Our view at Stack - Shopify has just about everything you need if you're looking to sell online. It excels with unlimited products, user-friendly setup, and 24/7 support. It offers 6,000+ app integrations, abandoned cart recovery, and shipping discounts up to 88%. Plus, it allows selling both online and in-person, scaling as your business grows.

“Net 30” is a common payment term you might see on an invoice. It simply means buyers have 30 days after receiving an invoice to complete their payment. Buyers typically receive their goods in the interim. Net 30 is popular among buyers that purchase products from wholesalers because it gives them enough time to sell the products before paying for them.

For some merchants, the idea of waiting 30 days for payment is risky. How will they operate in the meantime? Is there any guarantee that your customer will settle their debt, or is there a risk of them going silent before the payment term expires?

These are all valid concerns, but there are steps you can take to insulate your business from bad debt if you’re offering a net 30 payment. Here’s how to protect your business and allow customers flexible payment options.

What is net 30?

Net 30 is a payment agreement in which a customer pays for their order within 30 days of receiving the product. It’s most often used in business-to-business (B2B) commerce, where buyers pay for inventory once they’ve sold it.

How do net 30 days payment terms work?

Net 30 days payment terms mean that the buyer has 30 days from the date of receiving the invoice to settle the payment in full. Some buyers opt for these terms because it gives them extra time to improve cash flow. During the 30-day period, the buyer can confirm the products meet their expectations, and sell it to their own customers (if this is the purpose of the sale).

If the buyer hasn’t paid for the goods when the 30-day period expires, the outstanding amount may be subject to late fees or penalties.

An example of net 30 payments

Let’s say a small business owner purchases inventory from a wholesaler that offers net 30 payment terms. Upon receiving the products, the wholesaler issues an invoice dated March 1, stating that payment is due within 30 days. The wholesaler also offers an early repayment discount of 10% if the buyer pays within 15 days.

The small business has until March 16 to claim the discount, with a final deadline of March 31 to make the payment in full. This is enough time to inspect and resell the products before settling the sales invoice within the agreed timeframe.

If the small business doesn’t make payment within 30 days, the wholesaler will likely issue a new invoice with an additional late payment fee.

How to manage net 30 payment terms

1. Create an agreement

A contract is a legally enforceable agreement that protects you if a customer doesn’t pay within 30 days. To make the agreement watertight and let the buyer know what’s expected of them, you can include the following elements in your contract:

- The start date and end date of the agreement

- Products or services provided

- A discount offer for early payment

- Penalties for missing the payment date

- How returns are handled

Alongside the contract, prepare an invoice, a document that explains what you’re selling and for how much. This should include an invoice date, your agreed net 30 payment terms, what you’re selling, and instructions on settling the debt.

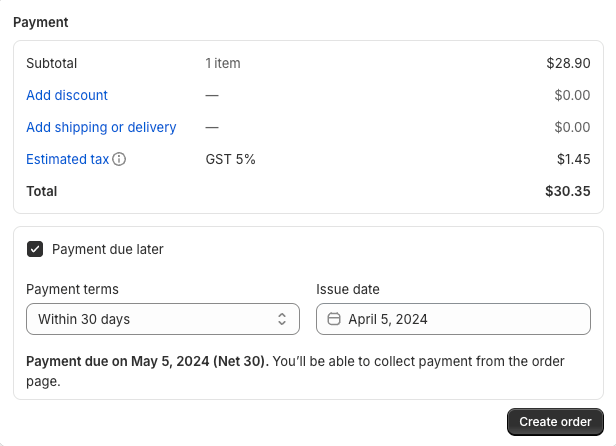

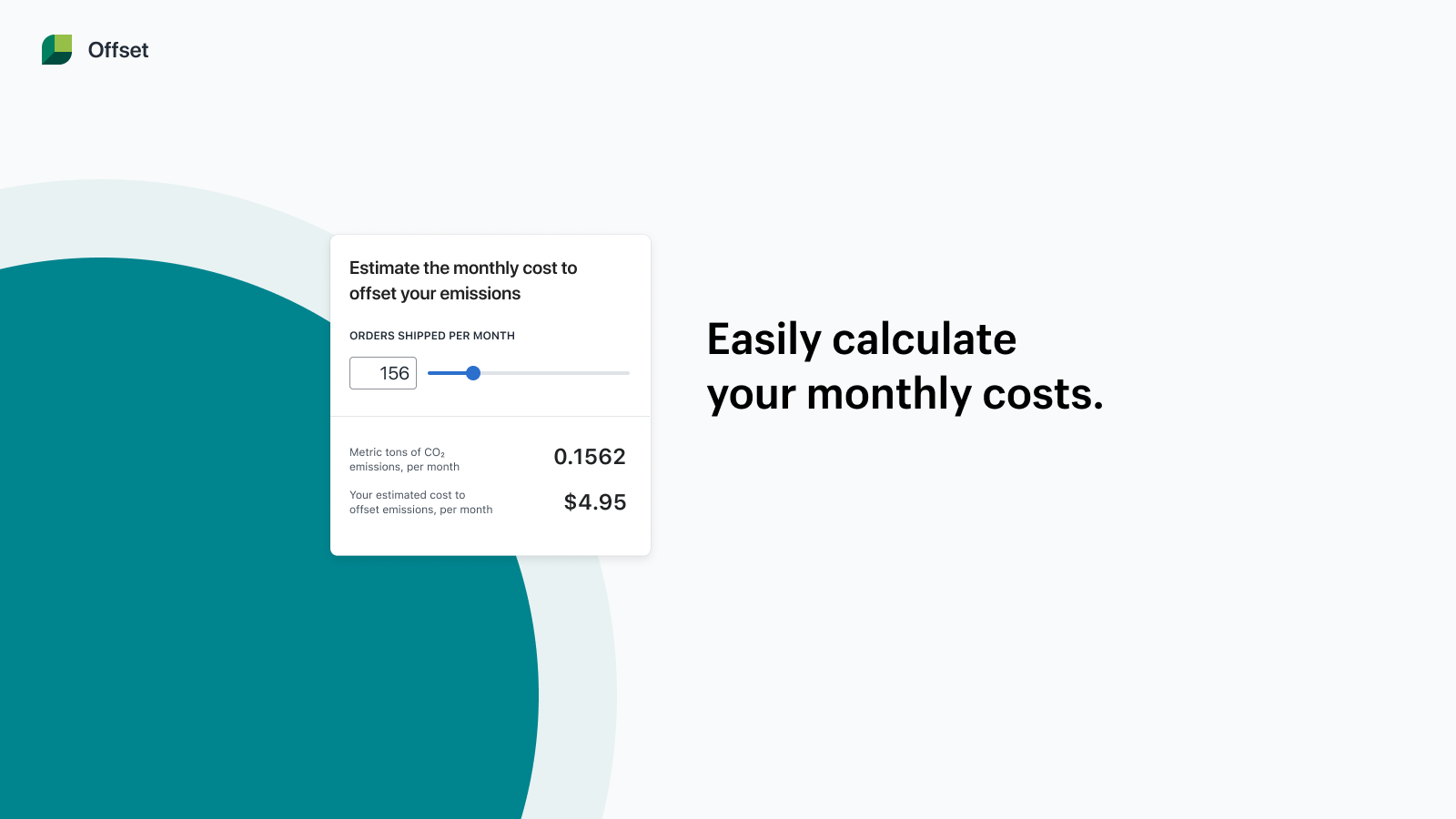

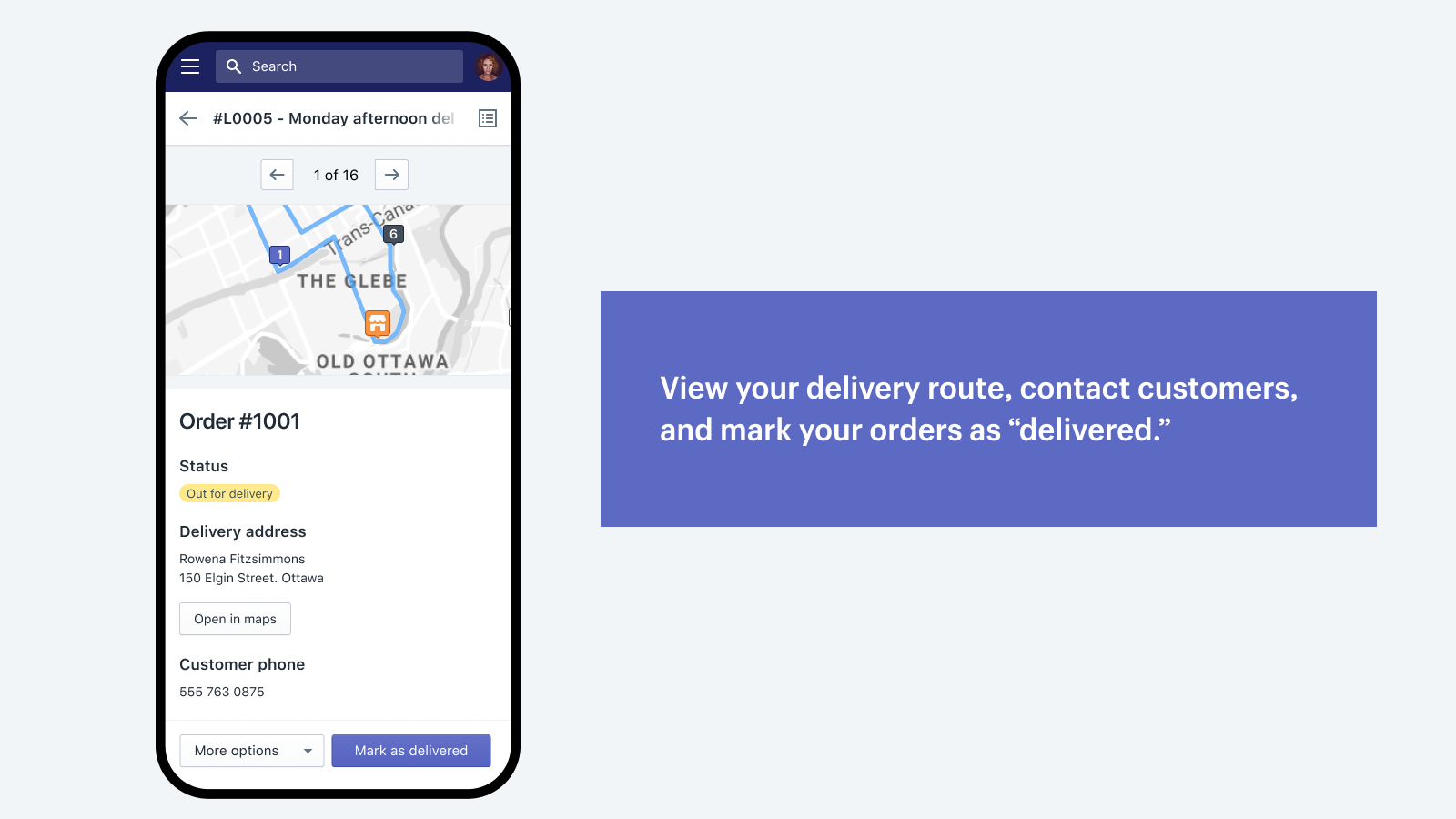

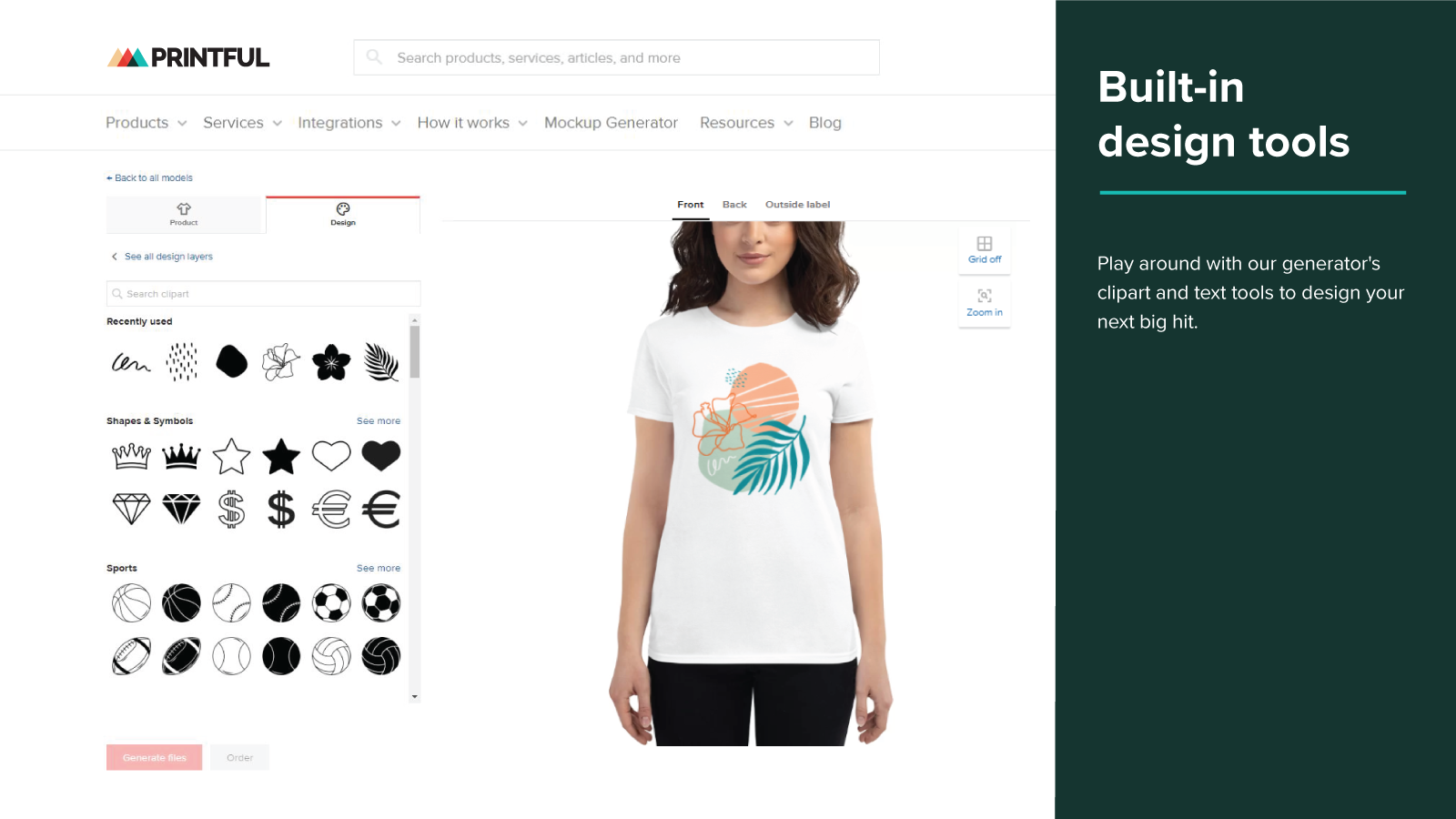

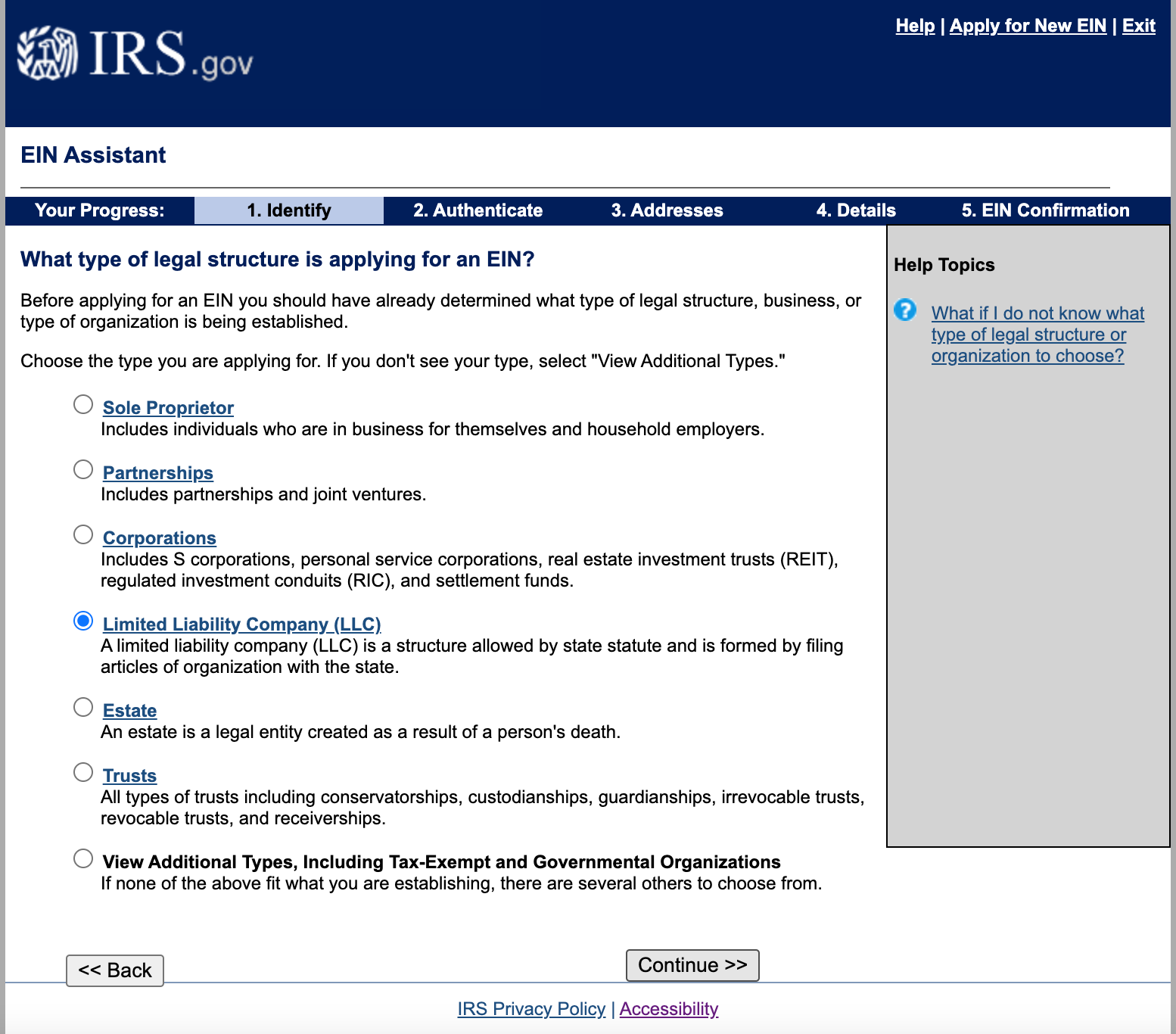

To do this from your Shopify admin, create a draft order and select the “Payment due later” option. Here, you can set your payment terms. Choose “Within 30” days for net 30.

2. Consider an early payment discount

If you’re offering net 30 payment terms to your customers but would rather not wait a month for the money to hit your bank account, you can offer early payment discounts to incentivize people to pay earlier.

Early repayment discounts are typically written in the following format: [discount]% / [number] days. For example, 5% / 15 days net 30 means customers get a 5% discount if they settle their invoice within 15 days (before the net 30 deadline).

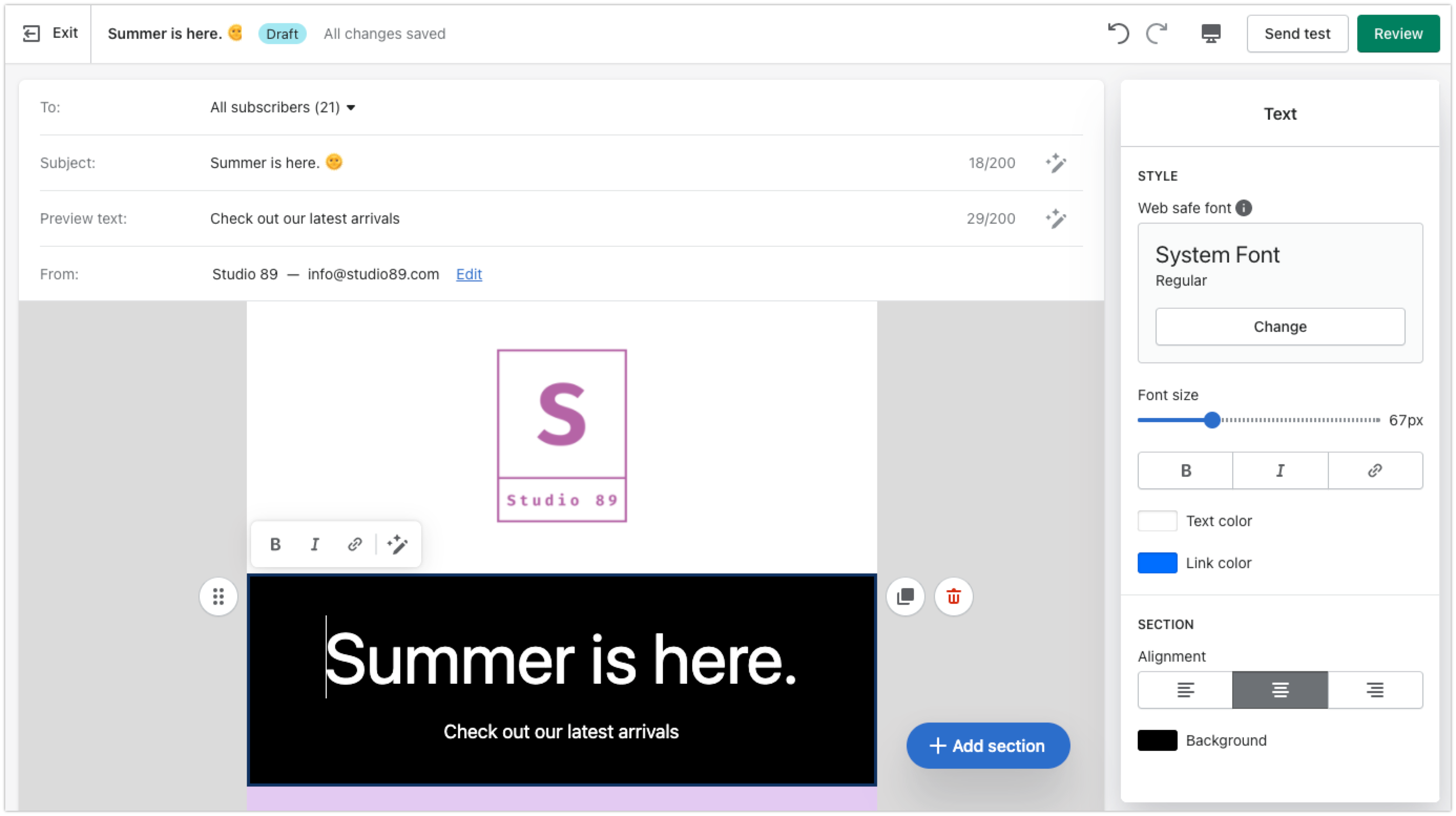

3. Send regular payment reminders

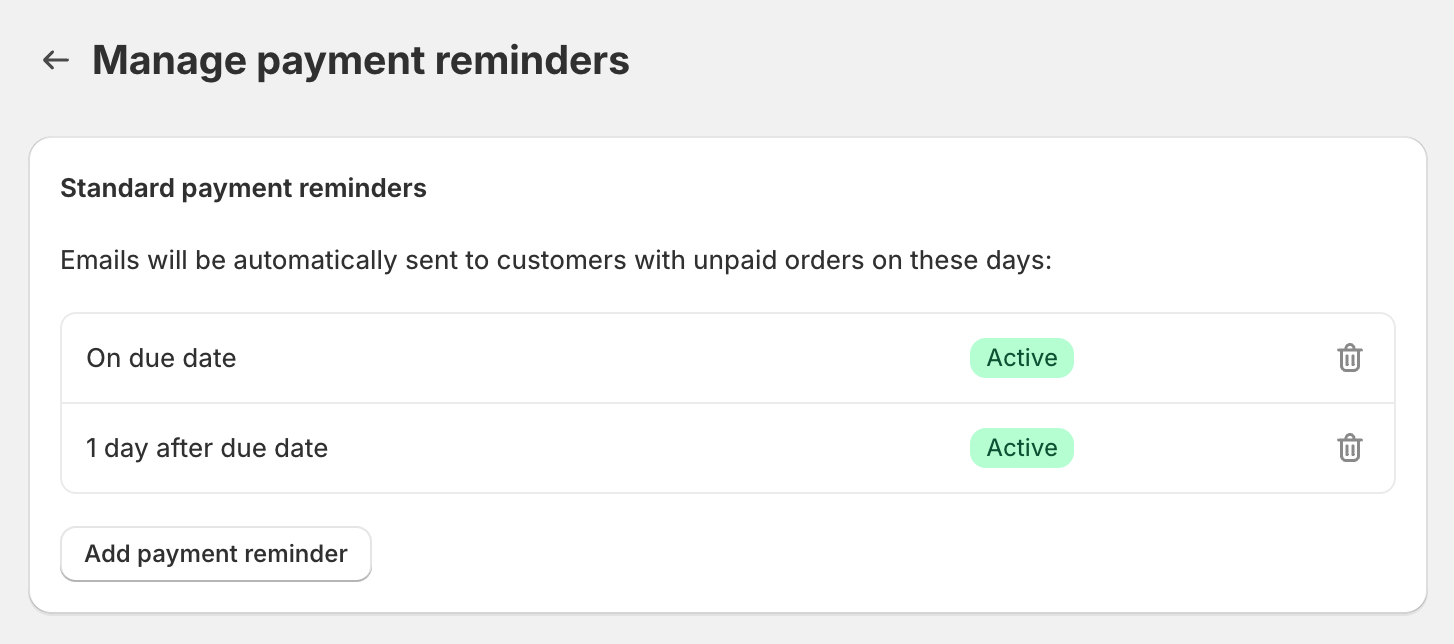

Your customers might be busy people who forget about their upcoming payment deadline. Instead of waiting for the deadline to pass, you can send regular reminders to people who’ve agreed to a net 30 payment term. Here’s what that might look like:

- 23 days after invoicing: One week left to complete their payment

- 29 days after invoicing: Final reminder with warning of a late payment fee

- 31 days after invoicing: New invoice with a late payment fee

Shopify can send automatic payment reminders for you. Go to Settings and choose “Notifications.” Select “Customer notifications” and find the payment reminder section. You can edit what the reminder email looks like and choose how often you want to send them.

Advantages of net 30 terms

Net 30 payment terms are popular among ecommerce retailers because they offer the following advantages:

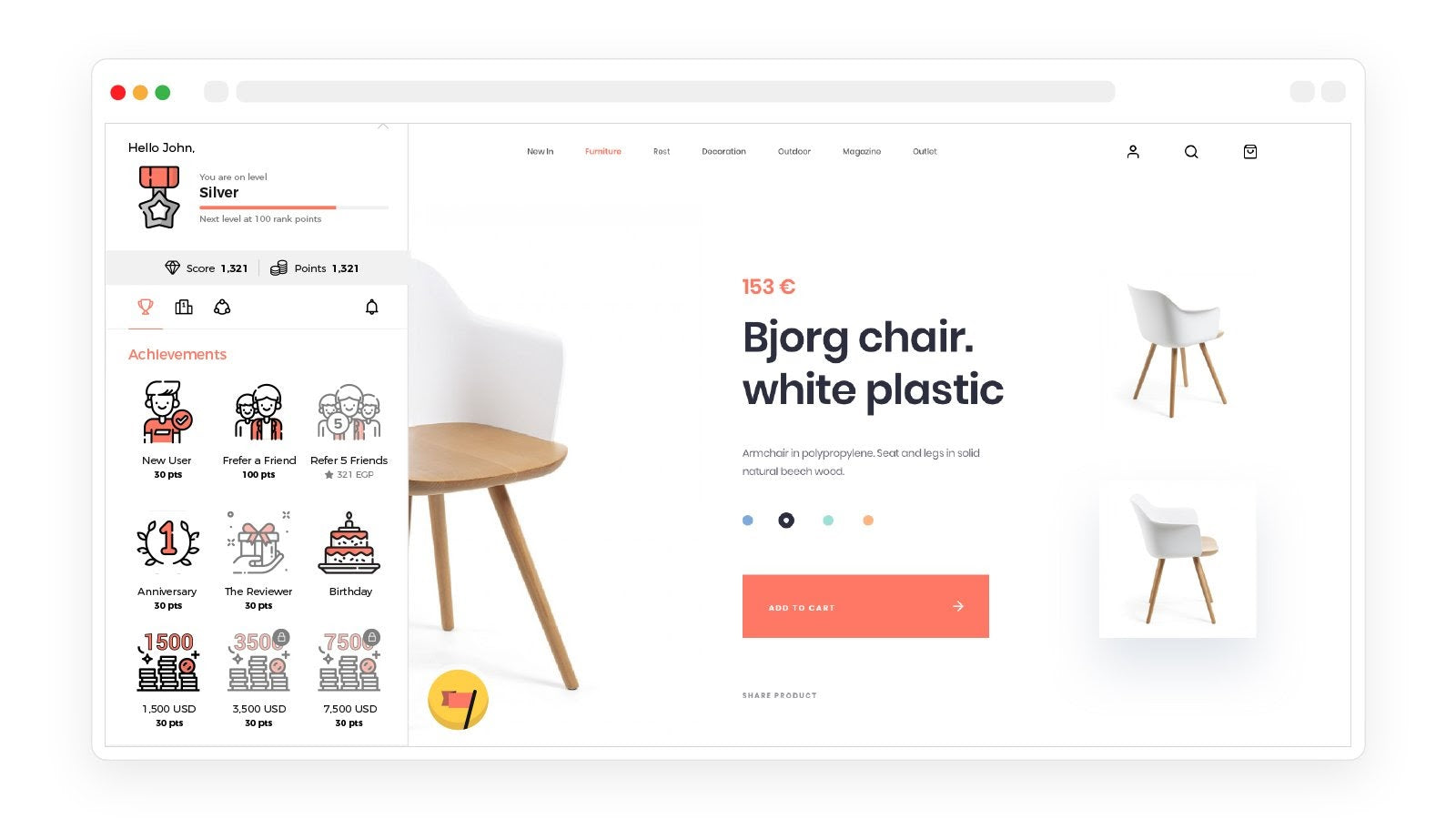

- Incentivize new customers. Net 30 can help customers improve their own cash flow if they don’t have to pay for their goods until 30 days after receiving them. This removes any concern about trying new brands.

- Competitive advantage. If a customer is choosing between two merchants, the one offering net 30 payment terms could be the best choice for a customer who prefers a longer payment period, such as small business owners.

- Encourage customer loyalty. Offering net 30 payment terms is a sign of trust that can solidify strong relationships. This can build loyalty, because it’s easier for people to stick with a brand if they feel a strong connection to it.

Disadvantages of net 30 terms

Despite the advantages that net 30 can provide, there are some disadvantages to consider before you offer these payment terms to your customers:

- You’ll need more working capital. You won’t recoup the cost of producing a product until 30 days after you’ve sold it. That means you’ll likely need a lot more working capital to operate your business in the interim.

- Unpredictable cash flow. When people take you up on your net 30 offer, you trust that they’ll pay within 30 days. If they fail to do so, your business can experience cash flow management problems.

- You may need to manually approve net 30 requests. Customers with poor personal or business credit scores might be more likely to default on their payments, and approving these people in advance takes time.

- You’ll need to remind people of upcoming payments. This is made easier with software that can send deferred payment reminders, such as Shopify.

Alternatives to net 30 payment

If you’re not set on the idea of waiting 30 days to receive payment, consider these alternatives:

- Net 0. Also known as payment on receipt or immediate payment, net 0 means that payment is due immediately after placing an order. It’s most commonly used in direct-to-consumer (DTC) ecommerce, where orders are processed at scale.

- Net 15. A customer has 15 days to make their payment. Some retailers find the shorter payment window is a good middle ground between flexibility and waiting for money to hit their bank account. You’ll most often find net 15 terms offered by wholesalers to smaller businesses.

- Net 60. This payment term gives customers more time—60 days—to pay for their order. The longer window is more attractive to customers with cash flow problems, but you’ll need substantial working capital to operate in the meantime. Net 60 isa popular arrangement between wholesalers and larger businesses.

- Net 90. This tends to be the maximum payment term that businesses offer. Again, you’ll need a lot of working capital to operate while waiting. You’re most likely to find these longer payment terms in government contracts with longer sales cycles and approval processes.

Accept deferred payments with Shopify

Getting paid is a key part of selling online, so take some time to determine whether net 30 terms are right for you. Does the potential of converting more customers balance the risk of late payment?

If you’re not sure yet, you could also try offering net 30 payments to specific customers. You might contact existing customers you already know and trust to explore the idea of net 30 terms. Once you’ve got the hang of it and feel more comfortable accepting deferred payments, you can open it up to more customers.

Net 30 payment terms FAQ

What is the most common net payment term?

What is the 2% net 30 payment terms?

What is a net 30 payment term late payment?

If Shopify is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.

Tie-dye cycled back into popularity in ’90s, popping up in fashion retailer collections on everything from sneakers to underwear. Tie-dyed goods are easy crafts to make and sell from home, requiring very few materials and skills.

Tie-dye cycled back into popularity in ’90s, popping up in fashion retailer collections on everything from sneakers to underwear. Tie-dyed goods are easy crafts to make and sell from home, requiring very few materials and skills.

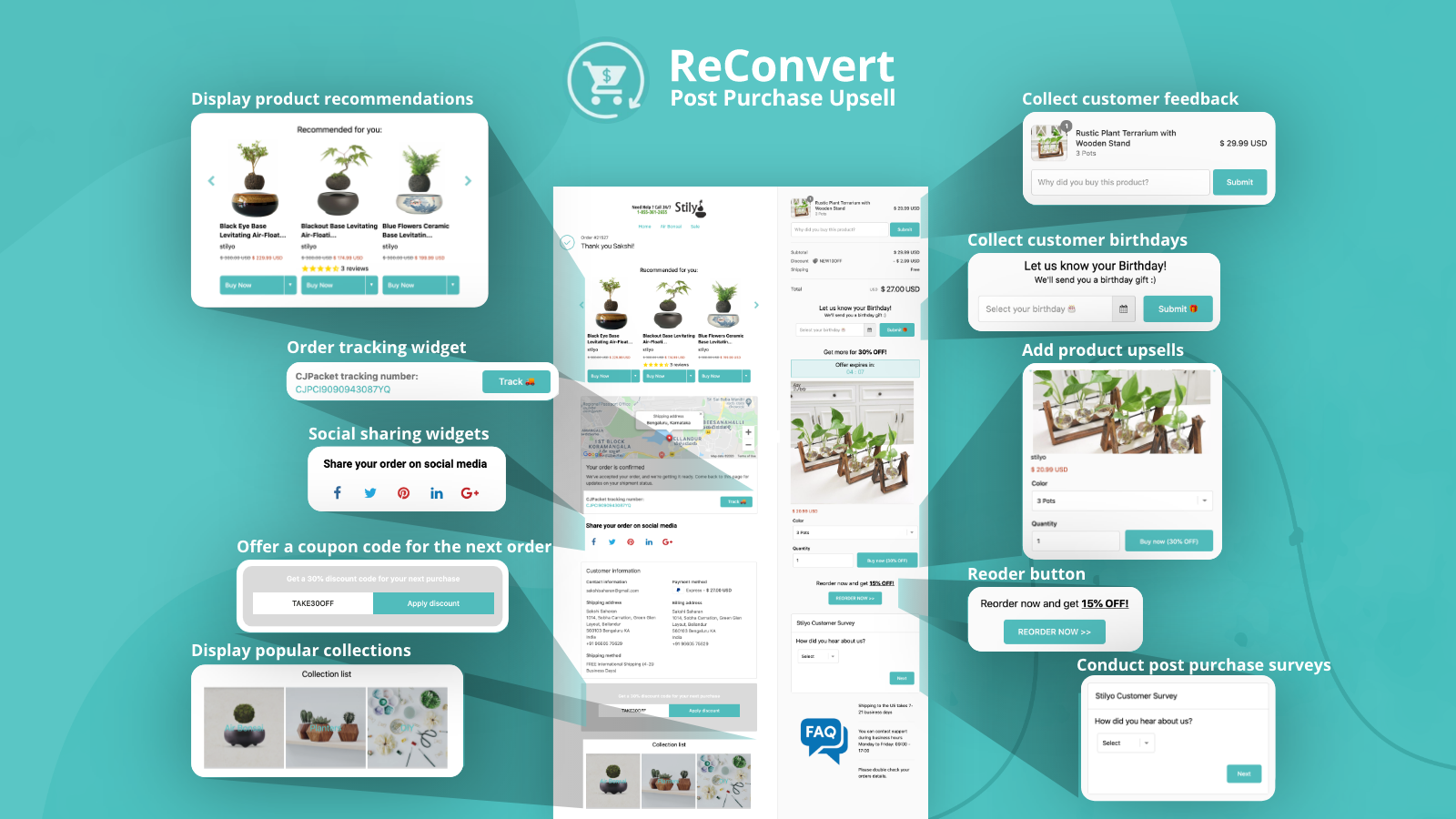

The plant-parent population grew like a weed at the onset of the pandemic, and businesses selling plants and plant accessories harvested the benefits. And, with plant care being a long-term commitment, tangential businesses will see benefits for years to come.

The plant-parent population grew like a weed at the onset of the pandemic, and businesses selling plants and plant accessories harvested the benefits. And, with plant care being a long-term commitment, tangential businesses will see benefits for years to come.

If you’re looking for a sustainable idea for a craft you can do from home, vintage upcycling might be for you. The process involves sourcing vintage or used clothing—maybe pieces that have rips, stains, or dated shapes—and repurposing parts into new products.

If you’re looking for a sustainable idea for a craft you can do from home, vintage upcycling might be for you. The process involves sourcing vintage or used clothing—maybe pieces that have rips, stains, or dated shapes—and repurposing parts into new products.

Both resin and polymer clay jewelry creations began trending a couple of years ago but are still popping up all over the web because of their versatility and appeal as DIY crafts. Martha Stewart magazine names resin art as one of 2024’s trending crafts.

Both resin and polymer clay jewelry creations began trending a couple of years ago but are still popping up all over the web because of their versatility and appeal as DIY crafts. Martha Stewart magazine names resin art as one of 2024’s trending crafts.

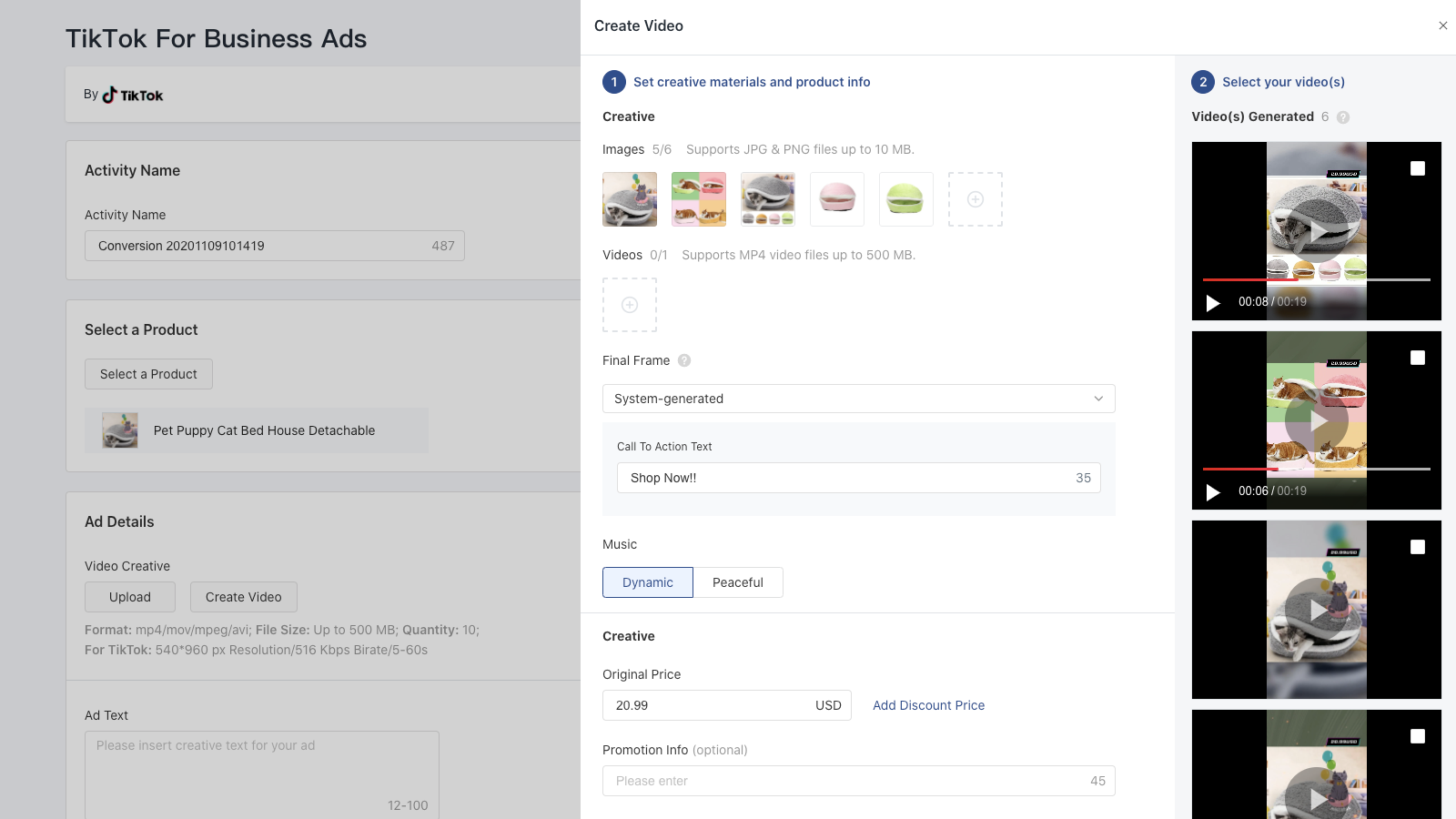

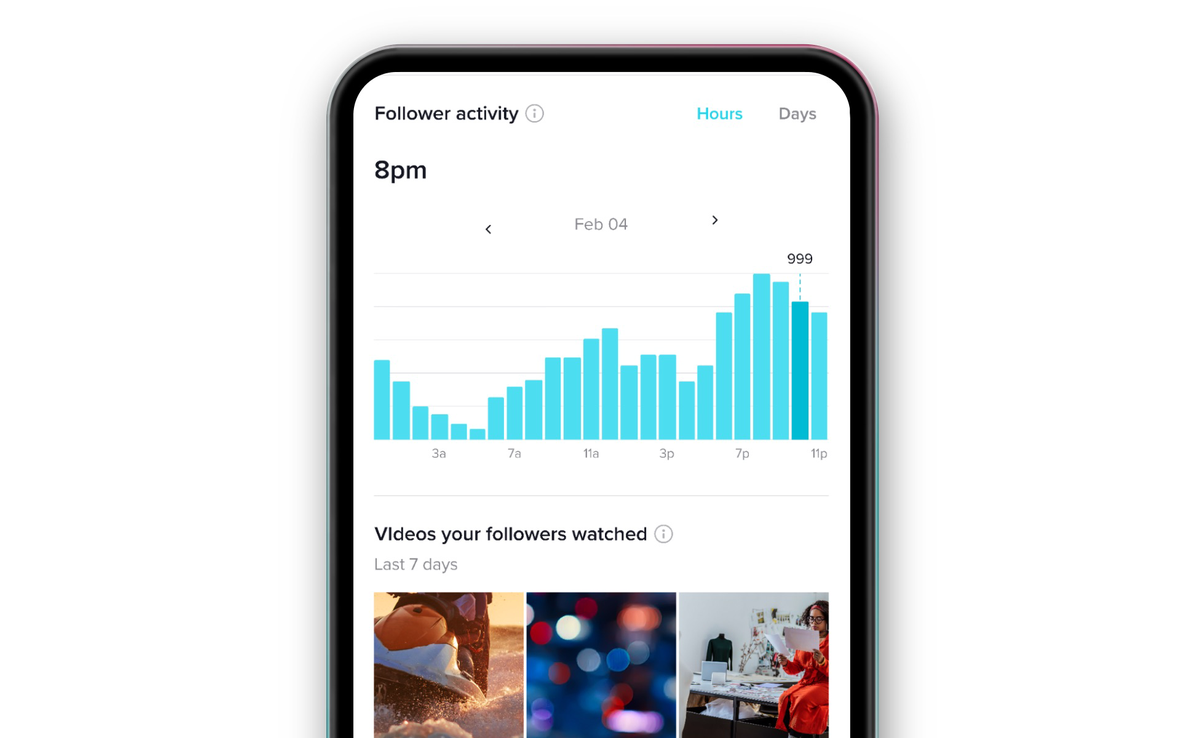

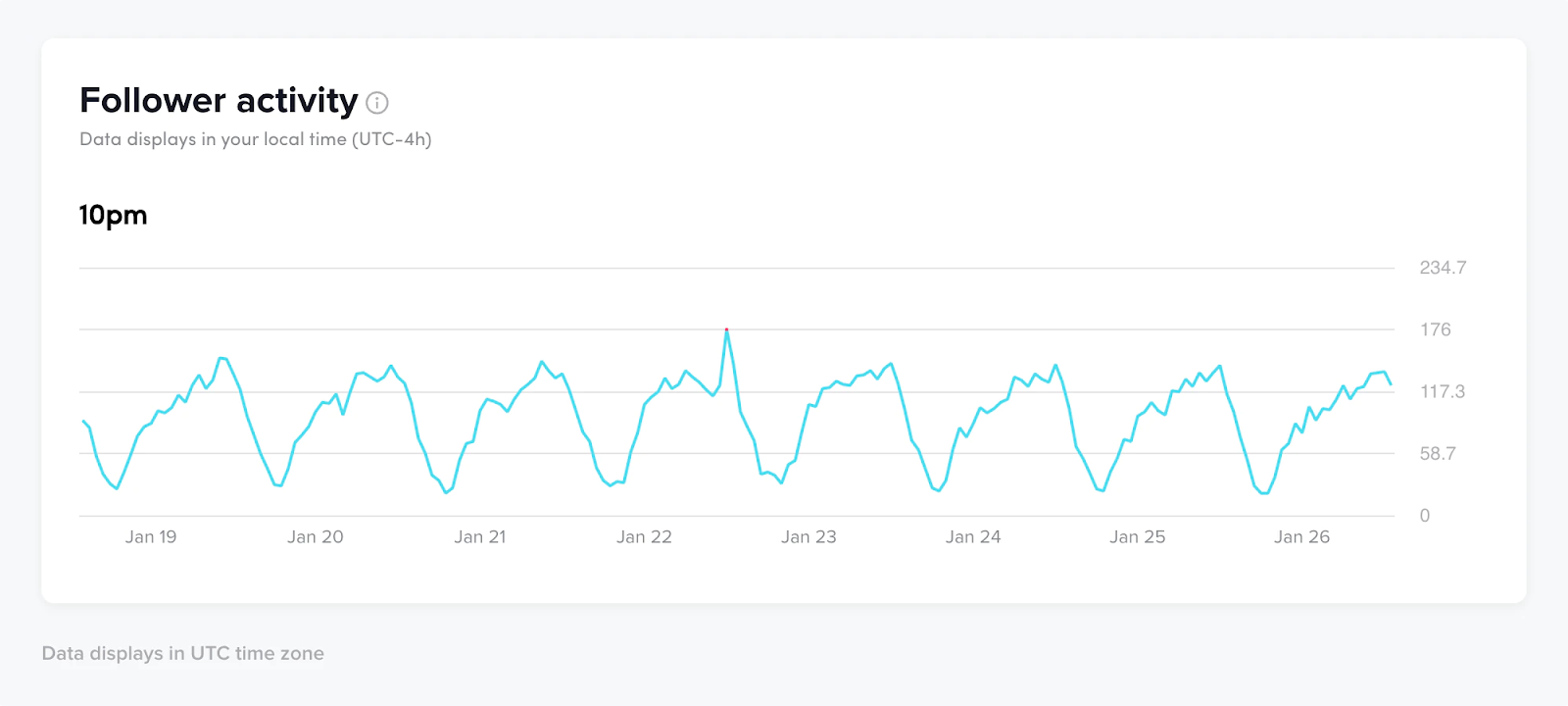

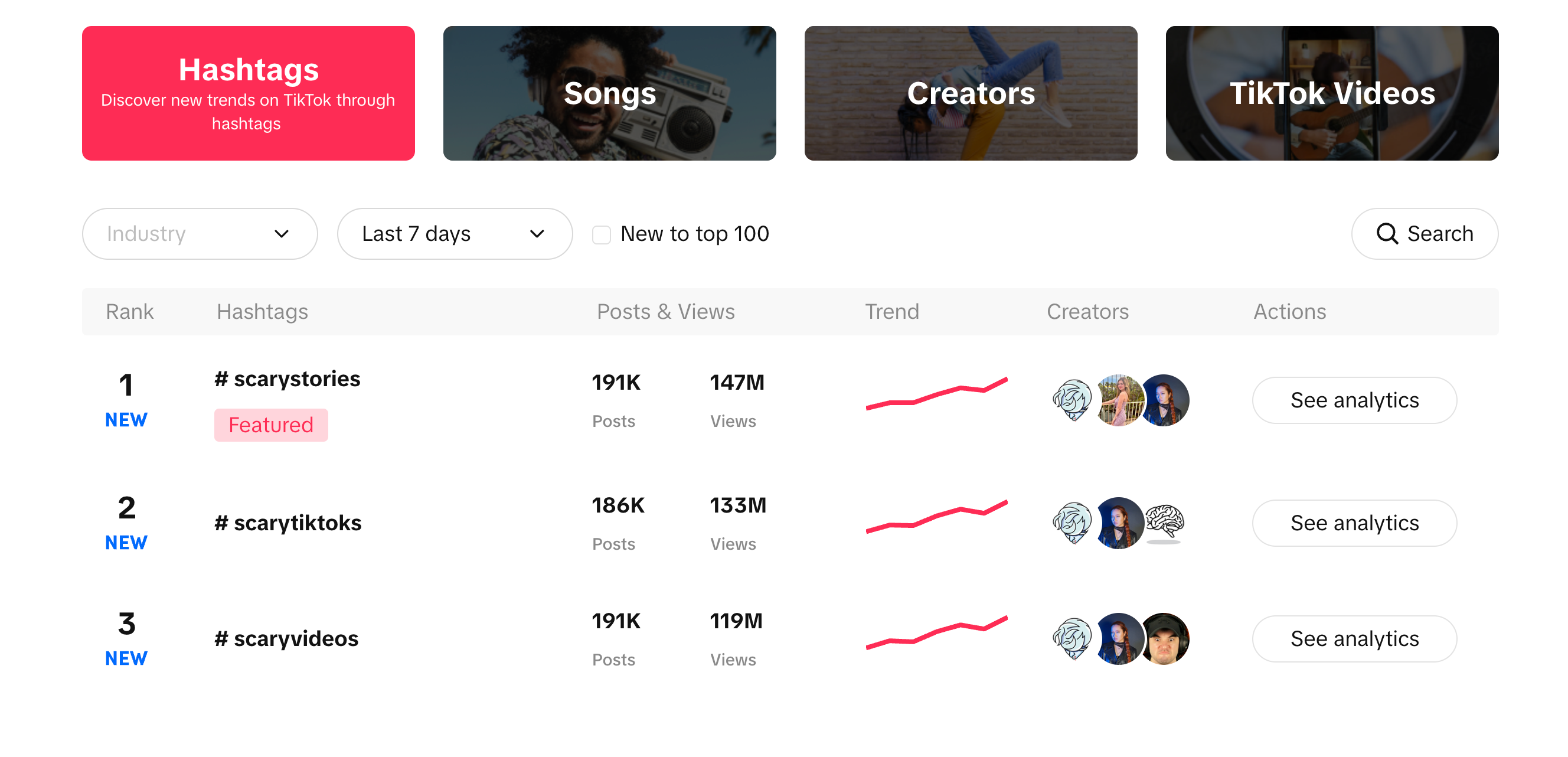

Another aspect of maximizing engagement on TikTok is staying up to date with current trends. Whether or not you follow TikTok trends can influence the best times for you to post.

Another aspect of maximizing engagement on TikTok is staying up to date with current trends. Whether or not you follow TikTok trends can influence the best times for you to post.

Today, Loran handles all of the tasks involved with keeping the online store running, including everything from social media to email marketing. Her younger sister manages the shipping and fulfillment, while most of the family makes up the production team, with Trevor at the helm. Matriarch Angela Polder heads up quality control. “If anybody’s slacking, she makes sure they know it,” says Loran.

Today, Loran handles all of the tasks involved with keeping the online store running, including everything from social media to email marketing. Her younger sister manages the shipping and fulfillment, while most of the family makes up the production team, with Trevor at the helm. Matriarch Angela Polder heads up quality control. “If anybody’s slacking, she makes sure they know it,” says Loran.

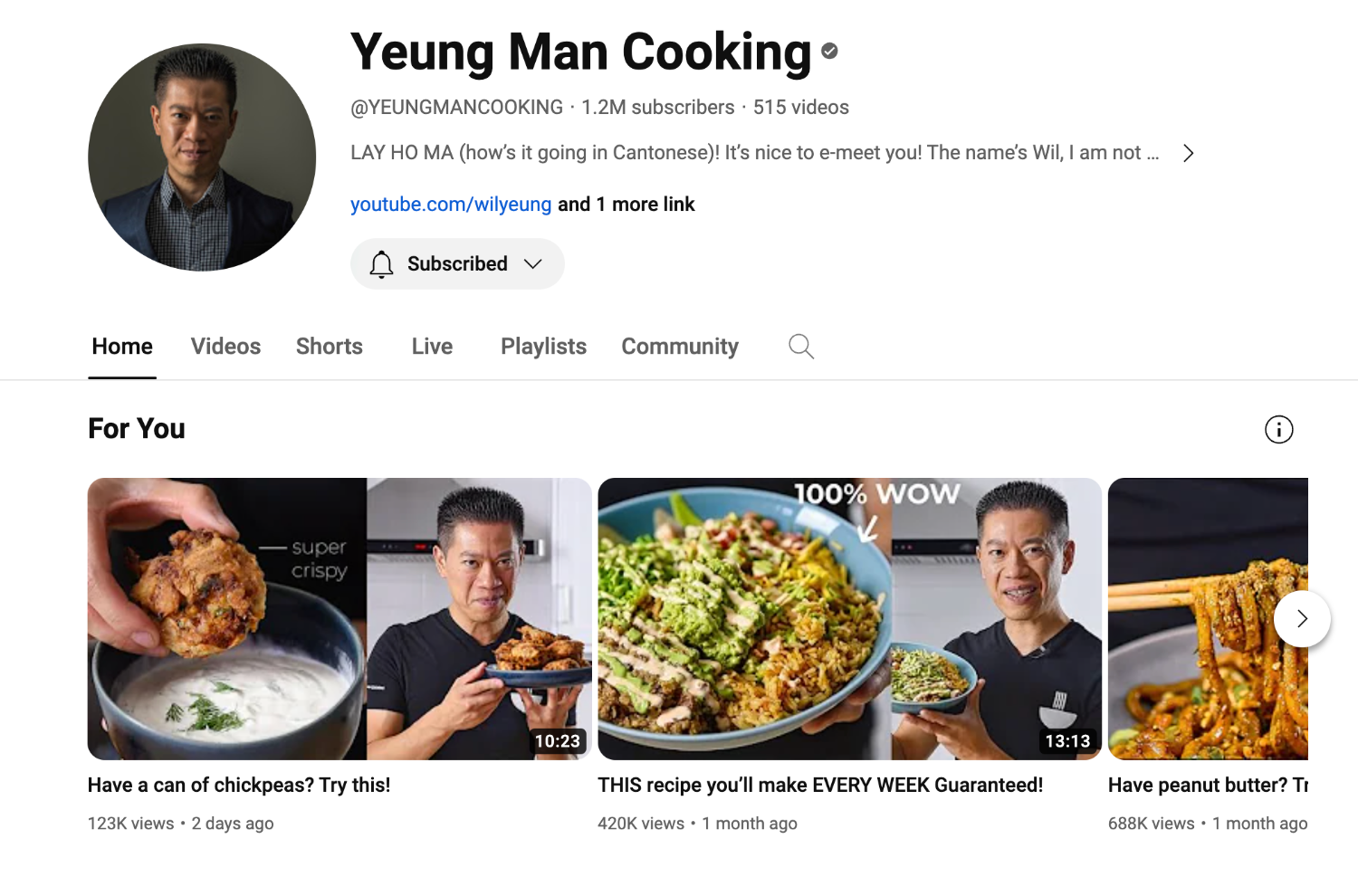

In 2010, Mimi Ikonn co-founded Luxy Hair, a line of hair extensions and accessories, and grew the brand’s YouTube channel to reach over three million subscribers. She later sold the multimillion-dollar company and launched Intelligent Change. Again she found success, selling more than two million copies of the company’s Five Minute Journal.

In 2010, Mimi Ikonn co-founded Luxy Hair, a line of hair extensions and accessories, and grew the brand’s YouTube channel to reach over three million subscribers. She later sold the multimillion-dollar company and launched Intelligent Change. Again she found success, selling more than two million copies of the company’s Five Minute Journal.