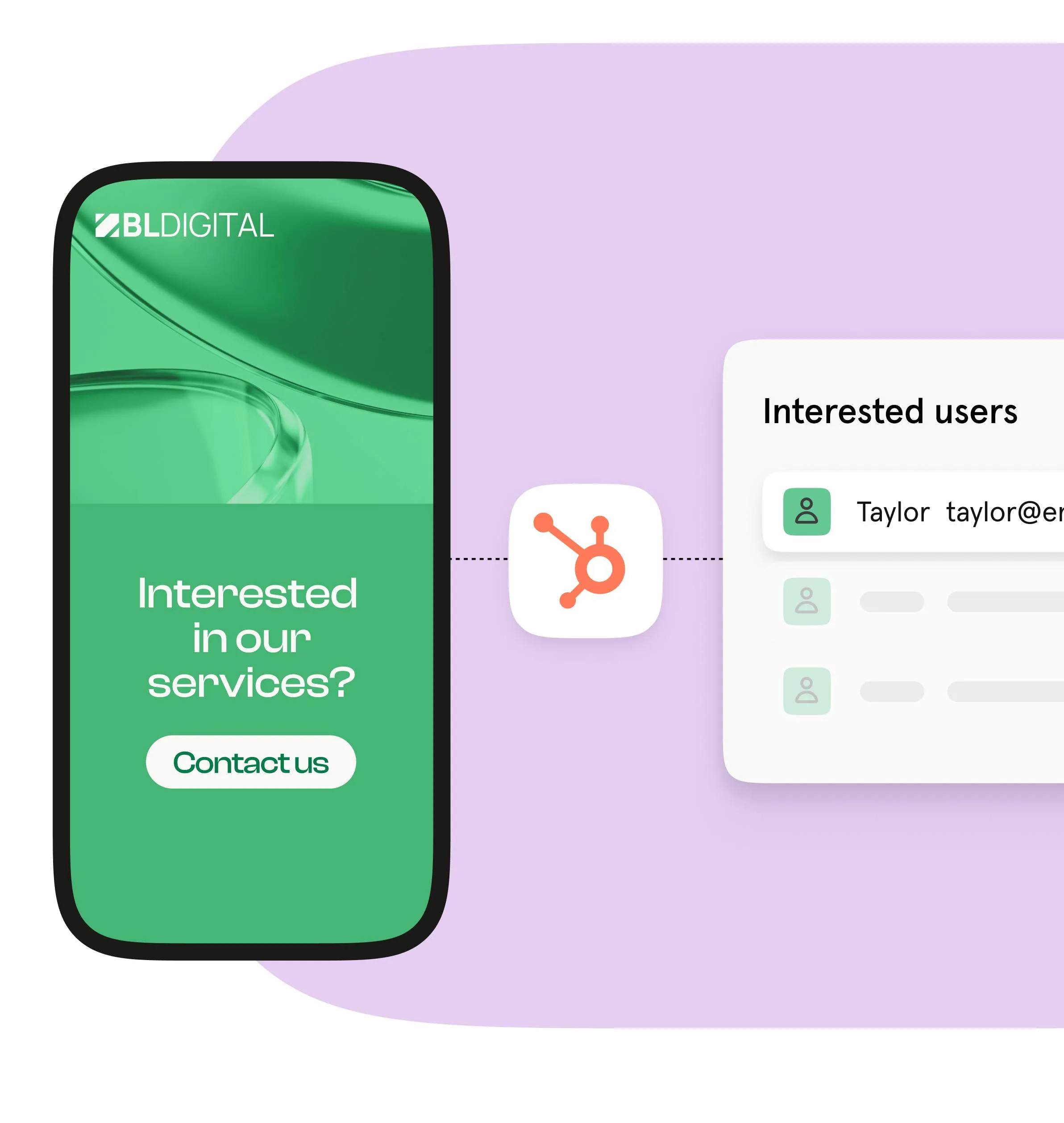

Need participants for your research? We’ve made it easier than ever to get high-quality responses with our Eureka Surveys integration. Now, you can share your survey directly with verified, high-quality participants right from the Typeform Share page.

This seamless integration saves you time by eliminating the hassle of sourcing qualified respondents. Whether you’re conducting market research, user testing, or gathering feedback, you’ll have access to reliable insights faster than ever.

Focus on what truly matters—analyzing the results and using your research to make smarter, data-driven decisions. With Eureka Surveys, great data is just a few clicks away.

Learn More

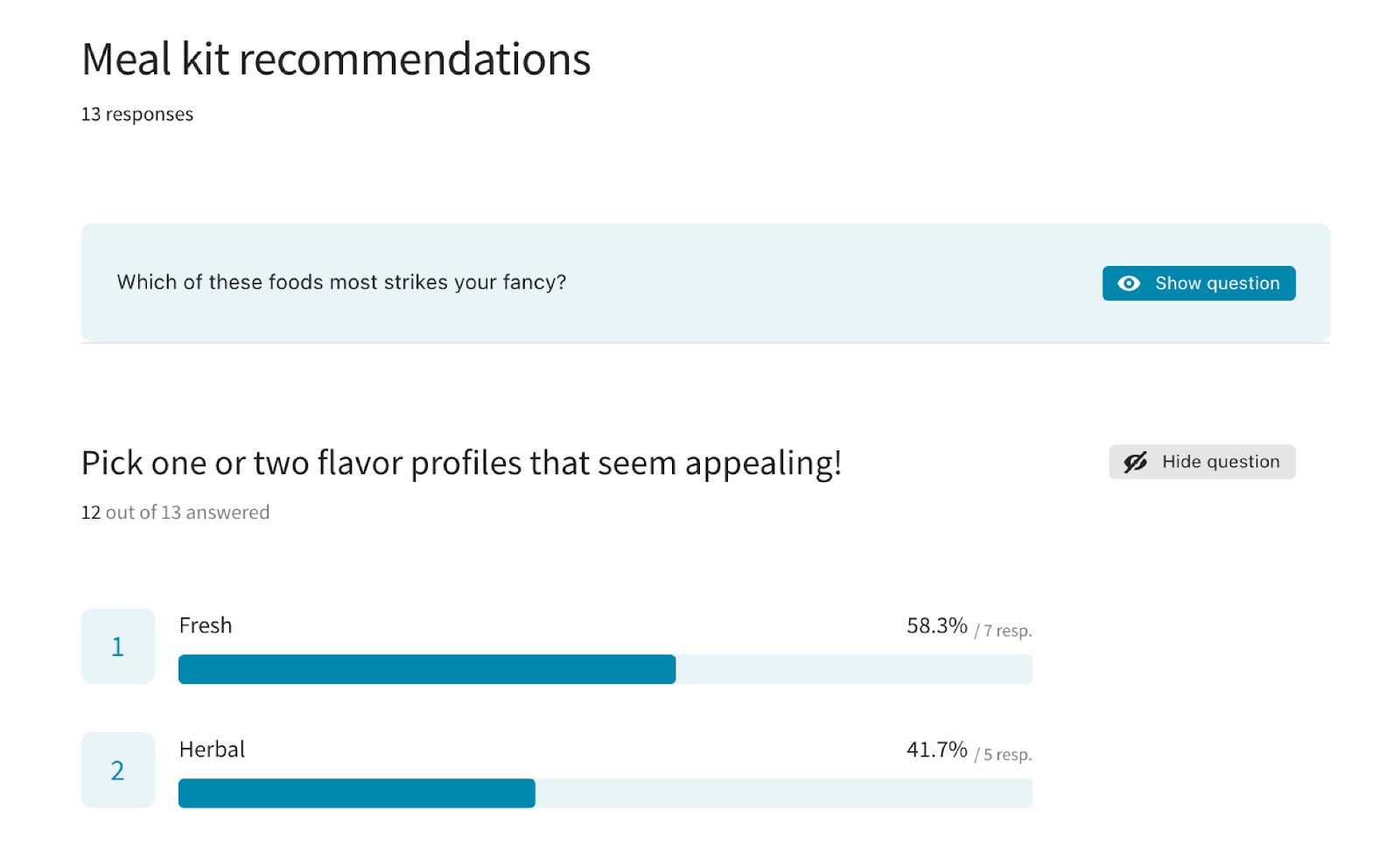

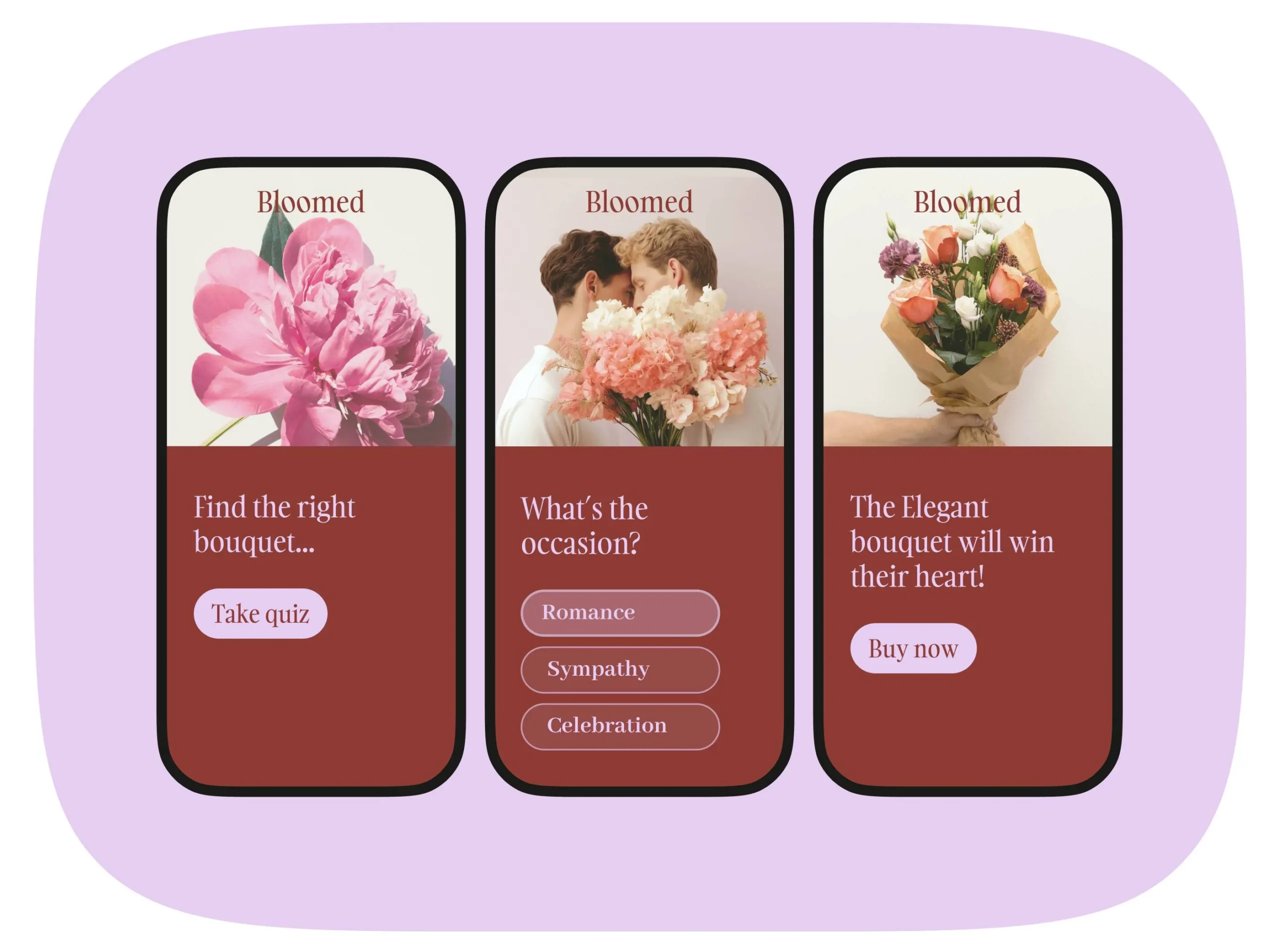

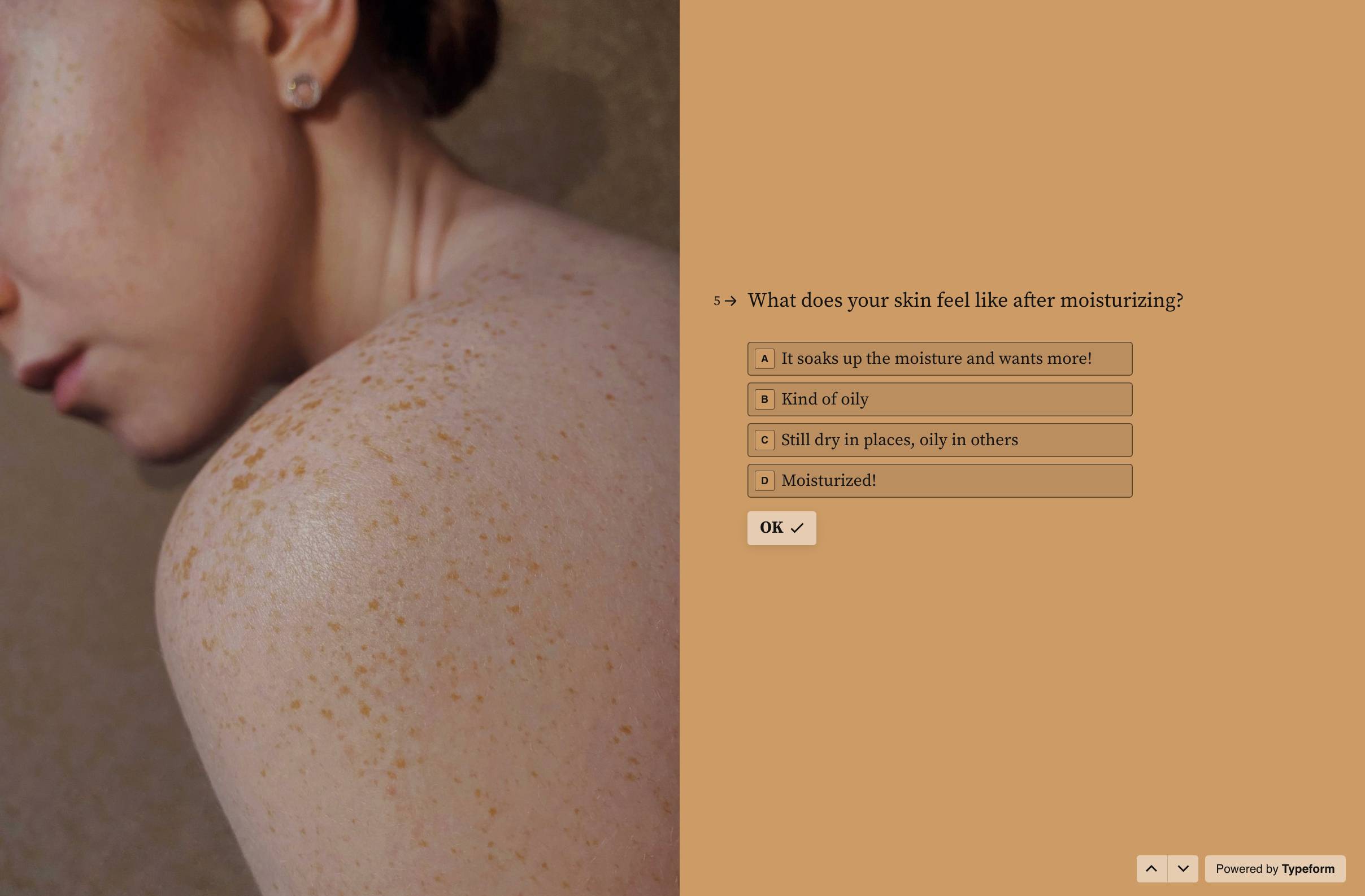

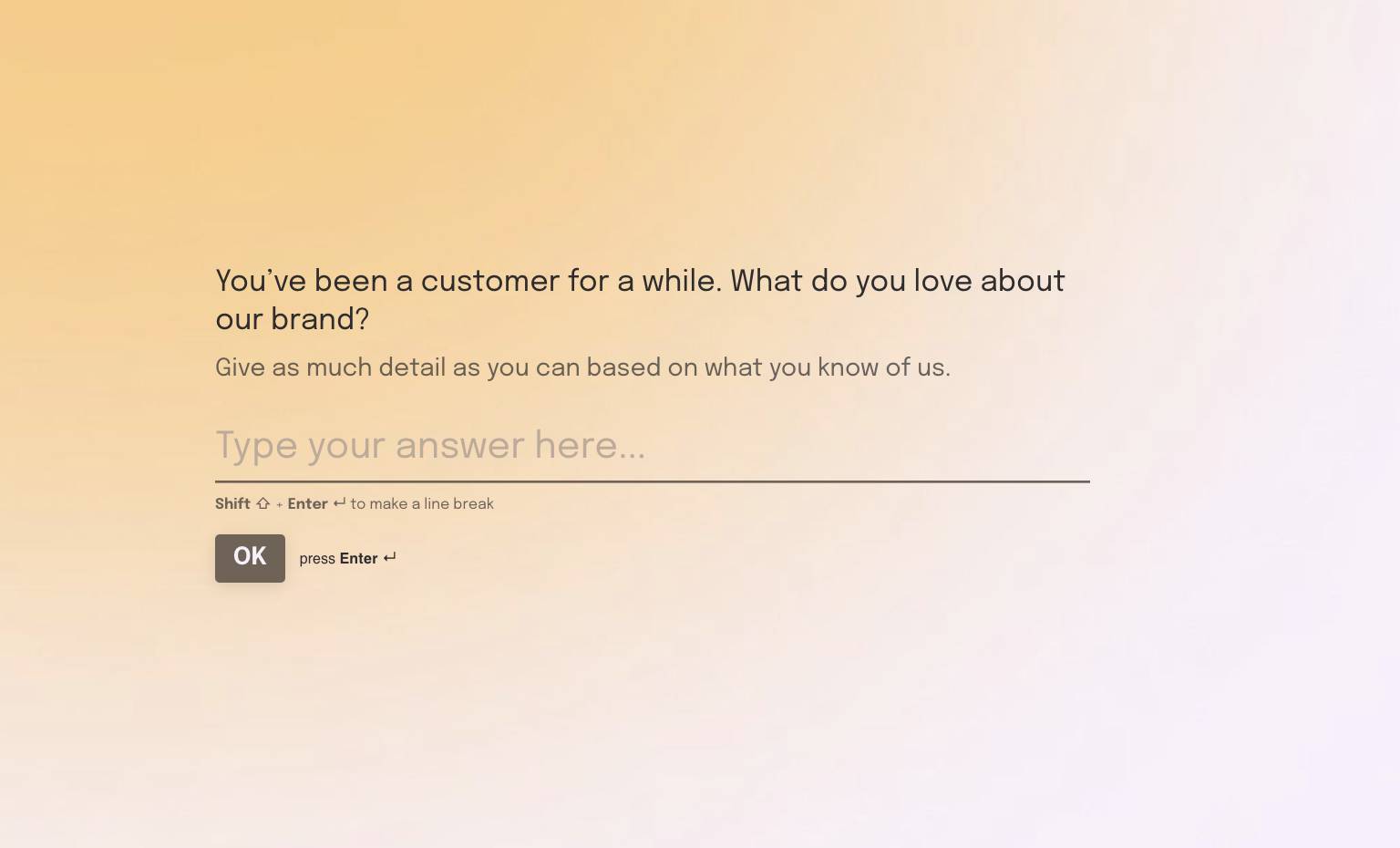

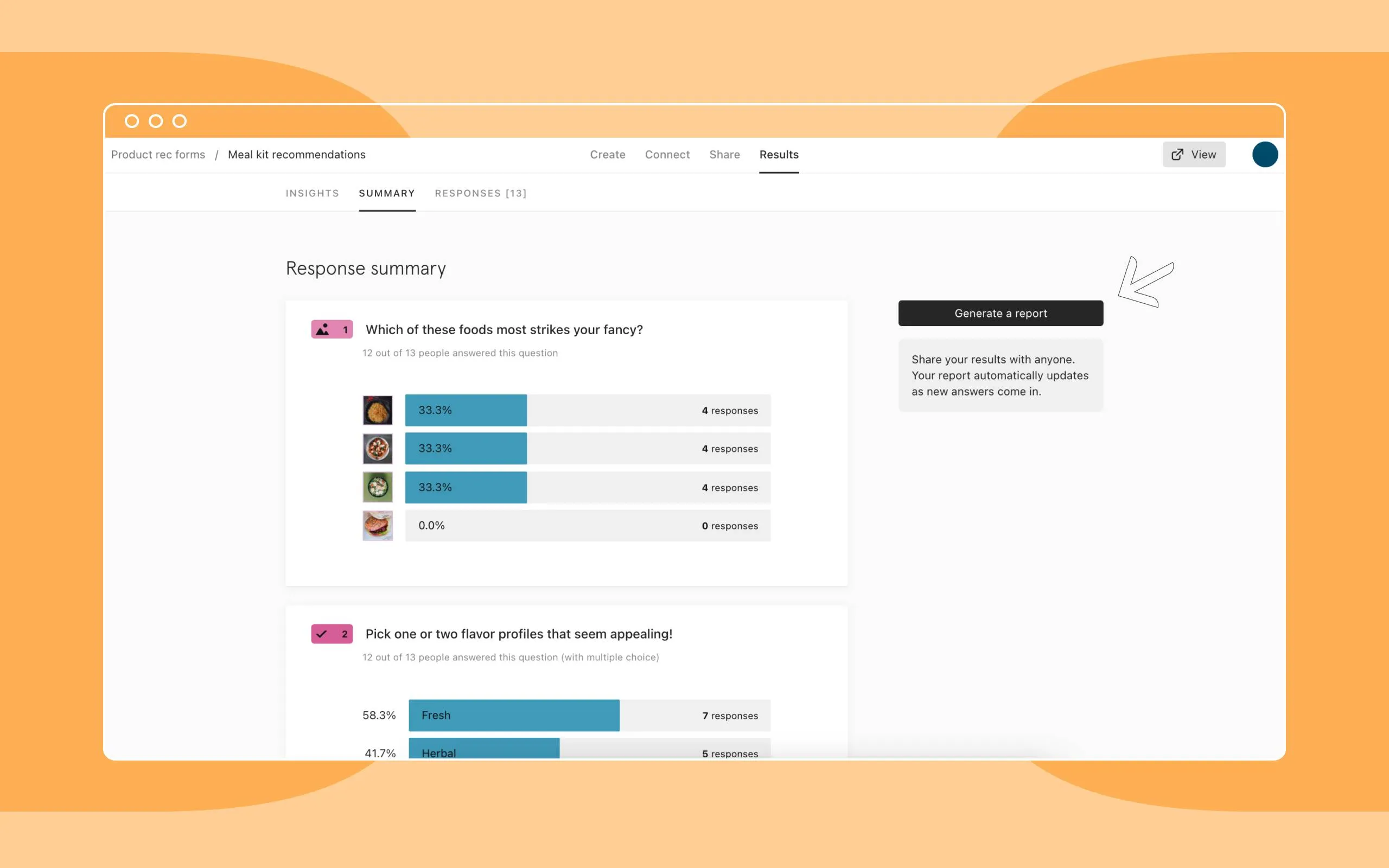

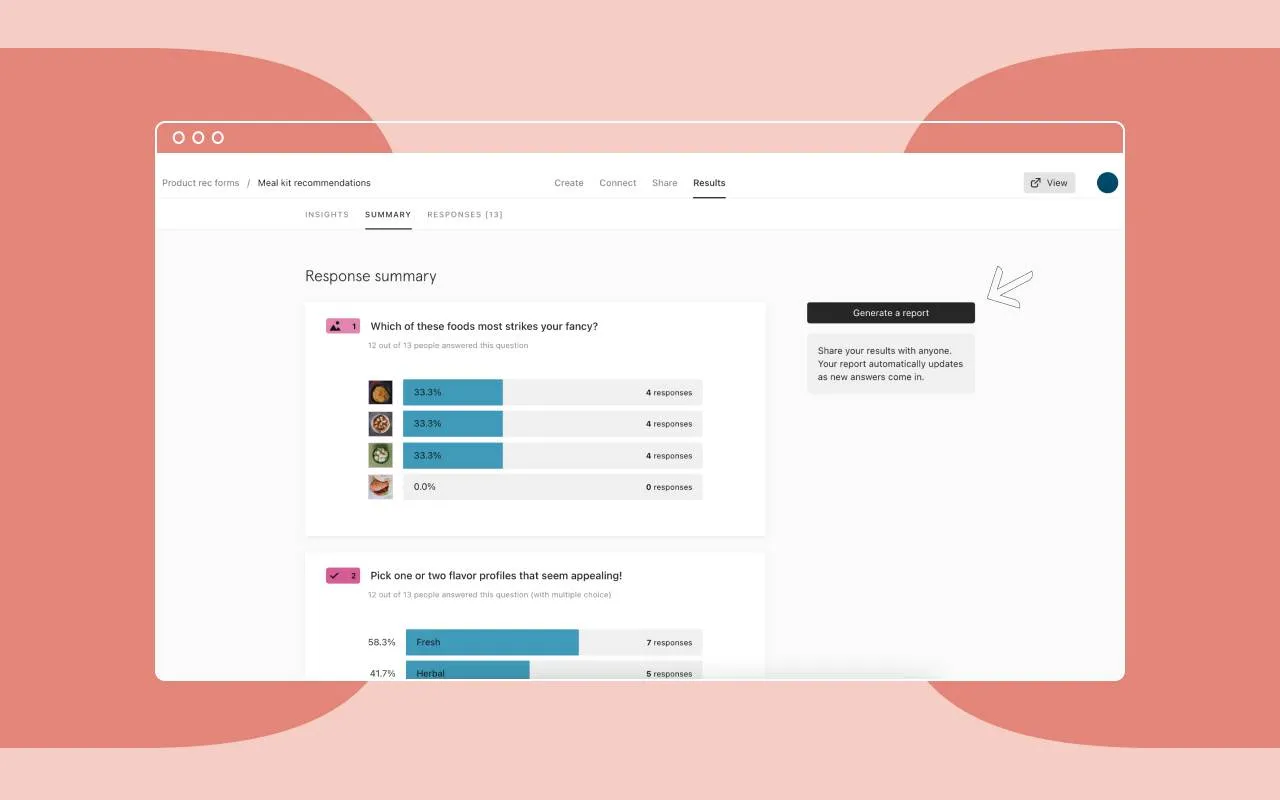

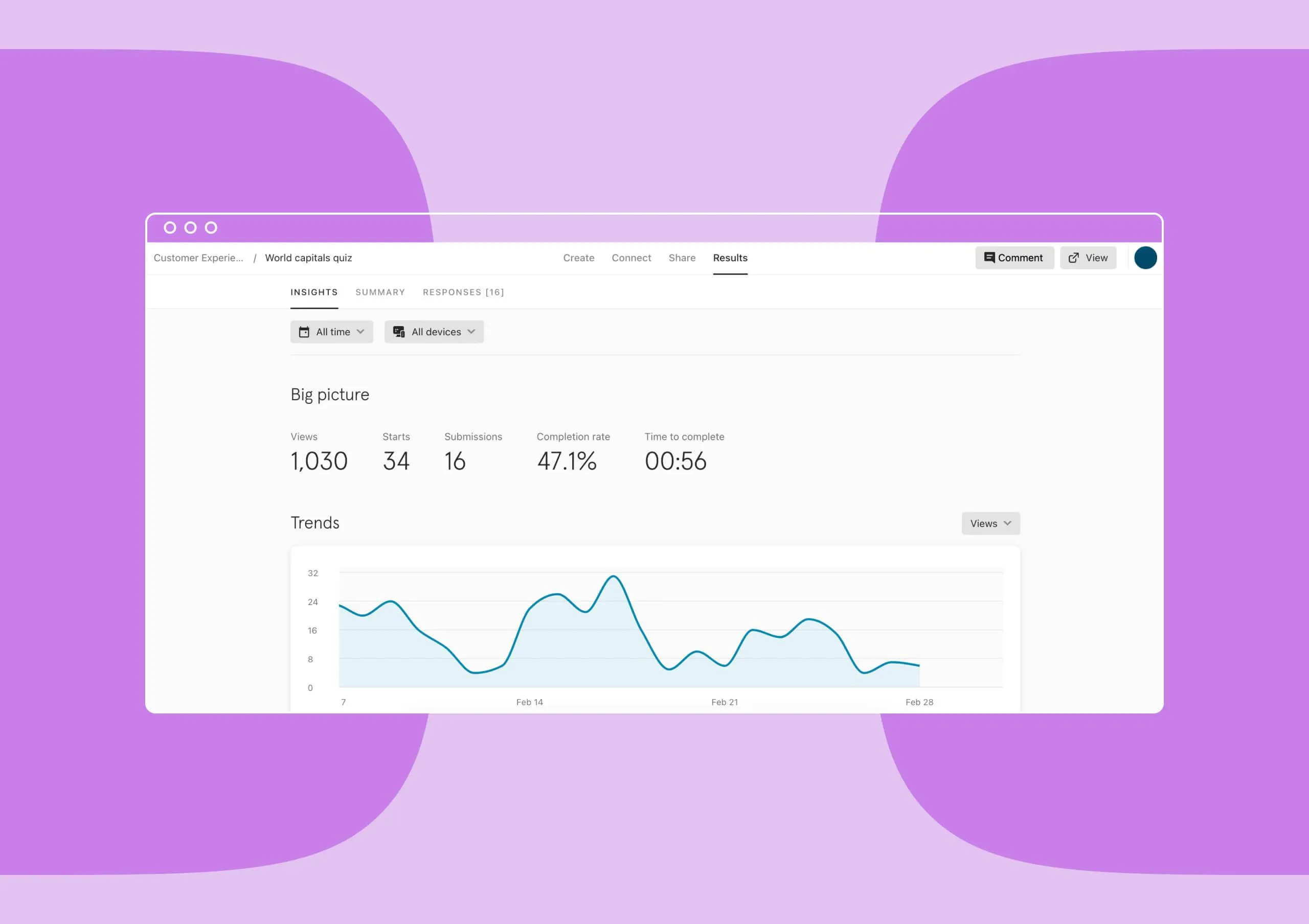

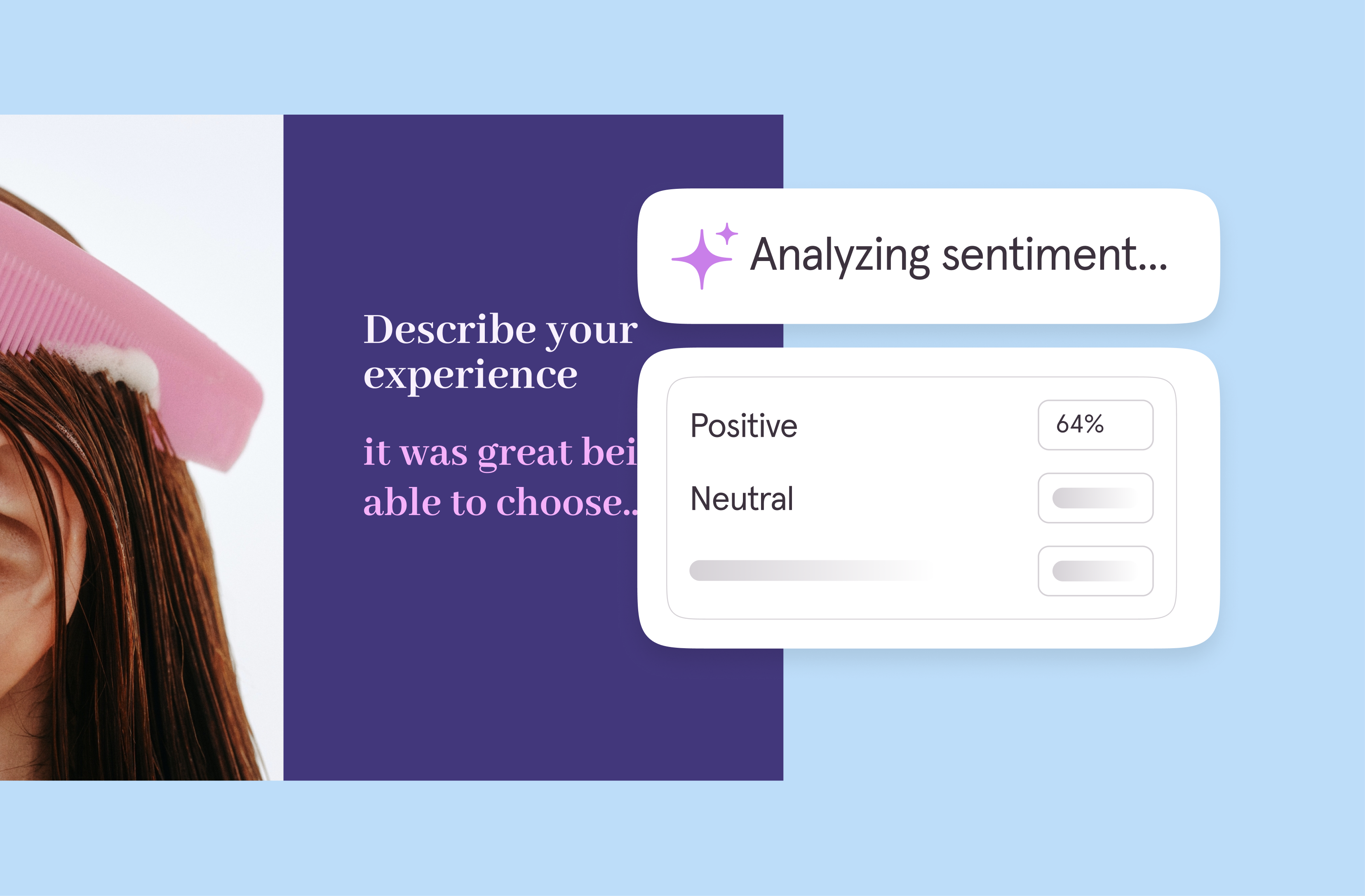

Turn words into wisdom with sentiment analysis

Open-ended text and video responses often hold the richest insights, but analyzing them can be time-consuming. Our new Sentiment Analysis feature, a Smart Insight tool, helps you automatically gauge the tone of responses—whether they’re positive, neutral, or negative. Spot important trends faster and gain actionable insights that drive smarter decisions.

Learn More

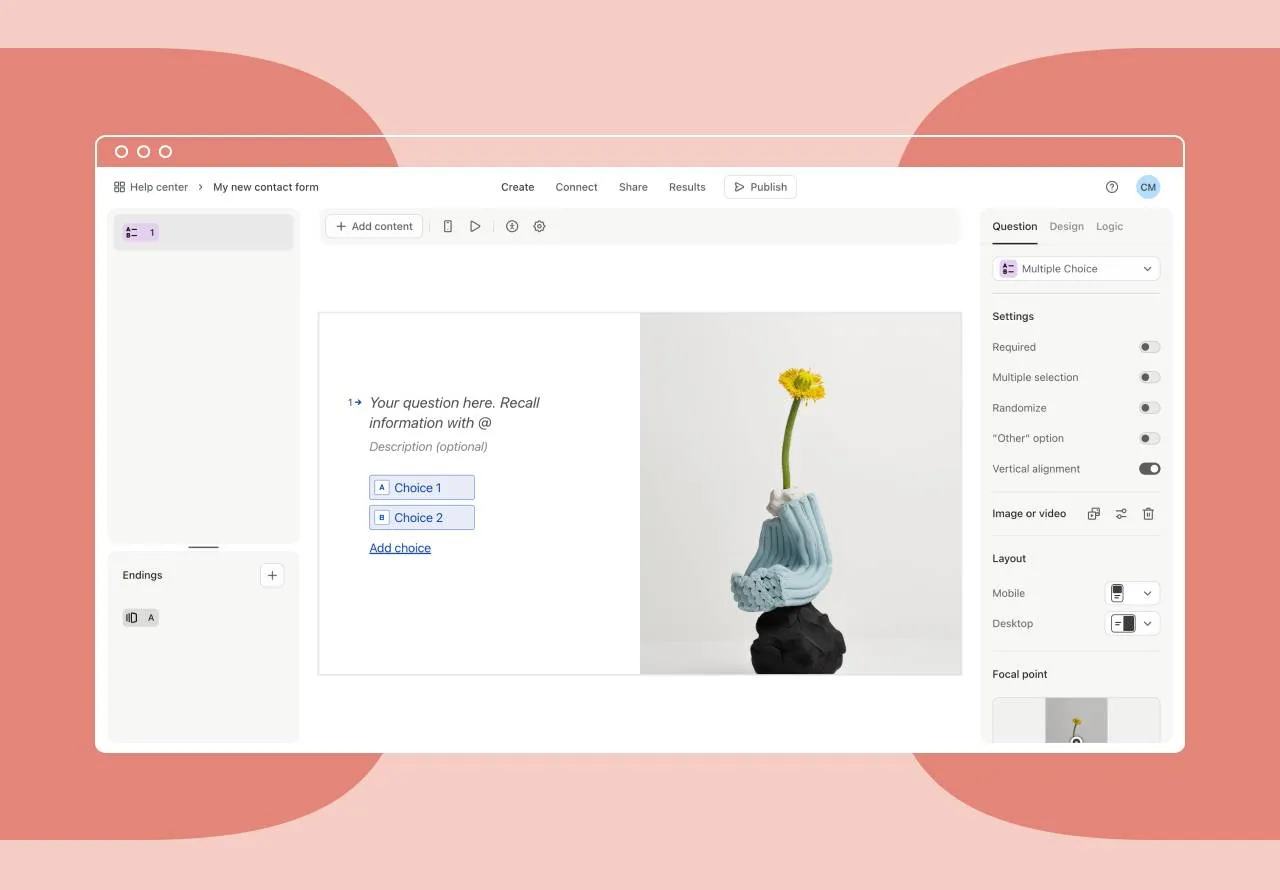

Publish with zero interruptions

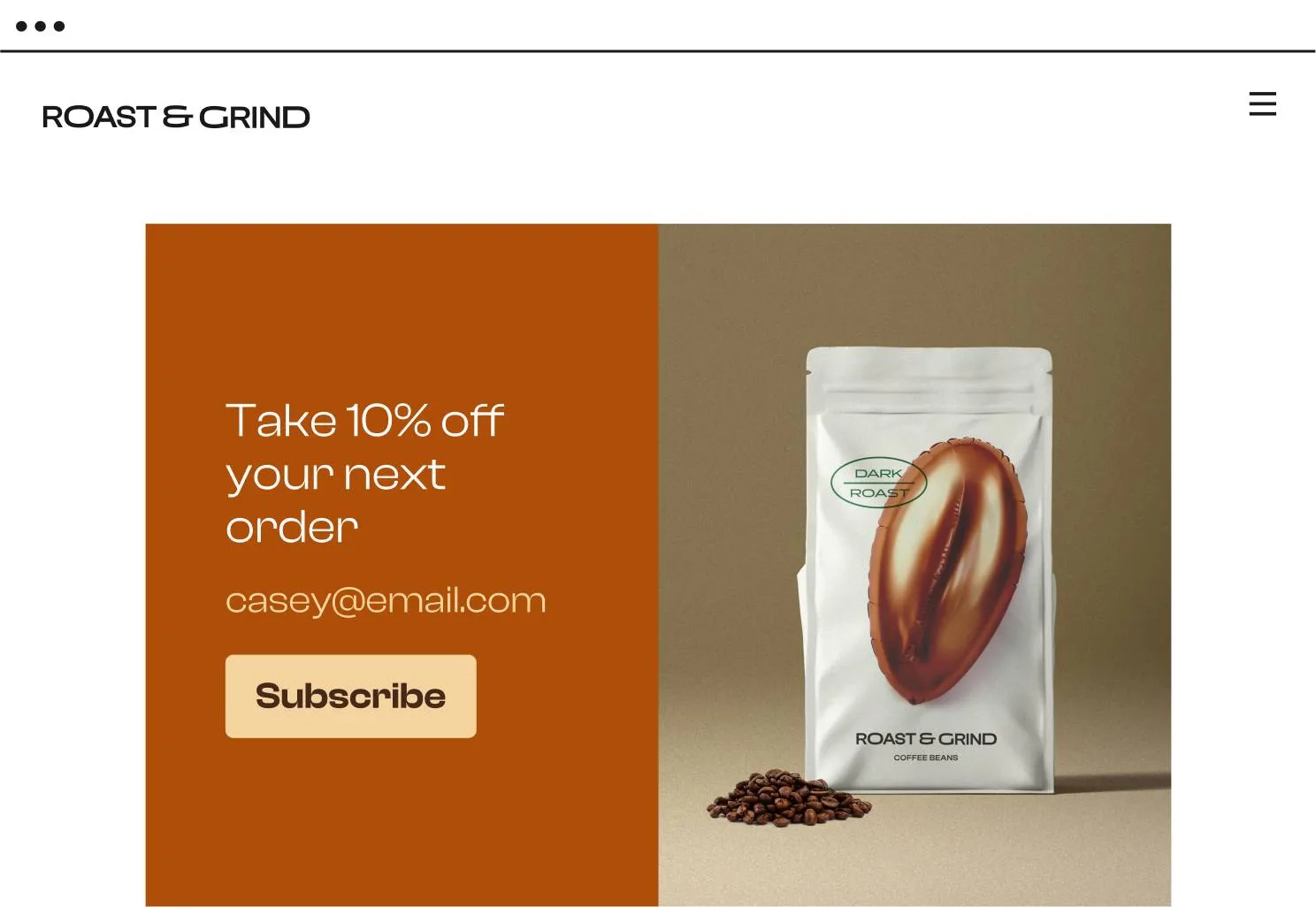

Say goodbye to extra steps. With our enhanced publishing capabilities, you can now effortlessly publish updates from any page in the builder—no more screen switching or workflow interruptions. Just create, edit, and share your forms with a single click. This makes building and sharing forms smoother than ever before, giving you more time to focus on what matters most: engaging your audience.

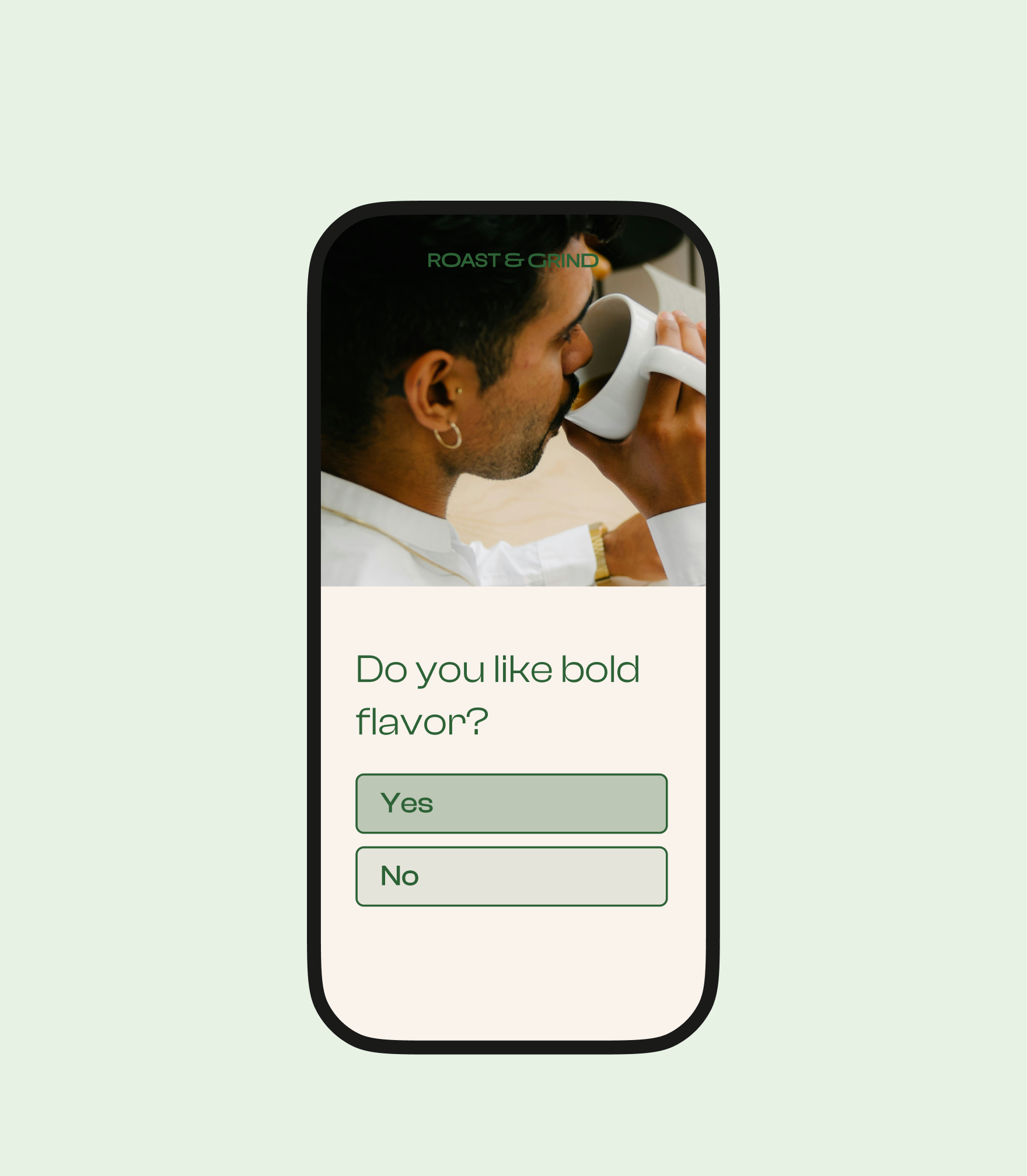

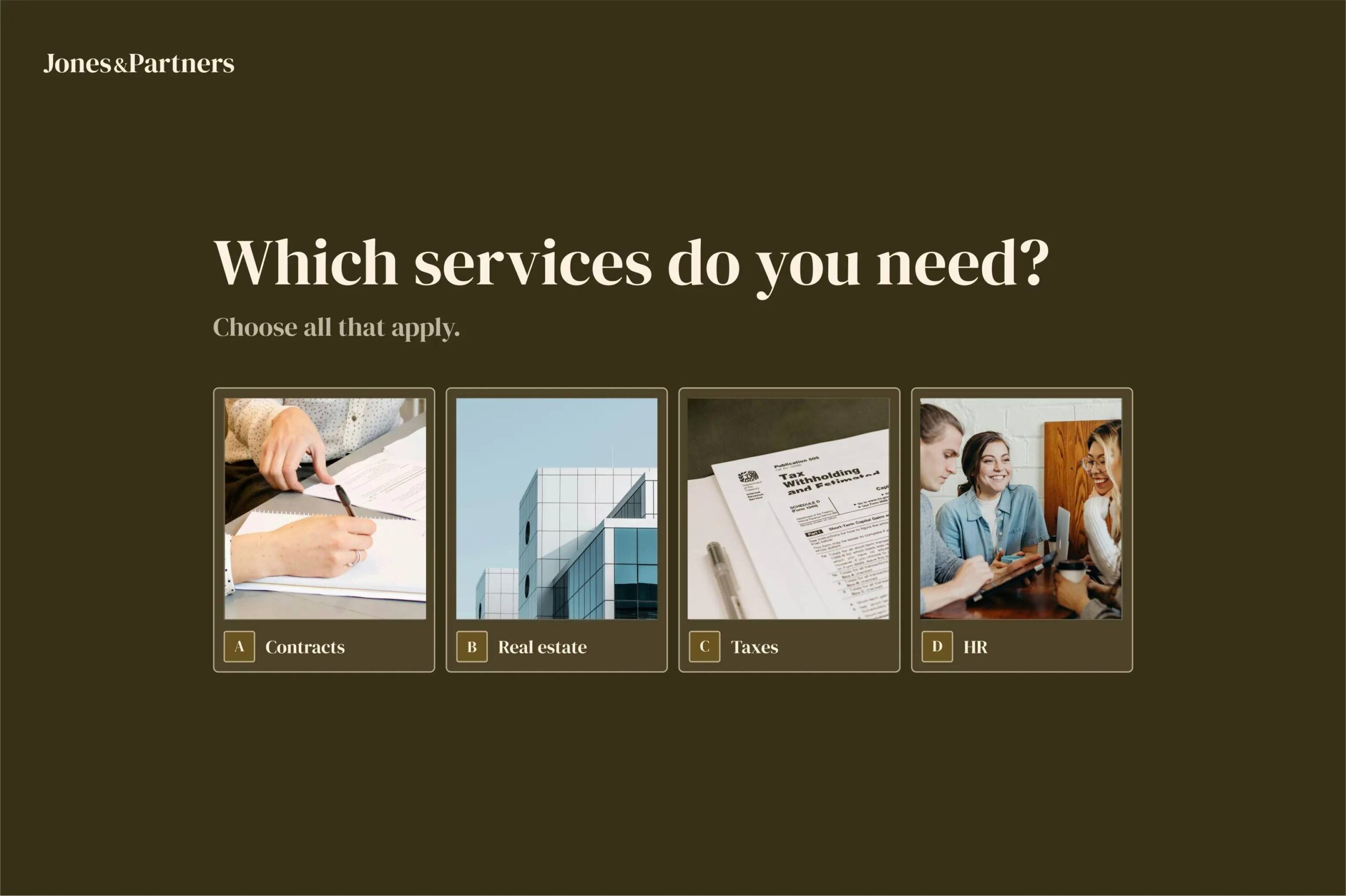

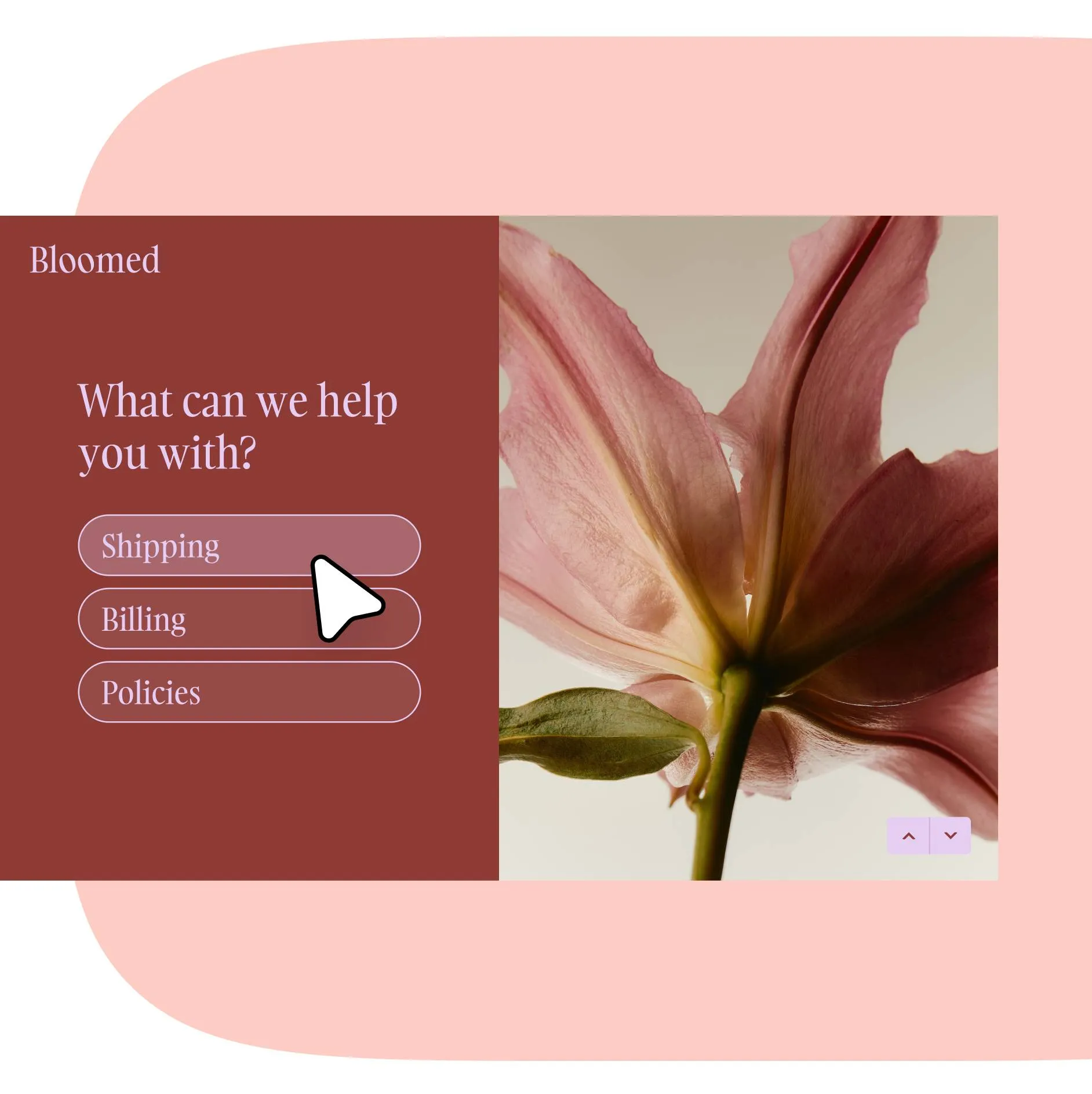

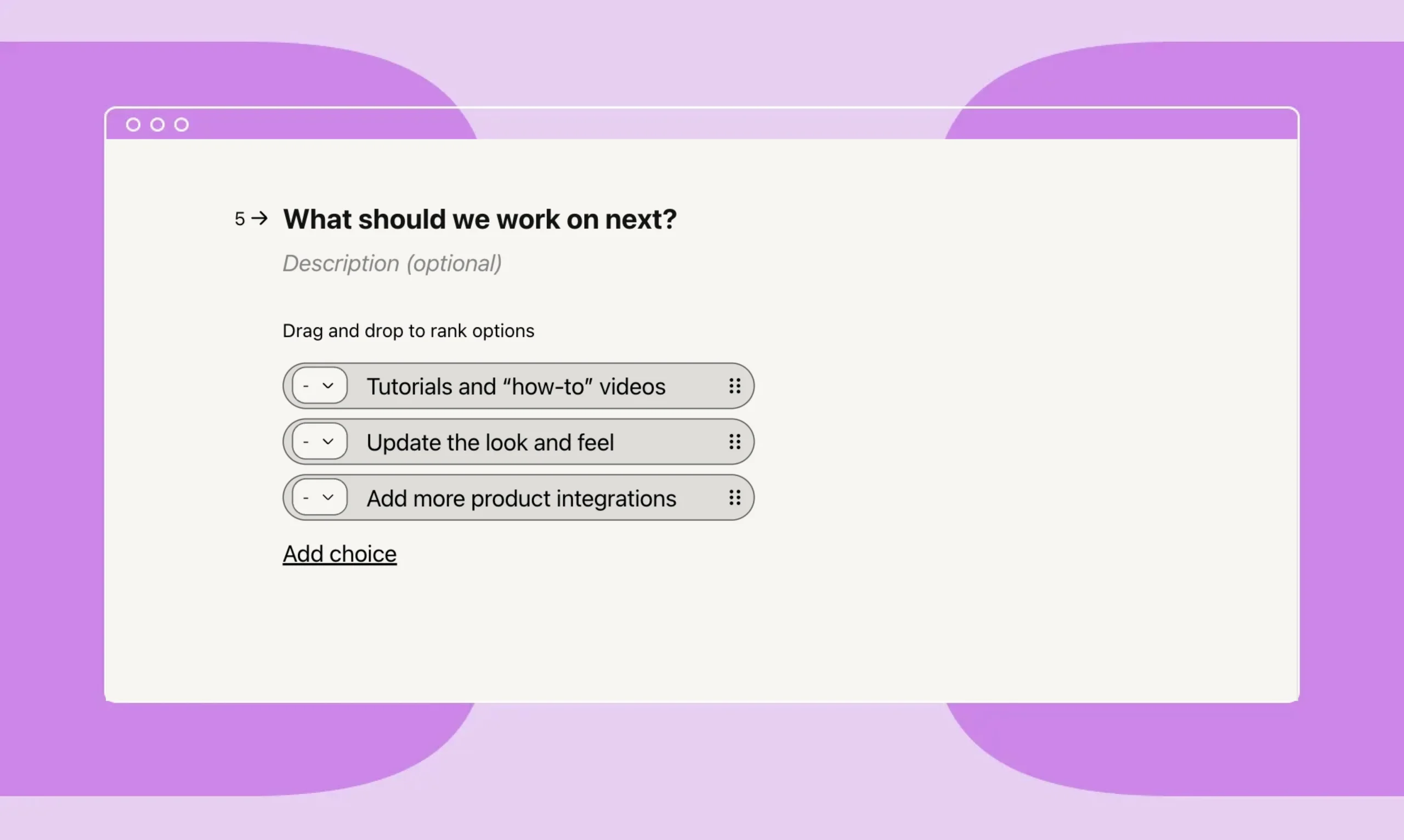

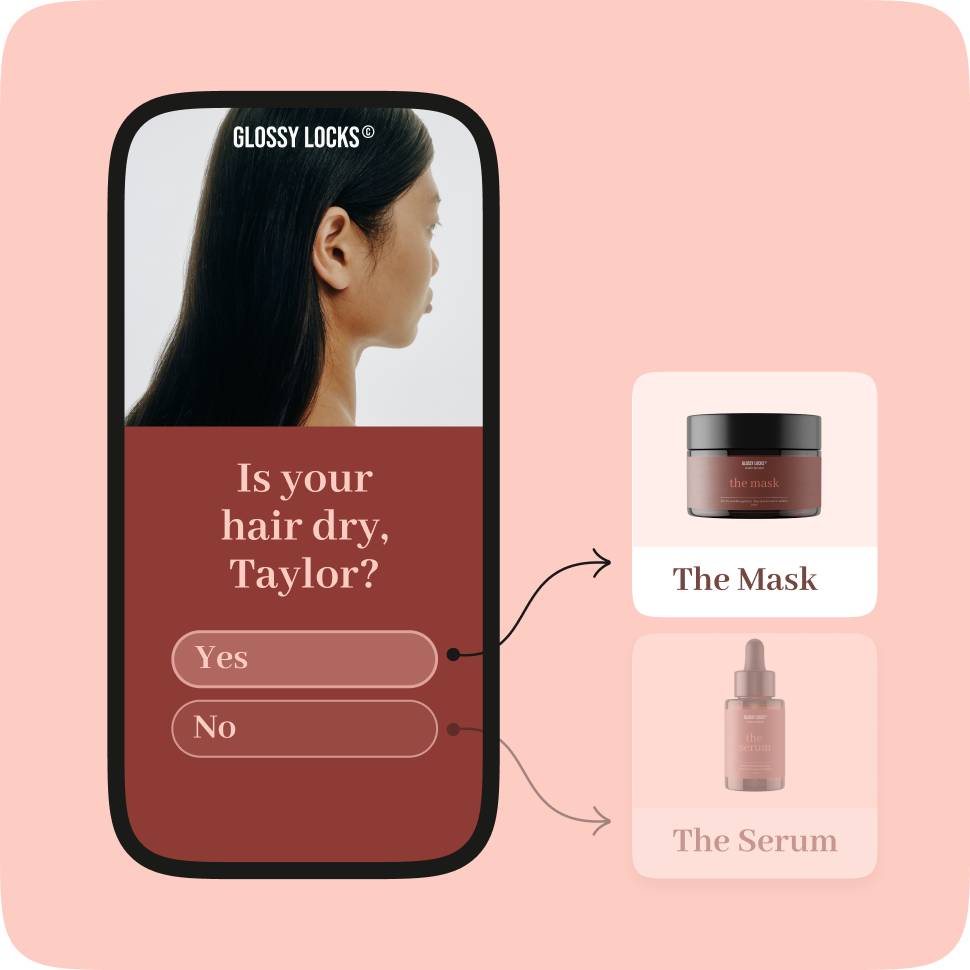

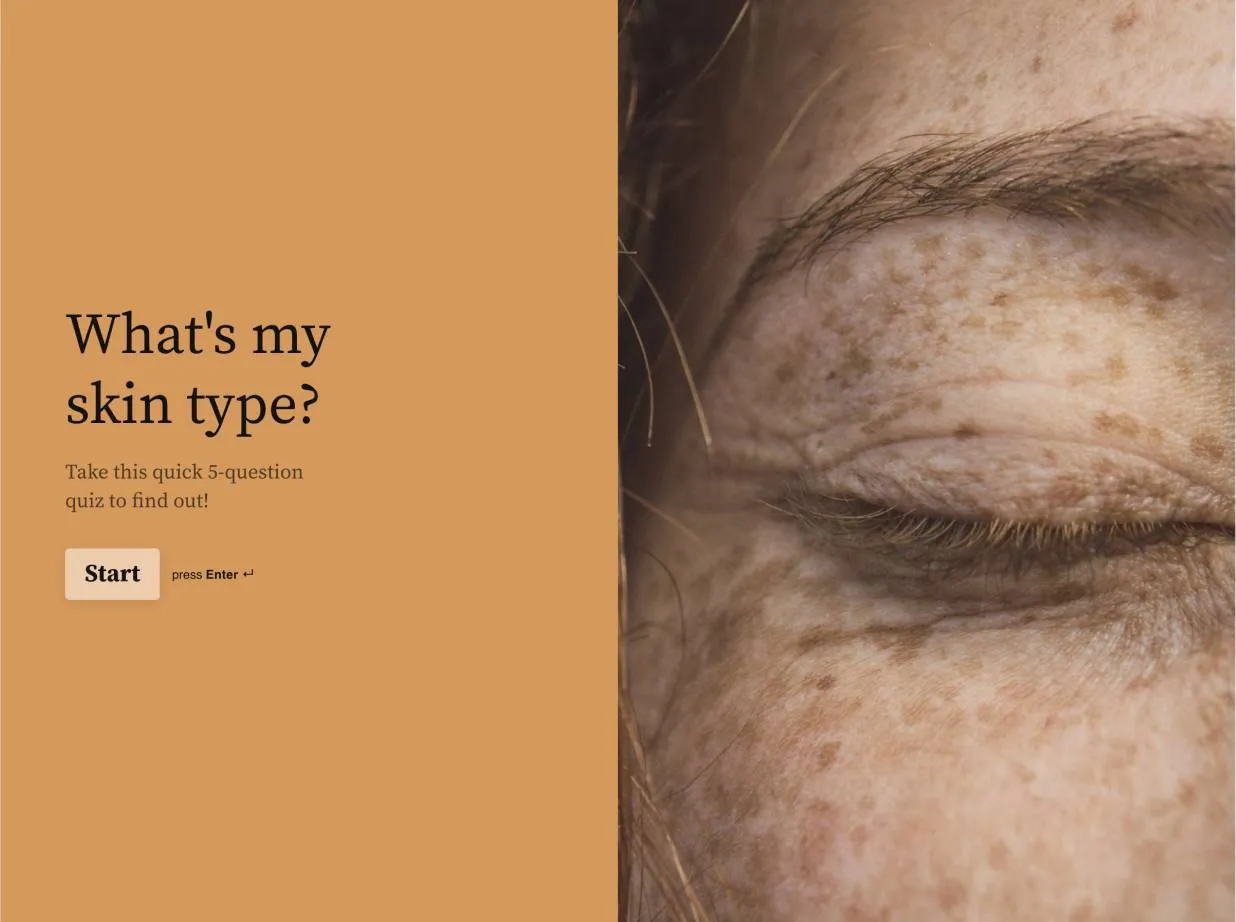

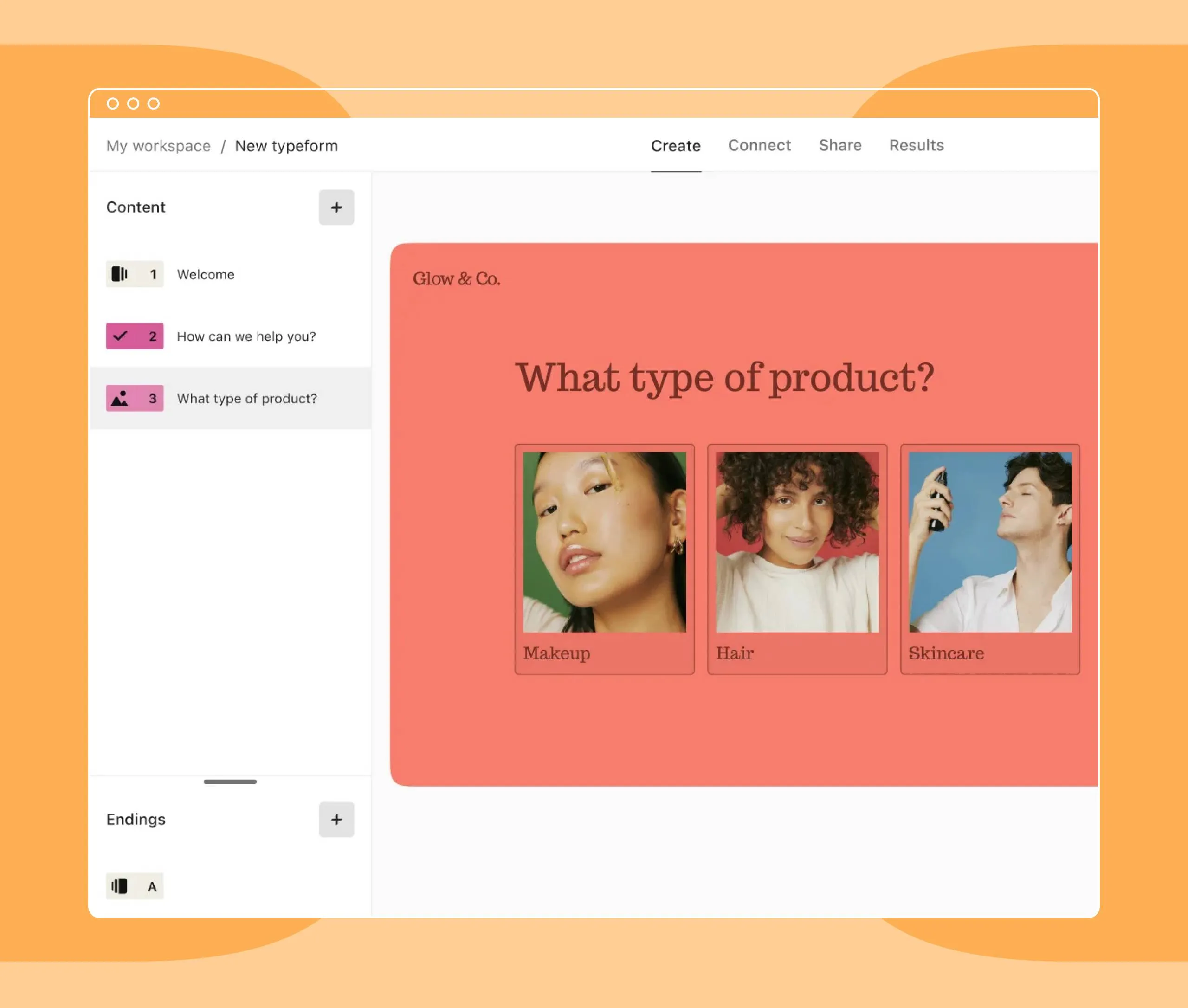

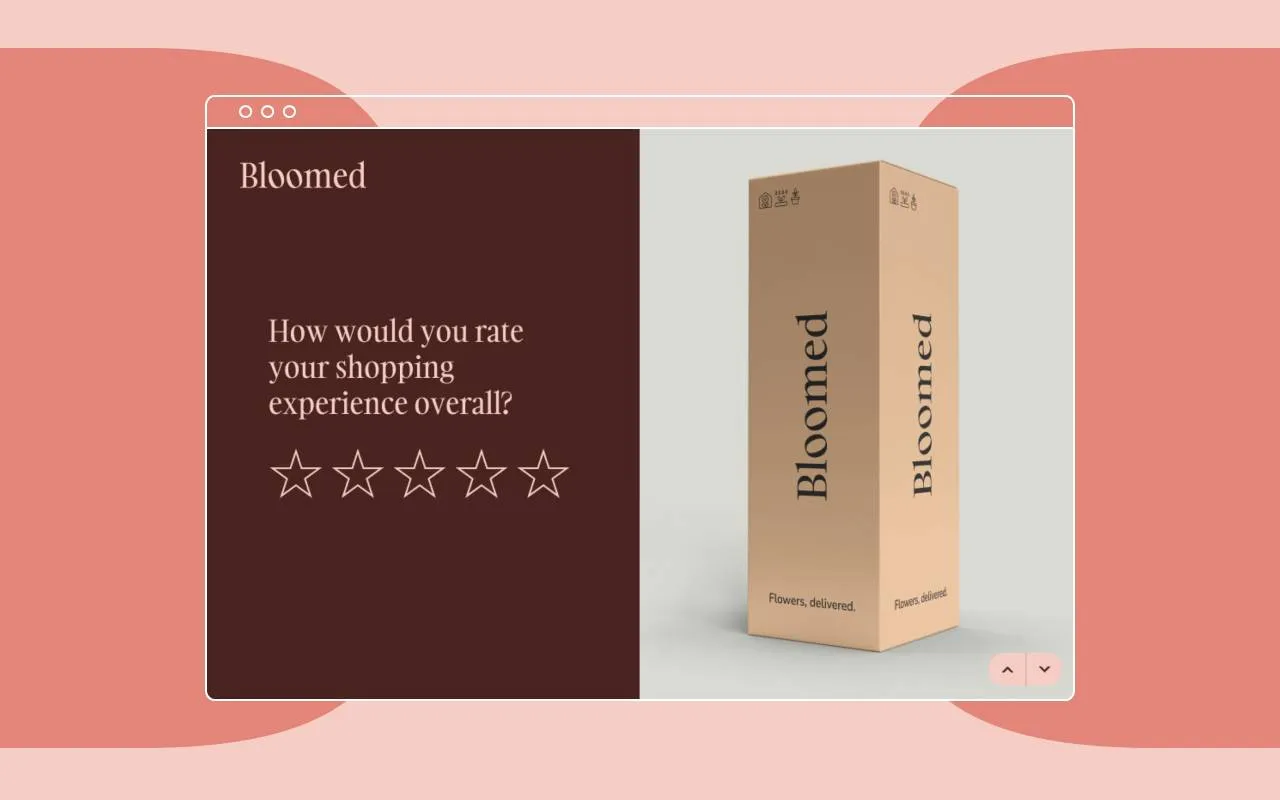

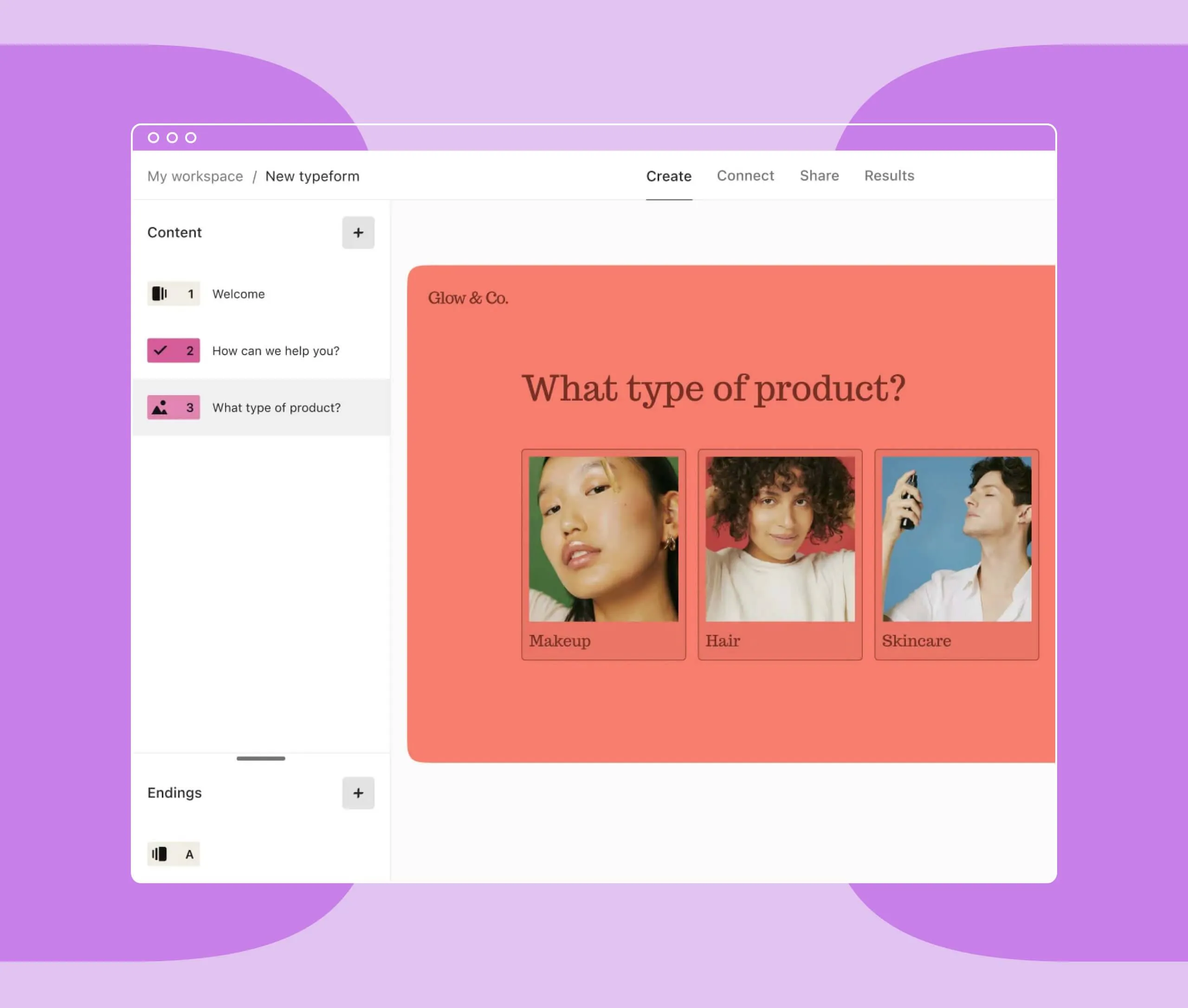

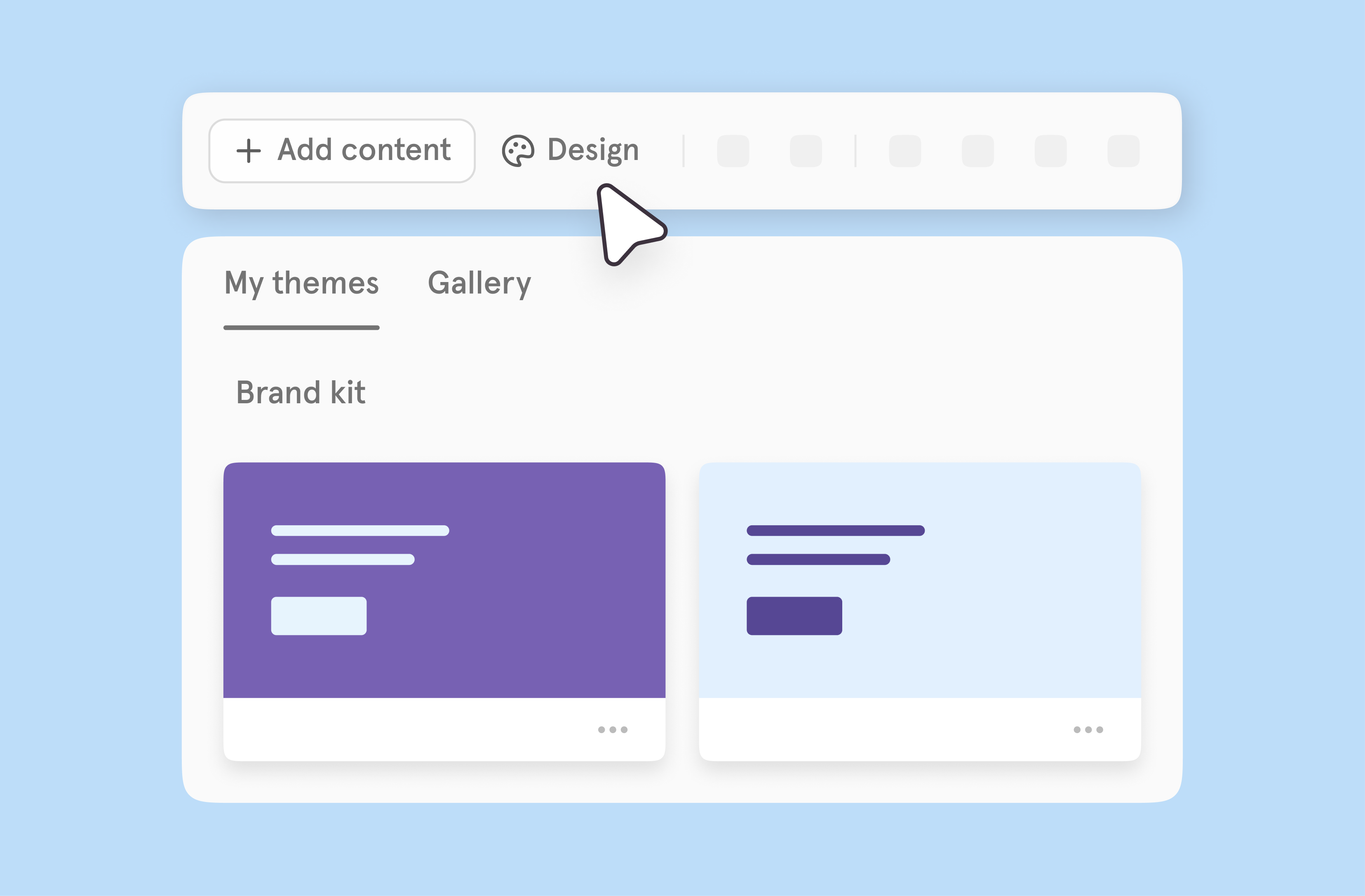

Make your forms uniquely yours

Customization just got a whole lot simpler. You can now add logos, images, colors, fonts, and themes directly from the toolbar. It’s never been easier to create forms that reflect your brand.

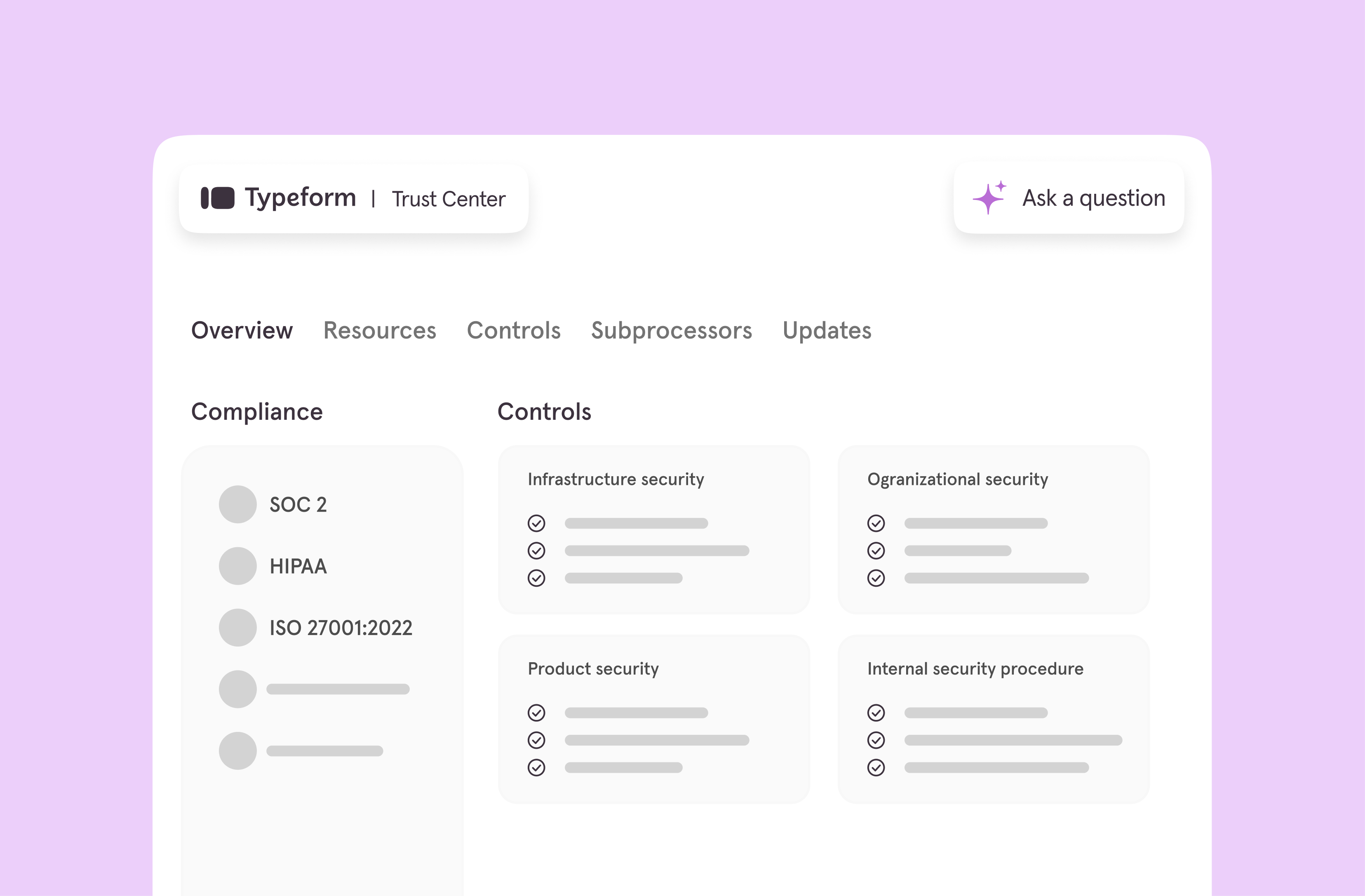

Security and transparency made easy

We know trust is essential. That’s why we’re excited to announce the launch of the Typeform Trust Center. This centralized hub provides:

- Instant access to security reports and certificates

- The ability to sign NDAs without needing to speak to a human

- Answers to over 4,500+ security questions, supported by an AI assistant

Enterprise customers can still enjoy enhanced features like custom NDAs and HIPAA-compliant BAAs, but now all users have access to robust tools for ensuring data security and compliance.

Explore the Trust Center

Don’t just read about these updates—see them in action! Check out our latest Winter 2025 Product Release Webinar where we demo these new features and give a sneak peek at what’s coming next.