Our view at Stack - Simplify growth with an all-in-one platform. Powerful marketing, sales, and support automation. Integrated CMS. Scalable software. Crafted for customer experience.

The first time I was assigned to write a budget proposal, I stared anxiously at a blank spreadsheet, wondering where to begin. What was a budget proposal supposed to include? Was there a specific structure to follow? How could I ensure it met all the necessary criteria?

My early attempts at writing a proposal taught me the challenges of building a convincing plan that turns rough ideas into fundable projects. I had to learn to align proposal details with business objectives and articulate the potential benefits in a way that resonated with stakeholders.

It was an overwhelming task at times — but with a strategic approach and a bit of guidance, my ability to synthesize financial data and communicate value gradually became second nature.

In this article, I’ll guide you through how to write a simple budget proposal that delights your audience and secures funding. I’ll also provide practical tips, templates, and sample projects to streamline your planning process.

So, let’s get started.

Table of Contents

- What is a budget proposal, and why is it important?

- The Anatomy of a Budget Proposal

- How to Create a Simple Budget Proposal

- Building My Own Basic Budget Proposal

- 8 Budget Proposal Best Practices

What is a budget proposal, and why is it important?

A budget proposal outlines the financial plans for a project or initiative, detailing the expected costs and resources needed for successful completion.

Budget proposals also show potential funders or stakeholders how their money will be spent and the tangible benefits their investment will achieve.

While the content of your budget proposal will change depending on your project’s parameters and specific goals, a well-crafted plan leads to benefits like:

- Stakeholder buy-in. Providing a transparent breakdown of anticipated expenses instills confidence and trust, encouraging stakeholder support or investment.

- Efficient resource usage. Outlining a clear resource allocation plan ensures that funds are directed to the areas where they are needed most.

- Risk mitigation. Applying a risk management framework helps proactively identify potential costs and contingencies, ensuring that the project remains on track and within budget constraints.

- Project tracking. Identifying key project milestones and benchmarks promotes informed decision-making, maintaining efficient and agile progress.

The Anatomy of a Budget Proposal

Before you begin drafting your budget proposal, it’s helpful to first familiarize yourself with its key components and overarching structure.

Knowing which strategic points to emphasize — and the order in which to present them — improves your ability to create a logical and compelling argument, while also ensuring you effectively communicate your project’s feasibility.

So, let’s examine five critical sections found in every effective budget proposal, drawing on the structure used in Hubspot’s Free Budget Proposal Template.

Free Budget Proposal Template

About the Project

The first section of the proposal lays the foundation of your proposal, detailing the purpose, significance, and intended impact of your project.

It serves to introduce stakeholders to the scope and goals of your initiative, highlighting its value and necessity.

Timeline

A project timeline outlines your proposed schedule from start to finish, providing a clear roadmap of phases and milestones. It helps stakeholders understand the duration of the project and key deliverables at each stage.

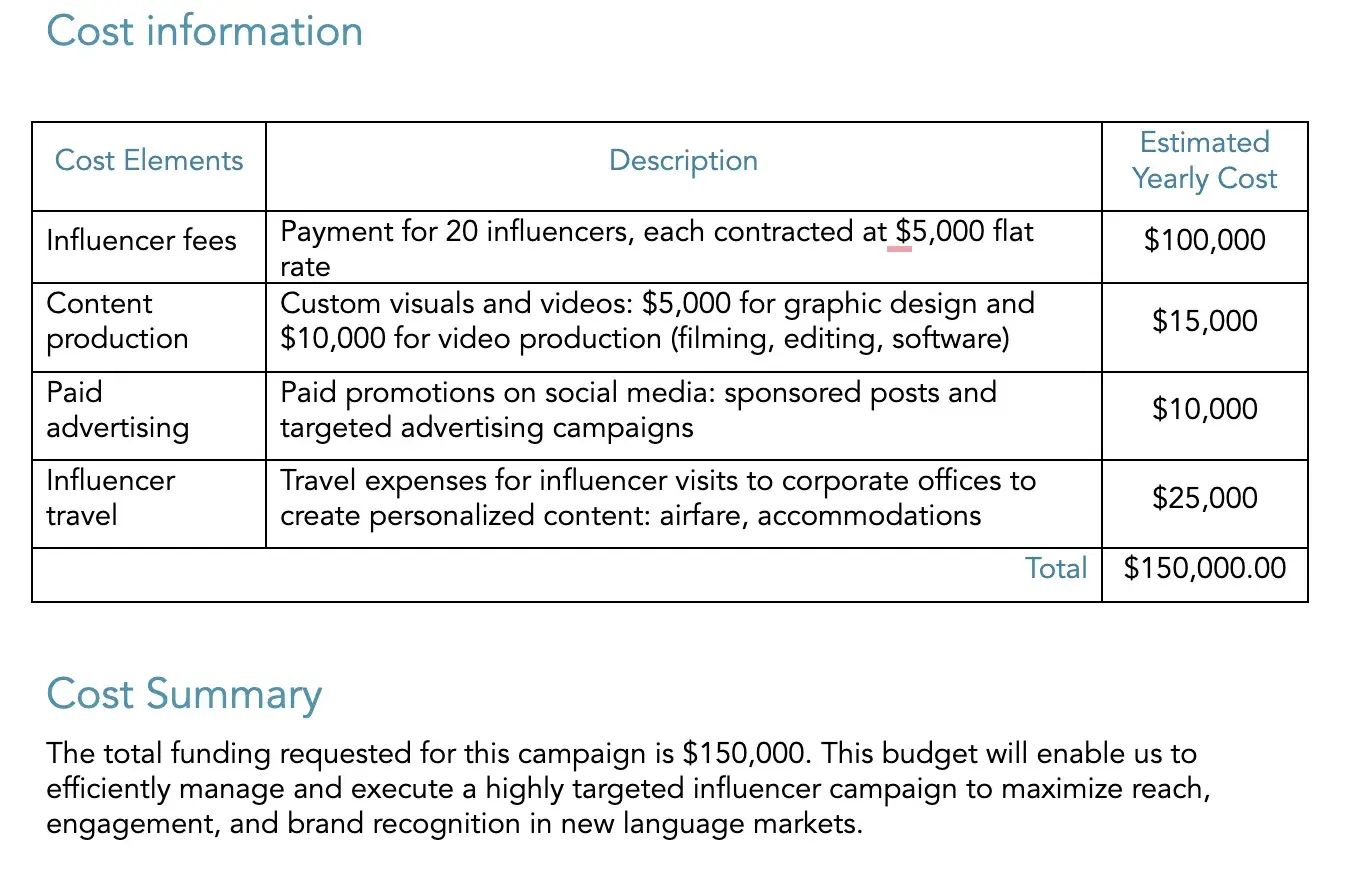

Cost Information

This section itemizes the individual expenses associated with the project. It also breaks down costs into categories such as labor, materials, and equipment to provide a transparent view of how funds will be allocated.

Pro tip: If you’re unsure how to approach cost analysis, begin by analyzing past campaigns and other historical data to understand what worked — and what didn’t. This data-driven approach ensures your budget allocations are justified, even if it’s a new or experimental campaign.

Cost Summary

This part of the proposal consolidates all the detailed cost elements into a total funding request. It summarizes the financial needs of the project, presenting the total amount you are asking from stakeholders in a clear and concise manner.

Conclusion

The closing section serves as a final pitch to your funders. It reiterates the project’s benefits and the importance of the requested funding, urging stakeholders to take action and support the initiative.

How to Create a Simple Budget Proposal

Now that we have a big-picture overview of the five essential components of building a budget proposal, I’ll explore how I practically apply them to build out a proposal.

Step 1. Define your project goals.

When I make a budget, I start my proposal by defining the specific objectives and expected outcomes of your project.

This step is crucial for setting the tone for the entire proposal by immediately conveying to stakeholders the significance and feasibility of my project.

It also helps build a compelling case for why the project deserves funding, by aligning my goals with the tangible benefits for stakeholders.

How I define project goals:

- Identifying my target audience. I describe the direct improvements my project will bring to particular groups, clients, or customers.

- Outlining measurable outcomes. I specify clear, quantifiable goals that illustrate what the project aims to achieve.

- Clarifying the project’s purpose. I highlight its importance in the broader context of the business, detailing the strategic value and potential long-term benefits.

Step 2. Build your project timeline.

I try to establish a project timeline early on by identifying the sequence of events needed to reach completion. This step is crucial to align all team members and stakeholders on the planned progression of activities and schedules.

How to I build my project timeline:

- Defining key milestones. I identify major milestones that mark significant phases of the project, such as the completion of the design phase or the first prototype.

- Detailing critical deadlines. I set deadlines that must be met to keep the project on track, such as funding application deadlines or regulatory approval dates.

- Sharing necessary checkpoints. I define phases in the timeline where assessments or evaluations are required to proceed to the next phase.

Pro tip: Ensure your project timeline includes buffer periods between major milestones. This flexibility helps accommodate potential delays or adjustments without derailing the overall project schedule.

Download this project timeline template for free.

Step 3. Estimate your costs.

I detail the financial requirements of my project by categorizing and explaining each type of cost.

This breakdown gives stakeholders an overview of how funds will be allocated, sharpening the project’s financial viability and operational efficiency.

How I estimate my costs:

- Categorizing expenses. I break down costs into categories like labor, materials, equipment, and overhead, explaining each in relation to the project’s needs.

- Quantifying each category. I provide estimates for each cost category, detailing how these figures were derived from data or market research.

- Highlighting cost efficiency. I demonstrate how each expense contributes to the project efficiently, maximizing resource utilization and cost-effectiveness.

Pro tip: Streamline your cost analysis with Hubspot’s Free Budget Templates. With eight different templates to choose from, you can easily monitor your monthly, quarterly, and yearly campaign spending, keeping your team aligned — and within budget.

Step 4. Create a cost summary.

I summarize the financial aspects of my project, consolidating the detailed costs into a clear total.

This overview helps stakeholders quickly grasp the total financial scope and the rationale behind the funding request, improving the proposal’s credibility and clarity.

How I create a cost summary:

- Aggregating total costs. I combine all individual expenses and present them in a unified, total project budget.

- Justifying the investment. I detail how the total expenditure aligns with expected project returns or benefits, illustrating the financial feasibility.

- Detailing funding requirements. I specify the required funding amount and provide clear explanations for these financial needs to assure stakeholders of the necessity and strategic thought behind the request.

Step 5. Reiterate your argument.

I always conclude my proposal text by reinforcing the project’s value and motivating stakeholders to take action.

This ending serves to emphasize the project’s significance, alignment with stakeholder goals, and the strategic benefits it offers, providing a solid basis for funding approval.

How I reiterate my argument:

- Restating project benefits. I summarize the key benefits of the project, emphasizing how it aligns with the stakeholders’ interests.

- Highlighting impact and readiness. I showcase the project’s potential impact and readiness for implementation, stressing any competitive advantages.

- Making a call-to-action. I provide a clear next step for stakeholders to take, whether it’s setting up a meeting, reviewing further documentation, or approving funding.

Pro tip: Compelling budget proposals go hand-in-hand with strong business proposals. Use Hubspot’s Free Business Proposal Templates to seamlessly merge financial planning with strategic business objectives, ensuring a comprehensive and compelling pitch for your next project.

Image Source

Step 6. Review, edit, and submit.

Finally, I review all sections of my proposal for accuracy and clarity before submitting it for approval or consideration. This step ensures that my document is free from errors and aligns with the funding objectives.

How I review and edit my proposals:

- Asking for feedback. I ask for input from colleagues to identify what is working in the proposal — and what may require revision.

- Proofreading. I thoroughly re-read the document to catch grammatical errors and ensure that the language is professional and precise. Sometimes, I even read the document out loud to make sure it sounds coherent.

- Following submission guidelines. I always make sure to adhere to the specific submission guidelines, such as format, deadline, and method of submission.

Building My Own Basic Budget Proposal

Using HubSpot’s Budget Template, I developed a basic marketing campaign proposal for how my company could leverage social media influencers to promote our product’s new language availability options.

I started by honing in on the project scope and identifying the target audience — French, German, and Spanish speakers — focusing on how we can enhance accessibility and expand our market reach.

I also paid special attention to describing the strategic value of influencers in gaining traction within these key audience groups, ensuring our approach was both effective and culturally authentic.

Then, in the Key Stakeholders section, I detailed the roles of everyone involved, like the social media manager and community managers, ensuring clarity on each person‘s responsibilities.

This was crucial for aligning our internal teams with the campaign’s objectives.

For the Timeline and Budget sections, I broke down the campaign into phases, specifying activities and dates to ensure a structured approach.

I then estimated costs, breaking them down into specific elements like influencer fees, content production, and paid advertising. This is critical for providing a clear picture of the financial resources needed to avoid over- or under-budgeting.

Finally, for the conclusion, I condensed our campaign’s goals and the strategic importance of the requested funding into a compelling call-to-action.

My goal was to craft a narrative that not only informed — but also motivated our stakeholders to support the initiative.

I then shared the proposal with two of my colleagues for feedback, applied their notes, and submitted it to my manager for review and approval.

8 Budget Proposal Best Practices

Crafting an effective budget proposal demands practice and precision. Here are eight best practices to get you started on the right foot.

1. Engage stakeholders early.

Get relevant stakeholders involved in the budgeting process as early as possible.

For example, I may loop in department heads, finance staff, and other key decision-makers. Soliciting their input and buy-in can lead to a more collaborative (and therefore successful) budget proposal.

I reached out to Kaitlin Milliken, a senior program manager at HubSpot, to get her take on building budgets at the company.

“My manager and I keep track of our annual budgeting cycle, so I can earmark the time to create any budgeting documents for the next fiscal year,” Milliken says. “By making sure I work with her and our accounting team early, I can resolve issues before deadlines loom.”

2. Understand the scale of operation.

The size of the company you’re working with significantly influences the scope and detail of your budget proposal.

If you’re at a smaller business, stakeholders may wish to see a proposal focused on agility, directing funds towards critical growth areas like product development and market entry strategies.

In contrast, larger businesses might be more interested in expanding existing successful initiatives — or more open to testing new ideas.

3. Know your audience.

Tailor your proposal to the audience who will review it. If it‘s for senior management, focus on high-level summaries and strategic goals. If it’s for a finance committee, offer additional financial analysis.

“Most of my budget asks go to our senior director or VP. I know they’re busy and want the perfect balance — enough context to understand the ask in a format that’s quick to read,” Milliken says. “Because I know my audience is tight on time, I make sure to include easy-to-skim charts and tables.”

4. Balance needs and wants.

Aim for a balanced approach that addresses both essential needs and aspirational wants, so that you’re prioritizing critical investments, while also considering opportunities for innovation.

Pro tip: Implement a structured prioritization framework, such as the MoSCoW method, to systematically distinguish between essential needs and discretionary wants, optimizing resource allocation for maximum impact.

5. Think about long-term implications.

Especially in the beginning stages of your proposal, think beyond the immediate fiscal year and consider the long-term implications of your budget decisions.

Anticipate how your proposed allocations may impact future budgets, operational sustainability, and organizational development.

For more context, I asked Kaitlin Milliken about how she thinks about the budget for her program.

“I make assignments to freelance writers. When I ask for budget, I always make sure that I’m realistic about how much we can spend,” she says. “If I ask for too much and can’t spend it, we may limit what we can ask for in years to come. That’s a huge long-term implication.”

6. Consider multiple scenarios.

Similarly, try presenting alternative scenarios or contingency plans to account for potential risks or changes in circumstances.

This shows flexibility and preparedness. Milliken notes that she spent time in startups prior to working at HubSpot. In the past, when making budget proposals, she’s created three scenarios:

- The first is the bare minimum amount of budget a project would require. This may put strain on the team, but anything under this number would be impressive.

- The ideal and realistic amount a project will cost. “This is the amount I will need to comfortably accomplish the project with a limited number of nice-to-haves,” she says.

- A stretch budget. “This budget would allow me to run experiments and test new tools when working on a project,” she notes.

- “With these three numbers in mind, I could pivot and refine my budget request based on what’s available to spend,” Milliken says.

7. Build a story.

Weave in a strong storytelling narrative that provides context, explains assumptions, and addresses any potential concerns or questions. This adds depth to your proposal and helps guide readers through the document.

Pro tip: Incorporate data visualization techniques, such as graphs or infographics, to complement your narrative and enhance the clarity and persuasiveness of your budget proposal.

8. Review, Review, Review

Before finalizing your budget proposal, carefully review it for consistency and completeness. Consider seeking feedback from colleagues or mentors to ensure it’s polished and persuasive.

Perfecting Your Budget Proposal

Crafting a clear and effective budget proposal is an indispensable skill that will dramatically increase your project’s likelihood of securing necessary funding.

By integrating the best practices and strategic steps outlined in this article, you’ll position yourself to clearly present your financial needs — and your overall project vision. Good luck!

![]()

If Hubspot is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.