Our view at Stack - ClickFunnels was founded by an online marketing legend Russell Brunson and it offers several benefits for online businesses and marketers:

- Time and Cost Savings: Efficiently create sales funnels without extensive development efforts.

- Maximized Conversions: Test offers, copy, and images to enhance conversions.

- Specific Landing Pages: Generate highly targeted landing pages.

- Predictable Pipeline: Create consistent, predictable sales paths.

- Increased Sales: On average, it boosts sales of lesser products by 15%

The post Metrics To Drive Your Startup’s Growth appeared first on ClickFunnels.

If you’re a startup founder – or just starting out on your entrepreneurial journey – then this article could be the most important thing you read all year.

Metrics are critical to the success of your startup.

They act as powerful milestones that validate your business’s status, growth, and potential.

More than just numbers on a dashboard, metrics are the first thing investors scrutinize when evaluating a potential opportunity, and any funding will rely on good selection and tracking of metrics.

But with so many possibilities, which metrics should you focus on?

In this post, we’ve drawn insights from Andreessen Horowitz (aka a16z), one of the world’s leading venture capital firms, managing $44 billion in committed capital.

These are the 11 key metrics they rely on when deciding where to invest.

Keep reading to discover the metrics that could guide your startup to success!

11 Essential Metrics You Need for Success With Your Startup Success

1. Revenue

Revenue is the total amount of money generated by your business through the sale of goods or services before any expenses are deducted.

Why it’s Important:

Revenue is the foundation of your startup’s financial health and scalability. High revenue growth often signals strong demand, it validates your business model and is usually the first metric that investors look for.

Here are some of the main ways that startups track their revenue:

1. Deferred Revenue

Deferred revenue refers to income received by a company for goods or services that have not yet been delivered. For example, a SaaS company might collect payment upfront for a subscription or service that spans several months, but the revenue is recognized incrementally as the service is provided.

2. Recurring Revenue

Recurring revenue refers to predictable, stable income generated on a regular basis. This includes Monthly Recurring Revenue (MRR) or the total subscription revenue generated in a month; and Annual Recurring Revenue (ARR) which is the annualized version of recurring revenue.

2. Bookings

Bookings represent the total value of a contractual agreement between your company and a customer.

Why it’s Important:

Bookings are a key metric for startups as they provide insight into the demand for your product or service and future cash flow potential. For early-stage businesses, they demonstrate traction and validate product-market fit.

3. Gross Merchandise Value (GMV)

Gross Merchandise Value (GMV) represents the total sales dollar volume of all goods or services transacted through a marketplace within a specific period.

For example, if an e-commerce marketplace sells 1,000 items priced at $50 each, the GMV for that period is $50,000. Importantly, GMV is not the same as revenue, as it includes the total transaction value without deducting marketplace fees or other costs.

Why it’s Important:

GMV is a critical metric for marketplace startups as it serves as a barometer of marketplace size and growth.

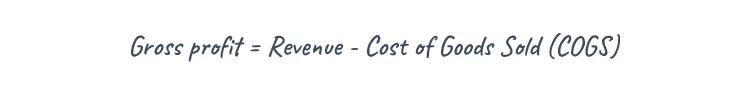

4. Gross Profit

Gross Profit is the total revenue your business generates minus the direct costs associated with producing and delivering your product or service.

These costs typically include manufacturing expenses, delivery costs, and support services.

Why it’s Important:

Gross Profit is a critical metric for startups because it offers insight into the profitability and efficiency of your revenue streams. While top-line growth (like bookings) shows demand, gross profit reveals how efficiently the business generates profit from that demand.

5. Total Contract Value (TCV)

Total Contract Value (TCV) is the total monetary value of a single contract between your startup and a customer.

Why it’s Important:

TCV is a crucial metric for startups as it gives investors a clearer picture of deal sizes and the revenue potential of each customer. Investors can assess whether you’re closing high-value deals, which may indicate product-market fit in higher-value market segments.

Additionally, understanding TCV enables better forecasting of long-term revenue and helps align sales strategies with company goals.

Here are two different ways to look at the TCV:

1. Total Contract Value (TCV):

As mentioned above, TCV includes all revenue components within the contract, such as recurring charges (e.g., subscriptions), one-time charges (e.g., setup fees), and professional service fees. The TCV demonstrates the average deal size, providing a comprehensive understanding of the total monetary value generated per customer.

2. Annual Contract Value (ACV):

ACV measures the value of the contract over a 12-month period. Offers insight into how much revenue you can expect from a customer annually, helping to standardize comparisons across contracts with different timeframes.

6. Lifetime Value (LTV)

Lifetime Value (LTV) is the present value of the future net profit generated from a customer over the entire duration of their relationship with your business.

Why it’s Important:

LTV is a critical metric for startups because it determines the long-term value of each customer. By understanding LTV, you can assess how much net profit your business generates per customer after accounting for acquisition and retention costs.

This insight helps shape marketing budgets, pricing strategies, and customer experience initiatives.

Here are two ways to look at it:

1. Lifetime Value (LTV):

A common mistake is to calculate LTV as the present value of revenue or gross margin of the customer rather than as the net profit generated over the relationship’s duration. Properly calculating LTV requires considering all costs, including customer support, product delivery, and retention strategies.

2. Contribution Margin Per Customer (Per Month):

The profit is generated from a customer each month after accounting for variable costs, such as selling, administrative, and operational expenses. This provides a clearer picture of profitability by showing the true value of a customer after subtracting costs directly tied to serving them.

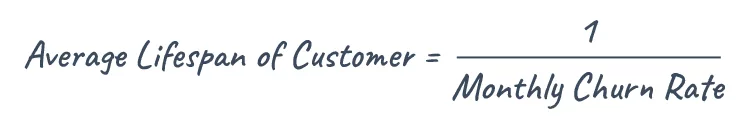

3. Average Lifespan of a Customer (In Months):

The expected duration a customer will stay with your business. Knowing how long customers typically stay helps in projecting long-term revenue and profitability.

4. LTV to CAC Ratio:

The LTV to CAC ratio measures how efficiently your business turns customer acquisition costs (CAC) into long-term value. It is calculated by dividing the LTV by CAC. For example, if your LTV is $3,000 and your CAC is $1,000, your LTV to CAC ratio is 3:1.

7. Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) measures the total cost of acquiring a new customer, including expenses like marketing, sales, referral fees, and other related efforts.

Why it’s Important:

CAC is a vital metric for understanding how much your business spends to gain new customers. It helps evaluate the efficiency of your marketing and sales efforts and ensures your customer acquisition strategies are sustainable and profitable.

There are different ways to calculate CAC:

1. Blended CAC:

Blended CAC is calculated by dividing the total acquisition cost by the total number of new customers acquired across all channels. Many businesses default to calculating CAC as a blended cost because it provides a comprehensive view of overall acquisition efficiency.

2. Paid, Organic, and Inorganic CAC:

Breaking down CAC by acquisition channel involves calculating the cost of acquiring customers through paid efforts (e.g., ads), organic methods (e.g., SEO, referrals), or inorganic means (e.g., partnerships).

Analyzing CAC by channel helps determine if scaling specific channels, such as paid acquisition, is profitable. For instance, a high-paid CAC might indicate diminishing returns, whereas a low organic CAC might highlight opportunities to invest further in content or referral strategies.

8. Active Users

Active Users refers to the number of unique users engaging with your platform, app, or SaaS product within a specific period.

Why it’s Important:

Tracking active users helps measure the success of your product in attracting and retaining users over time. It provides valuable insights into user behavior, product stickiness, and overall platform health, which are essential for driving growth and improving customer experience.

There are different ways to measure active users depending on your product:

1. Weekly or Monthly Active Users (WAU/MAU):

WAU and MAU measure the number of unique users who interact with your product within a week or month, respectively.

2. Other kinds of engagement:

Depending on your business model, you can track more granular user activities, such as how often users log in, send messages, or use specific features within a given time frame.

9. Month-On-Month Growth (MoM Growth)

Month-On-Month (MoM) Growth measures the percentage change in a specific metric – such as revenue, users, or transactions – from one month to the next.

It is commonly used by platforms, apps, and SaaS businesses to track their growth trajectory over time.

Why it’s Important:

MoM Growth is crucial for assessing short-term progress and identifying growth trends in rapidly evolving markets. It helps businesses evaluate the effectiveness of recent strategies, make data-driven decisions, and forecast future performance.

MoM Growth is usually tied to a specific metric and sometimes, depending on your product, there are different ways to measure it such as:

- Compounded Monthly Growth Rate (CMGR):

- CMGR calculates the average growth rate over multiple months, providing a smoother and more reliable view of growth compared to fluctuating single-month metrics. CMGR is especially relevant for marketplaces and other businesses with volatile month-to-month activity.

10. Churn Rate

Churn Rate measures the percentage of customers, revenue, or units lost over a specific period, indicating how effectively a business retains its users or revenue streams.

Why it’s Important:

Churn Rate is a vital metric for SaaS businesses, subscription models, and platforms where retention drives growth. High churn signals problems with customer satisfaction, product-market fit, or competition, while low churn indicates a loyal and stable customer base.

There’s a huge variety of ways to measure churn:

1. Dollar Churn:

The percentage of recurring revenue lost in a specific period due to customer cancellations or downgrades. Particularly relevant for subscription-based businesses, as it directly impacts Monthly Recurring Revenue (MRR) and provides insights into revenue retention rather than customer numbers.

2. Customer Churn:

The percentage of customers lost during a given period. Valuable for businesses with high customer volumes, such as e-commerce or marketplaces, as it helps track overall customer satisfaction and retention rates.

3. Net Dollar Churn:

The percentage of MRR lost, adjusted for upsells or expansions. Commonly used in SaaS, this metric provides a net view of revenue retention, combining churn with the impact of customer growth through upgrades or cross-sales.

4. Monthly Unit Churn:

The percentage of customers lost in a given month, is calculated as lost customers divided by the prior month’s total customers. Ideal for high-volume businesses that want a granular view of customer attrition trends over time.

5. Retention by Cohort:

Tracks customer retention within a specific group (cohort) over time, calculated as the percentage of the original customer base still active in subsequent months.

Helps businesses identify trends in customer behavior by segment, making it valuable for subscription businesses or platforms with diverse customer types.

6. Gross Churn:

The percentage of MRR lost due to cancellations or downgrades in a given month. Shows the total revenue lost from churn, helping businesses understand the downside risk without factoring in upsells.

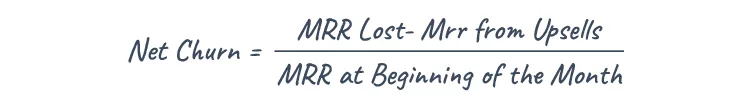

7. Net Churn:

The percentage of MRR lost after accounting for upsells and expansions. Reflects the net impact of churn, upsells, and expansions, making it a crucial metric for SaaS businesses focused on maximizing net revenue retention.

11. Burn Rate

Burn Rate is the rate at which a company uses up its cash reserves to cover operating expenses and other outflows.

It reflects how quickly a startup is “burning” through its available cash.

Why it’s Important:

Especially in early-stage startups, monitoring the burn rate is critical because companies fail when they run out of cash without sufficient time to secure additional funding or reduce expenses.

Burn rate helps founders and investors assess how much runway remains and whether financial strategies are sustainable.

There are a few common metrics used to measure the burn rate:

1. Monthly Cash Burn:

Monthly cash burn measures the average cash outflow per month. This metric is crucial for tracking how quickly a business is spending its cash reserves.

It’s particularly relevant for startups that are pre-revenue or in the early growth stages, as it provides a straightforward indicator of sustainability.

2. Net Burn:

Net burn calculates the true amount of cash a company is losing each month, factoring in revenues. This measure accounts for both expenses and revenue, making it a more accurate representation of financial health.

It’s especially relevant for startups generating some revenue but not yet profitable, as it shows the gap between income and expenditures.

3. Gross Burn:

Gross burn focuses solely on cash outflows, including operating expenses and other cash outlays, without factoring in revenue. Gross burn is useful for understanding the total cash requirements of a business.

It’s particularly relevant for pre-revenue startups or during periods of rapid scaling, where expenses are high, and revenue has not yet caught up.

BONUS: 7 More Popular Startup Metrics

1. Cash Runway

Cash runway is the amount of time a business can continue operating before running out of cash, based on its current burn rate.

2. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

EBITDA measures a company’s profitability by calculating earnings before subtracting interest, taxes, depreciation, and amortization.

3. Net Promoter Score (NPS)

NPS gauges customer satisfaction and loyalty by measuring how likely customers are to recommend a product or service to others.

4. North Star Metric (NSM)

The North Star Metric is a single key metric that reflects the core value your product delivers to customers, guiding growth and strategy.

5. Cost Per Acquisition (CPA)

CPA measures the average cost of acquiring a new customer through marketing and sales efforts.

6. Conversion Rate

Conversion rate is the percentage of users who take a desired action, such as signing up, purchasing, or completing a specific task.

7. Average Order Size (AOS)

AOS is the average dollar amount spent per transaction, calculated by dividing total revenue by the number of orders.

The #1 Mistake Startups Make When Tracking Metrics

Many startup founders focus on metrics primarily to attract investors.

In many cases, they emphasize figures that paint the most favorable picture.

But this approach doesn’t end well.

Metrics should serve to assess and improve the financial health of your own business – i.e. metrics are most important for you, the founder, and your goal of creating a profitable business.

If you’re not selling, no metric can obscure this reality.

How to Ensure Your Startup is Cash Positive (Even Without Funding)

ClickFunnels is designed to enhance your business’s financial health by improving lead generation, sales, and average order value through high-converting sales funnels.

In fact, it’s specifically designed to help startups who don’t even have funding.

ClickFunnels co-founder Russell Brunson took the business to $14 million in its first year and to $100 million in annual sales by year 5 without any outside capital – only using the ClickFunnels software.

Its features include built-in upsells, cross sells, and tools like email automation to generate and nurture leads.

And its not just ClickFunnels themselves.

Many successful startups and businesses utilize ClickFunnels to drive growth.

Here are a few examples from our friends at Starter Story:

- Writing Income Accelerator: An online course that teaches intermediate-level writers how to command $1,000 – $3,000 per article, generating $10,000 in monthly revenue.

- Entrepreneurs on Fire: A podcast offering online courses, coaching, and a mastermind program, with a monthly revenue of $202,000.

- Modern Producers: An e-commerce platform selling software and tools for modern music producers, earning $120,000 per month.

- Pawstruck: A dog treat business providing all-natural, reasonably-priced pet supplies, with a monthly revenue of $1.75 million.

- Lost Empire Herbs: A supplements company specializing in high-quality, phyto-androgenic herbs, achieving $320,000 in monthly revenue.

Try ClickFunnels Free For 14 Days!

Final Thoughts: Key Metrics for Startup Success

In this article, we covered 11 essential metrics and 7 bonus metrics for startups.

But, metrics are not only to attract investors.

Metrics should be used to assess and improve operations, ensuring profitability and sustainable growth – key factors investors ultimately seek.

ClickFunnels helps businesses achieve this by optimizing lead generation, sales, and average order value with high-converting sales funnels, built-in upsells, cross sells, and email automation tools.

Successful startups like Entrepreneurs on Fire and Pawstruck use ClickFunnels to scale.

Start your journey with a 14-day free trial today!

Try ClickFunnels Free For 14 Days!

Thanks for reading Metrics To Drive Your Startup’s Growth which appeared first on ClickFunnels.

If Click Funnels is of interest and you'd like more information, please do make contact or take a look in more detail here.

Credit: Original article published here.