Welcome to our monthly roundup of what’s new in Xero. This month, we’re excited to share updates designed to save you time, reduce errors, and give you greater flexibility. From duplicate bill detection to streamlined GST reporting, we’ve been busy making Xero even better. So sit back, and read on to learn how these enhancements can benefit you and your business.

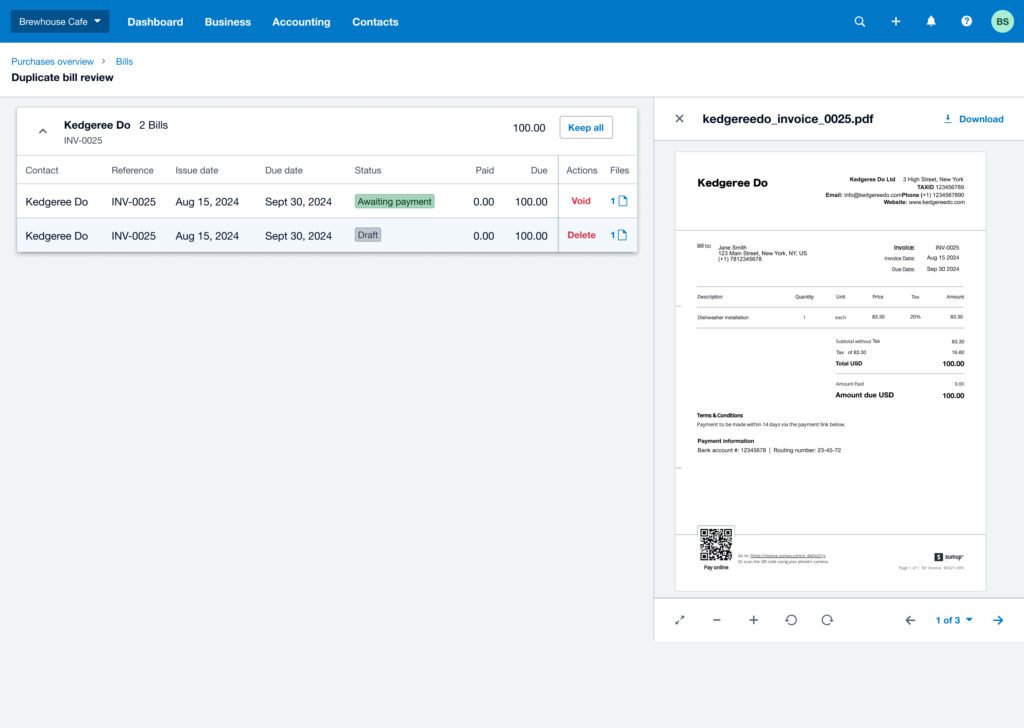

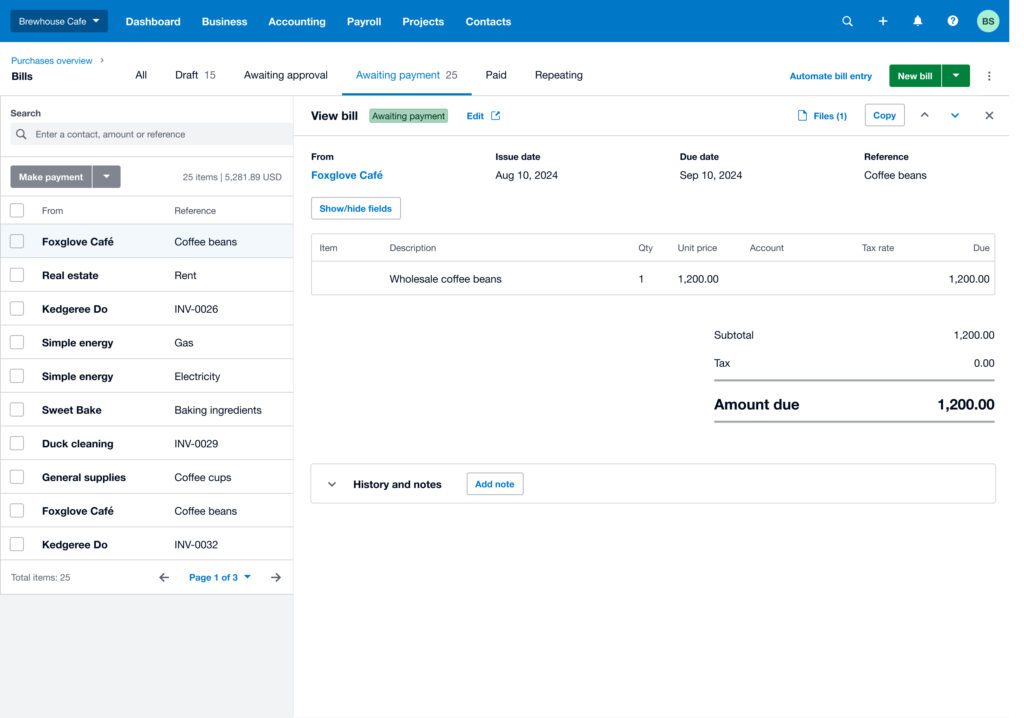

Global: Avoid duplicate bill payments and streamline bill reviews [Product Idea ]

]

Exciting news! You asked, and we listened. We’ve rolled out not one, but two, highly requested updates to Xero that answer eleven of your most requested product ideas.

Firstly, duplicate bills are a thing of the past! The new duplicate detection feature proactively alerts you when potential duplicate bills are detected, regardless of how the bill was created in Xero, reducing the risk of overpaying suppliers and the time-consuming task of rectifying errors.

Secondly, say goodbye to clicking through individual bills or juggling multiple tabs: a new quick view of bills lets you view and approve bills directly from a single screen, streamlining your workflow and saving precious time.

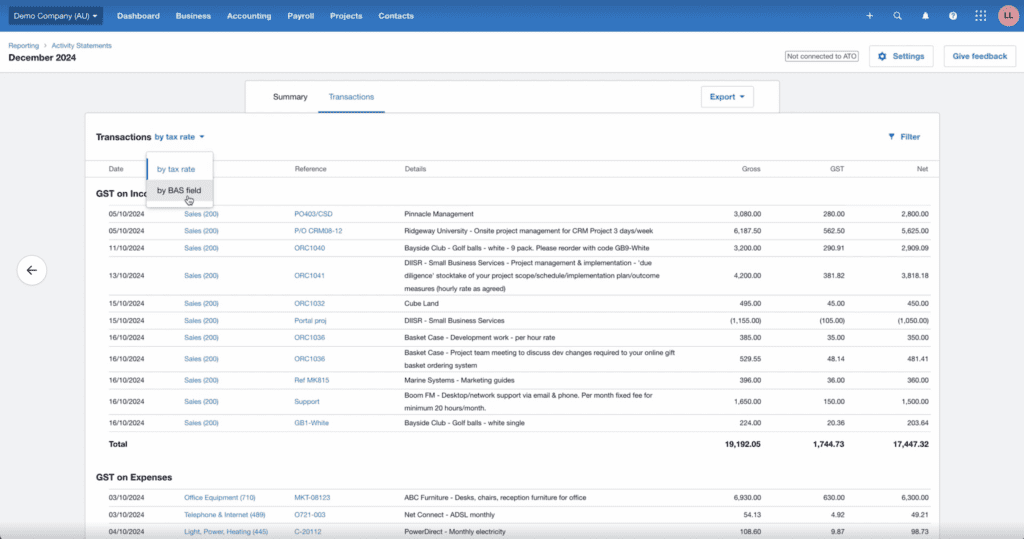

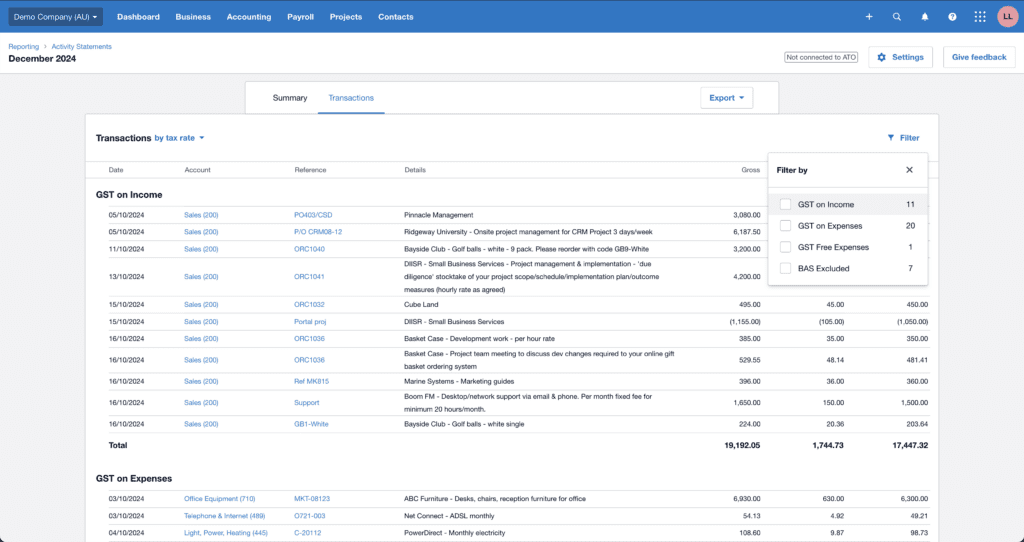

Australia: Easier GST reporting

We’ve streamlined the GST transactions reports to be more user-friendly. You’ll enjoy a more intuitive layout with combined tax rate and BAS field tabs, and customisable filters to find the exact information you need. No more endless scrolling; the wider view and sticky header make navigating the reports a breeze.

UK: New reporting fields added to the annual accounts template

Improvements to the annual accounts template have made it simpler to create reports. This pack of necessary reports for end-of-year accounts provides a more intuitive and consistently formatted solution to streamline your workflows and save you time.

Now, you also have access to new system fields that auto-populate key information like fixed asset schedules, net profit before tax, and net profit after tax. This means less manual entry and more accurate, up-to-date reporting. We’ve also tackled a pesky bug that affected report fields during editing, so your reports will stay intact and dynamic.

These are just some of the updates that have rolled out in Xero this month. You can check out the October edition here, and for a full list of what’s new this November read the release notes in Xero Central.

The post What’s new in Xero – November 2024 appeared first on Xero Blog.